Truck Platooning Market Outlook:

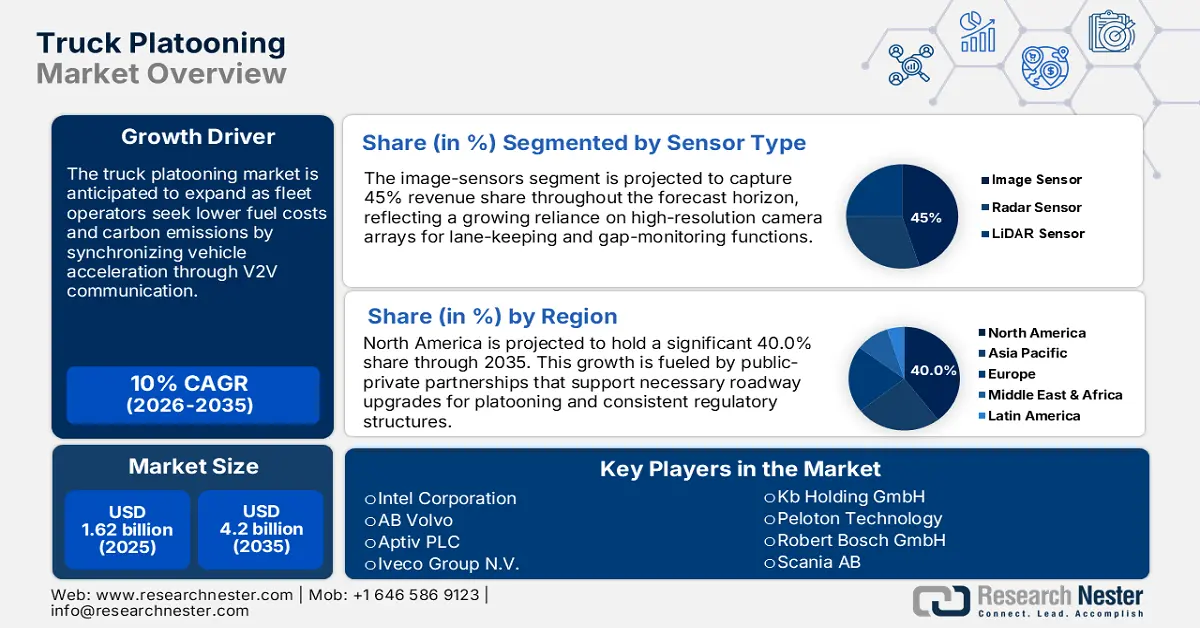

Truck Platooning Market size was over USD 1.62 billion in 2025 and is projected to reach USD 4.2 billion by 2035, growing at around 10% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of truck platooning is evaluated at USD 1.77 billion.

Logistics operators are seeking solutions to enhance efficiency and sustainability while addressing driver shortages, thereby fueling the growth of the truck platooning market. In April 2025, Kratos Defense & Security Solutions expanded its platooning systems in Ohio and Indiana, along with DriveOhio and INDOT. The deployment highlights growing confidence in the real-world readiness of autonomous trucking in key US freight corridors. Similarly, governments are actively funding trials to reduce logistics costs and greenhouse gas emissions. Additionally, growing investments in V2V connectivity and AI for coordinated movement are further supporting adoption. Such shifts suggest an industry trend towards scalable platooning infrastructure. The commercial interest is increasing across regions, and the market outlook is promising.

While the U.S. is driving the current wave of innovation, stakeholders in Asia and Europe are scaling up deployment pilots. For example, in January 2025, KargoBot received approval for driverless truck platooning trials in Beijing's high-level demonstration zone, making China one of the leading innovators in this field. This indicates a move from R&D to pre-commercial testing in complex traffic environments. At the same time, Japan and Germany are launching public–private trials on highways to test autonomous truck behavior under controlled conditions. These initiatives signal the world's alignment with autonomous freight as a strategic priority. Furthermore, bilateral cooperation, infrastructure adaptation, and regulatory harmonization are building positive truck platooning market momentum.

