Global Fragrance and Perfume Market

- An Outline of the Global Fragrance and Perfume Market

- Market Definition and Segmentation

- Study Assumptions and Abbreviations

- Research Methodology & Approach

- Primary Research

- Secondary Research

- Data Triangulation

- SPSS Methodology

- Executive Summary

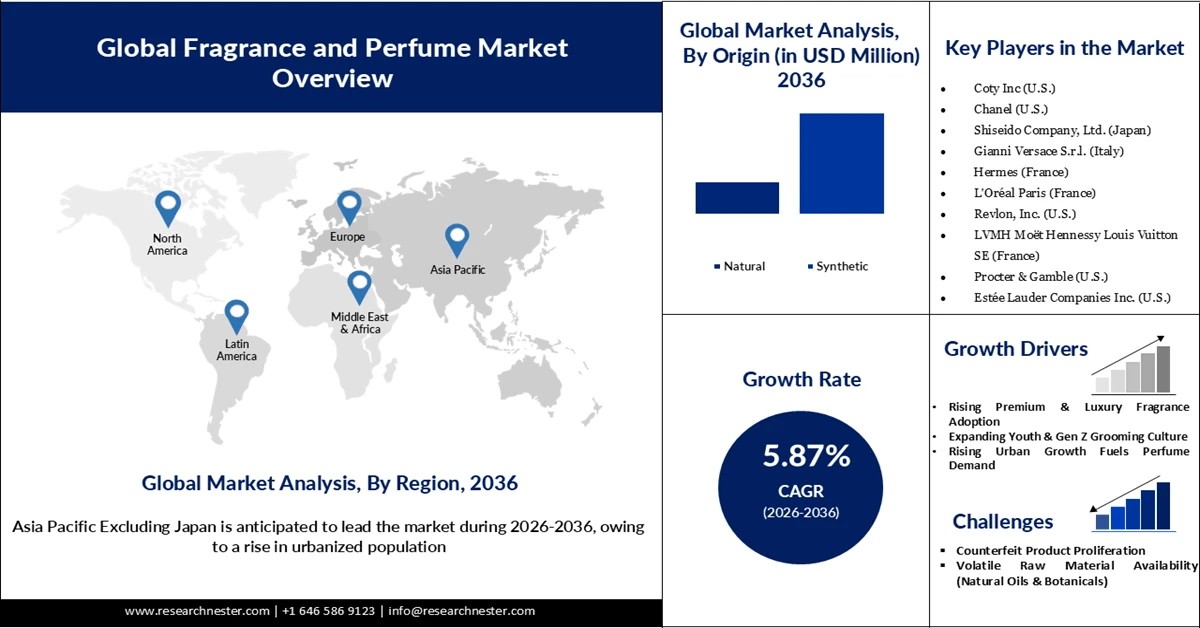

- Growth Drivers

- Major Roadblocks

- Opportunities

- Prevalent Trends

- Government Regulation

- Growth Outlook

- Competitive White Space Analysis – Identifying Untapped Market Gaps

- Risk Overview

- SWOT

- Technological Advancement

- Technology Maturity Matrix for Fragrance and Perfume

- Recent News

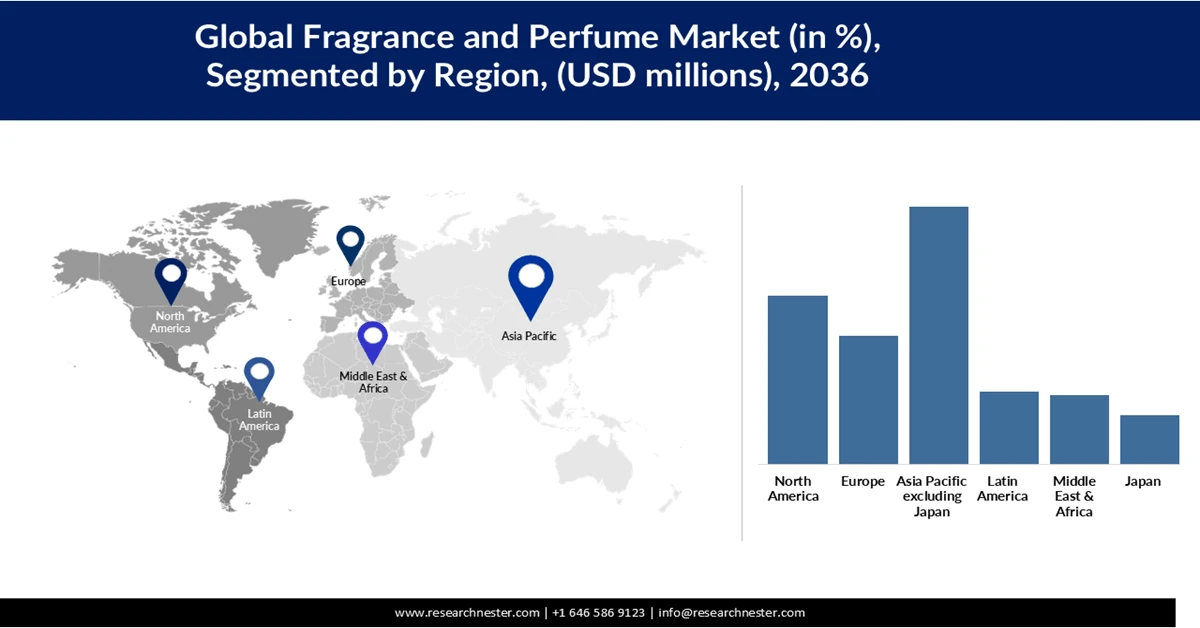

- Regional Demand

- Global Fragrance and Perfume by Geography – Strategic Comparative Analysis

- Strategic Segment Analysis: Fragrance and Perfume Demand Landscape

- Global Fragrance and Perfume Demand Trends Driven by Sustainability, Veganism and Long Lasting Impact (2026-2036)

