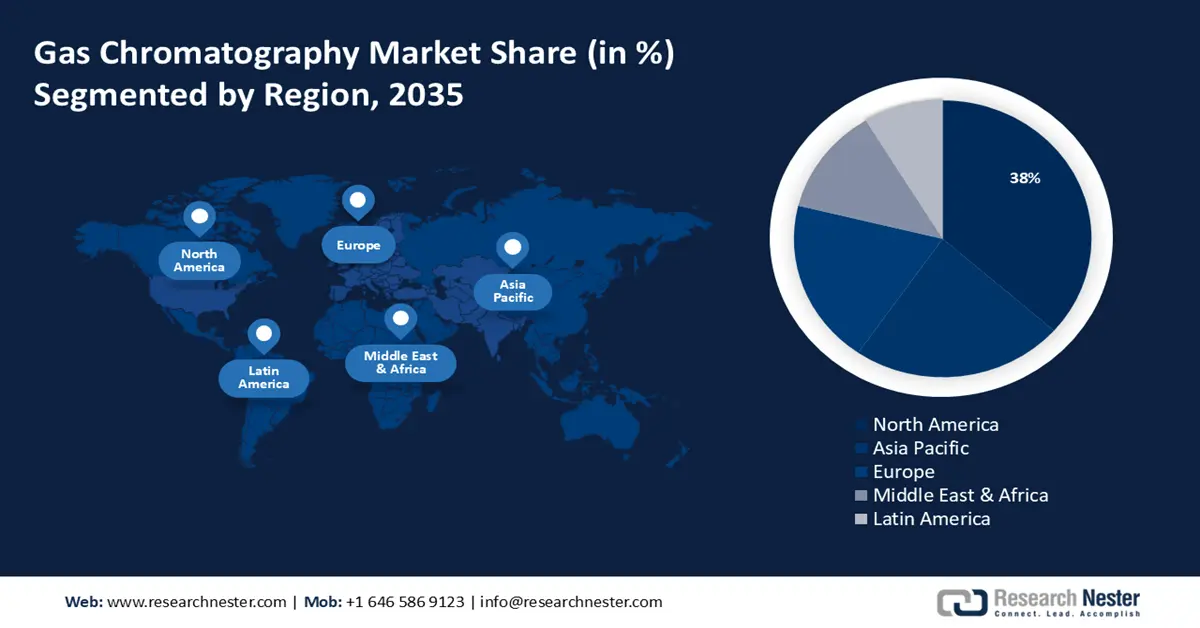

Gas Chromatography Market Regional Analysis:

North American Market Insights

The North America gas chromatography market is poised to account for the largest revenue share of 38% by the end of 2035. This proprietorship is owned by the growing demand for advanced analytical systems in the enlarging food and beverage industry across the region. There is a notable use of GC devices in vaporization and a gas carrier to analyze and detect nutrients or contaminants in the production samples. As per the Department of Commerce, the number of establishments associated with this industry in the U.S. was 42,708 in 2022. It also mentioned that 16.8% and 15.4% of sales and employees of the total U.S.-based manufacturing establishments belonged to this merchandise. This testifies to the region’s significance in revenue generation from this sector.

The U.S. is home to several global leaders in the market such as Waters Corporation, Agilent Technologies, Thermo Fisher Scientific, and others. This indicates a remarkable commercial engagement and revenue generation in this landscape. For instance, in 2022, Waters secured an 8.0% constant currency growth in net sales of its analytical products, including GC systems and columns in America, in comparison to the previous year. The country’s predominant contribution in the global biopharma production and economy is also a driver in this field. In this regard, the International Trade Administration stated that the total biopharmaceutical R&D expenditure by the U.S.-based companies accounted for USD 96.0 billion in 2023.

APAC Market Insights

The Asia Pacific gas chromatography market is estimated to hold the second largest share of 24% and a greater pace of growth over the analysed timeframe. The increasing public awareness about the environmental impact of rapid industrialization is boosting this sector. Thus, both domestic and international pioneers are investing heavily in this region. For instance, in September 2023, Shimadzu launched Brevis GC-2050 gas chromatograph, offering enhanced productivity and space saving. Furthermore, the growing R&D activities in pharmacology, particularly in precision medicine, is propelling need for GC-related products. This can further be testified by the expected dominance of APAC in the pharmaceutical contract manufacturing services industry, with the largest share of 42.9% by 2035.

India is strengthening its position in the regional market by escalating domestic manufacturing capabilities for various industries, including pharmaceuticals and chemicals. For instance, in 2025, this country was ranked as the 4th largest producer of agrochemicals in the world, acquiring up to 18.0% of the global dyestuffs and dye intermediates production. Additionally, India became the largest vaccine manufacturer worldwide, accounting for over 50.0% of the global supply. On the other hand, the nationwide demand for chemicals and petrochemicals is projected to surpass USD 1.0 trillion by 2040 (IBEF). These figures indicate the country strong emphasis on this field, as it present lucrative business opportunities and a wider consumer base.