Frozen Fruits Market Outlook:

Frozen Fruits Market size was valued at USD 5.1 billion in 2025 and is projected to reach USD 9.8 billion by the end of 2035, rising at a CAGR of 6.9% during the forecast period, i.e., 2026-2035. In 2026, the industry size of frozen fruits is evaluated at USD 5.4 billion.

The global frozen fruits market is defined by the strong demand from the industrial and food service sectors and is driven by the need for a consistent, year-round ingredient supply. The fusion of frozen fruits as a key input in the secondary food manufacturing, including dairy, beverages, bakery, and confectionery, is the primary growth factor for the market expansion. The operational efficiency offered by the frozen fruits, including extended shelf life, minimizes the spoilage, and batch-to-batch consistency is vital for large-scale production. This industrial demand is boosted by the public sector initiatives. For example, the USDA National School Lunch Program has served lunches with a portion of frozen fruits included to meet the nutritional standards, creating a stable, high-volume procurement channel. Furthermore, the OEC data in 2023 states that the global trade value of frozen fruits and nuts reached USD 7.1 billion, reflecting the scale of the cross-border B2B transactions.

Governments are also underwriting the supply chain stability via cold chain and processing capacity. India’s Ministry of Food Processing Industries has approved hundreds of integrated cold chain projects under the PMKSY to reduce the post-harvest losses and enable the availability of the fruit throughout the year for freezing and export. Further, India’s Production Linked Incentive for the Food Processing with a multi-year outlay aims to expand the processing throughput and modernize lines supporting a consistent frozen fruit supply for domestic and global buyers. For procurement teams, this means near-term supply reliability and the opportunity to secure the multi-year contracts indexed to government-backed program calendars. Service levels and margin discipline can be enhanced by giving priority to suppliers with grant-funded cold chains, verifying origin compliance for public tenders, and connecting FAO supply data to seasonal formulations.

Key Frozen Fruits Market Insights Summary:

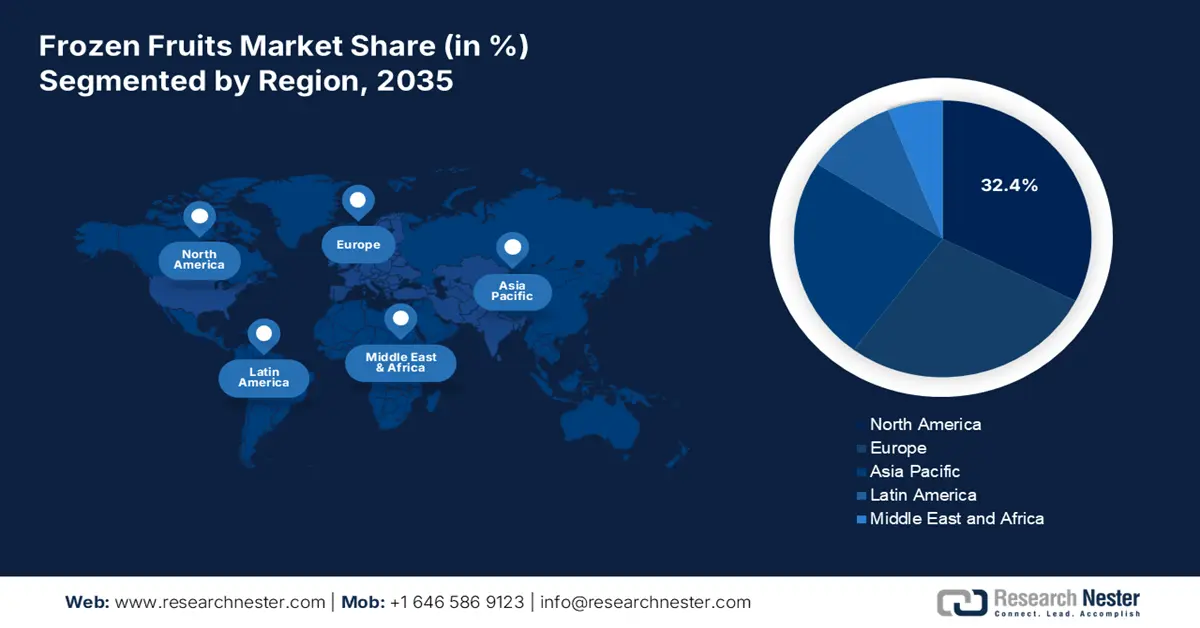

Regional Highlights:

- North America is projected to secure a 32.4% share by 2035 in the frozen fruits market, upheld by a strong industrial base and value-added product demand impelled by expanding utilization of frozen fruits in large-scale food and nutrition programs.

