Functional Printing Market Outlook:

Functional Printing Market size was over USD 30.19 billion in 2025 and is poised to exceed USD 180.79 billion by 2035, growing at over 19.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of functional printing is estimated at USD 35.52 billion.

The growth of the market can be attributed primarily to the expansion of the printing industry on the back of rising inclination towards 3D printed devices and growth in 3D printing construction processes worldwide. According to estimates, in 2021, the printing industry accounted for USD 77 Billion in the United States.

Practical printing applications include 3D printers, electronic printed goods, and RFID tags. The technology of functional printing is used in many industries, including automotive, electrical, healthcare, clothing, and paper. Moreover, the presence of a variety of substrates, the high-speed development of the product, the growing demand for functional printing for reducing the impact on the environment, along with the low cost of the manufacturing process are factors projected to drive the functional printing market growth over the forecast period. One of the other factors for market growth is the demand for cost-effective functional printing technologies through which manufacturers achieve high-speed printing at low costs. Also, the increased high-volume electronic production is expected to develop advanced functional printing services which are projected to boost the market growth and its sales prospect.

Key Functional Printing Market Insights Summary:

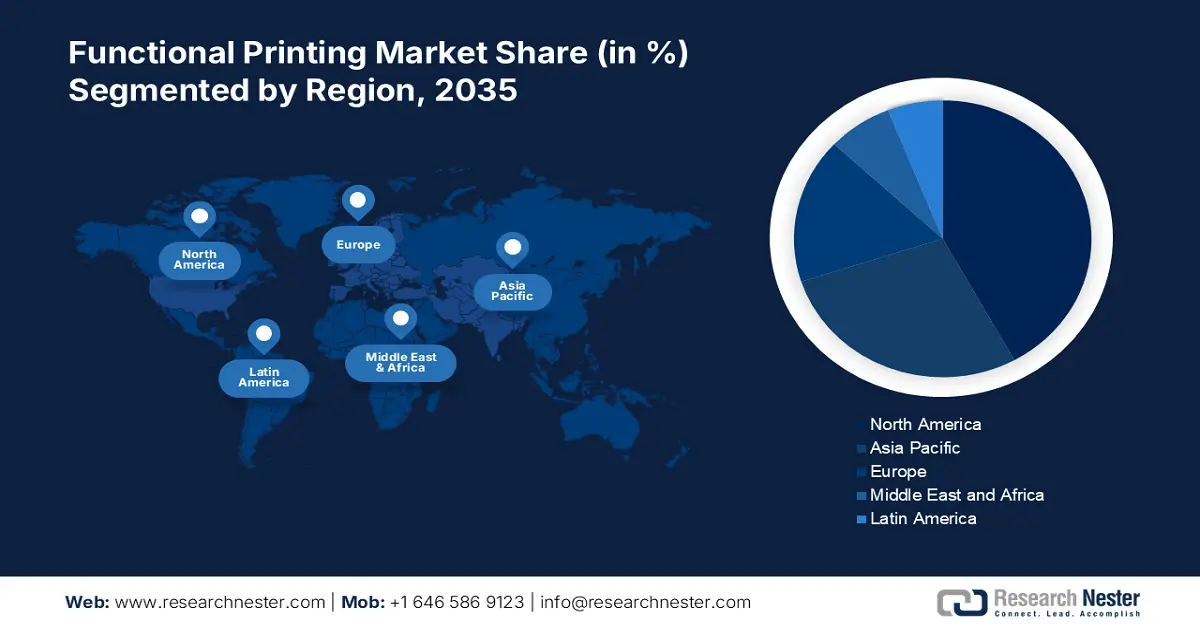

Regional Highlights:

- The North America functional printing market will hold around 38% share by 2035, fueled by a large manufacturing base and high demand from various industries.

- The Asia Pacific market will achieve significant revenue share by 2035, attributed to increased packaging production and adoption of advanced printing techniques.

Segment Insights:

- The inks segment in the functional printing market is projected to secure the largest share by 2035, influenced by higher ink exports and adoption in various end-use industries including 3D printing.

- The inkjet printing segment in the functional printing market leads with the largest share, fueled by cost-effectiveness and increasing use in electronics and 3D product design, forecast year 2035.

Key Growth Trends:

- Increasing Home Printer Usage

- Expansion of Consumer Electronics Industry

Major Challenges:

- Disruption in Supply and Demand Owing to COVID-19 Pandemic

- Lack of Electrically Functional Inks

Key Players: BASF SE, DuraTech Industries, E Ink Holdings Inc., Eastman Kodak Company, Mark Andy Inc., Blue Spark Technologies, Inc., Enfucell, Nissha Co., Ltd., ISORG, TOYO INK SC HOLDINGS CO., LTD.

Global Functional Printing Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 30.19 billion

- 2026 Market Size: USD 35.52 billion

- Projected Market Size: USD 180.79 billion by 2035

- Growth Forecasts: 19.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, South Korea

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 9 September, 2025

Functional Printing Market Growth Drivers and Challenges:

Growth Drivers

- Increasing Home Printer Usage – The rising disposable income of the population is expected to surge the demand for home printers for office work and for student projects. As a result, global functional printing market growth is therefore expected to be driven by the increasing use of printers, which in turn is expected to stimulate printer sales worldwide. Globally, 105 million printers and copiers were sold for home use in 2020, an increase of 11%. A majority of consumers prefer inkjet multifunction printers priced between USD 390 and USD 480 for their home printers, followed by all-in-one inkjet printers.

