Oil and Gas Pipeline Market Outlook:

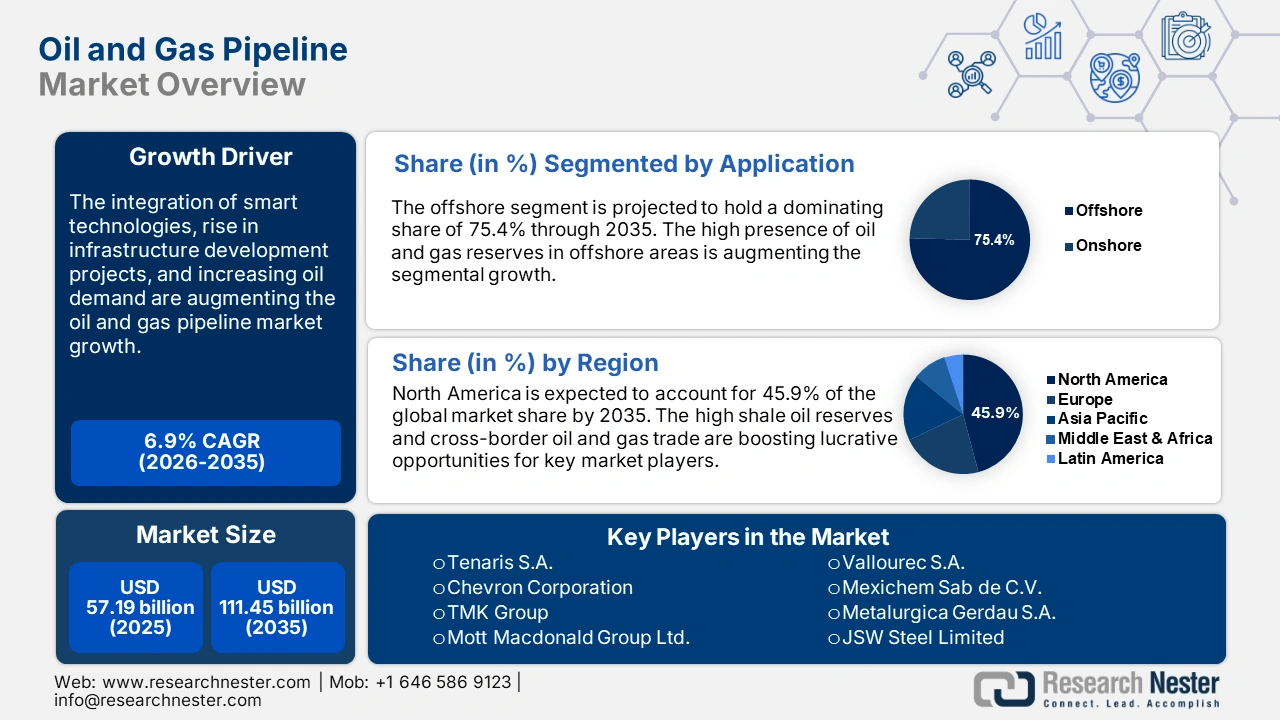

Oil and Gas Pipeline Market size was over USD 57.19 billion in 2025 and is projected to reach USD 111.45 billion by 2035, witnessing around 6.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of oil and gas pipeline is evaluated at USD 60.74 billion.

The overall energy landscape is shaped by four disruptors: macroeconomic variables including rising materials costs and high interest rates, evolving policies and regulations, the emergence of new technologies, and geopolitical factors. These disruptors influence the demand and supply, along with the trade and investments in the crude oil and natural gas (O&G) sector. With the addition of the Organization of the Petroleum Exporting Countries (OPEC+) output cutback of 2.5 million barrels per day (mbpd) in early November 2023, the U.S. Henry Hub natural gas prices rebounded to USD3.50/mmBtu and pushed Brent oil prices over USD 90/bbl.

