Network Forensics Market Outlook:

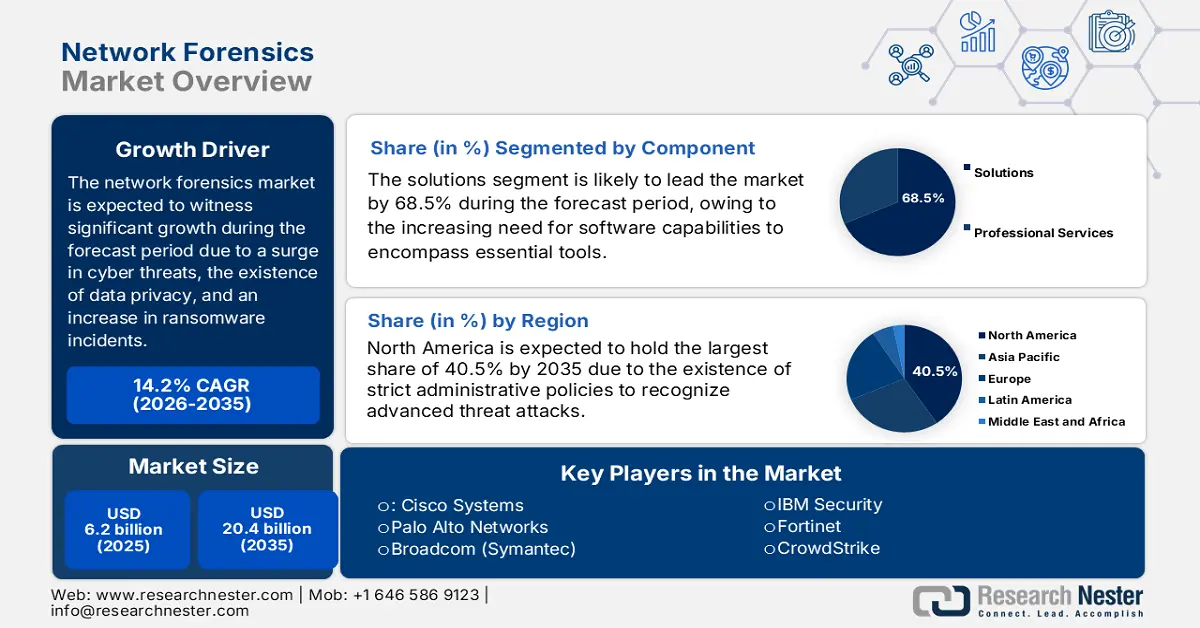

Network Forensics Market size was USD 6.2 billion in 2025 and is anticipated to reach USD 20.4 billion by the end of 2035, increasing at a CAGR of 14.2% during the forecast period, i.e., 2026-2035. In 2026, the industry size of network forensics is assessed at USD 6.0 billion.