- Root Cause Analysis (RCA) for discovering problems of the Fragrance and Perfume Porter Five Forces

- PESTLE

- Comparative Positioning

- Fragrance and Perfume – Key Player Analysis (2036)

- Competitive Landscape: Key Suppliers/Players

- Competitive Model: A Detailed Inside View for Investors

- Company Market Share, 2036 (%)

- Business Profile of Key Enterprise

- Coty Inc

- Chanel

- Shiseido Company, Ltd

- Gianni Versace S.r.l

- Hermes

- L'Oréal Paris

- Revlon

- LVMH Moët Hennessy Louis Vuitton SE

- Procter & Gamble

- Estée Lauder Companies Inc

- Business Profile of Key Enterprise

- Global Fragrance and Perfume Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), Volume (Million Tons), and Compound Annual Growth Rate (CAGR)

- Global Segmentation Fragrance and Perfume Analysis (2026-2036)

- By Type

- Perfume/ Parfum, Market Value (USD Million), and CAGR, 2026-2036F

- Eau de Parfum, Market Value (USD Million), and CAGR, 2026-2036F

- Eau de Toilette, Market Value (USD Million), and CAGR, 2026-2036F

- Eau de Cologne, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By Origin

- Natural, Market Value (USD Million), and CAGR, 2026-2036F

- Synthetic, Market Value (USD Million), and CAGR, 2026-2036F

- By Price Tier

- Luxury, Market Value (USD Million), and CAGR, 2026-2036F

- Premium, Market Value (USD Million), and CAGR, 2026-2036F

- Mass, Market Value (USD Million), and CAGR, 2026-2036F

- By Sales Channel

- Department Stores, Market Value (USD Million), and CAGR, 2026-2036F

- Duty-Free Shops, Market Value (USD Million), and CAGR, 2026-2036F

- E-commerce, Market Value (USD Million), and CAGR, 2026-2036F

- Salon & Spa, Market Value (USD Million), and CAGR, 2026-2036F

- Direct Sales, Market Value (USD Million), and CAGR, 2026-2036F

- Specialty Retail, Market Value (USD Million), and CAGR, 2026-2036F

- Supermarkets and Drug Store, Market Value (USD Million), and CAGR, 2026-2036F

- Other, Market Value (USD Million), and CAGR, 2026-2036F

- By Demographics

- Female, Market Value (USD Million), and CAGR, 2026-2036F

- Male, Value (USD Million), and CAGR, 2026-2036F

- Unisex, Market Value (USD Million), and CAGR, 2026-2036F

- Children/Teen, Market Value (USD Million), and CAGR, 2026-2036F

- By Scent Family

- Floral, Market Value (USD Million), and CAGR, 2026-2036F

- Woody, Value (USD Million), and CAGR, 2026-2036F

- Amber, Market Value (USD Million), and CAGR, 2026-2036F

- Musk, Market Value (USD Million), and CAGR, 2026-2036F

- Powdery, Market Value (USD Million), and CAGR, 2026-2036F

- Fresh/Citrus/Aquatic, Market Value (USD Million), and CAGR, 2026-2036F

- Fruity, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By End User

- Personal Fragrance, Market Value (USD Million), and CAGR, 2026-2036F

- Home Fragrance, Value (USD Million), and CAGR, 2026-2036F

- Personal Care Fragrance, Market Value (USD Million), and CAGR, 2026-2036F

- Industrial/Institutional, Market Value (USD Million), and CAGR, 2026-2036F

- Regional Synopsis, Value (USD Million), 2026-2036

- North America Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Europe Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Asia Pacific excluding Japan Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Japan Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Latin America Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Middle East and Africa Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- By Type

