Garbage Truck Bodies Market Outlook:

Garbage Truck Bodies Market size was valued at USD 5.1 billion in 2025 and is projected to reach USD 9.3 billion by the end of 2035, rising at a CAGR of 6.3% during the forecast period, i.e., 2026-2035. In 2026, the industry size of garbage truck bodies is assessed at USD 5.4 billion.

The demand landscape for the market is directly related to the municipal solid waste generation, public sanitation budgets, and fleet replacement cycles led by local governments. In the U.S., the Environmental Protection Agency in October 2025 reported that the municipal solid waste generation reached approximately 292.4 million tons, reflecting a steady and a long term growth driven by population expansion and urban density increases. The local governments remain the primary buyers, with waste collection representing one of the most capital-intensive public works functions. The report from the EPA in December 2025 indicates that the solid waste infrastructure for recycling grants nationwide by the EPA reached USD 100 million, a material portion of which is allocated to vehicle procurement and body retrofits. Replacement demand is further reinforced by fleet aging. The Federal Highway Administration indicates that the heavy-duty municipal trucks often remain in service for a decade, creating a predictable renewal cycle.

Solid Waste Infrastructure for Recycling (SWIFR) Grant Program - Funding Allocation Overview

|

Category |

Details |

|

Authorizing Legislation |

Save Our Seas 2.0 Act |

|

Funding Legislation |

Infrastructure Investment and Jobs Act (IIJA) |

|

Administering Agency |

U.S. Environmental Protection Agency (EPA) |

|

Total Program Funding (IIJA) |

USD 275 million |

|

Funding Period |

Fiscal Years (FY) 2022-FY 2026 |

|

Annual Allocation |

USD 55 million per year |

|

Fund Availability |

Funds remain available until expended |

|

Additional EPA Implementation Funding – FY 2022 |

USD 2.5 million |

|

Additional EPA Implementation Funding – FY 2023 |

USD 6.5 million |

|

Additional EPA Implementation Funding – FY 2024 |

USD 5.0 million |

|

Program Objective |

Support solid waste infrastructure improvements aligned with the Building a Better America initiative |

Source: EPA December 2025

Similar dynamics are seen in Europe, where the Eurostat data in February 2022 shows over 225.7 million tons of municipal waste generated every year across the EU, prompting the sustained procurement of refuse collection equipment via city-level tenders. These conditions anchor baseline demand for rear loader, front loader, and side loader truck bodies without reliance on discretionary private sector spending. Regulatory pressure and public accountability are also reshaping the purchasing criteria for garbage truck bodies. In the U.S., the Clean Air Act and state-level implementation have stimulated fleet modernization, with the EPA confirming that the diesel-powered refuse trucks are among the highest NOx emitters in urban duty cycles, increasing the scrutiny on vehicle efficiency and compatibility with never chassis platforms. The European Environment Agency, in December 2025, links improved waste collection infrastructure to higher recycling rates, which reached 47.7% across the EU in 2023, supporting continued municipal investment in specialized waste collection bodies.

Key Garbage Truck Bodies Market Insights Summary:

Regional Highlights:

