Oil and Gas EPC Market Outlook:

Oil and Gas EPC Market size was valued at USD 56.52 billion in 2025 and is set to exceed USD 92.95 billion by 2035, expanding at over 5.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of oil and gas EPC is estimated at USD 59.11 billion.

The global growth in industrial and urban activities is driving advancements in the majority of sectors, such as automotive, manufacturing, aviation, and construction. The significant rise in infrastructure development projects is fueling the energy demand. To meet energy needs, the exploration of oil and gas is witnessing a boom, which is directly leading to developments in the engineering, procurement, and construction (EPC) field. For instance, the study by the Global Infrastructure Outlook estimates that the infrastructure investment at current needs is projected to increase from USD 2.9 trillion in 2024 to USD 3.6 trillion by 2037.

The hydrocarbon exploration activities are estimated to increase at a high pace during the forecast period, which is set to create a lucrative space for EPC companies. The majority of explorations are been observed in the oceans. The new offshore discoveries are anticipated to hold around 8.0 billion barrels of oil equivalent (bboe) of resources, as per the Global Energy Monitor study. Nearly 85.0% of new discoveries are situated in ten offshore fields, out of which the 2 biggest are Nokhatha and Mopane fields, in Kuwait and Namibia, respectively. Furthermore, the International Energy Agency (IEA) analysis highlights that in 2025, the oil demand is expected to reach over 1 mb/d, up from 830 kb/d in the previous year. Asia Pacific leads the oil demand and captures 60.0% of the gains.

Key Oil and Gas EPC Market Insights Summary:

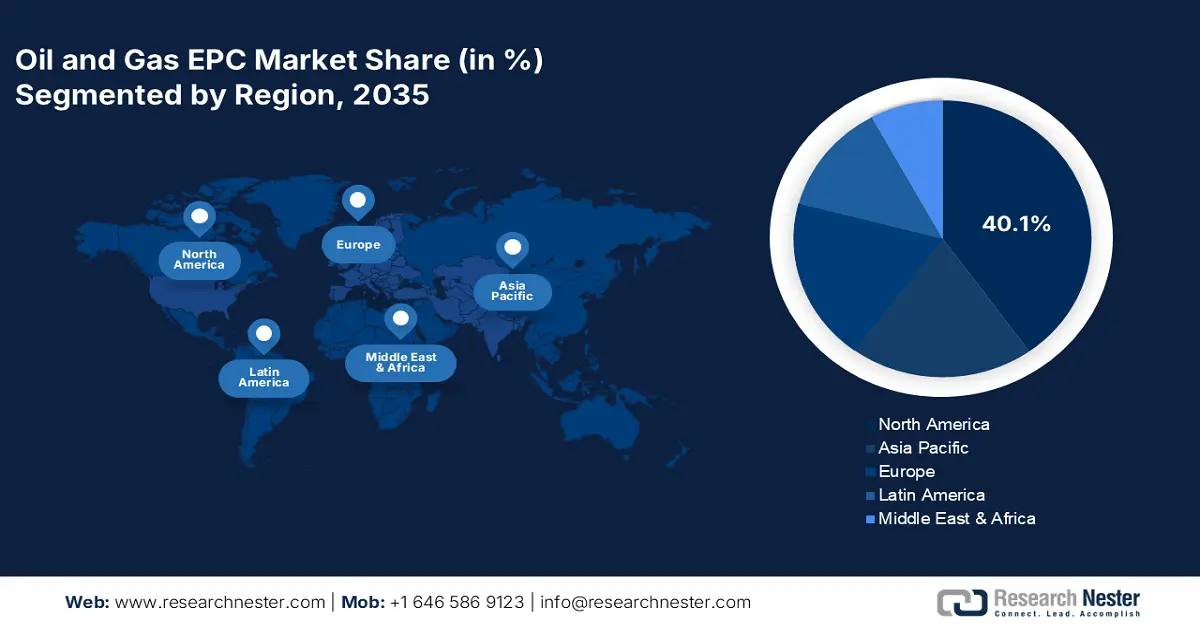

Regional Highlights:

- North America leads the Oil and Gas EPC Market with a 40.1% share, propelled by supportive government policies for hydrocarbon exploration and growth in offshore drilling activities, ensuring robust growth through 2035.

- The Asia Pacific Oil and Gas EPC Market is forecasted for the fastest growth by 2035, propelled by the boom in infrastructure development projects and growing energy demand.

Segment Insights:

- The Construction segment is projected to see significant growth by 2035, fueled by rising global energy demand and investments in oil and gas facility construction.

- The Onshore segment is anticipated to hold a 69.1% market share by 2035, propelled by increasing investments in onshore oil and gas exploration and supportive government policies.