- Market Overview

- North America Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2026-2036

- Increment $ Opportunity Assessment, 2026-2036

- Segmentation (USD Million), 2026-2036, By

- By Type

- Perfume/ Parfum, Market Value (USD Million), and CAGR, 2026-2036F

- Eau de Parfum, Market Value (USD Million), and CAGR, 2026-2036F

- Eau de Toilette, Market Value (USD Million), and CAGR, 2026-2036F

- Eau de Cologne, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By Origin

- Natural, Market Value (USD Million), and CAGR, 2026-2036F

- Synthetic, Market Value (USD Million), and CAGR, 2026-2036F

- By Price Tier

- Luxury, Market Value (USD Million), and CAGR, 2026-2036F

- Premium, Market Value (USD Million), and CAGR, 2026-2036F

- Mass, Market Value (USD Million), and CAGR, 2026-2036F

- By Sales Channel

- Department Stores, Market Value (USD Million), and CAGR, 2026-2036F

- Duty-Free Shops, Market Value (USD Million), and CAGR, 2026-2036F

- E-commerce, Market Value (USD Million), and CAGR, 2026-2036F

- Salon & Spa, Market Value (USD Million), and CAGR, 2026-2036F

- Direct Sales, Market Value (USD Million), and CAGR, 2026-2036F

- Specialty Retail, Market Value (USD Million), and CAGR, 2026-2036F

- Supermarkets and Drug Store, Market Value (USD Million), and CAGR, 2026-2036F

- Other, Market Value (USD Million), and CAGR, 2026-2036F

- By Demographics

- Female, Market Value (USD Million), and CAGR, 2026-2036F

- Male, Value (USD Million), and CAGR, 2026-2036F

- Unisex, Market Value (USD Million), and CAGR, 2026-2036F

- Children/Teen, Market Value (USD Million), and CAGR, 2026-2036F

- By Scent Family

- Floral, Market Value (USD Million), and CAGR, 2026-2036F

- Woody, Value (USD Million), and CAGR, 2026-2036F

- Amber, Market Value (USD Million), and CAGR, 2026-2036F

- Musk, Market Value (USD Million), and CAGR, 2026-2036F

- Powdery, Market Value (USD Million), and CAGR, 2026-2036F

- Fresh/Citrus/Aquatic, Market Value (USD Million), and CAGR, 2026-2036F

- Fruity, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By End User

- Personal Fragrance, Market Value (USD Million), and CAGR, 2026-2036F

- Home Fragrance, Value (USD Million), and CAGR, 2026-2036F

- Personal Care Fragrance, Market Value (USD Million), and CAGR, 2026-2036F

- Industrial/Institutional, Market Value (USD Million), and CAGR, 2026-2036F

- Country Level Analysis, Value (USD Million)

- U.S. Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Canada Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- By Type

- Overview

- Europe Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2026-2036

- Increment $ Opportunity Assessment, 2026-2036

- Segmentation (USD Million), 2026-2036, By

- By Type

- Perfume/ Parfum, Market Value (USD Million), and CAGR, 2026-2036F

- Eau de Parfum, Market Value (USD Million), and CAGR, 2026-2036F

- Eau de Toilette, Market Value (USD Million), and CAGR, 2026-2036F

- Eau de Cologne, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By Origin

- Natural, Market Value (USD Million), and CAGR, 2026-2036F

- Synthetic, Market Value (USD Million), and CAGR, 2026-2036F

- By Price Tier

- Luxury, Market Value (USD Million), and CAGR, 2026-2036F

- Premium, Market Value (USD Million), and CAGR, 2026-2036F

- Mass, Market Value (USD Million), and CAGR, 2026-2036F

- By Sales Channel

- Department Stores, Market Value (USD Million), and CAGR, 2026-2036F

- Duty-Free Shops, Market Value (USD Million), and CAGR, 2026-2036F

- E-commerce, Market Value (USD Million), and CAGR, 2026-2036F

- Salon & Spa, Market Value (USD Million), and CAGR, 2026-2036F

- Direct Sales, Market Value (USD Million), and CAGR, 2026-2036F

- Specialty Retail, Market Value (USD Million), and CAGR, 2026-2036F

- Supermarkets and Drug Store, Market Value (USD Million), and CAGR, 2026-2036F

- Other, Market Value (USD Million), and CAGR, 2026-2036F

- By Demographics

- Female, Market Value (USD Million), and CAGR, 2026-2036F

- Male, Value (USD Million), and CAGR, 2026-2036F

- Unisex, Market Value (USD Million), and CAGR, 2026-2036F

- Children/Teen, Market Value (USD Million), and CAGR, 2026-2036F

- By Scent Family

- Floral, Market Value (USD Million), and CAGR, 2026-2036F

- Woody, Value (USD Million), and CAGR, 2026-2036F

- Amber, Market Value (USD Million), and CAGR, 2026-2036F

- Musk, Market Value (USD Million), and CAGR, 2026-2036F

- Powdery, Market Value (USD Million), and CAGR, 2026-2036F

- Fresh/Citrus/Aquatic, Market Value (USD Million), and CAGR, 2026-2036F

- Fruity, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By End User

- Personal Fragrance, Market Value (USD Million), and CAGR, 2026-2036F

- Home Fragrance, Value (USD Million), and CAGR, 2026-2036F

- Personal Care Fragrance, Market Value (USD Million), and CAGR, 2026-2036F

- Industrial/Institutional, Market Value (USD Million), and CAGR, 2026-2036F

- Country Level Analysis, Value (USD Million)

- UK Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Germany Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- France Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Italy Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Spain Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Netherlands Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Russia Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Switzerland Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Poland Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Belgium Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Rest of Europe Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- By Type

- Overview

- Asia Pacific excluding Japan Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2026-2036