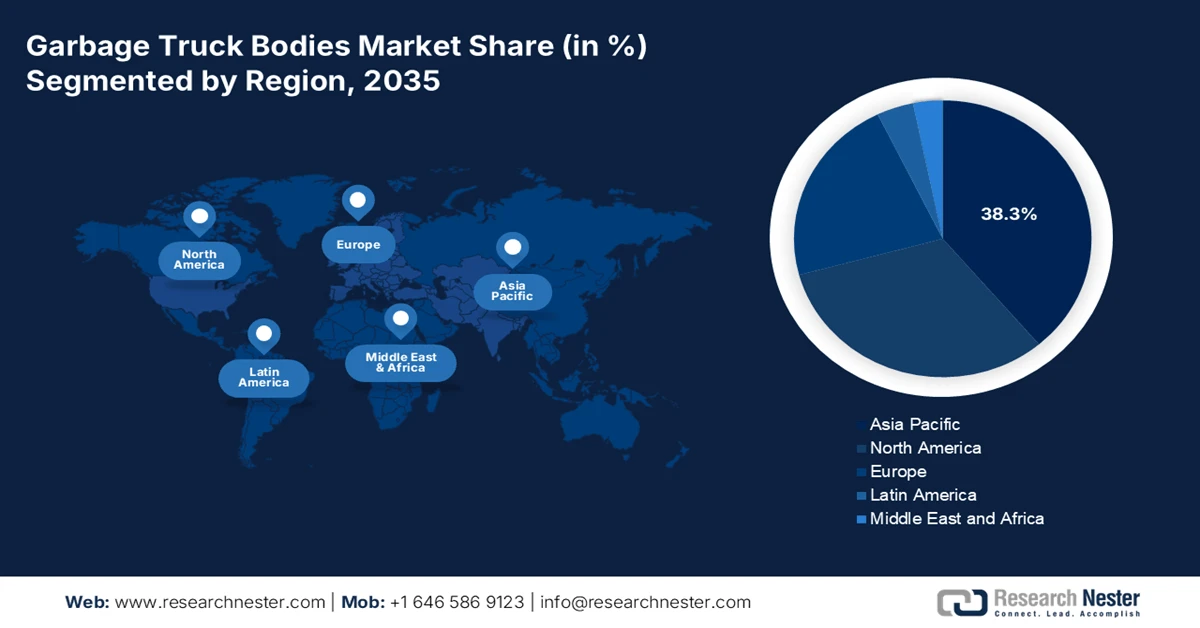

- In the garbage truck bodies market Asia Pacific is projected to secure a 38.3% revenue share by 2035, reflecting its leadership as rapid urbanization and large-scale government-backed cleanliness and waste management initiatives accelerate demand for efficient collection systems.

- North America is expected to emerge as the fastest-growing region at a CAGR of 4.5% during 2026–2035, supported by legislated zero-emission mandates and aggressive fleet replacement policies promoting cleaner and automated refuse vehicles.

Segment Insights:

- In the garbage truck bodies market, the steel material segment is anticipated to account for a 68.6% share by 2035, as its structural resilience and cost efficiency continue to satisfy demanding operational lifecycles and payload requirements in municipal and industrial applications.

- The 10-20 tons load capacity segment is projected to maintain leadership by 2035, as fleet operators prioritize this range to balance regulatory compliance with efficient maneuverability across dense urban infrastructure.

Key Growth Trends:

- Rising municipal solid waste volumes and collection obligations

- Expansion of recycling and segregated collection systems

Major Challenges:

- High capital intensity and R&D costs

- Supply chain volatility for specialized components

Key Players: Heil Environmental, McNeilus Companies, Labrie Enviroquip Group, Rosh Group, New Way Trucks, Kirchhoff Grou.

Global Garbage Truck Bodies Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.1 billion

- 2026 Market Size: USD 5.4 billion

- Projected Market Size: USD 9.3 billion by 2035

- Growth Forecasts: 6.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (38.3% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Germany, Japan, France

- Emerging Countries: India, South Korea, Canada, Spain, Italy

Last updated on : 22 January, 2026

Garbage Truck Bodies Market - Growth Drivers and Challenges

Growth Drivers

- Rising municipal solid waste volumes and collection obligations: The growth in municipal solid waste generation is a primary structural driver for garbage truck body market demand, as the local governments must expand and modernize collection fleets to maintain service coverage. The U.S. EPA reports that the municipal solid waste generation reached significant tons, continuing a multi-year upward trend tied to population growth and consumption patterns. Similar pressure exists globally; the World Bank estimates that the global waste generation will increase to 3.4 billion tons by 2050, with urban municipalities bearing most collection responsibilities. High waste volumes directly increase the collection frequency, vehicle utilization rates, and mechanical wear, stimulating the replacement cycles for truck bodies. For suppliers, this creates a predictable volume-driven procurement demand primarily in dense urban regions where the compaction efficiency and durability are the procurement priorities rather than optional features.

- Expansion of recycling and segregated collection systems: Rising recycling targets increase demand for the specialized garbage truck bodies market. The European Environment Agency in January 2026 reports that the overall recycling rate reached 44.3% in 2022, driven by the policy mandates requiring segregated waste collection. Separate collection streams for organic recyclable and residual waste require additional vehicles or modified body designs. Similar trends are emerging in North America via state and municipal recycling mandates. This structural shift increases the fleet complexity and total state and municipal recycling mandates. This structural shift increases the fleet complexity and total vehicle counts, supporting sustained demand beyond the population-driven growth. For suppliers, recycling-led procurement favors bodies designed for frequent unloading, contamination control, and route efficiency, reinforcing the long term demand stability.