Key Growth Trends:

- Rise in LNG trade

- Rise in petrochemical production and commercialization

Major Challenges:

- High investment business

- Supply chain disruptions challenge financial structure

Key Players: Saipem S.p.A., Technip Energies NV, Consolidated Contractors Company, Bechtel Corporation, and Fluor Corporation.

Global Oil and Gas EPC Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 56.52 billion

- 2026 Market Size: USD 59.11 billion

- Projected Market Size: USD 92.95 billion by 2035

- Growth Forecasts: 5.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40.1% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, United Kingdom, Japan, Germany

- Emerging Countries: China, India, Brazil, Russia, Mexico

Last updated on : 12 August, 2025

Oil and Gas EPC Market Growth Drivers and Challenges:

Growth Drivers

- Rise in LNG trade: The LNG consumption is likely to witness a swift rise in the years ahead, owing to its growing awareness and cost-effectiveness compared to other fuels. This trend is further set to drive the engineering, procurement, and construction activities, offering high-earning opportunities to market players. The FSRU Summit 2024 underscores that in 2022, the worldwide LNG imports totaled 389.2 MT, up from 16.9 MT in 2021. The low-carbon energy trend is also backing the LNG demand. The continuous rise in the LNG trade is likely to offer a double-digit percent revenue growth to EPC companies during the foreseeable period.

|

The Global LNG Industry in 2023 |

|||||

|

Imported |

Importing Markets |

Exporting Countries |

Total Regasification Capacity |

Total Liquefication Capacity |

Spot & Short-term Trade |

|

401 MT |

48 |

20 |

1143 MTPA |

481 MTPA |

39% |

Source: GIIGNL

- Rise in petrochemical production and commercialization: The speedy expansion of the petrochemical sector is foreseen to drive EPC activities, offering lucrative gains to market players. The petrochemical field is witnessing the development of new facilities and the upgradation of new projects. These new greenfield projects and upgrades are further driving a swift involvement of EPC companies in designing, procuring materials, and construction. The IEA study highlights that China leads the petrochemical capacity, followed by other Asian countries and North America. In 2023, the petrochemical capacity in China amounted to 8.9 MT/year, while in North America it reached 3.0 MT/year. The growing demand for feedstocks derived from oil is backing the overall oil and gas EPC market growth.

Challenges

- High investment business: The oil and gas EPC is a capital-intensive business, which makes new market entries quite challenging. High CAPEX requirements act as obstacles for small-scale companies, hindering them from accessing the latest oil and gas EPC market developments and earning opportunities. The long gestation period and returns distract some investors, leading to a low flow of trade. However, increasing energy demand and a rise in oil and gas consumption are anticipated to drive lucrative developments in the EPC field in the years ahead.

- Supply chain disruptions challenge financial structure: The fluctuations in raw material prices and supply are leading to delays in projects for longer periods. The rise in the cost of shipbuilding steel grade challenges the construction of new projects and creates a supplier risk-sharing agreements in procurement models. Considering these fluctuations, the oil and gas EPC market players engage in negotiations and changes in financial models. Strategic investments and financing movements, during supply chain disruptions, are estimated to aid oil and gas EPC companies to sustain their position in the global landscape.

Oil and Gas EPC Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.1% |

|

Base Year Market Size (2025) |

USD 56.52 billion |

|

Forecast Year Market Size (2035) |

USD 92.95 billion |

|

Regional Scope |

|

Oil and Gas EPC Market Segmentation:

Service Type (Engineering, Procurement, Construction, Fabrication)

Construction segment is poised to dominate over 55.1% oil and gas EPC market share by 2035. The continuous rise in the global energy demand is fueling the sales of oil and gas. To meet these energy demands, the exploration activities are gaining momentum and subsequently leading to investments in oil and gas facility construction. The integration of digital technologies for design and analysis is uplifting the capabilities of construction activities. Furthermore, to expand oil and gas supply, many countries are investing in diversified routes, which is increasing the need for the construction of modern and advanced oil and gas pipelines.

Application (Onshore, Offshore)

By 2035, onshore segment is expected to capture over 69.1% oil and gas EPC market share. The adequacy of onshore hydrocarbons is increasing investments in EPC actions across the world. The rising explorations increase the need for engineering, procurement, and construction services in the oil and gas plants. The Research Nester’s study estimates that nearly 70.0% of the global oil and gas exploration activities are performed onshore. Supportive government policies and incentives are also supporting the expansion of onshore oil and gas exploration.