- Increment $ Opportunity Assessment, 2026-2036

- Segmentation (USD Million), 2026-2036, By

- By Type

- Perfume/ Parfum, Market Value (USD Million), and CAGR, 2026-2036F

- Eau de Parfum, Market Value (USD Million), and CAGR, 2026-2036F

- Eau de Toilette, Market Value (USD Million), and CAGR, 2026-2036F

- Eau de Cologne, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By Origin

- Natural, Market Value (USD Million), and CAGR, 2026-2036F

- Synthetic, Market Value (USD Million), and CAGR, 2026-2036F

- By Price Tier

- Luxury, Market Value (USD Million), and CAGR, 2026-2036F

- Premium, Market Value (USD Million), and CAGR, 2026-2036F

- Mass, Market Value (USD Million), and CAGR, 2026-2036F

- By Sales Channel

- Department Stores, Market Value (USD Million), and CAGR, 2026-2036F

- Duty-Free Shops, Market Value (USD Million), and CAGR, 2026-2036F

- E-commerce, Market Value (USD Million), and CAGR, 2026-2036F

- Salon & Spa, Market Value (USD Million), and CAGR, 2026-2036F

- Direct Sales, Market Value (USD Million), and CAGR, 2026-2036F

- Specialty Retail, Market Value (USD Million), and CAGR, 2026-2036F

- Supermarkets and Drug Store, Market Value (USD Million), and CAGR, 2026-2036F

- Other, Market Value (USD Million), and CAGR, 2026-2036F

- By Demographics

- Female, Market Value (USD Million), and CAGR, 2026-2036F

- Male, Value (USD Million), and CAGR, 2026-2036F

- Unisex, Market Value (USD Million), and CAGR, 2026-2036F

- Children/Teen, Market Value (USD Million), and CAGR, 2026-2036F

- By Scent Family

- Floral, Market Value (USD Million), and CAGR, 2026-2036F

- Woody, Value (USD Million), and CAGR, 2026-2036F

- Amber, Market Value (USD Million), and CAGR, 2026-2036F

- Musk, Market Value (USD Million), and CAGR, 2026-2036F

- Powdery, Market Value (USD Million), and CAGR, 2026-2036F

- Fresh/Citrus/Aquatic, Market Value (USD Million), and CAGR, 2026-2036F

- Fruity, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By End User

- Personal Fragrance, Market Value (USD Million), and CAGR, 2026-2036F

- Home Fragrance, Value (USD Million), and CAGR, 2026-2036F

- Personal Care Fragrance, Market Value (USD Million), and CAGR, 2026-2036F

- Industrial/Institutional, Market Value (USD Million), and CAGR, 2026-2036F

- Country Level Analysis, Value (USD Million)

- China Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- India Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- South Korea Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Australia Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Indonesia Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Malaysia Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Vietnam Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Thailand Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Singapore Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- New Zealand Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Rest of Asia Pacific Excluding Japan Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- By Type

- Overview

- Latin America Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2026-2036

- Increment $ Opportunity Assessment, 2026-2036

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2026-2036, By

- By Type

- Perfume/ Parfum, Market Value (USD Million), and CAGR, 2026-2036F

- Eau de Parfum, Market Value (USD Million), and CAGR, 2026-2036F

- Eau de Toilette, Market Value (USD Million), and CAGR, 2026-2036F

- Eau de Cologne, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By Origin

- Natural, Market Value (USD Million), and CAGR, 2026-2036F

- Synthetic, Market Value (USD Million), and CAGR, 2026-2036F

- By Price Tier

- Luxury, Market Value (USD Million), and CAGR, 2026-2036F

- Premium, Market Value (USD Million), and CAGR, 2026-2036F

- Mass, Market Value (USD Million), and CAGR, 2026-2036F

- By Sales Channel

- Department Stores, Market Value (USD Million), and CAGR, 2026-2036F

- Duty-Free Shops, Market Value (USD Million), and CAGR, 2026-2036F

- E-commerce, Market Value (USD Million), and CAGR, 2026-2036F

- Salon & Spa, Market Value (USD Million), and CAGR, 2026-2036F

- Direct Sales, Market Value (USD Million), and CAGR, 2026-2036F

- Specialty Retail, Market Value (USD Million), and CAGR, 2026-2036F

- Supermarkets and Drug Store, Market Value (USD Million), and CAGR, 2026-2036F

- Other, Market Value (USD Million), and CAGR, 2026-2036F

- By Demographics

- Female, Market Value (USD Million), and CAGR, 2026-2036F

- Male, Value (USD Million), and CAGR, 2026-2036F

- Unisex, Market Value (USD Million), and CAGR, 2026-2036F

- Children/Teen, Market Value (USD Million), and CAGR, 2026-2036F

- By Scent Family

- Floral, Market Value (USD Million), and CAGR, 2026-2036F

- Woody, Value (USD Million), and CAGR, 2026-2036F

- Amber, Market Value (USD Million), and CAGR, 2026-2036F

- Musk, Market Value (USD Million), and CAGR, 2026-2036F

- Powdery, Market Value (USD Million), and CAGR, 2026-2036F

- Fresh/Citrus/Aquatic, Market Value (USD Million), and CAGR, 2026-2036F

- Fruity, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By End User

- Personal Fragrance, Market Value (USD Million), and CAGR, 2026-2036F

- Home Fragrance, Value (USD Million), and CAGR, 2026-2036F

- Personal Care Fragrance, Market Value (USD Million), and CAGR, 2026-2036F

- Industrial/Institutional, Market Value (USD Million), and CAGR, 2026-2036F

- Country Level Analysis, Value (USD Million)

- Brazil Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Argentina Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Mexico Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Rest of Latin America Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- By Type