- Expansion of Consumer Electronics Industry – Noteworthy growth of the electronics industry is expected to increase the utilization rate of functional printing owing to their cost-effectiveness and efficient printing functions. Also, the growth in the production rate of printed electronics is also projected to create a positive outlook for market growth. As per recent statistics, the Indian appliances & consumer electronic industry is expected to reach a worth of approximately INR 1 lakh crore by 2025. Also, the total production of electronics in India garnered around USD 80 billion in 2021-22.

- Rapid Growth in the 3D Printing Industry – 3D printing offers various advantages such as reduced costs, enhanced efficiency, increased durability, higher resolution, and lower material consumption. As a result of the high adoption rate of 3D printing solutions in numerous industries is expected to positively contribute to market expansion during the forecast period. For instance, the 3D printing industry was estimated at approximately 13 billion in the year 2021.

- Boost in the Chemical Industry – By 2025, the Indian chemical industry is expected to generate USD 300 billion in revenue with a CAGR of 10%.

- Increasing Printing Businesses Worldwide - It was observed that in the United States, there are nearly 46,000 printing businesses employing about 300,000 people.

Challenges

- Disruption in Supply and Demand Owing to COVID-19 Pandemic - COVID-19 caused unprecedented supply chain disruption that imposed multiple financial and operational consequences on the functional printing market. Since everything was closed, the demand dropped drastically which affected the export/import volume. Hence, this factor is estimated to hamper the growth of the market over the forecast period.

- Lack of Electrically Functional Inks

- Increasing Demands for High Accuracy Product

Functional Printing Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

19.6% |

|

Base Year Market Size (2025) |

USD 30.19 billion |

|

Forecast Year Market Size (2035) |

USD 180.79 billion |

|

Regional Scope |

|

Functional Printing Market Segmentation:

Material Segment Analysis

The global functional printing market is segmented and analyzed for demand and supply by materials into substrates, and inks. Among these segments, the inks segment captured the largest market share by end of the year 2035 in the global functional printing market owing to the increasing exports of inks and their higher utilization for multiple purposes worldwide. For instance, the export value of printing inks of India was calculated to be approximately USD 10 million during the fiscal year 2020-2021. Moreover, the higher adoption of ink printing in various end-use industries along with the surge in 3D printing is expected to augment segment growth over the forecast period. Also, various advantages offered by inks such as the ability to produce vibrant and rich colors, increased productivity, high performance, environmental benefits, and lower energy costs are also estimated to bring in lucrative growth opportunities for segment growth during the analysis period.

Technology Segment Analysis

The global functional printing market is also segmented and analyzed for demand and supply by technology into inkjet printing, screen printing, flexography, gravure printing, and others. Out of these, the inkjet printing segment is attributed to holding the largest share of the market with a notable CAGR value. The major factor attributed to segment growth is the high production of cost-effective office and graphic art printers. This has led to raising the awareness level about the usage of inkjet printing for product designing, the fabrication of flat panel displays devices, biochip production, and printable electronics. In addition to that, the sales of inkjet printing technology are expected to surge owing to its numerous advantages in various supply chains. Also, it is projected that along with the growing demand for 3D printing, the utilization rate of inkjet printing is expected to evolve globally and increase the market growth of the functional printing market globally.

Our in-depth analysis of the global market includes the following segments:

|

By Material |

|

|

By Technology |

|

|

By Coating |

|

|

By Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Functional Printing Market Regional Analysis:

North American Market Insights

North America functional printing market is set to account for 38% revenue share by 2035. The presence of a large manufacturing base along with the high demand for functional printing from various end-use industries is attributed to be the major factor for market growth. Along with that, the rising investments by major key players in research and development activities to develop technologically advanced functional printing solutions to reduce cost are also projected to bring lucrative growth opportunities for market growth in the region. Rising government support to commercialize functional printing and the rising spending capacity of the consumer along with the increased Gross Domestic Product (GDP) are other factors that are anticipated to contribute positively to market expansion in North America.

APAC Market Insights

The Asia Pacific functional printing market is projected to hold significant market share by 2035. The growth of the market can be ascribed to the increasing number of packaging products in various industries such as food and beverage chemicals, textiles, and others in the region. For instance, packaging production in China accounts for 48% of the printing industry. Moreover, the adoption of technologically advanced printing techniques, improved infrastructure, and the presence of numerous electronics manufacturers along with modest growth in the consumer electronics sector are expected to drive functional printing market growth in the region during the forecast period. In addition to the aforementioned factors, the rising need for packaged items including food, medicines, and others by the burgeoning population of the region is considered to be another factor anticipated to fuel market expansion.

Functional Printing Market Players:

- BASF SE

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- DuraTech Industries

- E Ink Holdings Inc.

- Eastman Kodak Company

- Mark Andy Inc.

- Blue Spark Technologies, Inc.

- Enfucell

- Nissha Co., Ltd.

- ISORG

- TOYO INK SC HOLDINGS CO., LTD.

Recent Developments

-

E Ink Holdings Inc. collaborated with Sharp Display Technology Corporation (SDTC) on ePaper backplanes for its electronic readers and notepads.

-

GT Investment Partners sponsored a USD 40 million intellectual property-based financing solution to expand Blue Spark Technologies Inc., sales and marketing and enhance its wearable remote patient monitoring capabilities.

- Report ID: 4439

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Functional Printing Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.