Gangrene Treatment Market Outlook:

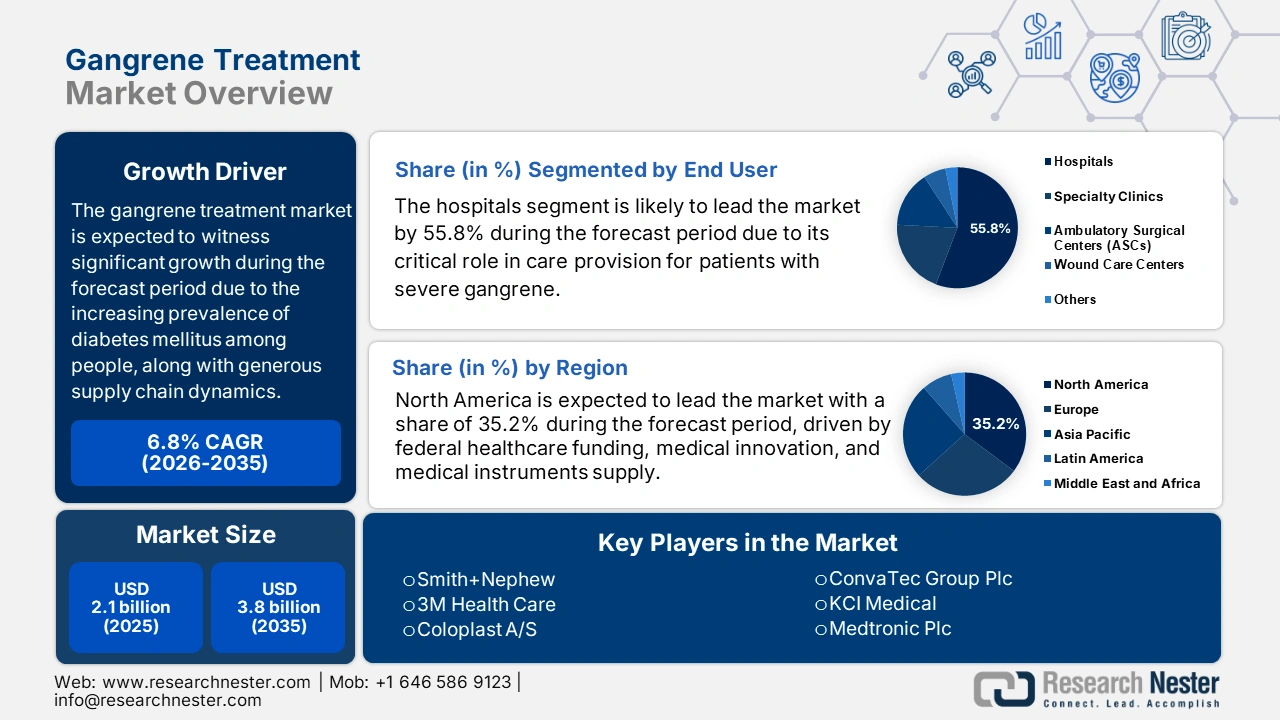

Gangrene Treatment Market size was USD 2.1 billion in 2025 and is anticipated to reach USD 3.8 billion by the end of 2035, increasing at a CAGR of 6.8% during the forecast period, i.e., 2026-2035. In 2026, the industry size of gangrene treatment is estimated at USD 2.2 billion.

Moreover, the supply chain dynamic in the market takes into consideration the gangrene-related therapeutics and devices production that effectively depends on the international APIs chain, surgical tools, hyperbaric systems, and wound dressing. As per the July 2024 AHA Organization data report, the U.S. heavily relies on China for medical supplies and equipment, and the country has readily imported USD 14.9 billion, in comparison to USD 14 billion the previous year. Besides, an estimated 10.5% of global hospitals’ budget, catering to medical supply costs has successfully accounted for USD 146.9 billion as of 2023, denoting an increase of more than USD 6.6 billion as of 2022.