Key Truck Platooning Market Insights Summary:

Regional Highlights:

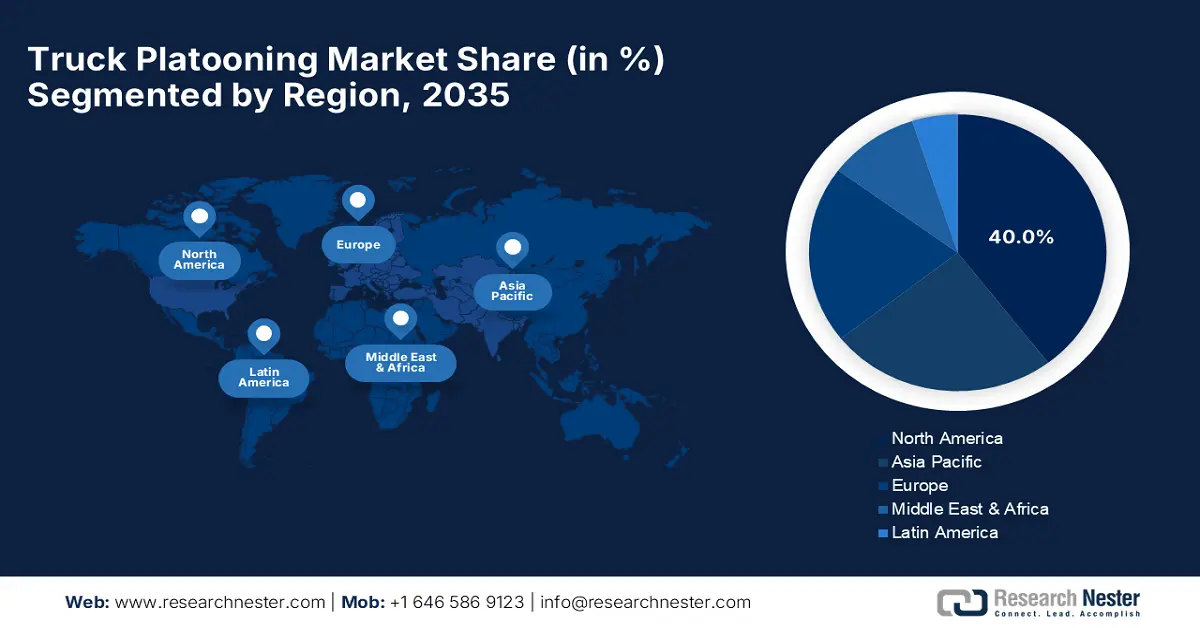

- North America leads the Truck Platooning Market with a 40.00% share, driven by state-level AV programs, extensive AV testing, regulatory flexibility, and logistics sector investments, ensuring strong growth by 2035.

- Asia Pacific's Truck Platooning Market is experiencing substantial growth through 2026–2035, attributed to logistics growth, smart city development, government regulatory approvals, and manufacturing incentives.

Segment Insights:

- The Image Sensors segment is expected to capture 45% market share by 2035, driven by their critical role in object detection and synchronized movement for truck platooning.

- The Adaptive Cruise Control segment is forecasted to achieve a 34% market share by 2035, propelled by its integration in both conventional and autonomous vehicle fleets.

Key Growth Trends:

- Logistics efficiency and driver shortage mitigation

- Sustainability and fuel efficiency gains

Major Challenges:

- Regulatory fragmentation across jurisdictions

- Public trust and safety concerns

- Key Players: Intel Corporation, Iveco Group N.V., Kb Holding GmbH, AB Volvo, Aptiv PLC, Continental Aktiengesellschaft, DAF Trucks N.V. (PACCAR Inc.), Hino Motors Ltd. (Toyota Motor Corporation), Peloton Technology, Robert Bosch GmbH, Scania AB (Traton SE), ZF Friedrichshafen AG (Zeppelin-Stiftung).