Recycling Rates of Packaging, Municipal, Electronic and Total Waste Recycling Rates

|

Metric |

2021 |

2022 |

2023 |

|

Packaging Waste |

64 |

65.3 |

67.5 |

|

Municipal Waste |

49.7 |

49.1 |

47.7 |

|

Electrical and Electronic Waste |

35.9 |

31.6 |

30.8 |

|

Overall Recycling Rate |

- |

44.3 |

- |

Source: EEE January 2026

- Regulatory pressure on emissions and operational efficiency: Environmental regulations drive the garbage truck body market demand by stimulating fleet modernization. The U.S. EPA identifies that the refuse trucks are disproportionately high contributors to NOx emissions due to stop-and-go duty cycles, prompting regulatory scrutiny at the federal and state levels. In Europe, the European Environmental Agency links cleaner municipal fleets to air quality compliance in the urban areas. As municipalities upgrade chassis to meet emissions targets, compatible new truck bodies are typically procured simultaneously. This coupling effect increases the body demand even when chassis upgrades are regulation-driven. Manufacturers that ensure the structural compatibility with newer vehicle platforms gain an advantage in regulation-led procurement cycles.

Challenges

- High capital intensity and R&D costs: The market requires a massive investment in specialized manufacturing facilities for heavy-duty fabrication tooling and R&D for body innovation. Competing with established players such as Heil or McNeilus, which benefits from economies of scale, is prohibitively expensive for newcomers. Significant R&D capital is also needed to develop automated or electric compatible bodies. For instance, BYD successfully entered the electric refuse truck space in North America by leveraging its global expertise in battery technology, but this required enormous initial capital investment, as highlighted in its market expansion reports.

- Supply chain volatility for specialized components: Production demands on the stable supply of specialized high-grade steel hydraulic systems and custom electronic controllers. Recent global disruptions have caused price spikes and delays. For example, the top players reported that the supply chain constraints and material inflation impacted the production schedules and margins, a challenge in the market that smaller entrants with less purchasing power find even more difficult to manage.

Garbage Truck Bodies Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.3% |

|

Base Year Market Size (2025) |

USD 5.1 billion |

|

Forecast Year Market Size (2035) |

USD 9.3 billion |

|

Regional Scope |

|

Garbage Truck Bodies Market Segmentation:

Material Segment Analysis

Under the material segment, steel is leading the segment and is poised to hold the share value of 68.6% by 2035 in the market. The market is valued for its unmatched durability, high strength-to-cost ratio, and ease of repair. It dominates mainly in heavy-duty rear loaders and roll-off bodies that endure extreme stress and impact. The primary driver is the material’s ability to meet demanding operational lifecycles and payload requirements in municipal and industrial applications. While aluminum and composites grow for lightweighting to improve fuel efficiency, steel’s prevalence is sustained by advanced high-strength low-alloy grades that offer greater strength without added weight. The report from the World Steel in January 2023 indicates that nearly 70% of total global steel production is based on the inputs of coal via the BF/BOF route, underscoring its entrenched role in heavy vehicle production, such as refuse trucks.

Load Capacity Segment Analysis

In the load capacity segment, the 10 to 20 tons segment is leading in the garbage truck bodies market, serving as the optimal balance between regulatory compliance, operational efficiency, and versatility for both the municipal residential routes and commercial collection. This range accommodates standard axle weight limits on public roads while maximizing the collection economics per trip. Bodies in this class, primarily automated side loaders and rear loaders, are the workhorses for city-wide waste management contracts. The fleet standardization around this capacity is driven by the need to navigate urban infrastructure efficiently. A key statistic from the BTS Annual Report in 2024 indicates that the Light-duty trucks had a gross vehicle weight rating of 10,000 pounds in 2021, highlighting the industry’s concentration in this mid-range capacity for daily operations.

