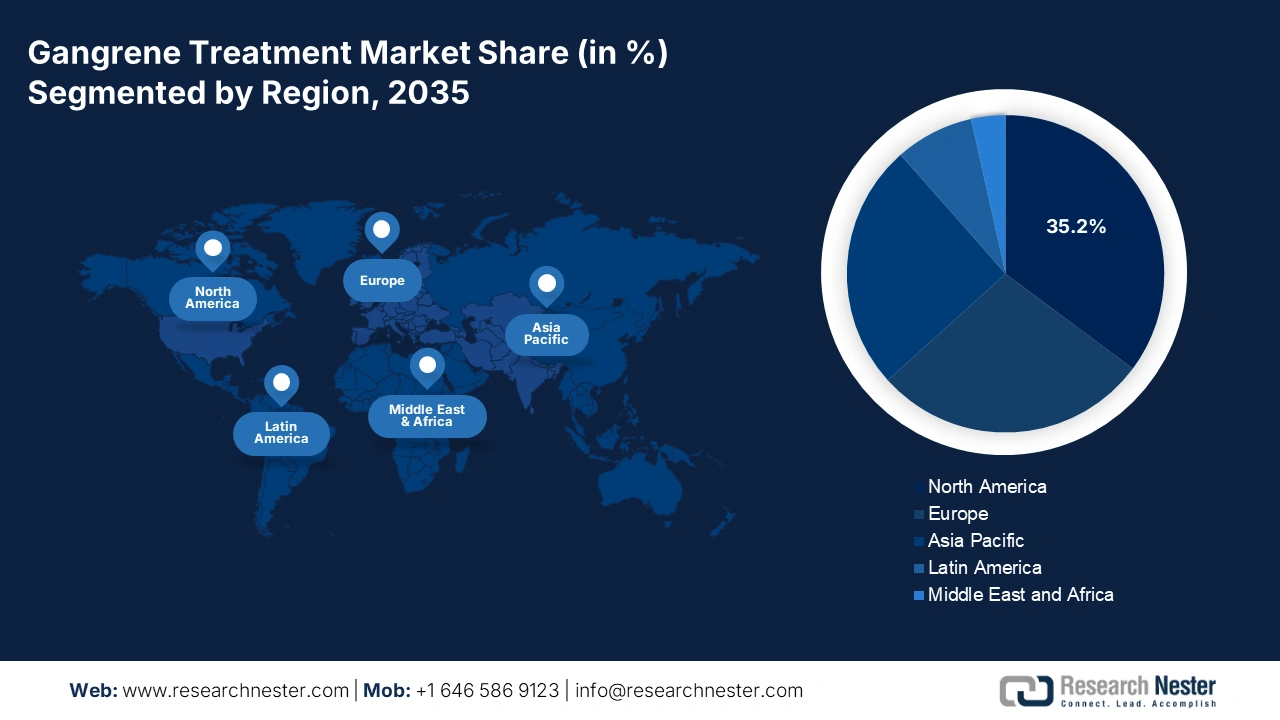

Gangrene Treatment Market - Regional Analysis

North America Market Insights

North America market is expected to garner the highest share of 35.2% by the end of 2035. The market’s growth in the region is highly driven by the federal healthcare budget, advancements in surgical and wound care solutions, import dependency on the international supply chain for surgical instruments, and an increase in government-based funding for innovation. As per an article published by AHRQ in September 2024, there has been an increase in hospital expenses in the U.S. from USD 31.3 billion to USD 52.1 billion, which is positively impacting the overall market in the region.

The gangrene treatment market in the U.S. is growing significantly, owing to the presence of NIH funding for infectious diseases, increased integration of wound dressing systems, generous sourcing of medical instruments, federal spending, and an expansion in Medicare and Medicaid reimbursement services. As stated in the 2025 OEC data report, the country is one of the leading exporters of medical instruments, with a valuation of USD 34.8 billion, and USD 37.7 billion in terms of imports, which is significantly uplifting the market’s development. Besides, the focus on limb preservation, as well as infection control facility is also responsible for positively impacting the market in the country.

2023 Medical Instruments Across Other Countries in North America

|

Countries |

Export |

Import |

|

Mexico |

USD 17.6 billion |

4.6 billion |

|

Canada |

USD 1.2 billion |

USD 3.7 billion |

|

Costa Rica |

USD 5.9 billion |

USD 828 million |

|

Dominican Republic |

USD 2.1 billion |

USD 201 million |

|

Guatemala |

- |

USD 117 million |

|

Panama |

- |

USD 110 million |

Source: OEC

APAC Market Insights

The gangrene treatment market in India is gaining increased traction, owing to the availability of healthcare and medical reforms, increase in number of patients, an expansion in private and public healthcare industries, an increase in awareness through campaigns, along with government’s strategies, which are readily focused on enhancing funding for infection prevention and chronic wound care. As stated in the May 2024 NLM article, under the Pradhan Mantri Ayushman Bharat Health Infrastructure Mission (PM ABHIM), the overall financial outlay for the 5-year scheme period is account for USD 7.8 billion, with the objective of supporting both urban and rural healthcare centers, public health laboratories, and public health units, all of which cater to the market’s upliftment.

Europe Market Insights

The gangrene treatment market in the UK is gaining increased exposure, owing to the National Health Service (NHS) readily prioritizing limb preservation programs, the growing incidence of rare diseases, an increase in government investment for progressive preventive care, the Association of the British Pharmaceutical Industry (ABPI), public awareness campaigns, and integrated digital health solutions. As per the 2023 NHS England data report, an amount of £107.8 billion has been initiated for promoting localized health services, along with £29.8 billion for catering to primary care services and personalized public health service, thereby suitable for boosting the overall market.

Medical, Surgical, or Laboratory Sterilizers 2023 Export and Import in Europe

|

Countries |

Export |

Import |

|

Italy |

USD 193 million |

USD 15.4 million |

|

Germany |

USD 104 million |

USD 52.3 million |

|

Poland |

USD 51.6 million |

USD 18.8 million |

|

France |

USD 21.5 million |

USD 41.9 million |

|

Spain |

USD 48.2 million |

USD 18.4 million |

|

UK |

USD 12.4 million |

USD 27 million |

Source: OEC