- Overview

- Middle East & Africa Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2026-2036

- Increment $ Opportunity Assessment, 2026-2036

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2026-2036, By

- By Type

- Perfume/ Parfum, Market Value (USD Million), and CAGR, 2026-2036F

- Eau de Parfum, Market Value (USD Million), and CAGR, 2026-2036F

- Eau de Toilette, Market Value (USD Million), and CAGR, 2026-2036F

- Eau de Cologne, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By Origin

- Natural, Market Value (USD Million), and CAGR, 2026-2036F

- Synthetic, Market Value (USD Million), and CAGR, 2026-2036F

- By Price Tier

- Luxury, Market Value (USD Million), and CAGR, 2026-2036F

- Premium, Market Value (USD Million), and CAGR, 2026-2036F

- Mass, Market Value (USD Million), and CAGR, 2026-2036F

- By Sales Channel

- Department Stores, Market Value (USD Million), and CAGR, 2026-2036F

- Duty-Free Shops, Market Value (USD Million), and CAGR, 2026-2036F

- E-commerce, Market Value (USD Million), and CAGR, 2026-2036F

- Salon & Spa, Market Value (USD Million), and CAGR, 2026-2036F

- Direct Sales, Market Value (USD Million), and CAGR, 2026-2036F

- Specialty Retail, Market Value (USD Million), and CAGR, 2026-2036F

- Supermarkets and Drug Store, Market Value (USD Million), and CAGR, 2026-2036F

- Other, Market Value (USD Million), and CAGR, 2026-2036F

- By Demographics

- Female, Market Value (USD Million), and CAGR, 2026-2036F

- Male, Value (USD Million), and CAGR, 2026-2036F

- Unisex, Market Value (USD Million), and CAGR, 2026-2036F

- Children/Teen, Market Value (USD Million), and CAGR, 2026-2036F

- By Scent Family

- Floral, Market Value (USD Million), and CAGR, 2026-2036F

- Woody, Value (USD Million), and CAGR, 2026-2036F

- Amber, Market Value (USD Million), and CAGR, 2026-2036F

- Musk, Market Value (USD Million), and CAGR, 2026-2036F

- Powdery, Market Value (USD Million), and CAGR, 2026-2036F

- Fresh/Citrus/Aquatic, Market Value (USD Million), and CAGR, 2026-2036F

- Fruity, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By End User

- Personal Fragrance, Market Value (USD Million), and CAGR, 2026-2036F

- Home Fragrance, Value (USD Million), and CAGR, 2026-2036F

- Personal Care Fragrance, Market Value (USD Million), and CAGR, 2026-2036F

- Industrial/Institutional, Market Value (USD Million), and CAGR, 2026-2036F

- Country Level Analysis, Value (USD Million)

- Saudi Arabia Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- UAE Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Israel Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Qatar Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Kuwait Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Oman Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- South Africa Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Rest of Middle East & Africa Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- By Type

- Overview

- Global Economic Scenario

- World Economic Outlook

- About Research Nester

- Our Global Clientele

- We Serve Clients Across World

Fragrance and Perfume Market Outlook:

Fragrance and Perfume Market size is valued at USD 66.42 billion in 2025 and is expected to grow to USD 124.10 billion by 2036, registering a CAGR of 5.87% during the forecast period, i.e., 2026-2036. In 2026, the industry size of fragrance and perfume is evaluated at USD 70.16 billion.

Expansion in retail and e-commerce has significantly expanded consumer choice in the fragrance and perfume market, making it easier for shoppers to access a wide variety of products tailored to their preferences. Large online marketplaces and omnichannel retailers like Amazon and Walmart enhance this access by offering competitive pricing, discounts, fast delivery options, and convenient shopping experiences, all of which help reduce both time and cost for consumers. E-commerce platforms now play a larger role in retail overall, with an increasing share of purchases happening online and many consumers valuing convenience and competitive pricing as top reasons for choosing digital channels. The growing presence of e-commerce has also shifted how consumers discover and decide on products. A majority of online shoppers conduct product research or compare prices before completing a purchase, and many prefer online shopping for its convenience and the ability to explore a wider set of options. Demographic trends have had a notable impact on these patterns.

Younger generations, particularly Millennials and Generation Z, are more inclined to shop online and value digital convenience. In one survey, around two-thirds of Millennials said they prefer online shopping compared to older age groups’ preference for in-store experiences. In the fragrance segment specifically, younger shoppers also show a stronger preference for buying fragrances online, contributing to the growing share of digital fragrance purchases, even though traditional retail still remains important for sensory product testing. At the same time, broader consumer behavior data show that mobiles are increasingly the preferred device for online shopping, and consumers place high value on convenience features like fast delivery, free returns, and easy comparison shopping, all factors that influence purchasing decisions in categories such as fragrances. These shifts intensify competition among e-commerce brands not just on price, but on product range, user experience, and digital engagement. Younger cohorts’ preference for quick, cost-effective purchases and expanded access to premium brands online helps accelerate purchase decisions and supports the ongoing evolution of the fragrance market in retail and digital channels.

Key Perfume and Fragrance Market Insights Summary:

Regional Highlights:

- In the perfume and fragrance market is projected to hold the largest 40.2% share by 2035, supported by rapid urbanization, economic expansion, a large fashion-conscious youth population, and accelerating e-commerce penetration.