- Asia Pacific is anticipated to expand rapidly through 2026–2035, expected to capture a rising share powered by accelerating urbanization and cold-chain advancements owing to increasing industrial consumption in dairy, beverage, and confectionery applications.

Segment Insights:

- In the frozen fruits market, the industrial leads segment is projected to hold 60.6% share by 2035, anchored by evolving consumer inclination toward convenience and processed nutritional offerings stimulated by manufacturers’ increasing incorporation of natural fruit-based inputs.

- By 2035, the business-to-business segment is anticipated to dominate the distribution channel with the highest share, supported by large-volume institutional utilization in food service and processing sectors propelled by rising dependence on frozen fruits as essential production inputs.

Key Growth Trends:

- Expansion of cold chain logistics infrastructure

- Government led sustainability and food waste reduction agendas

Major Challenges:

- Strong food safety and certification hurdles

- Logistical complexity and supply chain disruptions

Key Players: Dole Food Company (U.S.), SunOpta (U.S.), Nature's Touch (U.S.), Cascade Fresh (U.S.), Seneca Foods (U.S.), Nomad Foods (UK), Frosta AG (Germany), Pinguin Lutosa (Belgium), Hortex Holding (Poland), Ardo (France), Simplot Food Group (J.R. Simplot) (Italy), Nichirei Foods Inc. (Japan), Kagome Co., Ltd. (Japan), Simplot (Australia), Cheil Jedang (South Korea), Al Kabeer Group (India), Darshan Foods Pvt. Ltd. (India), Coolpad Group (Malaysia), Frozenco Sdn Bhd (Malaysia), Frutarom Industries Ltd. (New Zealand).

Global Frozen Fruits Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.1 billion

- 2026 Market Size: USD 5.4 billion

- Projected Market Size: USD 9.8 billion by 2035

- Growth Forecasts: 6.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (32.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, Brazil, Mexico, Indonesia, Vietnam

Last updated on : 27 November, 2025

Frozen Fruits Market - Growth Drivers and Challenges

Growth Drivers

- Expansion of cold chain logistics infrastructure: The government investment in the cold chain infrastructure, mainly in developing countries, is significant for the market expansion. The PIB data in August 2024 highlights that nearly 1,217 food processing projects were approved costing ₹31,308.24 crore under MOFPI that directly aids the frozen fruits market by expanding the national cold-chain capacity, infrastructure in fruit-processing, and value-addition units critical for large-scale freezing and preservation. This directly addresses the logistical barrier, enabling the new entrant regional players into the formal frozen food market and securing the supply chain for both domestic consumption and export. This strategic public funding is expected to minimize the post-harvest losses, thereby increasing the raw material available for the frozen sector.

- Government led sustainability and food waste reduction agendas: National policies are now actively focusing on reducing food waste and are creating a structural pattern for the frozen fruit industry. The UK government has invested a significant amount to support organizations tackling food waste, as part of its wider Net Zero strategy, indicating this trend. Further, freezing is recognized as a vital technology to preserve a huge amount of fresh products. This government push promotes the retailers and food service providers to partner with the frozen fruit suppliers as a part of their sustainability reporting, transforming frozen fruit from a mere commodity into a strategic tool for achieving corporate and national environmental goals.

- Rising demand for fruit based export products in emerging markets: Countries such as India, Mexico, Peru, and Chile are expanding their fruit processing and frozen export capabilities. The USDA FAS indicates that there is a rapid export growth in the berries and tropical fruits from South America to the U.S. and the EU. Further, the APAC government is proactively investing in fruit processing clusters under the national food processing missions. These initiatives boost the frozen fruit market and global supply availability. The Ministry of Food Processing Industries data in 2025 depicts that the market 2025 in India is expected to reach USD 284.55 billion and is set to grow at a CAGR of 6.5%, driven by the government-backed sectoral expansion.

Challenges

- Strong food safety and certification hurdles: Compliance with global standards and certification is mandatory, time consuming and costly. For example, the USDA Organic certification process can take years and requires rigorous documented practices. The Cascade Fresh uses its strong food safety protocols as a market differentiator yet the cost of the audit record keeping and facility upgrades pose a significant challenge for new suppliers mainly when targeting premium or international markets with strong import regulations.