Global Truck Platooning Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.62 billion

- 2026 Market Size: USD 1.77 billion

- Projected Market Size: USD 4.2 billion by 2035

- Growth Forecasts: 10% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, Germany, Japan, United Kingdom, France

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 12 August, 2025

Truck Platooning Market Growth Drivers and Challenges:

Growth Drivers

- Logistics efficiency and driver shortage mitigation: Driver utilization is optimized by truck platooning, where one human-driven truck leads several autonomous followers. In May 2023, Kratos announced that its self-driving truck solutions have scaled in the Midwest to address workforce shortages and increase hauling productivity. This model cuts headcount requirements while maintaining route coverage, an attractive feature for carriers with labor constraints. This is likely to help fleet operators reduce operational costs while improving delivery timelines. Furthermore, the system is reliable, allowing for 24/7 logistics continuity. With supply chains stretched to meet increasing demand, platooning offers a cost-effective resilience strategy. However, driver shortage continues to be a key catalyst behind the adoption worldwide.

- Sustainability and fuel efficiency gains: The potential fuel savings of 8–10% per follower vehicle makes platooning attractive to fleet managers who are under cost and emissions pressure. Studies by the U.S. Department of Transportation (DOT) found that synchronized braking and close spacing reduce aerodynamic drag by a significant amount. In December 2023, an Ohio-based company began offering a paid freight service utilizing truck platooning, with the goal of reducing costs and enhancing sustainability. These initiatives align with ESG mandates and corporate decarbonization objectives. Furthermore, lower emissions also help in compliance with carbon reporting obligations. Platooning is a viable lever for shippers seeking to green their supply chains. The combination of fuel economy and regulatory alignment is driving long-term interest.

- Advancements in autonomous and V2V technology: Precise coordination is key to the success of Platooning, which is achieved through sensor fusion, AI, and ultra-low latency communication. In April 2025, Aurora demonstrated autonomous trucks safely operating in rain and fog, addressing weather-related safety concerns. This milestone serves to build confidence in platooning performance under variable conditions. Reliability is ensured through continuous software updates, machine learning algorithms, and robust perception systems. Additionally, the integration of 5G and V2X continues to improve response times and lane discipline. These technical breakthroughs are bringing Level 4 platooning closer to commercial rollout. Autonomy and connectivity are converging to become a primary enabler for growth.

Challenges

- Regulatory fragmentation across jurisdictions: The differing rules for AV operation across states and countries make seamless platooning difficult. Following distance, lead vehicle control, and liability regulations vary greatly. This complicates cross-border and multi-state logistics planning. Missing harmonized standards hinder fleet-level deployments and heightens compliance risks. Industry associations are urging lawmakers to define clear, uniform AV operational frameworks. However, regulatory misalignment will slow the pace of full-scale adoption until then.

- Public trust and safety concerns: The widespread rollout of such systems depends on public and stakeholder confidence in the safety of the systems. Fully autonomous road freight has been met with caution following accidents elsewhere involving autonomous vehicles (AVs). Community engagement, clear communication, and third-party validation are key. Political and public buy-in are vital, and addressing perception gaps is critical. Without proactive education and visible safety records, market resistance could continue. Furthermore, cybersecurity for autonomous platoons must be guaranteed against hacking and data breaches to maintain trust. Public acceptance will also depend on establishing clear legal frameworks for liability in the event of an accident involving platooning trucks.