Our in-depth analysis of the global oil and gas EPC market includes the following segments:

|

Service Type |

|

|

Type |

|

|

Application |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Oil and Gas EPC Market Regional Analysis:

North America Market Forecast

North America oil and gas EPC market is estimated to capture revenue share of over 40.1% by 2035. The supportive government policies for hydrocarbon exploration are offering high-earning opportunities for EPC companies. The need for upgrades of existing oil and gas plants is also fueling the demand for EPC services. The growth in offshore drilling and exploration activities is also highlighting the lucrativeness of the region for oil and gas EPC companies. The growth in public-private investments and cross-border partnerships is further set to augment the overall oil and gas EPC market growth in the coming years.

The swift rise in the import and export trade of hydrocarbon gas liquids is anticipated to drive the demand for EPC services in the U.S. Technological advancements and the strong presence of leading oil and gas producers are uplifting the position of the U.S. oil and gas EPC market in the global landscape. The hydrocarbon gas liquids exports amounted to 2.4 million b/d in 2022, up from 70,000 b/d in 2007, states the U.S. Energy Information Administration (EIA) study. In the Federal Offshore Gulf of America, the oil and natural gas accounted for 15.0% of the total crude oil production in 2022. The advanced construction technologies and efficiency of exploration are boosting the adoption of floating platforms in the country.

Canada is one of the largest producers of hydrocarbons, owing to the abundance of oil sands and offshore reserves. The growth in the offshore oil and gas exploration is likely to boost the demand for EPC services in the years ahead. The study by the Canadian Association of Petroleum Producers (CAPP) projects that the country’s offshore exploration holds nearly 4.0% of the total oil production. While White Rose, Newfoundland and Labrador, Hibernia, Terra Nova, and Hebron are some of the top offshore areas. Furthermore, in 2022, Canada exported 97.0% of the hydrocarbon gas liquids to the U.S., according to EIA. Overall, the expanding oil and gas trade is poised to offer lucrative opportunities for EPC companies in the years ahead.

Asia Pacific Market Statistics

The Asia Pacific oil and gas EPC market is projected to increase at the fastest pace from 2025 to 2035. The boom in infrastructure development projects, growth in industrial plants, and rapid urbanization are augmenting energy demand in the region. This energy demand, fulfilled by the oil and gas sector, is increasing the EPC service demand. The growing LNG demand is driving infrastructure development activities in Asian countries and opening profitable doors for oil and gas EPC companies. China, India, South Korea, and Japan are anticipated to lead the oil and gas EPC landscape in Asia Pacific in the years ahead.

China is one of the leading energy producers across the world, which fuels high demand for oil and gas and subsequently EPC services. The booming industrial and urban developments are driving the government to invest in hydrocarbon production. The country’s vast population is also uplifting its position as a major oil and gas consumer. For instance, the EIA report highlighted that in 2023, China’s domestic natural gas production accounted for 58.0% of its supply, and the consumption totaled 2.66 billion cubic feet per day.

The supportive government policies and positive foreign direct investments are underscoring the positive economic growth of India. This growth directly represents the high energy consumption in the country. Investments in hydrocarbon exploration activities are poised to meet the growing energy demand and increase the need for advanced EPC services. The analysis by the Directorate General of Hydrocarbons (DGH) reveals that in FY 2023-24, the eastern offshore of the country contributed 1.46 MMT of the total oil production. The cross-border collaborations and strategic partnerships with high-tech companies are likely to offer enhanced EPC services to the oil and gas plants.

Key Oil and Gas EPC Market Players:

- Saipem S.p.A.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Technip Energies NV

- Consolidated Contractors Company

- Bechtel Corporation

- Fluor Corporation

- McDermott International

- Petrofac

- Wood Plc

- KBR, Inc.

- NPCC

- Lamprell

- SNC-Lavalin Group Inc.

- Worley

- Aker Solutions

- Hyundai Engineering & Construction Co., Ltd.

- Samsung Engineering Co., Ltd.

- Mott MacDonald

- Jacobs Engineering Group Inc.

The leading oil and gas EPC market are investing heavily in innovative technologies such as artificial intelligence, machine learning, digital twins, and data analytics to enhance their capabilities in project planning and execution. This move is helping them to hold a dominant position in the global landscape. The industry giants are also employing partnerships and collaboration strategies to get a steady raw material supply and to increase their customer base. The cross-border investments are offering lucrative gains to EPC companies owing to supportive polices and ROI rates.

Some of the key players include in oil and gas EPC market:

Recent Developments

- In April 2025, Saipem S.p.A. received new offshore contracts of around USD 720 million in the Middle East and Guyana. The company is estimated to perform the operations using various construction and support vessels, including Saipem FDS2.

- In May 2023, Technip Energies NV revealed that it entered into a partnership with Consolidated Contractors Company (CCC) for an engineering, procurement, construction, and commissioning (EPCC) contract. This joint venture is set to work on QatarEnergy’s contract for the onshore facilities of the North Field South Project (NFS).

- Report ID: 7524

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Oil and Gas EPC Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.