Estimated Vehicle Counts by Average Weight Class

|

Avg. weight |

Vehicle Estimate |

|

Less than 6,000 pounds |

122,200,910.20 |

|

6,001 to 8,500 pounds |

32,958,835.30 |

|

8,501 to 10,000 pounds |

5,048,018.90 |

|

10,001 to 14,000 pounds |

2,865,847.20 |

|

100,001 to 130,000 pounds |

55,414.80 |

|

130,001 pounds or more |

14,437.40 |

|

14,001 to 16,000 pounds |

650,197 |

|

16,001 to 19,500 pounds |

763,020.80 |

|

19,501 to 26,000 pounds |

1,258,305 |

|

26,001 to 33,000 pounds |

451,563.50 |

|

33,001 to 40,000 pounds |

303,556.50 |

|

40,001 to 50,000 pounds |

312,403.60 |

|

50,001 to 60,000 pounds |

385,841.80 |

|

60,001 to 80,000 pounds |

2,105,474.60 |

|

80,001 to 100,000 pounds |

142,033.50 |

Source: U.S. BTS 2021

End user Segment Analysis

The municipal/government collection sector is the leading end-user segment in the market, acting as a primary driver for the technological adoption and fleet renewal. The municipalities operate large standardized fleets under the long term service contracts, prioritizing reliability, safety, and compliance with emission regulations. This segment’s purchasing decisions are heavily influenced by the public policy sustainability goals and available federal or state grants, mainly for transitioning to electric and automated vehicles. Their demand for durable high-capacity bodies with advanced telematics is constant. Supporting this, the government data indicates that the local government's solid waste collection has employed a significant number of people, representing a massive, stable fleet base that drives the consistent demand for new truck bodies and replacement cycles.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Product Type |

|

|

Load Capacity |

|

|

End user |

|

|

Operation |

|

|

Fuel Type |

|

|

Material |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Garbage Truck Bodies Market - Regional Analysis

APAC Market Insights

Asia Pacific is the largest market and is projected to hold the revenue share of 38.3% by 2035. The market is driven by unprecedented urbanization, stringent new environmental policies, and massive government investment in public health infrastructure. The key drivers include national campaigns such as Beautiful China and Waste Free Cities initiative, and India’s Swachh Bharat Mission, which mandate improved waste collection coverage and efficiency. A dominant trend is the rapid electrification of municipal fleets, with China leading the world in the production and deployment of electric vehicles. The market is highly varied, ranging from mature, technology-driven economies like Japan and South Korea to high-growth, volume-driven markets like India and Southeast Asia, creating diverse opportunities for both standard and advanced body solutions.

The China garbage truck bodies market is defined by its integration into a larger state-guided industrial strategy for global dominance in both heavy-duty and new-energy vehicle sectors. The market’s growth is propelled by domestic policy drivers such as the Beautiful China initiative and fueled by the export-oriented Belt and Road strategy. In December 2025, Shacman’s dual success with its New Pearl truck and the export of 30 Zhiyun S500 electric garbage trucks to Uzbekistan demonstrates how Chinese manufacturers use domestic scale to compete internationally. This export of a fully integrated electric vehicle, noted as the largest of its kind in 2025, showcases the market’s move beyond simple body fabrication to supplying complete high-tech municipal solutions. The underlying supply chain focus on new energy, which drove a 251.6% YoY surge in Shacman’s NEV sales in 2025, confirms that the electrification and the global market penetration are the defining interconnected trends of the China industry.

The national Swachh Bharat Mission 2.o is driving the India garbage truck bodies market and is experiencing a transformative growth. The data from the PIB April 2025 indicates that the approval of waste-to-energy and waste-to-biogas projects worth ₹23,549.42 crore, with a central government share of ₹8,662.28 crore and ₹1,970.92 crore released between FY 2020 to 2021 and FY 2025 to 2026, directly strengthens the upstream waste collection infrastructure demand. These projects depend on a consistent, segregated, and high-volume feedstock supply, which increases the municipal investment in specialized garbage truck bodies capable of handling organic wet and segregated waste streams. This government investment creates a direct top-down demand signal for municipal fleets, mandating the procurement of advanced collection vehicles.

North America Market Insights

The North America garbage truck bodies market is the fastest growing and is expected to grow at a CAGR of 4.5% during the forecast period 2026 to 2035. The market is defined by the stringent regulatory mandates, high fleet replacement rates, and a strong push toward electrification and automation. The primary driver is the government policy, notably the U.S. EPA’s Clean Trucks Plan and Canada’s national zero-emission vehicle strategy, which create a direct legislated demand for cleaner vehicles. Substantial federal and municipal spending on solid waste management at the state or local level in the U.S> provides a stable demand base. The shift to automated side loader bodies to reduce the high injury rates among the workers is a dominant trend supported by the OSHA ergonomic guidelines. Concurrently, the smart city investments are integrating telematics for route optimization, turning refuse trucks into data collection assets.