- Logistical complexity and supply chain disruptions: The supply chain of frozen foods is vulnerable to disruptions, from port delays to energy price shocks that surge the freezing and storage costs. The COVID-19 pandemic and subsequent global logistics constraints highlight how reliant the industry is on seamless transport. Key players such as Ardo have resilient and diversified logistics networks, but the new companies that are entering the market face significant risk from single points of failure that can stop operations and spoil inventory.

Frozen Fruits Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.9% |

|

Base Year Market Size (2025) |

USD 5.1 billion |

|

Forecast Year Market Size (2035) |

USD 9.8 billion |

|

Regional Scope |

|

Frozen Fruits Market Segmentation:

End use Segment Analysis

Under the end use segment, the industrial leads segment is expected to hold the share value of 60.6% by 2035. The segment is driven due to the fundamental shift in consumer eating habits towards convenience and processed foods with perceived health attributes. The frozen fruits are the essential ingredients in a wide array of products that align with these trends, including the fruit-based snacks, nutritional bars, and ready-to-drink smoothies and flavored yogurts. Their standardized quality, safety, and longer shelf life make them the preferred choice for large-scale food production. This industrial reliance ensures that a significant portion of the frozen fruit supply is channeled towards manufacturing rather than direct retail, setting its dominant revenue share. This trend is further stimulated by the food manufacturers reformulating products to fuse more natural, fruit-based ingredients to meet clean-label demands.

Distribution Channel Segment Analysis

By 2035, the business-to-business segment is expected to hold the largest share value in the distribution channel segment. The segment is driven by the extensive use of frozen fruits as main ingredients by other industries. The food service sector totally relies on frozen berries and tropical fruits for a consistent year-round supply in desserts, smoothies, and breakfast items. These frozen fruits are the critical ingredients for manufacturers of jams, juices and dairy products, and baked goods. This bulk, institutional demand far surpasses the individual retail sales. The growth of the food processing industry is the vital driver. For example, the U.S. Department of Energy data in May 2023 depicts that the food manufacturing shipments in the U.S reached USD 950 billion in 2022, with frozen fruit consumption representing an increasing share of total input purchases by industrial food manufacturers.

Type Segment Analysis

Berries are leading the sub-segment and are mainly driven by its unparalleled nutritional profile and associated health benefits. The scientific research on the berries has highlighted that they are rich in antioxidants, vitamins, and fiber that are linked to minimizing the risk of chronic disease. The consumer awareness of these benefits is amplified by the public health initiatives that fuel the demand. The USDA promotes the inclusion of fruits like berries in dietary patterns such as MyPlate, reinforcing their health image. Further, the rise in the imports of U.S. cultivated blueberries in 2021 reached USD 415 million, indicating the rising demand for frozen berries, according to the USDA data in March 2023. A substantial share of these imported blueberries enters the market in frozen form to support bakery, beverage, and retail frozen fruit segments.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Type |

|

|

Form |

|

|

Distribution Channel |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Frozen Fruits Market - Regional Analysis

North America Market Insights

North America is dominating the frozen fruits market and is expected to hold the market share of 32.4% by 2035. The market is defined by mature demand and the focus on value-added products. The growth is fueled by the robust industrial sector that utilizes frozen fruits as ingredients for bakery, dairy, and beverage production. A key trend is the integration of frozen fruits into government-assisted food programs such as school meals, ensuring a stable, high-volume demand. The consumers' shift towards health and convenience further drives the category, with innovation focused on the organic offerings and clean label ingredients. The market is highly consolidated with major players investing heavily in supply chain resilience and sustainable packaging to meet the regulatory and consumer expectations.

The U.S. frozen fruits market is forecasted to grow by the institutional and industrial demand, underpinned by the federal nutritional programs. The U.S. Department of Agriculture data in 2024 states that the U.S. has exported over 7.51 metric tons of fruits and vegetables globally. This data indicates that there is a stronger upstream supply capacity that supports higher processing volumes for frozen fruits. Moreover, a portion of exported fruit products are frozen or are sourced by global processors for frozen applications. Strong B2B demand from food makers, who depend on frozen fruits for their affordability, safety, and year-round consistency in items like yogurt, smoothies, and baked goods, complements the public-sector demand. This robust export activity signals a mature and efficient agricultural sector capable of meeting both domestic and international demand for frozen fruit inputs.