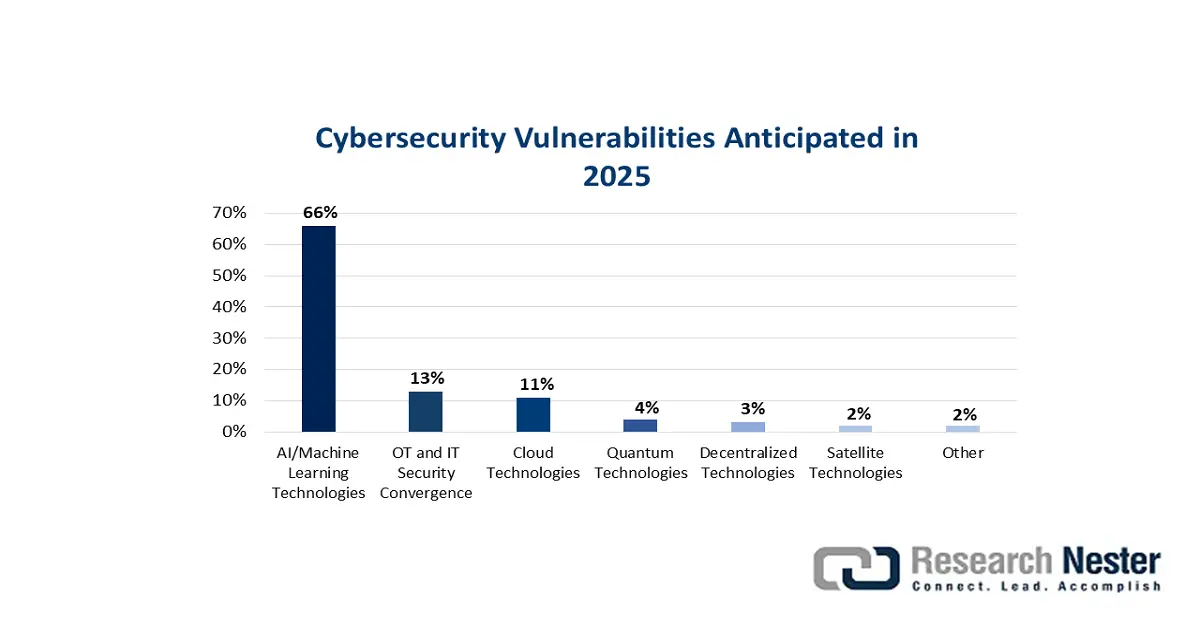

The market is rapidly evolving, which is driven by an escalation in the threat landscape, along with technological disruption. Factors such as sophistication and the unmanageable volume of cyber threats, and the presence of data privacy laws are readily uplifting the market internationally. According to a data report published by the World Economic Forum in January 2025, the public sector is inevitably impacted, with 38% of the global population reporting insufficient resilience in comparison to only 10% of medium and large-scale private sector companies. Besides, 49% of public sector players stated the lack of required talent to achieve cybersecurity objectives, thus making it suitable for enhancing the market’s demand.

Source: World Economic Forum

Furthermore, as per an article published by the IMF in April 2024, cyberattacks have increased, and for instance, Equifax was forced to make a payment of over USD 1 billion in penalties after a massive data breach, which negatively impacted almost 150 million consumers. Besides, between 2004 and 2023, 5,000 cyber incidents have taken place in banks, 10,000 in insurers, 15,000 with asset managers, and 20,000 with others. Simultaneously, a USD 3 billion financial loss took place in banks, followed by USD 6 billion in the case of asset managers, and USD 9 billion for others. This, in turn, is readily bolstering the network forensics market across different sectors in numerous countries.

Key Network Forensics Market Insights Summary:

Regional Highlights:

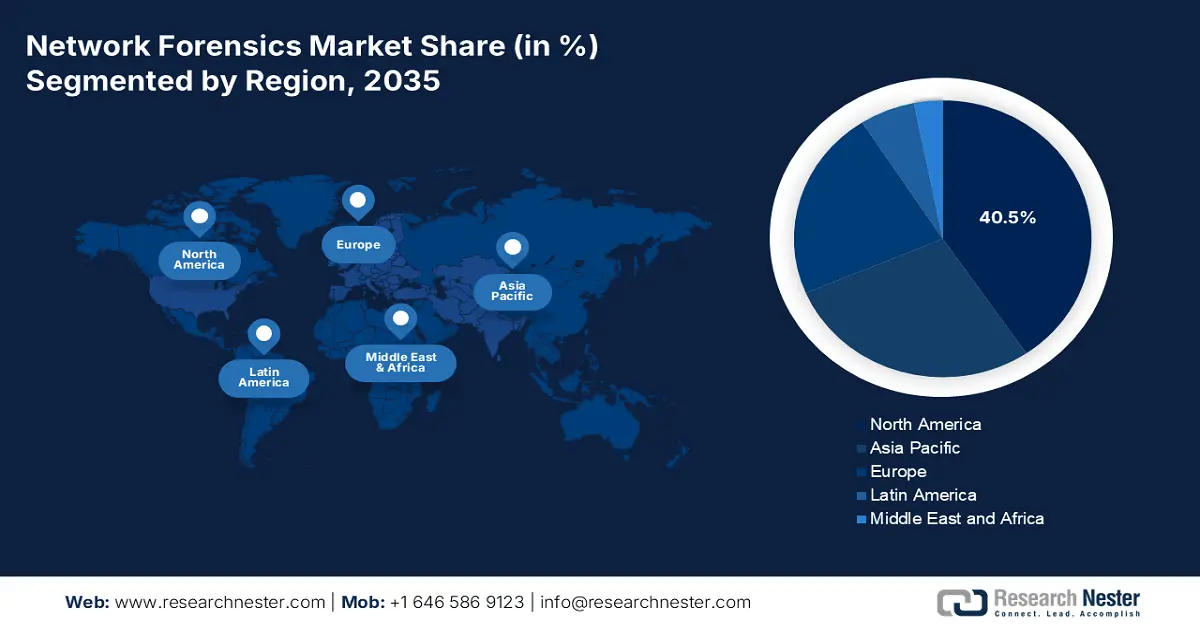

- North America in the network forensics market is estimated to hold a 40.5% share by 2035, owing to heightened cybersecurity investments, strict regulatory frameworks, and a rise in advanced threat activities.

- Europe is projected to witness the fastest growth through 2026–2035, impelled by the enforcement of regional data protection regulations and the adoption of Zero Trust principles aligned with ENISA’s cybersecurity framework.

Segment Insights:

- The solutions segment in the network forensics market is projected to capture a 68.5% share by 2035, propelled by the surging need for integrated platforms and advanced software capabilities supporting AI-driven threat analysis and active threat hunting.

- The large enterprises segment is expected to secure the second-largest share by 2035, driven by the complexity of vast IT infrastructures and the heightened demand for comprehensive forensic platforms to counter persistent ransomware and advanced cyber threats.

Key Growth Trends:

- Proliferation of IoT and hybrid cloud facility

- Artificial intelligence integration

Major Challenges:

- Overwhelming storage expenses and data volume

- The complexity of cloud and hybrid environments

Key Players: Cisco Systems (U.S.), Palo Alto Networks (U.S.), Broadcom (Symantec) (U.S.), IBM Security (U.S.), Fortinet (U.S.), CrowdStrike (U.S.), Trellix (U.S.), Darktrace (UK), VIAVI Solutions (U.S.), Corelight (U.S.), LogRhythm (U.S.), ExtraHop (U.S.), VMware (Broadcom) (U.S.), Nokia (Finland), AT&T Cybersecurity (U.S.), NEC Corporation (Japan), Rapid7 (U.S.), Securonix (U.S.), F-Secure (Finland), Kaspersky Lab (Russia)

Global Network Forensics Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 6.2 billion

- 2026 Market Size: USD 6.0 billion

- Projected Market Size: USD 20.4 billion by 2035

- Growth Forecasts: 14.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40.5% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, United Kingdom, Germany, France, Canada

- Emerging Countries: India, China, Japan, Singapore, Australia

Last updated on : 14 October, 2025

Network Forensics Market - Growth Drivers and Challenges

Growth Drivers

- Proliferation of IoT and hybrid cloud facility: The extension of the attack surface denotes a robust structural driver for the network forensics market upliftment. The sudden shift to hybrid cloud models, along with the explosion of IoT-based devices, creates distributed and complex networks that cannot be monitored with conventional tools. In this regard, an article has been published by NLM in April 2023, wherein the latest devices are successfully added to IoT networks regularly, and there were almost 20.4 billion connected devices as of 2022, denoting an increase from 8.4 billion as of 2020.

- Artificial intelligence integration: The network forensics market is eventually transitioning from reactive analysis to proactive threat hunting, and based on this, suitable solutions are effectively embedded by AI and machine learning integration. The purpose is to successfully automate unknown threats and anomalous patterns detection with huge network data streams. According to an article published by NLM in December 2024, malware classification, particularly using machine learning techniques, accounts for 10%. This readily reflects increasing concerns regarding malicious software, such as viruses and ransomware, in the cybersecurity domain, which, in turn, is positively impacting the market.

