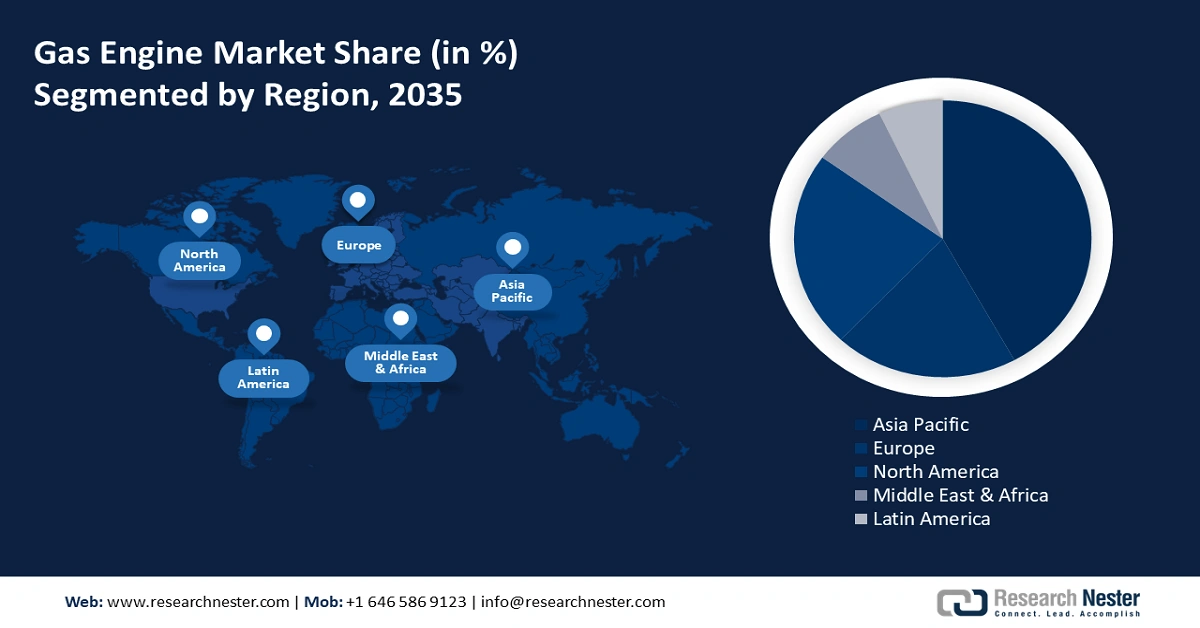

Gas Engine Market Regional Analysis:

APAC Market Insights

The Asia Pacific gas engine market is projected to hold largest revenue share of 42% by the end of 2035. The net gas import in the region showcased a 291% surge in the last two decades, with a net gas import of 24.3% in 2022, finds EIA. The domestic natural gas production has also increased at a rate of 135% in the last 20 years, accounting for a global production share of 16% in 2022, while the total share of gas generated locally stood at 76.1%. Rise in domestic production, electrification, policy measures supporting coal- and oil-to-gas switching, and investments in building gas infrastructure, comprising regasification capacity, and the expansion of distribution and transmission, are among the main drivers.

Gas turbine import trade value in China was USD 9.9 billion in 2022, marking its spot as the top five importers. China and its People’s Liberation Army Air Force (PLAAF) are investing in advancing capabilities to penetrate the aerospace with widespread gas engine manufacturing facilities. The PLAAF aims to operate modern aircraft, comprising the J-31, J-10, and J-20. Beijing has embarked on an indigenization effort to boost in-house aero-derivative gas turbine production to offset foreign dependencies for key capabilities.

North America Market Insights

North America gas engine market is slated to grow at substantial rate through 2035. The expansion is driven by well-established and extensive energy infrastructure, including natural gas pipelines, storage facilities, and distribution networks. The region has abundant natural gas reserves and a long history of gas production and utilization. This infrastructure provides a reliable and readily available supply of natural gas, which is a common fuel for gas engines.

The U.S. is a key player in the generation of aerospace and automobile subsector. The capacity utilization of manufacturing aerospace and transportation equipment reached 60% in November 2024, as per Fred Economic Data. In 2023, the country consumed 32.50 Tcf of natural gas, which is equivalent to 33.61 quadrillion British thermal units’ quads and 36% of the total U.S. energy consumption. 4% or 1.27 Tcf was consumed for transportation, including gas engines. Approximately most of the natural gas consumption in transportation is by private vehicle fleets and government as compressed and liquefied natural gas.