U.S. Fruits and Vegetables Export in 2024

|

Country |

Total Value (USD) |

|

Canada |

5.8 Billion |

|

Mexico |

2.31 Billion |

|

Japan |

1.06 Billion |

|

South Korea |

680.54 Million |

|

Taiwan |

439.45 Million |

|

European Union |

411.61 Million |

|

Australia |

216.85 Million |

|

China |

204.95 Million |

|

Hong Kong |

177.05 Million |

|

Philippines |

176.67 Million |

Source: USD 2024

In Canada, the market is shaped by the evolving consumer preferences that are guided by the national health policies and the country’s growing ethnic diversity. The government initiatives by Agriculture and Agri-Food Canada provide support for production innovation, climate adaptation practices, and specialty crop cultivation. Investments in cold chain infrastructure improve the availability and quality maintenance, aiding the retail and industrial demand. The increasing popularity of berries and mixed frozen fruit blends as ingredients in desserts, beverages, and snacks is notable. Further, the Government of Canada data in July 2025 stated that Canada’s frozen fruits exports grew by 21.2% over the past five years and reached USD 1.1 billion in 2024.

Canada’s Fruit Export Performance in 2024

|

Country |

Share |

|

U.S. |

72% of total exports |

|

Japan |

5.4% |

|

Germany |

3.4% |

|

Netherlands |

2.6% |

|

China |

2.1% |

Source: Government of Canada July 2025

APAC Market Insights

Asia Pacific frozen fruits market is growing rapidly and is driven by fast urbanization and market expansion of modern retail and cold chain infrastructure. Massive industrial demand from the region’s food processing and beverage sector is the primary drivers that utilize frozen fruits as the vital ingredients for dairy, juices, and confectionery. Government initiatives play a key role in the market expansion, for example, India’s Pradhan Mantri Kisan SAMPADA Yojana has allocated a significant amount to develop the integrated cold chains that directly reduce the post-harvest losses and boost the processing capacity. On the other hand, consumer trends are shifting towards health and convenience, with the demand growing for both tropical fruits and imported berries. The market is highly competitive with the regional players expanding their presence to capitalize on the potential and scale up to address the robust food safety standards.

China’s frozen fruits market is fueled by the massive government investment in agricultural modernization and cold chain infrastructure. Rapid growth in the e-commerce sector and the online grocery platforms are the key drivers of the market growth, which rely on frozen products to ensure quality and quick delivery. The B2B sectors is are major consumers of the market with food processors using these frozen fruits in various ingredients. China has exported 44,480,800 kg of frozen strawberries, according to the WITS 2023 data. This data reflects the robust, expanding, and domestic production capacity. This established supply base supports both the growing domestic demand and China's position as a significant global exporter. Further, export strength, along with vast domestic consumption, highlights China's role as a cornerstone of the global frozen fruit supply chain.

In India, the market is experiencing a transformative growth and is largely fueled by the federal government initiatives that are aimed at minimizing food waste and adding value to agricultural produce. Various government programs that support the trend are the key drivers of the market. Further, governments are sanctioning various integrated cold chain projects that are supporting the market growth. As per the IBEF data in October 2025, the food processing market reached Rs. 30,49,800 crores, as frozen fruits are a sub-segment of the country’s processed foods industry, supplying inputs for beverages, bakery, dairy, and ready-to-cook categories that rely on processed fruit ingredients. Consumer acceptance of frozen fruits as a practical and nourishing choice is being accelerated by growing health consciousness and the growth of organized retail.

Europe Market Insights

The frozen fruits market in Europe is defined by a strong consumer base focusing on health and sustainability. The growth is mainly propelled by the robust industrial sectors that are using frozen fruits in their products. The key trend is the alignment with the Farm to Fork strategy that promotes sustainable food systems and reduces food waste, positioning frozen fruits as a strategic solution. Consumers are highly seeking clean label and organic preferences with certifications such as the EU Organic logo, which is becoming a significant market differentiator. This regulatory environment, coupled with enhanced retail infrastructure, guarantees consistent product quality and availability. Consequently, manufacturers are investing in recyclable packaging and energy-efficient freezing technologies to meet both regulatory and consumer expectations for environmental responsibility.

Germany is projected to hold the largest revenue share in Europe by 2035 and is fueled by its powerful food processing industry and deeply ingrained health consciousness. The country is a hub for industrial food manufacturing, with frozen fruits being a critical input. The demand is further complemented by a strong consumer adherence to health trends that is supported by the federal initiatives, such as IN FORM, the German National Initiative to Promote Healthy Diets and Physical Activity. A key trend is the high demand for organic products, and Germany has one of the world's largest organic markets. The BIOFACH CONGRESS 2025 data depicts that the organic food private label surges the sales by 13.5%. This data supports the market growth as retailers are expanding organic frozen fruit SKUs such as berries, mango, and mixed fruit blends to meet rising consumer demand for affordable organic products.