Truck Platooning Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

10% |

|

Base Year Market Size (2025) |

USD 1.62 billion |

|

Forecast Year Market Size (2035) |

USD 4.2 billion |

|

Regional Scope |

|

Truck Platooning Market Segmentation:

Technology (Adaptive Cruise Control (ACC), Blind Spot Warning (BSW), Global Positioning System (GPS), Forward Collision Warning (FCW), Lane Keep Assist (LKA))

The adaptive cruise control (ACC) segment is expected to gain an estimated 34% truck platooning market share by 2035, primarily due to its widespread integration in both conventional and autonomous vehicle fleets. Truck platooning relies on Adaptive Cruise Control (ACC), which automatically adjusts throttle and braking to maintain safe following distances between the vehicles. ACC is typically the first layer of an autonomous control stack, enabling semi-automated platooning before full autonomy. In September 2023, Locomation claimed that its Level 4 platooning system, which relies heavily on adaptive cruise coordination, was making progress. This further reinforces the demand for ACC as the emphasis on real-time traffic responsiveness continues to grow. With increasing V2V integration, ACC will continue to play a key role in enabling safe platoon movement.

Sensor Type (Image Sensor, Radar Sensor, LiDAR Sensor)

The image sensors segment is projected to hold a 45% truck platooning market share through the forecast period, owing to their ability to facilitate object detection, lane recognition, and environmental awareness. Since platooning operations are based on synchronized movement and visual data processing, these sensors are critical. In April 2025, Aurora demonstrated its trucks in fog and rain using advanced image and AI-based recognition systems. With the emphasis shifting towards camera fusion with LiDAR and radar, decision-making is becoming more accurate. In mid-range AV fleets, image sensors are more cost-efficient and scale more easily than LiDAR, which can be a high-cost option. The segment is expected to continue to dominate with advancements in resolution and thermal vision capabilities.

Our in-depth analysis of the truck platooning market includes the following segments:

|

Segment |

Subsegment |

|

Technology |

|

|

Sensor Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Truck Platooning Market Regional Analysis:

North America Market Analysis:

The truck platooning market in North America is anticipated to dominate the industry with a share of 40.0% during the forecast period. Advancements in the policy environment are occurring through state-level AV programs such as those in California, Texas, and Ohio. In March 2025, a semi-autonomous platoon went live on I-70, proving AV capabilities in a mixed traffic corridor. The demonstration supports U.S. goals to modernize freight infrastructure. Pilot programs to optimize routes and reduce emissions are being explored by logistics giants. The area has a dense highway network and a mature tech ecosystem. Together, these factors are the basis of strong truck platooning market leadership.

Due to robust OEM participation, extensive AV testing grounds, and regulatory flexibility, the U.S. market is rising at a steady pace. In May 2023, Kratos further expanded automated truck deployments across the Midwest, solidifying its role as a first mover. Platooning trials are being funded jointly by the FHWA and DOE, and DOT guidelines support AV platoon safety validation. On-road evaluations are being conducted by private fleets such as Walmart and UPS. The dual-use potential is evident through U.S. Marine Corps mobility experiments and the defense sector's interest. The U.S. will remain central to global platooning progress thanks to strong institutional backing. This is key to competitiveness in the commercial trucking industry.

Canada approach is focused on harmonization across the border and reducing logistics costs. In March 2025, Electrovaya assisted Walmart Canada with warehouse electrification, supplying energy systems to platooning fleets. While Ontario and Alberta are adopting AV-friendly laws, such as allowing dual-mode platoon testing, those provinces that have adopted AV laws are now taking steps to remove them. Canadian firms are using U.S. partnerships to accelerate tech transfer. To address the winter terrain challenges, Transport Canada is piloting teleoperation and fail-safe protocols. Canada is integrating green logistics with platooning, and policy certainty is improving. As such, it is an attractive testbed for AV freight systems that operate under environmental constraints.

APAC Market Analysis:

Asia Pacific is set to observe notable growth throughout 2026-2035, driven by logistics growth and smart city development. In January 2025, Pony.ai was granted regulatory approval for autonomous trucking in Guangzhou, indicating readiness to scale platooning in China. With e-commerce and infrastructure surges, regional governments are prioritizing freight modernization. Commercial pilots are being nurtured in AV-friendly zones in Korea, Japan, and Singapore. Also, the demand for autonomous solutions is fueled by supply chain constraints. Strong deployment incentives are created by the region’s manufacturing and port logistics hubs. As tech investments in APAC continue to rise, it will remain the global engine of AV freight innovation.