Despite the abovementioned disruptions, the global oil demand increased between 2.3 mb/d to 101.7 mb/d in 2023 and this masked the impact of the macroeconomic climate. With Europe accounting for half the decline, the global 4Q23 demand growth was revised down by 400 kb/d and the slowdown continued in 2024, with global gains halving to 1.1 mb/d. Furthermore, the oil & gas sector faces pivotal opportunities to adapt to the evolving clean energy transitions and stringent energy economy regulations. Even under present-day policy settings including the Paris Agreement, the worldwide demand for both oil and gas is expected to peak by the end of 2030.

The rise in the oil and gas demand across the world is fuelling the need for safe and efficient pipelines. For instance, as per the International Energy Agency (IEA), in 2023, the global oil demand averaged over 102 million barrels per day. Several factors are contributing to the rising oil demand such as rapid urbanization and industrialization, a rise in shipping trade, and high energy consumption, worldwide. Thus, to ensure a stable supply of oil and gas the demand for advanced pipelines is gaining traction.

To reduce the dependency on a single oil and gas supplier, countries are investing in the diversification of oil and gas supply sources and routes, which is directly boosting the need for modern oil and gas pipelines. For instance, according to the European Commission, to mitigate the dependency of EU countries on a single oil and gas supplier, the Southern Gas Corridor project was carried out. This project was commissioned at the end of 202o and delivered 8.1 billion cubic meters of gas to Europe in 2021 and 11.4 billion cubic meters in 2022. The building of new routes drives investments in infrastructure development, increasing the need for the latest technologies and materials including advanced oil and gas pipelines.

Key Oil and Gas Pipeline Market Insights Summary:

Regional Highlights:

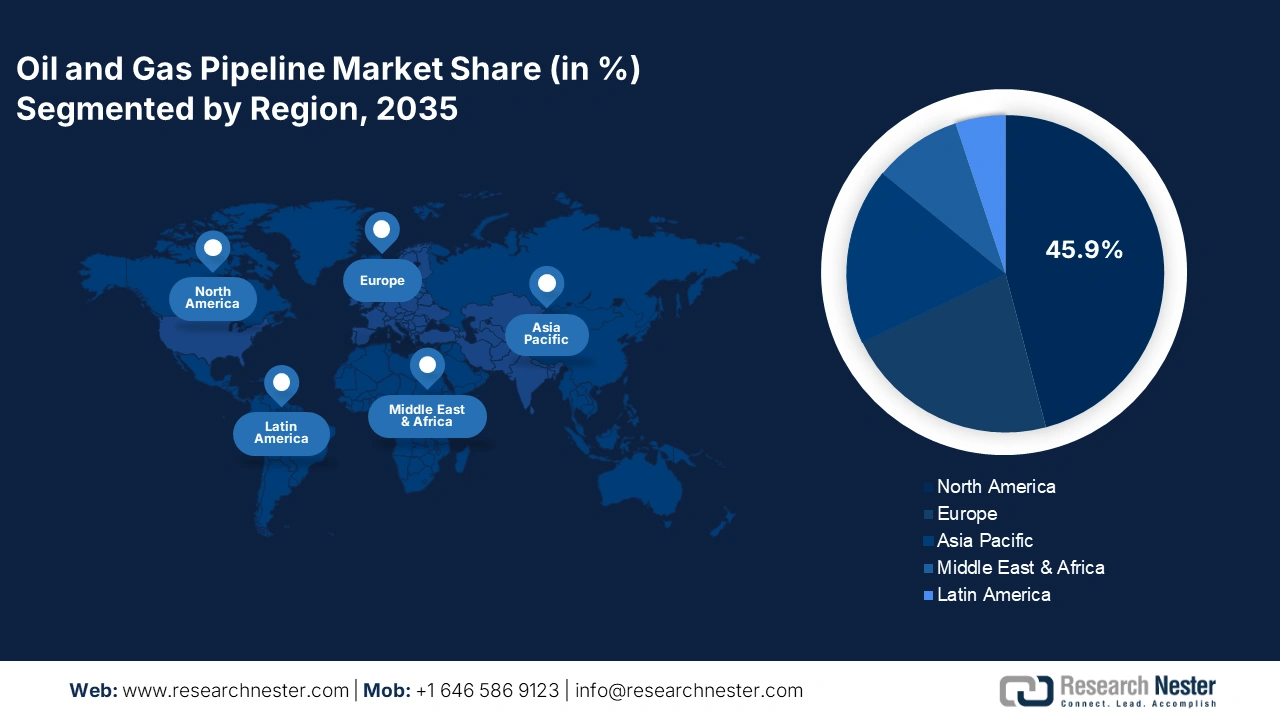

- North America oil and gas pipeline market will account for 45.90% share by 2035, driven by high shale oil reserves and increasing cross-border trades.

Segment Insights:

- The offshore segment in the oil and gas pipeline market is projected to hold a 75.40% share by 2035, driven by the majority of oil and gas reserves being located in offshore areas like the Gulf of Mexico and offshore Brazil, offering high-profit opportunities.

- The offshore segment in the oil and gas pipeline market is projected to hold a 75.40% share by 2035, driven by the majority of oil and gas reserves being located in offshore areas like the Gulf of Mexico and offshore Brazil, offering high-profit opportunities.

Key Growth Trends:

- Increasing integration of smart oil and gas pipelines

- Rise in liquified natural gas (LNG) demand

Major Challenges:

- Fluctuations in the raw material prices

Key Players: Tenaris S.A., Vallourec S.A., TMK Group, Nippon Steel Corporation, JFE Steel Corporation, ArcelorMittal S.A., Welspun Corp Ltd., Europipe GmbH, ChelPipe Group, EVRAZ plc.

Global Oil and Gas Pipeline Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 57.19 billion

- 2026 Market Size: USD 60.74 billion

- Projected Market Size: USD 111.45 billion by 2035

- Growth Forecasts: 6.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (45.9% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, India

- Emerging Countries: China, India, Brazil, Mexico, Thailand

Last updated on : 18 September, 2025

Oil and Gas Pipeline Market Growth Drivers and Challenges:

Growth Drivers

- Increasing integration of smart oil and gas pipelines: Smart oil and gas pipeline technologies are gaining boom across the world, the integration of advanced technologies such as the Internet of Things (IoT), sensing technologies, predictive analytics, and real-time monitoring systems are enhancing the operational performance of pipelines. These technologies collectively improve the response time and mitigate accidents or disruptions in services, effectively.

The sensors integrated with the pipes continuously detect the changes in temperatures, pressure, flow, and chemical compositions, which helps operators monitor real-time data and make effective decisions before the problem arises. The remote monitoring technology assists operators in controlling and managing pipeline activities from centralized locations. All such benefits associated with smart oil and gas pipelines are significantly contributing to their sales growth.

For instance, in May 2022, Smartpipe Technologies an innovative pipeline technology producer received an investment offer of USD 6.6 million from Enbridge. Enbridge investment was to improve its hydrogen and carbon dioxide transportation pipeline safety and versatility. Such infrastructure upgrade activities are highlighting the increasing need for advanced pipeline technologies, leading to overall oil and gas pipeline market growth. - Rise in liquified natural gas (LNG) demand: The increasing infrastructure developments related to LNG around the globe are generating lucrative opportunities for oil and gas pipeline manufacturers. LNG is increasingly being used in the supplement of domestic natural gas production. The rise in smart city projects, coupled with rapid improvements in LNG infrastructure are augmenting the demand for modern and reliable oil and gas pipelines.

- Apart from this, the LNG is transported from import terminals to local oil and gas pipeline markets such as power plants and industrial users, which again fuels a substantial demand for safe and innovative oil and gas pipelines. Furthermore, according to the International Trade Administration (ITA), Qatar is the largest LNG supplier in the world, and the North Field Expansion project is set to boost LNG capacity from 77 million tonnes per annum to 126 million tonnes per annum by 2027. Thus, as countries are investing heavily in LNG infrastructure development, the use of advanced oil and gas pipelines in the construction for the movement of gas is expected to exhibit high demand.