The U.S. garbage truck bodies market is currently defined by the large-scale publicly funded electrification projects that integrate vehicle deployment with the critical charging infrastructure. The delivery of the Mack LR Electric, a subsidiary of Volvo Group, to Royal Waste Services in July 2025 in New York, supported by a USD 10 million NYSERDA prize, highlights the dominant procurement model. These projects validate the commercial readiness of electric refuse vehicles for municipal and private fleets, directly driving the demand for the new specialized bodies compatible with zero-emission chassis. The concurrent development of the 32-charger freight depot by MN8 Energy and the order of 35 battery-electric trucks from Volvo by the International Waste Management Company in April 2025 underscores that infrastructure access is a prerequisite for scaling adoption, making public-private partnerships a key enabler for market growth and a primary source of new orders for body manufacturers.

The provincial climate mandates such as British Columbia’s Clean BC Program drive the municipal and private fleet electrification via aligned procurement and are defining the Canada market. The recent advancement, such as in June 2024, the deployment of eight Mack LR Electric trucks by Emterra for the Comox Valley noted as the largest fleet and is a direct result of this policy-driven demand. Further, each electric chassis is fitted with an automated side loader body from Labrie Environmental Group, confirming that the shift to zero emission vehicles is a primary driver for the new body sales. This transition is supported by the partnerships with the utilities, such as BC Hydro, for charging infrastructure, creating a complete ecosystem for adoption. Such projects validate the business case for electrification, signaling to other municipalities and waste operators across Canada that investing in new electric-compatible truck bodies is both feasible and increasingly necessary to meet the legislated emissions targets.

Europe Market Insights

The Europe garbage truck bodies market is primarily driven by the stringent EU-wide environmental regulations, notably the European Green Deal and Circular Economy Action Plan, which mandate higher recycling rates and cleaner urban transport. A key trend is the stimulated transition from the diesel to electric refuse collection vehicles supported by the municipal low-emission zone policies and direct funding programs like the EU’s Alternative Fuels Infrastructure Facility. In 2023, according to the IEA report, the sales of electric trucks increased by 35%. This shift is compounded by the need for fleet modernization to handle increasing waste volumes and complex separate collection streams, pushing the demand for the specialized automated body designs that improve operational efficiency and worker safety.

The Germany garbage truck bodies market is undergoing a significant transformation and is being driven by the dual track approach to fleet decarbonization. The established alternatives, such as compressed natural gas, remain in active deployment. The Abfallwirtschaftsbetrieb München's order for 34 new Scania CNG trucks in May 2022 has demonstrated that the market is simultaneously entering a new phase with the introduction of hydrogen fuel cell vehicles. On the other hand, in July 2025, Hyundai’s launch of the hydrogen electric hook lift and refuse collection vehicles based on its proven XCIENT Fuel Cell platform represents a pivotal moment. This development signals to body builders such as Faun that future designs must be compatible with the zero-emissions drivetrains from multiple energy sources, such as CNG, battery, electric, and hydrogen, to meet the diverse sustainability strategies of Germany’s leading municipal operators like AWM.

The UK garbage truck bodies market is defined by the regulatory mandates driving a rapid transition to cleaner vehicles and increased operational efficiency. The primary catalyst is the Environment Act 2021, which requires all English local authorities to implement separate weekly food waste collection. This legislation has created a time-bound massive demand for new collection vehicles fitted with specialized bodies, mainly multi-compartment designs for co-collection. This regulatory push aligns with the broader government targets, such as the Government of the UK, which in April 2021 stated that the country has committed to a 78% of reduction of greenhouse gas emissions by 2035. Supporting this transition, the Department of Transport reported a significant increase in grant funding, with the Zero Emission Road Freight Trial demonstrating a rise every year in applications for heavy vehicle electrification support. This policy-driven demand ensures the market remains focused on technologically advanced, often electric or low-emission body solutions compatible with modern chassis.

Key Garbage Truck Bodies Market Players:

- Heil Environmental (U.S.)

- McNeilus Companies (U.S.)

- Labrie Enviroquip Group (Canada)

- Rosh Group (U.S.)

- New Way Trucks (U.S.)

