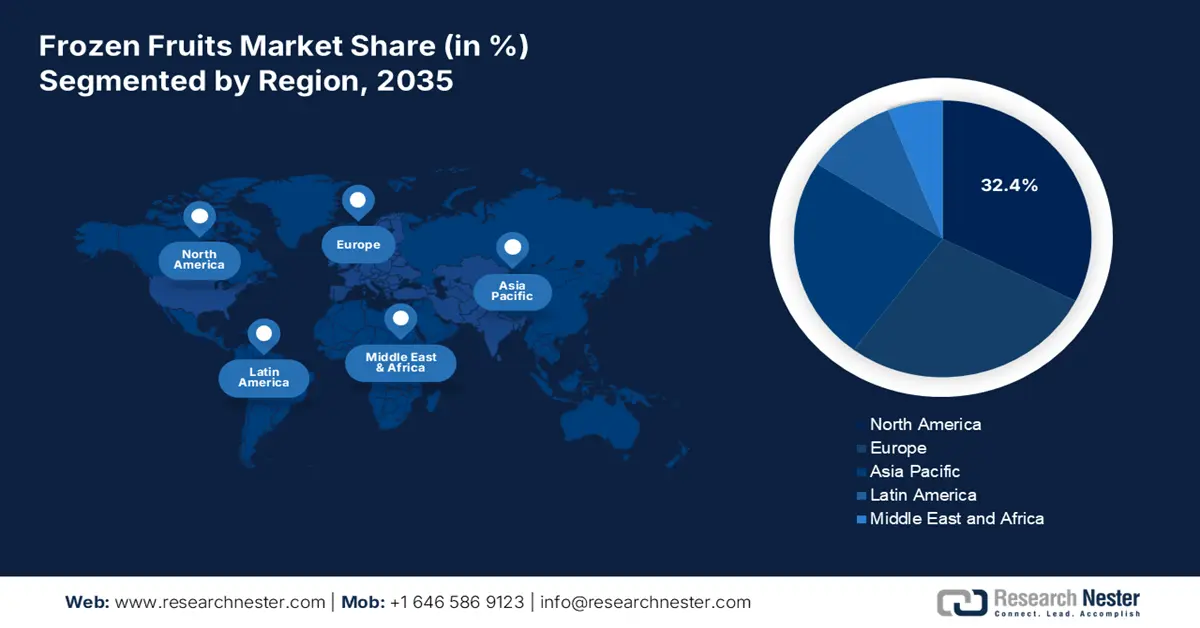

Frozen Fruits Market - Regional Analysis

North America Market Insights

North America is dominating the frozen fruits market and is expected to hold the market share of 32.4% by 2035. The market is defined by mature demand and the focus on value-added products. The growth is fueled by the robust industrial sector that utilizes frozen fruits as ingredients for bakery, dairy, and beverage production. A key trend is the integration of frozen fruits into government-assisted food programs such as school meals, ensuring a stable, high-volume demand. The consumers' shift towards health and convenience further drives the category, with innovation focused on the organic offerings and clean label ingredients. The market is highly consolidated with major players investing heavily in supply chain resilience and sustainable packaging to meet the regulatory and consumer expectations.

The U.S. frozen fruits market is forecasted to grow by the institutional and industrial demand, underpinned by the federal nutritional programs. The U.S. Department of Agriculture data in 2024 states that the U.S. has exported over 7.51 metric tons of fruits and vegetables globally. This data indicates that there is a stronger upstream supply capacity that supports higher processing volumes for frozen fruits. Moreover, a portion of exported fruit products are frozen or are sourced by global processors for frozen applications. Strong B2B demand from food makers, who depend on frozen fruits for their affordability, safety, and year-round consistency in items like yogurt, smoothies, and baked goods, complements the public-sector demand. This robust export activity signals a mature and efficient agricultural sector capable of meeting both domestic and international demand for frozen fruit inputs.

U.S. Fruits and Vegetables Export in 2024

|

Country |

Total Value (USD) |

|

Canada |

5.8 Billion |

|

Mexico |

2.31 Billion |

|

Japan |

1.06 Billion |

|

South Korea |

680.54 Million |

|

Taiwan |

439.45 Million |

|

European Union |

411.61 Million |

|

Australia |

216.85 Million |

|

China |

204.95 Million |

|

Hong Kong |

177.05 Million |

|

Philippines |

176.67 Million |

Source: USD 2024

In Canada, the market is shaped by the evolving consumer preferences that are guided by the national health policies and the country’s growing ethnic diversity. The government initiatives by Agriculture and Agri-Food Canada provide support for production innovation, climate adaptation practices, and specialty crop cultivation. Investments in cold chain infrastructure improve the availability and quality maintenance, aiding the retail and industrial demand. The increasing popularity of berries and mixed frozen fruit blends as ingredients in desserts, beverages, and snacks is notable. Further, the Government of Canada data in July 2025 stated that Canada’s frozen fruits exports grew by 21.2% over the past five years and reached USD 1.1 billion in 2024.