Challenges

- Regulatory challenges: In several regions across the world, a significant portion of existing pipelines are aging and need upgrades, or due to the increasing requirements the need for new infrastructure is emerging. Such projects thus necessitate a huge capital investment for construction, retrofitting, maintenance, and upgrading integrity. However, due to economic constraints and regularity hurdles, many companies postpone investments, which may hamper the oil and gas pipeline market to some extent. One of the latest examples of this is the Mountain Valley Pipeline project, due to several regulatory hurdles and lawsuits the project was delayed, raising the cost from USD 6.6 billion to USD 7.2 billion in 2024.

- Fluctuations in the raw material prices: The fluctuations in the prices of raw materials such as stainless steel, polyvinyl chloride (PVC), and high-density polyethylene (HDPE) can hinder the oil and gas pipeline market growth. The rise in the costs of raw materials directly fuels the final pipe product costs, which ultimately increases the capital expenditure required for oil and gas pipeline construction, hampering the market growth to some extent.

Oil and Gas Pipeline Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.9% |

|

Base Year Market Size (2025) |

USD 57.19 billion |

|

Forecast Year Market Size (2035) |

USD 111.45 billion |

|

Regional Scope |

|

Oil and Gas Pipeline Market Segmentation:

Application Segment Analysis

Offshore oil and gas pipeline segment is projected to account for oil and gas pipeline market share of more than 75.4% by the end of 2035. The majority of oil and gas reserves around the globe are located in offshore areas such as in the Gulf of Mexico and offshore Brazil, which offers high-profit opportunities for offshore oil and gas pipeline companies. According to the Bureau of Ocen Energy Management, the Gulf of Mexico generates around 97% of all the U.S. OCS oil and gas production.

Also, the onshore reserves when mature become more difficult to exploit, thus offshore exploration is being adopted to meet the future energy demand. Advanced offshore oil and gas pipelines are the most cost-effective way to transport resources from fields to processing facilities. Once installed, the offshore pipelines offer lower operational costs and effectively transport large volumes of oil and gas over long distances. The low maintenance costs make these pipelines more economical for large-scale projects.

Oil Type Segment Analysis

The natural oil pipeline segment is foreseen to hold a dominating oil and gas pipeline market share through 2035. Oil is one of the vital components of the global energy mix, and exhibiting high demand in sectors such as petrochemicals, transportation, and aviation. For instance, as per the analysis by the International Energy Forum, natural oil and gas is estimated to contribute around 47% to 54% of the energy mix by 2040. The high global oil demand is majorly contributing to the natural oil pipeline sales growth. Pipelines are a cost-effective way to meet the transportation of increasing oil demand. The rising investments in the new natural oilfields and upgrades in the existing infrastructure are augmenting the demand for advanced pipelines for effective and safe transportation.

Our in-depth analysis of the global oil and gas pipeline market includes the following segments:

|

Oil Type |

|

|

Application |

|

|

Stream Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Oil and Gas Pipeline Market Regional Analysis:

North America Market Insights

North America industry is predicted to dominate majority revenue share of 45.9% by 2035. The high shale oil reserves in the region are significantly contributing to the oil and gas pipeline sales. The increasing cross-border oil and gas trades are necessitating the need for advanced transportation systems such as smart pipelines, contributing to oil and gas pipeline market growth.

The U.S. is emerging as a major exporter of liquefied natural gas (LNG) and crude oil owing to the strong existence and ongoing construction of LNG facilities. According to the U.S. Energy Information Administration, Cove Point, Sabine Pass, Cameron, and Elba Island are firmly existing LNG facilities, while Port Arthur and Golden Pass are under construction LNG projects in the country. The estimated LNG export from the under-construction projects in the United States is expected to grow 9.7 billion cubic feet per day (Bcf/d) between 2024 to 2028. Such LNG export boom and infrastructure development are fuelling the demand for advanced and reliable oil and gas pipelines, benefitting the key oil and gas pipeline market players in earning more.