- Kirchhoff Group (Germany)

- FAUN Umwelttechnik (Germany)

- ZOELLER (Germany)

- HIAB (Finland)

- Dennis Eagle (UK)

- IVECO (Italy)

- Porsche Engineering (Germany)

- Fujian Longma Environmental Sanitation Equipment (China)

- Isuzu Motors (Japan)

- Tadano (Japan)

- Hyundai Motor Company (South Korea)

- Varley (Australia)

- BharatBenz (India)

- TATA Motors (India)

- MBM Technics (Malaysia)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Heil Environmental, a historic leader in the market, has driven competition via vertical integration and technological innovation. Its strategic initiatives focus on developing patented bodies such as the Set One automated side loader and integrating advanced telematics systems. These smart body solutions provide fleet operators with real-time data on payload weight, route efficiency, and maintenance needs, transforming the waste collection vehicle into a connected data hub for operational optimization.

- In the competition garbage truck bodies market, McNeilus Companies leverages the scale and engineering prowess of its parent company, OshKosh Corporation. Its key initiatives involve significant investment in alternative fuel technologies, including compressed natural gas compatible bodies and fully electric front loaders. Furthermore, McNeilus emphasizes and services strategically using durability and aftermarket support to secure long term municipal and private contracts. In October 2024, McNeilus Truck and Manufacturing, Inc., announced that Republic Services, Inc., a leader in the environmental services industry, had placed an order for 100 McNeilus Volterra ZSL electric refuse and recycling collection vehicles.

- Labrie Enviroquip Group strengthens its position in the garbage truck bodies market via a dual strategy of product specification and geographic acquisition. The company is renowned for its focus on ergonomic driver-centric designs for automated side loaders. Strategically, it has expanded its North America footprint by acquiring the established regional manufacturers, thereby consolidating market share and diversifying its product portfolio to offer customized solutions for the different municipal and residential collection needs.

- Rosh Group competes in the garbage truck bodies market by strategically targeting niche segments with high-performance specialized equipment. Its initiatives are centered on manufacturing rugged heavy-duty bodies for the demanding commercial, industrial, and roll-off sectors. By focusing on superior build quality, advanced hydraulic systems, and custom engineering for unique waste streams, Rosh differentiates itself from mass market manufacturing and builds a loyal customer base in specific industrial applications.

- New Way Trucks adopts a strategy of agility and customer collaboration within the garbage truck bodies market. A key initiative is its Diamond Plus integrated chassis and body solution developed in partnership with Ford, which streamlines purchasing and ensures optimal vehicle performance. Furthermore, New Way emphasizes flexible manufacturing and a wide array of body configuration allowing it to respond quickly to evolving customer specifications and regional collection requirements from the residential carts to public space litter bins.

Here is a list of key players operating in the global market:

The global garbage truck bodies market is driven by the established commercial vehicle OEMs and specialized body manufacturers. The market is highly competitive and drives strategic initiatives focused on electrification automaton and sustainability to meet the stringent emissions regulations and smart city demands. The key players are expanding via acquisitions, strategic partnerships, and geographic expansion into emerging markets. For example, in November 2025, Enviri Corporation announced the sale of Clean Earth to Veolia for USD 3.04 billion and a taxable spin-off of Harsco Environmental and Rail businesses. Innovations in lightweight composite materials and integrated route optimization software are also critical battlegrounds. While North America and Europe firms lead in technology Asia players compete strongly on cost effectiveness and rapidly improving quality, creating a diverse and dynamic global marketplace.

Corporate Landscape of the Garbage Truck Bodies Market:

Recent Developments

- In September 2025, Federal Signal Corporation is a leader in environmental and safety solutions, announced that it has signed a definitive agreement to acquire Scranton Manufacturing Company Inc., a leading U.S.based designer and manufacturer of refuse collection vehicles, for an initial purchase price of $396 million.

- In April 2025, SWITCH Mobility, a global electric buses and light commercial vehicles manufacturer, has announced the launch of 100 customized SWITCH IeV3 vehicles for waste management and has delivered to Indore Municipal Corporation.

- In November 2024, Lohia’s Humsafar IK Tipper combines zero-emission technology with high performance, offering an eco-friendly, cost-effective solution for waste management, featuring impressive range, durability, and quick charging for businesses seeking green transportation alternatives.

- Report ID: 4473

- Published Date: Jan 22, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Garbage Truck Bodies Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.