Key Gangrene Treatment Market Market Insights Summary:

Regional Highlights:

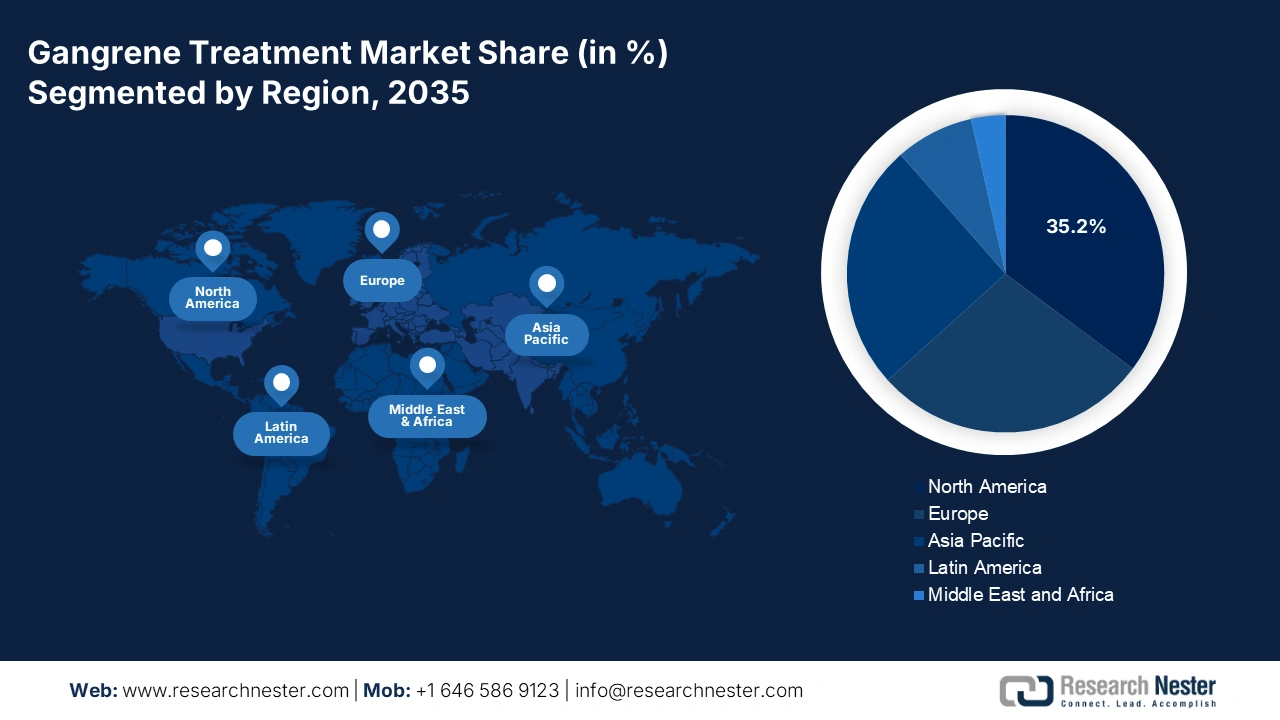

- North America is expected to capture a 35.2% share by 2035 in the gangrene treatment market, supported by expanding federal healthcare budgets, rising surgical and wound care advancements, and increased government-backed innovation funding.

- Asia Pacific is projected to advance as the fastest-growing region through 2035, strengthened by a rising elderly population, expanding healthcare infrastructure, and growing adoption of progressive treatment modalities.

Segment Insights:

- The hospitals segment is anticipated to secure a 55.8% share by 2035 in the gangrene treatment market, reinforced by hospitals’ central role in gangrene care, extensive funding across regions, and strengthened infection-control initiatives.

- The ischemic gangrene segment is projected to retain the second-largest share during the forecast period, supported by its severity as a progressive condition that drives higher incidence rates linked to peripheral vascular disorder.

Key Growth Trends:

- An increase in government healthcare expenditure

- Enhanced patient pool with chronic diseases

Major Challenges:

- Pricing restrictions and caps in government healthcare

Key Players: 3M Health Care, Coloplast A/S, ConvaTec Group Plc, Molnlycke Health Care AB, KCI Medical, Medtronic Plc, Organogenesis Holdings Inc., Smiths Medical, Integra LifeSciences, Baxter International Inc., Hollister Incorporated, Nipro Corporation, Toho Pharmaceutical, Terumo Corporation, Wockhardt Ltd., Sun Pharmaceutical Industries Ltd., CGBio, Compumedics Ltd., Duopharma Biotech Bhd.

Global Gangrene Treatment Market Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 7.41 billion

- 2026 Market Size: USD 7.78 billion

- Projected Market Size: USD 12.66 billion by 2035

- Growth Forecasts: 5.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, France, China, Japan

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 1 October, 2025

Gangrene Treatment Market - Growth Drivers and Challenges

Growth Drivers

- An increase in government healthcare expenditure: The aspect of an increase in Medicare and Medicaid services has effectively reflected the surging need, owing to the incidence of diabetes and an increase in the elderly population globally, which has positively impacted the market across different nations. Besides, as per an article published by Rare Diseases India in December 2024, the regional government established the National Fund for Rare Diseases (NFRD), with the provision of ₹974 crore (USD 110 million) for the financial year of 2024 and 2025. Therefore, with an increase in chronic conditions, the government has come forward to ensure federal spending, thus suitable for the market’s upliftment.