- North America is expected to account for 23.59% of the global market share by 2035, reinforced by the rising self-care culture, growing male participation among Gen Z, and the expansion of premium omnichannel retail.

Segment Insights:

- The Eau de Parfum (EDP) segment in the perfume and fragrance market is projected to capture a dominant 56.22% share by 2036, propelled by consumer preference for richer scent profiles offering extended longevity and everyday usability.

- The synthetic segment is anticipated to command a leading 75.43% share by 2036, strengthened by the increasing adoption of lab-developed aroma compounds enabling cost efficiency, consistency, and long-lasting performance.

Key Growth Trends:

- Rising demand for premium fragrance

- Increasing popularity of long-lasting perfumes

Major Challenges:

- Counterfeit products penetration

- Raw material volatility

Key Players: Coty Inc (U.S.), Chanel (U.S.), Shiseido Company, Ltd. (Japan), Gianni Versace S.r.l. (Italy), Hermes (France), L'Oréal Paris (France), Revlon, Inc. (U.S.), LVMH Moët Hennessy Louis Vuitton SE (France), Procter & Gamble (U.S.), Estée Lauder Companies Inc. (U.S.).

Global Perfume and Fragrance Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 66.42 billion

- 2026 Market Size: USD 70.16 billion

- Projected Market Size: USD 124.10 billion by 2036

- Growth Forecasts: 5.87% CAGR (2026-2036)

Key Regional Dynamics:

- Largest Region: Asia-Pacific (40.2% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, France, Germany, United Kingdom, China

- Emerging Countries: India, Brazil, South Korea, Mexico, Indonesia

Last updated on : 28 January, 2026

Global Fragrance and Perfume Market - Growth Drivers and Challenges

Growth Drivers

- Rising demand for premium fragrance: Consumer preference shifts toward higher-end, premium fragrances are increasingly shaping the global fragrance and perfume market by elevating both the value and character of purchases. In the U.S., the premium perfume segment captured the largest share of the market, with over 61 % of perfume revenue coming from premium products in 2024, reflecting consumers’ willingness to invest in luxury scent experiences, personalization, and brand prestige. Surveys and industry data also show that around 42 % of consumers in North America express a preference for premium brands with unique signature blends, illustrating that differentiated, high-quality fragrances are a key selection factor for a significant portion of buyers. Furthermore, prestige fragrance sales in key markets like the U.S. grew notably, with 12 % year-over-year increases reported in 2024, making luxury scents one of the fastest-growing beauty categories. These trends suggest that as disposable incomes rise and lifestyles evolve, consumers are increasingly treating premium fragrances not just as products but as expressions of identity and quality, thereby driving broader market demand and supporting new launches, niche brands, and personalized offerings across retail and e-commerce channels.

- Increasing popularity of long-lasting perfumes: The increasing popularity of long-lasting perfumes is contributing to the expansion of the global fragrance and perfume market by aligning product offerings with what many buyers now prioritize when making purchasing decisions. Industry data shows that a significant majority of fragrance consumers, nearly 80 %, consider long-lasting to be important or extremely important in their choice of perfume, especially among younger cohorts such as Millennials and Gen Z, who often seek scents that endure throughout daily activities. This preference has led brands to focus on higher-concentration formats like Eau de Parfum and Parfum, which are formulated with more aromatic oils and typically remain noticeable for many hours, reinforcing consumer satisfaction and loyalty.

Surveys also indicate that about 65 % of consumers prefer fragrances with strong sillage and lasting scent, particularly in the premium segment, where longevity is equated with quality and value. As more buyers associate durability of scent with better performance and cost-effectiveness (fewer reapplications needed), manufacturers increasingly innovate with advanced formulations and delivery technologies to meet these demands. These developments not only stimulate repeat purchases and higher price acceptance but also expand the appeal of fragrance products in both mature and emerging markets, reinforcing overall market growth. - Rising global urbanization: Densely urbanized regions foster frequent social interactions at workplaces, events, and public spaces, which in turn increase the use of long-lasting perfumes as part of daily grooming and personal presentation. Modern lifestyles in cities further integrate fragrance into everyday routines, broadening the market’s potential as consumers view scents as essential to self-expression and social engagement. According to the United Nations’ World Urbanization Prospects, the share of the global population living in urban areas has steadily risen and is projected to reach around 58 %, underscoring continued demographic shifts toward cities. Urban living often brings higher disposable incomes and greater exposure to global beauty trends, enabling consumers to spend more on beauty and personal care products, including premium fragrances. As people migrate to urban centers in search of better economic opportunities, their increased purchasing power and access to modern retail and e-commerce channels support broader adoption of fragrance products, strengthening the market’s growth trajectory.

Challenges

- Counterfeit products penetration: The widespread trade in counterfeit goods significantly challenges the fragrance and perfume industry by undermining brand integrity, reducing genuine sales, and eroding consumer trust. Counterfeits, including fake perfumes and knock-offs, form a notable part of the global illicit market; according to the Organization for Economic Co-operation and Development (OECD), counterfeit and pirated goods accounted for an estimated USD 467 billion in global trade, roughly 2.3 % of total world imports, illustrating the scale of illicit products that can include fragrances. These fake products are often sold at lower prices and do not meet safety or quality standards, which dilutes demand for authentic products, damages the reputation of brands, and discourages consumer loyalty in key segments of the market, particularly in luxury and premium fragrance categories where perceived quality and exclusivity are crucial.