- Rise in cloud-based forensics: The presence of cloud-based Network Detection and Response (NDR) platforms is steadily gaining traction over legacy on-premises appliances, which is readily driving the network forensics market globally. As stated in the January 2024 NLM article, the cloud digital forensics sector is projected to grow at an estimated 16.5% by the end of 2031. In addition, its market is predicted to reach a valuation of USD 36.9 billion by the end of the same duration, and currently, it is valued at USD 11.2 billion, thereby displaying a huge growth opportunity for generous investments in this field.

CEO and CISO Perspective of Cybersecurity Resulting in Severe Risks (2025)

|

Security Risks |

CEO |

CISO |

|

Operational disruption |

31% |

45% |

|

Cyber espionage and sensitive information loss |

33% |

27% |

|

Financial loss due to cyberattacks |

11% |

11% |

|

Brand reputation damage and customer trust loss |

7% |

12% |

|

Increased expenses for cybersecurity measures and responses |

8% |

1% |

|

Disinformation campaigns |

5% |

2% |

|

Not concerned |

3% |

2% |

|

Other |

2% |

1% |

Source: World Economic Forum

Challenges

- Overwhelming storage expenses and data volume: The presence of modernized networks tends to generate a torrent of packet and log data, creating an effective cost challenge and scalability in the global network forensics market. To be suitable for retrospective analysis, forensic solutions need to gain and retain data for an extended duration, which is prohibitively expensive. Besides, this has pressured companies to make problematic compromises on data retention reforms, frequently removing essential information before the occurrence of an incident. Meanwhile, the computational power needed to index and process data in real-time also causes strain on IT resources, thus negatively impacting the market.

- The complexity of cloud and hybrid environments: The rapid shift to multi-cloud and hybrid architectures has readily fragmented the perimeter in the network forensics market internationally. Forensic tools are significantly designed for on-premises and physical networks; as a result, they struggle to achieve consistent visibility into virtual private clouds, SaaS applications, and containerized workloads. Besides, cloud providers’ shared task models frequently restrict the depth of network telemetry that is easily available to consumers. This has resulted in blind spots, along with data silos, pressuring teams to effectively correlate events in different consoles.

Network Forensics Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

14.2% |

|

Base Year Market Size (2025) |

USD 6.2 billion |

|

Forecast Year Market Size (2035) |

USD 20.4 billion |

|

Regional Scope |

|

Network Forensics Market Segmentation:

Component Segment Analysis

The solutions segment in the network forensics market is anticipated to garner the largest share of 68.5% by the end of 2035. The segment’s upliftment is highly fueled by the crucial demand for an integrated platform and software capabilities that create the ultimate core of network forensic operations globally. These solutions successfully encompass crucial tools for threat intelligence adoption, thorough analysis, packet capture, and data acquisition. Besides, the market’s transition from reactive analysis to active threat hunting is fueling the machine learning and AI adoption to sift through huge data volumes, thus suitable for bolstering the segment’s exposure.

Organization Size Segment Analysis

The large enterprises segment in the network forensics market is projected to account for the second-largest share during the predicted duration. The segment’s growth is fueled by the presence of complicated and sprawling IT facilities, representing a massive attack surface that encompasses data infrastructures, cloud instances, as well as remote office centers. These organizations are actual targets for innovative persistent ransomware and threat campaigns, and possess financial resources to achieve and incorporate wide-ranging network forensic platforms, along with dedicated security teams, that are needed for ensuring effective management.

Deployment Mode Segment Analysis

The cloud segment in the network forensics market is predicted to cater to the third-largest share by the end of the projected period. The segment’s development is driven by its importance for enabling real-time visibility, the ability to carefully analyze massive data, and ensuring automated evidence collection. According to an article published by NLM in January 2024, the existence of cloud-based computing infrastructure or applications in different organizations has readily increased to 81% from 73%. This has further ensured growth in public cloud services to USD 304.9 billion, thereby making it suitable for boosting the segment.