Truck platooning adoption is being driven by China’s state-led AV strategy. In March 2025, Stack AV received funding to improve commercial readiness for freight automation. AV policy experimentation is led by Beijing and Shanghai, while industrial zones promote tech adoption. Rules for convoy operations on dedicated truck lanes have been drafted by the Ministry of Transport. Electric trucks capable of platooning are being designed by Chinese OEMs and integrated with Baidu’s Apollo platform. Central funding supports V2X infrastructure buildout. China has a strategic advantage in battery supply and hardware. By decade’s end, the country is on track to deploy national-scale freight platooning.

The truck platooning sector in India is nascent but is emerging rapidly with state-level autonomous vehicle (AV) trials. The National Highways Authority of India (NHAI) has started digital corridors integration with AV testing facilities. In May 2024, Kratos said it will begin exploring pilot deployments in India through partnerships with local logistics players. India’s longest highway, NH-44, is being assessed by government think tanks to see if platooning is viable. India has congested freight routes where controlled convoy experiments are possible. The National Logistics Policy is also developing regulatory roadmaps. However, India is anticipated to initially opt for hybrid human autonomy platoons, given its low-cost labor dynamics.

Key Truck Platooning Market Players:

- Intel Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- AB Volvo

- Aptiv PLC

- Iveco Group N.V.

- Kb Holding GmbH

- Peloton Technology

- Robert Bosch GmbH

- Scania AB (Traton SE)

- ZF Friedrichshafen AG (Zeppelin-Stiftung)

- Continental Aktiengesellschaft

- DAF Trucks N.V. (PACCAR Inc.)

- Hino Motors Ltd. (Toyota Motor Corporation)

The truck platooning market is competitive and innovation-oriented oriented with players focusing on leveraging autonomy, AI, and telematics. Key players in the market comprise AB Volvo, Peloton Technology, Hino Motors (Toyota), Continental AG, Robert Bosch, Scania (Traton), Aptiv, Knorr-Bremse, ZF Friedrichshafen, and Intel Corp. However, strategic partnerships between original equipment manufacturers (OEMs) and artificial intelligence (AI) startups are driving the pace of technology integration. Regulatory compliance and corridor access are key topics for companies seeking to enter the truck platooning market. Military trials and logistics pilots are securing early mover advantages. Fleet integration services are also emerging as a parallel ecosystem. In the U.S., China, and the EU zones, market competition is becoming more intense.

SoftBank invested around USD 1 billion in Stack AV, a startup founded by former Argo AI executives, in September 2023. The funding indicates growing investor interest in scalable autonomous freight systems. Stack AV is focused on real-world commercial deployment and weather-adaptive sensor stacks. This propelled Stack AV into the ranks of top-tier competitors with established OEMs. The investment also shows the strategic importance of regional AV leadership. Stack plans to accelerate entry into U.S. and Asia freight corridors with SoftBank’s support. This capital flow is likely to lead to further consolidation and the formation of partnerships globally.

Here are some leading players in the truck platooning market:

Recent Developments

- In March 2025, MHI-MS introduced a Merging Support Information System to assist autonomous trucks during merging maneuvers on public roads; this technology aims to streamline traffic flow and minimize potential accidents involving platooning vehicles. The system enhances safety and coordination in truck platooning operations.

- In January 2025, Pony.ai initiated expressway testing of unmanned truck platoons on the Beijing-Tianjin-Tanggu expressway, collecting valuable data on the performance and reliability of fully autonomous freight transport in a high-speed environment. The company has accumulated over 45,000 km of autonomous driving mileage on this route, marking a significant step in China's autonomous freight services.

- Report ID: 7642

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Truck Platooning Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.