- Raw material volatility: The fragrance industry depends heavily on natural and synthetic raw materials such as essential oils, aroma chemicals, and botanical extracts. These inputs are subject to significant price fluctuations and supply disruptions due to factors like climate change, seasonal crop variances, geopolitical tensions, and broader supply chain issues, leading manufacturers to face unpredictability in production costs and availability. For example, essential oils used in perfumery can vary widely in price and supply based on weather and harvest outcomes, which pushes up input costs and squeezes profit margins when companies cannot pass on those costs to consumers. This volatility can also slow product development, increase inventory costs, and force reformulations, all of which inhibit stable pricing strategies and can hinder market growth, especially for smaller or mid-sized brands with limited risk buffers.

Fragrance and Perfume Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2036 |

|

CAGR |

5.87% |

|

Base Year Market Size (2025) |

USD 66.42 billion |

|

Forecast Year Market Size (2036) |

USD 124.10 billion |

|

Regional Scope |

|

Fragrance and Perfume Market Segmentation:

Type Segment Analysis

The Eau de Parfum (EDP) segment is projected to account for the largest share, reaching 56.22% by the end of 2036, driven by its balanced blend of rich fragrance profiles and everyday practicality. EDPs typically contain a 10%–15% higher concentration of aromatic oils than lighter formats, delivering stronger projection and longer wear, which increasingly aligns with consumer preferences for lasting scents. In August 2025, Rare Beauty, owned by Selena Gomez, entered the fragrance space with the launch of its first Eau de Parfum featuring vanilla and sandalwood extracts, underscoring the growing brand's focus on premium, long-lasting formulations. Such launches highlight the rising dominance of EDPs over other segments, as consumers gravitate toward deeper scent compositions that offer extended longevity and enhanced value. This shift continues to reinforce EDPs as the preferred choice within the global fragrance and perfume market.

Origin Segment Analysis

The synthetic segment is projected to command the largest share at 75.43%, driven by the growing adoption of lab-developed fragrances formulated with aroma compounds. These ingredients, primarily derived from petrochemical sources, offer long-lasting performance and consistent scent profiles, enabling manufacturers to significantly reduce production costs through scalable, lab-grown alternatives. In 2025, Quimidroga’s fragrance chemistry report highlighted that synthetic molecules demonstrate greater stability, lower reactivity, and enhanced longevity compared to naturally derived counterparts. Additionally, synthetic compounds minimize environmental pressures by eliminating reliance on biodiversity, further supporting their uptake—particularly in price-sensitive and emerging markets.

Sales Channel Segment Analysis

The e-commerce segment is expected to hold a dominant share of 28.17% by the end of 2036, driven by growing consumer preference for convenience, competitive pricing, and secure purchasing channels. Brand-owned websites help reduce the risk of counterfeit products while enabling safe digital transactions, thereby strengthening consumer trust and supporting the overall growth of the fragrance and perfume market. E-commerce platforms are particularly advantageous for customers in regions with limited access to offline retail stores. In October 2025, Dubai-based V Perfume was recognized at the Big Box Global Retail & E-commerce Summit, highlighting the increasing operational excellence and global influence of online fragrance retailers.

Our in-depth analysis of the global fragrance and perfume market includes the following segments:

|

Segment |

Subsegment |

|

Type |

|

|

Packaging |

|

|

Price Tier |

|

|

Sales Channel |

|

|

Demographics |

|

|

Scent Family |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Fragrance and Perfume Market - Regional Analysis

Asia Pacific Excluding Japan Market Insights

The region accounts for the largest market share of 40.2%, underpinned by rapid urbanization, economic growth, and a large young demographic that is highly fashion-conscious and inclined toward experimenting with fragrances. E-commerce penetration has been a key enabler, with India alone boasting over 270 million online shoppers and expected to emerge as one of the world’s largest online retail markets by the end of this decade, supported by rising internet and smartphone adoption and increasing consumer expenditure across demographics. Brand-owned websites and major platforms help reduce the risk of counterfeit products while enabling secure digital transactions, strengthening consumer trust, and supporting the overall growth of the fragrance and perfume market. E-commerce platforms are particularly advantageous for customers in regions with limited access to offline retail stores.

India is emerging as a leading market for personalized and customized perfume collections tailored to evolving consumer preferences, further fueling market expansion. The strong presence of e-commerce platforms, including Flipkart and Amazon, has enhanced accessibility across both urban and rural areas, reshaping traditional retail behavior and supporting consumption growth in Beauty and Personal Care categories that contribute significantly to online orders. Further, in China, expanding middle-class populations and rising disposable incomes are encouraging greater fragrance adoption, including for premium, sustainable, and organic products. Globally, China continues to lead in online shopper base, further complemented by digital retail growth on platforms such as eBay and JD.com, which support convenient online access and competitive pricing that stimulate broader market uptake.