Our in-depth analysis of the network forensics market includes the following segments:

|

Segment |

Subsegments |

|

Component |

|

|

Organization Size |

|

|

Deployment Mode |

|

|

Application |

|

|

Vertical |

|

|

Forensic Intelligence Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Network Forensics Market - Regional Analysis

North America Market Insights

North America in the network forensics market is anticipated to account for the largest share of 40.5% by the end of 2035. The market’s exposure is highly driven by an increase in cybersecurity expenditure, the presence of strict administrative policies, and concentrated advanced threat activity. According to a data report published by the USA Spending Government in 2025, this government agency granted USD 536 million out of its overall federal budget for ensuring standard cybersecurity, energy security, emergency response, and energy programs, which is positively impacting the market in the overall region.

The network forensics market in the U.S. is effectively growing, owing to the compulsory integration of the Zero Trust Architecture, which has been mandated by the OMB Memorandum M-22-09. This particular framework readily demands the continuous monitoring and logging of overall network traffic, thereby resulting in a non-negotiable and immense need for forensic tools to investigate anomalies and validate trust. As stated in the December 2022 NLM article, the country comprises 11,000 digitalized forensics laboratories. Besides, a review-based study was conducted on 145 cases, of which 22 cases were based on computer forensics, thereby making it suitable for the market’s growth in the country.

The network forensics market in Canada is also growing due to the effective centralization of response coordination and threat intelligence through the regional center for cybersecurity. This particular center’s strategies, such as its National Cyber Threat Assessment, are readily driving a unified requirement for forensic tools that successfully align with shared protocols and have the ability to defend against state-based critical facilities. Besides, as stated in the December 2024 Government of Canada article, the Minister of Public Safety declared a funding of USD 10 million for more than 5 years regarding the establishment of a Cyber Attribution Data Centre (CADC), which is positively uplifting the market’s exposure.

Cybersecurity-Based Expenditure in America (2025)

|

Components |

Spending Amount |

|

Risk management technology and tools |

USD 371.7 million |

|

Cybersecurity for energy delivery |

USD 315.6 million |

|

Ceser, infrastructure, and investment |

USD 227.8 million |

|

Program direction |

USD 125.4 million |

|

Infrastructure security and energy resources |

USD 123.4 million |

Source: USA Spending Government

Europe Market Insights

Europe in the network forensics market is expected to emerge as the fastest-growing region during the forecast period. The market’s exposure in the region is attributed to the integration of strict regional regulations, preferably suitable for crucial and essential entities across different sectors. In addition, the increasing incorporation of Zero Trust principles, which are aligned with the Europe Union Agency for Cybersecurity (ENISA) framework for effectively moving security-based parameters to identities and data, is also bolstering the market in the region. As per the July 2022 ENISA data report, 623 ransomware cases have been recorded in the region, with an estimated 58.2% of stolen data, thus suitable for the market’s development.

The network forensics market in the UK is gaining increasing traction, owing to initiating enhancements in severe national infrastructure to boost defenses, and a generous commitment by the local government by allocating funds. According to an article published by the UK Government in June 2025, the new cyber growth action plan has focused on boosting innovation and jobs, resulting in the country’s cyber sectors’ growth at a £13.2 billion valuation. In addition, approximately £16 million has been allocated as a suitable fund to convert next-generation advancements into business and uplift cyber startups in the country.

The network forensics market in Germany is also developing due to the existence of the German Federal Office for Information Security (BSI), consistently reporting an increase in the volume of cyber-attacks. In addition, concrete federal investment is also evident in the country, along with the presence of the Digital Strategy Germany, along with the Aktorbezogene Cyberabwehr project. As mentioned in the 2025 GTAI data report, the country’s security market size is EUR 31 billion as of 2023, as well as recorded a 9.7% year-on-year growth. Additionally, there has also been a growth in IT security by 13.8% and a 12.6% yearly upliftment in security services, thereby denoting an optimistic outlook for the market in the country.