- Enhanced patient pool with chronic diseases: These conditions effectively demand continuous medical attention as they tend to limit activities of daily living, which is also proliferating the market. As per the October 2024 CDC data report, chronic conditions cater to USD 4.9 trillion in yearly healthcare care expenses. Besides, 6 in 10 people from America are affected with almost one chronic disease, and 4 in 10 have more than two chronic diseases. This growing patient pool continues to bolster the market for early diagnosis, wound management products, and advanced surgical treatments requirements.

- Chemical advancements in wound care: The creation and incorporation of antimicrobial dressings, foam dressings, hydrocolloids, and bio-engineered skin substitutes leads to improving healing rates and combat infection risk, which is also uplifting the global market. According to the May 2022 NLM article, epithelial keratins comprise 1% of sulfur, along with 3% of cysteine, suitable for stabilizing cells in epithelia. Besides, trichocyte keratins constitute 5% of sulfur, along with 4% to 17% of cysteine, thus also suitable for healing wounds. Therefore, the presence of these chemicals is a huge growth factor for the overall market across different nations.

Antimicrobial Resistance (AMR) Driving the Market

|

Components |

Incidence/ Rate |

|

Bacterial AMR |

1.2 million global deaths (2023) |

|

Additional healthcare expenses |

USD 1 trillion (2050) |

|

Gross domestic product (GDP) loss |

USD 3.4 trillion (2030) |

|

Third-generation cephalosporin-resistant E. coli presence |

42% across 76 nations |

|

Methicillin-resistant Staphylococcus aureus presence |

35% |

|

Urinary tract infections caused by E. coli |

1 in 5 cases |

Source: World Health Organization (WHO)

Challenges

-

Pricing restrictions and caps in government healthcare: Several countries have robust price caps on the advanced treatments for gangrene. This high cost is within their government-funded healthcare systems. For instance, in 2023, a company collaborated with a health authority in Germany to overcome these challenges in pricing, hence boosting the market access by 10.2%. Apart from these, reimbursement challenges often restrict the use of high-cost advanced biologic dressings by 20.2% among hospital patients.

Gangrene Treatment Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2025-2037 |

|

CAGR |

6.8% |

|

Base Year Market Size (2025) |

USD 2.1 billion |

|

Forecast Year Market Size (2035) |

USD 3.8 billion |

|

Regional Scope |

|

Gangrene Treatment Market Segmentation:

End user Segment Analysis

Based on the end user, the hospitals segment is anticipated to garner the largest share of 55.8% by the end of 2035. The segment’s upliftment is highly attributed to hospitals being considered the pivotal treatment center for patients suffering from gangrene, and are generously funded in different regions, leading to a maximization across wound care departments, particularly for the diabetic and elderly population internationally. Besides, the aspect of reimbursement in Medicare has a wide-ranging space for post-operative and surgical wound management services to bolster the patient inflow. Meanwhile, the WHO’s international plan has stressed the infection control infrastructure development, especially in hospital settings, which has reinforced the tendency, thus driving the segment’s growth.

Cause Segment Analysis

Type Segment Analysis

Based on type, the wet gangrene segment is expected to account for the third-largest share by the end of the projected duration. The segment’s development is highly driven by its severity and rapid progression in bacterial infection in dead tissue, which is frequently caused by restricted blood supply. This eventually leads to life-threatening conditions, such as septic shock and sepsis, requiring immediate medical intervention. Besides, wet gangrene develops when the body tissue is readily impaired with arterial or venous blood flow, leading to severe infection, which in turn, denotes a huge growth opportunity for the overall market.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

End user |

|

|

Cause |

|

|

Type |

|

|

Treatment |

|

|

Route of Administration |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Gangrene Treatment Market - Regional Analysis

North America Market Insights

North America market is expected to garner the highest share of 35.2% by the end of 2035. The market’s growth in the region is highly driven by the federal healthcare budget, advancements in surgical and wound care solutions, import dependency on the international supply chain for surgical instruments, and an increase in government-based funding for innovation. As per an article published by AHRQ in September 2024, there has been an increase in hospital expenses in the U.S. from USD 31.3 billion to USD 52.1 billion, which is positively impacting the overall market in the region.