North America Market Insights

The region is projected to account for 23.59% of the global market share, driven by the rising self-care culture that continues to boost demand for beauty and personal care products, including perfumes and fragrances. Market growth is further supported by increasing male participation, particularly among Gen Z consumers, who show a strong preference for clean-label and vegan formulations. In parallel, major retail brands such as Sephora, Ulta, and Macy’s are expanding both their online and brick-and-mortar presence, accelerating the adoption of premium and high-end fragrance products.

In the U.S., rising disposable income is significantly contributing to market expansion, enabling consumers to spend more on luxury offerings and strengthening the dominance of premium fragrances. Influencer-led product launches and digital storytelling are also playing a critical role, as global niche perfumers increasingly leverage brand narratives to enhance engagement and drive sales. In Canada, perfumes are becoming an everyday essential, broadening the market scope for fragrances. Growing online brand penetration is supporting fragrance discovery and improving accessibility, while increasing consumer awareness around sustainability is encouraging a shift toward eco-friendly perfumes produced through responsible manufacturing practices, further reinforcing market growth.

Europe Market Insights

Europe accounts for 17.43% of the global fragrance and perfume market, supported by its deep-rooted perfumery heritage and strong consumer preference for personalized formulations and high oil concentrations, such as extracts, which enhance scent longevity and quality. The region also benefits from a robust regulatory framework and a growing emphasis on sustainability, ensuring product safety while encouraging the adoption of naturally sourced ingredients. The EU Cosmetics Regulation continues to strengthen consumer confidence and supports the development of clean and responsibly produced fragrances.

In the UK, the perfume and fragrance market is influenced by tourism, with duty-free retail enabling consumers to purchase premium products at competitive prices. The expansion of retail and e-commerce channels is further driving consumer engagement, while rising interest in gender-neutral fragrances and innovative scent profiles is encouraging new users to invest in higher-end offerings. In Germany, consumers increasingly favor organic and natural perfumes, boosting demand for Eau de Parfum (EDP) formulations due to their higher natural oil content and longer-lasting performance. A well-established retail infrastructure continues to propel sales of premium and luxury fragrances, as consumers perceive both online and offline channels to be convenient and price-competitive.

Key Fragrance and Perfume Market Players:

- Coty Inc (U.S.)

- Chanel (U.S.)

- Shiseido Company, Ltd. (Japan)

- Gianni Versace S.r.l. (Italy)

- Hermes (France)

- L'Oréal Paris (France)

- Revlon, Inc. (U.S.)

- LVMH Moët Hennessy Louis Vuitton SE (France)

- Procter & Gamble (U.S.)

- Estée Lauder Companies Inc. (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Coty Inc. is a major global player in the fragrance market, offering a diverse portfolio that spans affordable mass-market scents to celebrity-owned and prestige perfumes. Operating across more than 150 countries, the company derives a significant portion of its revenue from fragrances, supported by strong licensing partnerships and an extensive distribution network. Coty’s focus on quality formulation and scalable production enables it to serve both budget-conscious consumers and premium buyers, reinforcing its leadership across multiple price tiers.

- Chanel remains a cornerstone of the luxury fragrance segment, leveraging its strong fashion heritage to deliver highly exclusive and premium perfume offerings. With a global retail presence across both offline boutiques and digital platforms, Chanel positions its fragrances as aspirational lifestyle products targeted toward high-end consumers. Its emphasis on craftsmanship, brand prestige, and limited accessibility continues to strengthen its dominance in the ultra-premium fragrance category.

- Procter & Gamble previously maintained a presence in fragrances but strategically divested its fragrance division to Coty Inc. in 2016 to sharpen its focus on core household and personal care categories. While P&G no longer operates directly in perfumes, this divestment played a pivotal role in reshaping the competitive landscape by strengthening Coty’s fragrance portfolio and consolidating market expertise under specialized beauty-focused companies.

- Estée Lauder Companies Inc. is a leading force in the premium and luxury fragrance market, operating a broad portfolio of globally recognized brands distributed through department stores and e-commerce platforms. The company integrates fragrance with its skincare and makeup businesses to create cohesive beauty ecosystems, positioning itself as a key innovator in prestige perfumery. Its strong emphasis on brand storytelling, product innovation, and global retail penetration continues to drive growth in high-value fragrance segments.

Below is the list of the key players operating in the global fragrance and perfume market:

The players operating in the global fragrance and perfume market are expected to face intense competition during the forecast timeline. The market is associated with both established key players and new entrants. However, the market is moderately fragmented. New entrants impose immense competition for the existing players, prohibiting them from acquiring the majority of the revenue share. Specialised manufacturers maintain a competitive landscape in the market. Key players in the market are significantly supported by the governments for research and innovation.

Competitive Landscape of Global Perfume and Fragrance Market Key Players:

Recent Developments

- In November 2025, Coty launched the Jawhara Collection, a premium line of unisex eaux de parfum inspired by Middle Eastern olfactory traditions, reinforcing the company’s strategic expansion across global fragrance segments and strengthening its presence in the luxury perfume market.

- In October 2025, Estée Lauder opened its Global Fragrance Atelier in Paris, an innovation hub dedicated to perfume artistry and advanced scent development, underscoring its strategic commitment to the luxury and prestige fragrance category.

- Report ID: 5376

- Published Date: Jan 28, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Perfume and Fragrance Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.