Cybersecurity Digital Products 2023 Import in Europe

|

Countries |

Import |

|

UK |

USD 160 million |

|

Germany |

USD 45.6 million |

|

France |

USD 45.4 million |

|

Spain |

USD 37.8 million |

|

Ireland |

USD 36.7 million |

|

Netherlands |

USD 23.2 million |

|

Italy |

USD 18.8 million |

|

Sweden |

USD 15.7 million |

Source: OEC

APAC Market Insights

Asia Pacific in the network forensics market is expected to witness steady growth by the end of the forecast timeline. The market’s development in the overall region is extremely driven by an upsurge in digital transformation across complete economic industries, an effective increase in state-driven and cybercriminal threat activity, and the enactment of strict data protection laws. According to an article published by the World Economic Forum in October 2024, there has been rapid growth in digitalization, which has led to an 82% surge in cybercrimes between 2021 and 2022. However, to combat this, the Anti-Financial Account Scamming Act has readily aimed to boost consumer defenses against cyber threats, thus denoting a positive outlook for the market.

The network forensics market in China is gaining increased exposure, owing to the presence of a massive digitalized ecosystem as well as national strategic imperatives. In addition, the integration of the country’s Cybersecurity Law, along with the subsequent Multi-Level Protection, which has mandated strict security controls and logging for overall network operators. Besides, the country’s government has recognized cybersecurity as the ultimate pillar of national security, resulting in double-digit and sustained annual development in both private and public sectors.

The network forensics market in India is also growing due to the government’s push for digital sovereignty, which is readily exemplified by the Digital India approach. Based on this, the country’s Computer Emergency Response Team (CERT-In) has successfully issued strict directives as of 2022, permitting enhanced logging and incident reporting. According to an article published by the Carnegie Endowment for International Peace in September 2025, the country’s digital economy has surged by 11.7%, contributing USD 402 billion to the gross domestic product (GDP). This has resulted in an increase in cyber-attacks on the regional government by 138%, thus denoting a huge growth opportunity for the market.

Key Network Forensics Market Players:

- Cisco Systems (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Palo Alto Networks (U.S.)

- Broadcom (Symantec) (U.S.)

- IBM Security (U.S.)

- Fortinet (U.S.)

- CrowdStrike (U.S.)

- Trellix (U.S.)

- Darktrace (UK)

- VIAVI Solutions (U.S.)

- Corelight (U.S.)

- LogRhythm (U.S.)

- ExtraHop (U.S.)

- VMware (Broadcom) (U.S.)

- Nokia (Finland)

- AT&T Cybersecurity (U.S.)

- NEC Corporation (Japan)

- Rapid7 (U.S.)

- Securonix (U.S.)

- F-Secure (Finland)

- Kaspersky Lab (Russia)

The international network forensics market is moderately consolidated, with the top five organizations accounting for almost half of the total market share. The competitive landscape is effectively defined by a tactical arms race between integrated and large-scale platform vendors, along with best-of-breed and agile specialists. Besides, notable strategic approaches are successfully focused on technological convergence and integration, while key players are strongly embedding machine learning and AI to ensure predictive threat hunting as well as automated responses. Meanwhile, the sudden transition towards consolidating tools and cloud-based architectures into XDR platforms is also bolstering the network forensics market globally.

Here is a list of key players operating in the global market:

Recent Developments

- In April 2025, Menlo Security readily enhanced its security enterprise power-based solution with the latest visibility and forensics capabilities, thereby providing security teams the control to remain ahead of AI-driven browser threats.

- In November 2024, Accenture declared its latest capabilities and services, which have been designed to ensure reinvention in cyber and business resilience through the power of generative AI, quantum data security, and deepfake protection.

- In January 2024, the PwC Japan Group effectively notified that it will effectively separate its forensic services division from PwC Advisory LLC, and successfully establish the PwC Risk Advisory LLC, which is the newest firm to focus on forensic services.

- Report ID: 8184

- Published Date: Oct 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Network Forensics Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.