The UK holds the top position in the frozen fruits market, and the growth is fueled by the high concentration of food service outlets and sustained public health messaging. The UK food industry continues to follow high safety and quality standards, with Public Health England’s legacy 5 A Day campaign remaining a powerful driver of fruit consumption. A major trend is the rapid expansion of the discount grocery sector that heavily features private-label frozen foods, making frozen fruits more accessible. The OEC 2023 data depict that the UK has exported nearly USD 6.01 million of frozen fruits and nuts globally, ensuring an efficient distribution and quality preservation for the market. This export activity demonstrates the international competitiveness of its supply chain and the global demand for its frozen fruit products.

Key Frozen Fruits Market Players:

- Dole Food Company (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- SunOpta (U.S.)

- Nature's Touch (U.S.)

- Cascade Fresh (U.S.)

- Seneca Foods (U.S.)

- Nomad Foods (UK)

- Frosta AG (Germany)

- Pinguin Lutosa (Belgium)

- Hortex Holding (Poland)

- Ardo (France)

- Simplot Food Group (J.R. Simplot) (Italy)

- Nichirei Foods Inc. (Japan)

- Kagome Co., Ltd. (Japan)

- Simplot (Australia)

- Cheil Jedang (South Korea)

- Al Kabeer Group (India)

- Darshan Foods Pvt. Ltd. (India)

- Coolpad Group (Malaysia)

- Frozenco Sdn Bhd (Malaysia)

- Frutarom Industries Ltd. (New Zealand)

- Dole Food Company is a dominating player in the global frozen fruits market and is utilizing its vast vertically integrated supply chain to ensure a consistent quality and year-round availability. Their strategic initiative is to focus on branding and introducing value-added organic and exotic fruit blends, directly targeting the health-conscious consumer segment. The gross profit earned in 2024 is USD 559,302 thousand.

- SunOpta has carved its position in the market and specializes in organic and non-GMO product lines. Their key advancements rely on incorporating sustainable sourcing practices and investing in clean-label ingredient processing that appeals to brands and consumers seeking health transparency and environmental responsibility in their frozen fruit choices.

- Nature’s Touch has made substantial advancements in the market by focusing on technological innovation in the field of freezer processes. Their adoption of individual quick freezing technology preserves the taste, texture, and nutritional integrity of fruits, positioning them as the premium suppliers.

- Cascade Fresh competes in the market by highlighting innovation in product form and application. A key strategic initiative involves developing proprietary freezing methods and creating specialized fruit products, such as thaw-and-serve offerings and smoothie-specific blends that provide added convenience and cater to the evolving needs of modern consumers.

- Seneca Foods is a major player in the frozen fruits market, and the strength of the company totally relies on the large-scale agricultural processing. Their primary strategic advancement is securing long-term partnerships with local growers, ensuring a reliable and cost-effective raw material supply. The net sales of the company in 2024 reached USD 1,458,603 thousand.

Here is a list of key players operating in the global market:

The global frozen fruits market is highly fragmented and very competitive, with a mix of multinational food giants and specialized regional players. The key competitors are actively focusing on backward integration by securing their own farms and supply chains to ensure a consistent quality and cost control. Product innovation is the critical driver as companies expand into organic offerings, exotic fruit blends, and added-value products such as smoothie packs to capture health-conscious consumers. Moreover, significant investment is being channeled into the expansion of the cold chain logistics and distribution network to improve the global reach, penetrate the emerging market, and meet the rising demand for convenience without compromising on the nutritional value. Further, companies are now focusing on mergers and acquisitions to expand their operations. For example, in September 2021, Fortenova Group announced that the company had completed the sale to Nomad Foods of the Frozen Food Business Group after receiving all regulatory approvals.

Corporate Landscape of the Frozen Fruits Market:

Recent Developments

- In June 2024, Del Monte, the UK's number one canned fruit brand and a subsidiary of the international group Fresh Del Monte Inc., has launched frozen British Strawberries, which is the latest product offering exclusively available in Iceland stores across the UK.

- In October 2024, Raya Holding has announced that Raya Foods secured USD 40 million in Investment from Helios Investment Partners to expand its operations and achieve sustainable growth.

- Report ID: 139

- Published Date: Nov 27, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Frozen Fruits Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.