Canada is leading in the oil sands sector and the huge production of crude oil in the country is positively supporting the market growth. For instance, according to the Canadian Association of Petroleum Producers, in 2023, around 58% of the country’s total oil production was from oil sands. To transport heavy crude oil to refineries and export oil and gas pipeline markets the existence of advanced and reliable pipeline infrastructure is vital. Considering the increasing production and sale of crude oil, many refineries are investing in advancing their pipeline network infrastructure, creating profitable opportunities for oil and gas pipeline manufacturers.

Europe Market Insights

Europe is estimated to hold the second most dominating share of the global oil and gas pipeline market through 2035 owing to the high investments in the gas pipeline infrastructures. According to the Global Energy Monitor, there are around 16 gas pipelines under construction projects in Europe amounting to a total length of 3,200 kilometers (km) at the cost of USD 7.01 billion. Such huge investments in infrastructure development projects are expected to boost the demand for advanced oil and gas pipelines in Europe in the coming years.

In Germany, the upgradation of existing pipeline infrastructure and investments in the new pipeline projects is positively influencing the oil and gas pipeline market growth. The expansion of advanced pipeline infrastructure is contributing to the efficient flow of oil and gas to meet the energy demand in the country. For instance, according to the Clean Energy Wire report, with the approval of the Core Grid by the Federal Network Agency, Germany is anticipated to witness the first hydrogen flow in pipelines in 2025. The core grid is acting as a foundation of new infrastructure with a vital role in energy transition. This project is anticipated to uplift the position of Germany in Europe. The investments in maintaining and modernizing pipelines, including the development of smart pipelines with advanced monitoring and control technologies are further acting as a key driver in fueling the overall oil and gas pipeline market growth.

The expansion of LNG capacities and storage facilities in Italy is augmenting a high demand for advanced and reliable oil and gas pipelines. These pipelines are vital in connecting LNG terminals with the domestic grid, which further aids in the efficient transportation of liquefied natural gas. According to the U.S. Energy Information Administration, in 2022 around 1.7 Bcf/d of the new and expanded LNG regasification capacity were added in Italy, Netherlands, Poland, and Finland.

Oil and Gas Pipeline Market Players:

- Tenaris S.A.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Smartpipe Technologies

- Chevron Corporation

- TMK Group

- Mott Macdonald Group Ltd.

- NOV Inc.

- Vallourec S.A.

- Mexichem Sab de C.V.

- Metalurgica Gerdau S.A.

- JSW Steel Limited

- American Cast Iron Pipe Company

- Aliaxis Group S.A.

- ArcelorMittal S.A.

- China Steel Corporation

- ConocoPhillips Company

- SUBSEA 7 S.A.

- TechnipFMC Plc

- ChelPipe Group

Key players in the oil and gas pipeline market are employing several organic and inorganic strategies to maximize their profit shares. Leading companies are investing heavily in research and development activities to introduce smart oil and gas pipelines. They are also forming strategic collaborations with other players and tech firms to develop innovative oil and gas pipelines. These moves are aiding them to attract a wider consumer base and earn high profits. Industry giants are also entering into high-potential markets to grab untapped opportunities and expand their oil and gas pipeline market reach.

Given the healthy cash flows, sustained capital discipline, robust financial health, and rapid technological advancements, the O&G companies are relatively well-positioned to focus on the energy transition in 2025. This also entails concerted efforts to abridge hydrocarbon emissions, while increasing investments in economical and scalable low-carbon solution transition of the O&G industry. This will directly impact the market dynamics of the oil and gas pipeline value chain.

Some of the key players include:

Recent Developments

- In September 2024, Vallourec S.A. a leading producer of premium seamless tubular solutions acquired 100% of the shares of Thermotite do Brasil Ltda. This acquisition is enhancing Vallourec’s thermal insulation pipe coating services for the offshore oil and gas industry.

- In October 2023, Smartpipe Technologies was recognized as Best Pipeline Integrity Technology by the 2023 Gulf Energy Information Excellence Awards. This award was an acknowledgment of its product contribution to Enbridge’s pipeline replacement project in Roanoke County, Virginia.

- Report ID: 6687

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Oil and Gas Pipeline Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.