Canada’s Fruit Export Performance in 2024

|

Country |

Share |

|

U.S. |

72% of total exports |

|

Japan |

5.4% |

|

Germany |

3.4% |

|

Netherlands |

2.6% |

|

China |

2.1% |

Source: Government of Canada July 2025

APAC Market Insights

Asia Pacific frozen fruits market is growing rapidly and is driven by fast urbanization and market expansion of modern retail and cold chain infrastructure. Massive industrial demand from the region’s food processing and beverage sector is the primary drivers that utilize frozen fruits as the vital ingredients for dairy, juices, and confectionery. Government initiatives play a key role in the market expansion, for example, India’s Pradhan Mantri Kisan SAMPADA Yojana has allocated a significant amount to develop the integrated cold chains that directly reduce the post-harvest losses and boost the processing capacity. On the other hand, consumer trends are shifting towards health and convenience, with the demand growing for both tropical fruits and imported berries. The market is highly competitive with the regional players expanding their presence to capitalize on the potential and scale up to address the robust food safety standards.

China’s frozen fruits market is fueled by the massive government investment in agricultural modernization and cold chain infrastructure. Rapid growth in the e-commerce sector and the online grocery platforms are the key drivers of the market growth, which rely on frozen products to ensure quality and quick delivery. The B2B sectors is are major consumers of the market with food processors using these frozen fruits in various ingredients. China has exported 44,480,800 kg of frozen strawberries, according to the WITS 2023 data. This data reflects the robust, expanding, and domestic production capacity. This established supply base supports both the growing domestic demand and China's position as a significant global exporter. Further, export strength, along with vast domestic consumption, highlights China's role as a cornerstone of the global frozen fruit supply chain.

In India, the market is experiencing a transformative growth and is largely fueled by the federal government initiatives that are aimed at minimizing food waste and adding value to agricultural produce. Various government programs that support the trend are the key drivers of the market. Further, governments are sanctioning various integrated cold chain projects that are supporting the market growth. As per the IBEF data in October 2025, the food processing market reached Rs. 30,49,800 crores, as frozen fruits are a sub-segment of the country’s processed foods industry, supplying inputs for beverages, bakery, dairy, and ready-to-cook categories that rely on processed fruit ingredients. Consumer acceptance of frozen fruits as a practical and nourishing choice is being accelerated by growing health consciousness and the growth of organized retail.

Europe Market Insights

The frozen fruits market in Europe is defined by a strong consumer base focusing on health and sustainability. The growth is mainly propelled by the robust industrial sectors that are using frozen fruits in their products. The key trend is the alignment with the Farm to Fork strategy that promotes sustainable food systems and reduces food waste, positioning frozen fruits as a strategic solution. Consumers are highly seeking clean label and organic preferences with certifications such as the EU Organic logo, which is becoming a significant market differentiator. This regulatory environment, coupled with enhanced retail infrastructure, guarantees consistent product quality and availability. Consequently, manufacturers are investing in recyclable packaging and energy-efficient freezing technologies to meet both regulatory and consumer expectations for environmental responsibility.

Germany is projected to hold the largest revenue share in Europe by 2035 and is fueled by its powerful food processing industry and deeply ingrained health consciousness. The country is a hub for industrial food manufacturing, with frozen fruits being a critical input. The demand is further complemented by a strong consumer adherence to health trends that is supported by the federal initiatives, such as IN FORM, the German National Initiative to Promote Healthy Diets and Physical Activity. A key trend is the high demand for organic products, and Germany has one of the world's largest organic markets. The BIOFACH CONGRESS 2025 data depicts that the organic food private label surges the sales by 13.5%. This data supports the market growth as retailers are expanding organic frozen fruit SKUs such as berries, mango, and mixed fruit blends to meet rising consumer demand for affordable organic products.

The UK holds the top position in the frozen fruits market, and the growth is fueled by the high concentration of food service outlets and sustained public health messaging. The UK food industry continues to follow high safety and quality standards, with Public Health England’s legacy 5 A Day campaign remaining a powerful driver of fruit consumption. A major trend is the rapid expansion of the discount grocery sector that heavily features private-label frozen foods, making frozen fruits more accessible. The OEC 2023 data depict that the UK has exported nearly USD 6.01 million of frozen fruits and nuts globally, ensuring an efficient distribution and quality preservation for the market. This export activity demonstrates the international competitiveness of its supply chain and the global demand for its frozen fruit products.