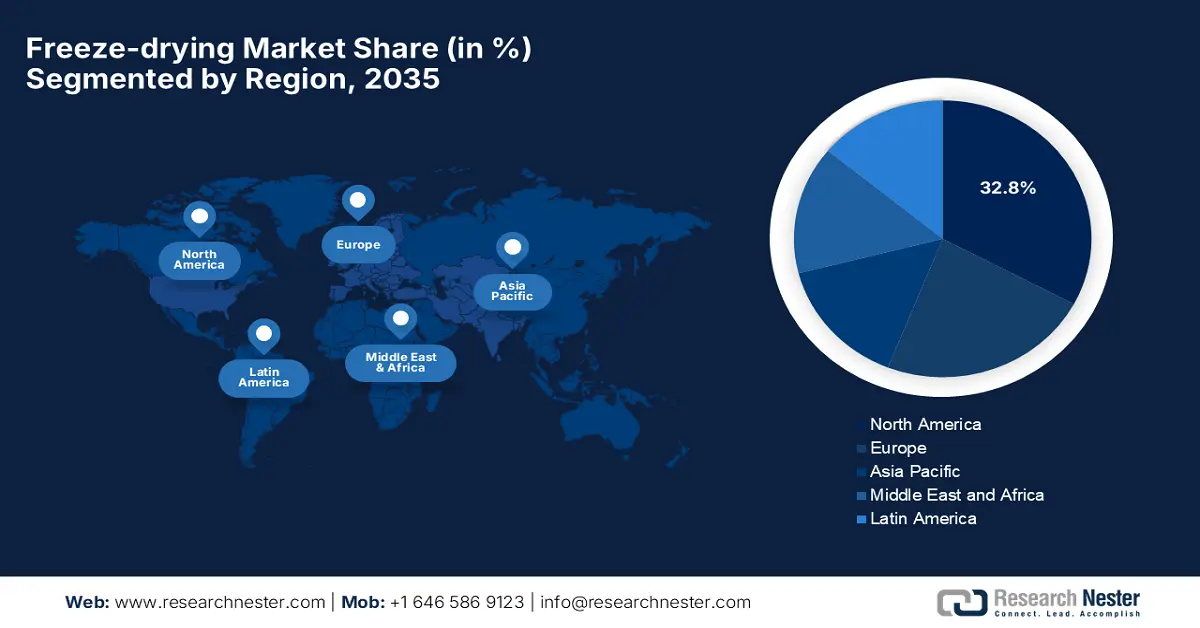

Freeze-drying Market - Regional Analysis

North America Market Insights

North America is recognized as the dominating region in the freeze-drying market, capturing the largest revenue share of 32.8% by the end of 2035. The dominance of the region is effectively attributable to advanced manufacturing infrastructure and a strong focus on research and development. In December 2022, Peak and Prairie Industries, has introduced Canada’s first domestically produced home-based freeze-drying appliance, which is the D-freeze system. The product is designed for both personal and small business use. It offers enhanced energy efficiency, larger batch capacity, and commercial-grade components.

The U.S. is augmenting its leadership in the freeze-drying market, influenced by a combination of factors such as a large pharmaceutical industry, a growing nutraceutical sector, and heightened awareness of food preservation technologies. In August 2025, Glacial Freeze Dry reported that it had acquired Foodynamics to enhance its freeze-dry contract manufacturing and co-packing capabilities. Hence, the move strengthens Glacial’s position in delivering premium, partner-focused freeze-drying solutions.

Canada is also solidifying its position in the regional market owing to increased applications in the food processing and pharmaceutical industries. The market is also supported by government initiatives promoting food safety, quality preservation, and export competitiveness. As of the May 2025 report from the country’s government agencies, such as the Canadian Food Inspection Agency, enforce compliance for both domestic and imported freeze-dried products, while Health Canada sets safety and nutritional standards, supported by scientific risk assessments. Hence, this strong regulatory framework supports consumer trust and positions freeze-dried goods for both local and international markets.

APAC Market Insights

The Asia Pacific region is presenting strong growth in the freeze-drying market, backed by the rising demand in sectors such as pharmaceuticals, food processing, and biotechnology. The expanding urbanization, growing middle class, and changing consumer preferences are prompting a stronger adoption of freeze-drying technology. In addition, the pharmaceutical manufacturing in the country is expanding, whereas the government initiatives supporting food preservation technologies are contributing to the market's development.

China is reinforcing its dominance in the regional freeze-drying market owing to the strong focus on food safety, innovation in pharmaceutical manufacturing, and expansion in functional food production. Domestic companies in the country are readily making investments in modern lyophilization equipment to improve product quality and export potential. In October 2025, Guanfeng Machinery reported that it had launched the high-performance GFD-200S freeze dryer, which is designed for large-scale food processing with a 19-layer heating rack and the ability to process up to 3,000 kg per batch, hence suitable for standard market growth.

India is steadily evolving in the freeze-drying market due to the increasing adoption in the nutraceutical, dairy, and herbal supplement sectors. The country's large agricultural output and rising demand for value-added processed foods are encouraging investment in freeze-drying infrastructure. In February 2025, CryoDry reported that it had partnered with Spinco as its official distributor in India, making advanced freeze-drying technology more accessible to labs, research facilities, and businesses nationwide.

Europe Market Insights

Europe represents an extremely dynamic landscape for the freeze-drying market, productively led by its emphasis on high-quality preservation techniques, especially in sectors such as biologics and nutraceuticals. Also, the pioneers in the region are implementing spectacular strategies to enhance their position in the global dynamics. In this regard, Itema in October 2023 reported that established a joint venture with Tofflon Group, marking a crucial step in advancing lyophilization technology for the pharmaceutical and biotech industries. The Tofflonit, a new company, will manufacture industrial freeze drying systems to serve the region’s market, focusing on products such as vaccines, antibiotics, and biotech compounds.

Germany is the leading contributor to progress in the regional freeze-drying market, facilitated by its robust pharmaceutical manufacturing base and a very strong food processing sector. Besides the country’s focus on technological innovation and automation encourages both the development and integration of these devices. For instance, in November 2024, Adragos Pharma notified that it had acquired Baccinex, enhancing its sterile manufacturing capabilities and expanding its footprint with a sixth manufacturing site. Hence, Baccinex’s expertise in liquid and lyophilized vial production strengthens Adragos’ solutions from development to commercial supply.

The U.K. is also solidifying its position in Europe’s market owing to its dynamic life sciences and biotechnology sectors, which play a pivotal role in shaping demand for lyophilization technologies. In November 2023, ISI notified that it has won funding as part of the Digital Lyo consortium to develop cutting-edge in-situ process analytical technologies, which are aimed at revolutionizing freeze-drying in biopharmaceutical manufacturing. Moreover, the project seeks to reduce cycle times, energy consumption, and product waste by integrating advanced sensors such as impedance and Raman spectroscopy for real-time process monitoring.