The gangrene treatment market in the U.S. is growing significantly, owing to the presence of NIH funding for infectious diseases, increased integration of wound dressing systems, generous sourcing of medical instruments, federal spending, and an expansion in Medicare and Medicaid reimbursement services. As stated in the 2025 OEC data report, the country is one of the leading exporters of medical instruments, with a valuation of USD 34.8 billion, and USD 37.7 billion in terms of imports, which is significantly uplifting the market’s development. Besides, the focus on limb preservation, as well as infection control facility is also responsible for positively impacting the market in the country.

2023 Medical Instruments Across Other Countries in North America

|

Countries |

Export |

Import |

|

Mexico |

USD 17.6 billion |

4.6 billion |

|

Canada |

USD 1.2 billion |

USD 3.7 billion |

|

Costa Rica |

USD 5.9 billion |

USD 828 million |

|

Dominican Republic |

USD 2.1 billion |

USD 201 million |

|

Guatemala |

- |

USD 117 million |

|

Panama |

- |

USD 110 million |

Source: OEC

APAC Market Insights

The gangrene treatment market in India is gaining increased traction, owing to the availability of healthcare and medical reforms, increase in number of patients, an expansion in private and public healthcare industries, an increase in awareness through campaigns, along with government’s strategies, which are readily focused on enhancing funding for infection prevention and chronic wound care. As stated in the May 2024 NLM article, under the Pradhan Mantri Ayushman Bharat Health Infrastructure Mission (PM ABHIM), the overall financial outlay for the 5-year scheme period is account for USD 7.8 billion, with the objective of supporting both urban and rural healthcare centers, public health laboratories, and public health units, all of which cater to the market’s upliftment.

Europe Market Insights

The gangrene treatment market in the UK is gaining increased exposure, owing to the National Health Service (NHS) readily prioritizing limb preservation programs, the growing incidence of rare diseases, an increase in government investment for progressive preventive care, the Association of the British Pharmaceutical Industry (ABPI), public awareness campaigns, and integrated digital health solutions. As per the 2023 NHS England data report, an amount of £107.8 billion has been initiated for promoting localized health services, along with £29.8 billion for catering to primary care services and personalized public health service, thereby suitable for boosting the overall market.

Medical, Surgical, or Laboratory Sterilizers 2023 Export and Import in Europe

|

Countries |

Export |

Import |

|

Italy |

USD 193 million |

USD 15.4 million |

|

Germany |

USD 104 million |

USD 52.3 million |

|

Poland |

USD 51.6 million |

USD 18.8 million |

|

France |

USD 21.5 million |

USD 41.9 million |

|

Spain |

USD 48.2 million |

USD 18.4 million |

|

UK |

USD 12.4 million |

USD 27 million |

Source: OEC

Key Gangrene Treatment Market Players:

- Smith+Nephew (UK)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- 3M Health Care (U.S.)

- Coloplast A/S (Denmark)

- ConvaTec Group Plc (UK)

- Molnlycke Health Care AB (Sweden)

- KCI Medical (U.S.)

- Medtronic Plc (Ireland/ U.S.)

- Organogenesis Holdings Inc. (U.S.)

- Smiths Medical (U.S.)

- Integra LifeSciences (U.S.)

- Baxter International Inc. (U.S.)

- Hollister Incorporated (U.S.)

- Nipro Corporation (Japan)

- Toho Pharmaceutical (Japan)

- Terumo Corporation (Japan)

- Wockhardt Ltd. (India)

- Sun Pharmaceutical Industries Ltd. (India)

- CGBio (South Korea)

- Compumedics Ltd. (Australia)

- Duopharma Biotech Bhd (Malaysia)

The global gangrene treatment market is extremely consolidated with different multinational firms, accounting for a dominant share through vertical integration, with innovative supply chains and R&D pipelines. In addition, the latest tactical launches and PPPs are extending the market’s reach of this global sector, even in developing nations. Besides, organizations, such as Coloplast, 3M, and Smith+Nephew, are effectively leading through advancements in infection control and wound care products. The efforts to make associated products more cost-effective through cost-optimized manufacturing along with resource localization are also boosting the development, as well as attracting developers, which are related to mental health.

Here is a list of key players operating in the global market:

Recent Developments

- In March 2025, Mölnlycke declared that it has successfully signed an agreement to gain P.G.F. Industry Solutions GmbH, with the objective of consolidating its position as the ultimate international leader in wound care.

- In November 2024, BioStem Technologies Inc. notified that it has signed a letter of intent (LOI) to effectively achieve commercial-based product, along with developmental technologies from ProgenaCare Global LLC.

- Report ID: 3076

- Published Date: Oct 01, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Gangrene Treatment Market Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.