Aromatherapy Market Outlook:

Aromatherapy Market size was valued at USD 7.9 billion in 2025 and is projected to reach USD 15.2 billion by the end of 2035, rising at a CAGR of 6.8% during the forecast period, i.e., 2026-2035. In 2026, the industry size of aromatherapy is estimated at USD 8.4 billion.

Institutional demand for the aromatherapy market services and supplies are shaped by the measurable utilization within healthcare, wellness, and occupational health settings rather than consumer-led trends. The National Cancer Institute report in September 2023 indicates that 53 patients with different types of cancer have undergone 6 aromatherapy sessions and have experienced a decrease in anxiety and depression. This data indicates that the higher usage is observed in hospital-affiliated integrative medicine programs and long-term care environments. Hospitals increasingly embed complementary health approaches within pain management, anxiety reduction, and palliative care pathways as a part of opioid and non-pharmacologic care strategies supported by federal health agencies. Further, the U.S. Department of Veterans Affairs has also expanded the medical centers, incorporating integrative health modalities, including aromatherapy, to address the chronic pain and stress among the veterans.

From a workforce and facility perspective, the aromatherapy market is supported by the sustained growth in healthcare and wellness employment and infrastructure. The U.S. Bureau of Labor Statistics in November 2025 shows that the employment in healthcare and social assistance exceeded 64.0 thousand in November 2025, creating a broad institutional base where complementary therapies are increasingly offered as adjunct services. Long-term care facilities and hospices represent a steady channel for the procurement of aromatherapy-related inputs tied to resident well-being and staff-assisted care programs. Regulatory oversight also influences the aromatherapy market structure by maintaining clear distinctions between cosmetic wellness and drug claims, shaping the compliance-driven sourcing and limiting unsubstantiated standardization, practitioner training, and safety monitoring for complementary therapies, which is shifting towards the institutionally acceptable solution.

Key Aromatherapy Market Insights Summary:

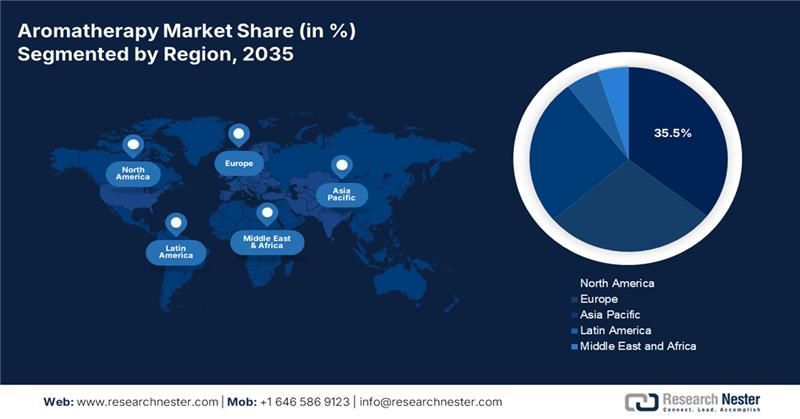

Regional Highlights:

- In the aromatherapy market, North America is projected to secure a commanding 35.5% revenue share by 2035, reflecting strong consumer spending power and mature adoption of complementary wellness practices, reinforced by clinical research support and regulated product standardization.

- Asia Pacific is anticipated to emerge as the fastest-growing region during 2026–2035 with a CAGR of 9.4%, shaped by rising disposable incomes, deep-rooted traditional medicine usage, and digitally driven consumption patterns across younger populations.

Segment Insights:

- Within the aromatherapy market, the conventional sub-segment is projected to command a dominant 65.3% share by 2035, supported by its affordability and broad availability across supermarkets and general retail channels compared to certified organic alternatives.

- The individual consumers sub-segment is anticipated to retain the largest revenue share by 2035, underpinned by the widespread adoption of self-care routines and at-home wellness practices enabled through e-commerce access and digital wellness education.

Key Growth Trends:

- Rising public healthcare expenditure on mental health and stress reduction

- Demographic shifts and healthcare spending in aging populations

Major Challenges:

- Supply chain volatility and sourcing integrity

- High barrier of consumer trust and greenwashing claims

Key Players: Young Living (U.S.), doTERRA (U.S.), Mountain Rose Herbs (U.S.), Aura Cacia (U.S.), Neal's Yard Remedies (UK), Tisserand (UK), PRANARÔM (Belgium), Farfalla (Switzerland), Florihana (France), Oshadhi (Germany), Laboratoire (France), Shizen Ryoho (Japan), L'Occitane en Provence (France), In Essence (Australia), ECO. Modern Essentials (Australia), Aromatica (South Korea), Moksha Lifestyle (India), VedaOils (India), The Body Shop (UK), NOW Foods (U.S.)

Global Aromatherapy Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 7.9 billion

- 2026 Market Size: USD 8.4 billion

- Projected Market Size: USD 15.2 billion by 2035

- Growth Forecasts: 6.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: India, South Korea, France, Italy, Australia

Last updated on : 7 January, 2026

Aromatherapy Market Market - Growth Drivers and Challenges

Growth Drivers

- Rising public healthcare expenditure on mental health and stress reduction: Government spending on mental health is directly supporting the aromatherapy market adoption as a low-cost adjunct intervention. According to the World Health Organization in June 2025, the government globally allocates an average of 2% of the national health budgets to mental health, with policy emphasis shifting toward preventive and supportive therapies. Further, aromatherapy is increasingly deployed in publicly funded outpatient clinics, correctional health systems, and community wellness centers as part of stress mitigation and anxiety reduction initiatives. In the UK, the NHS long-term plan explicitly supports non-pharmacological therapies for mental well-being, indirectly enabling aromatherapy use in public hospitals and hospice settings.

- Demographic shifts and healthcare spending in aging populations: Aging global populations, mainly in developed economies such as Japan and Europe, drive the demand for supportive non-invasive care options. The national healthcare budgets are increasingly strained by age-related chronic conditions, prompting interest in cost-effective complementary therapies. Aromatherapy market is positioned for growth in home care and geriatric care settings for pain, agitation, and sleep support. The NLM study in December 2024 conducted research on the effects of sleep quality in older adults, and the results show that aromatherapy enhances sleep quality, with single-use lavender non-inhalation aromatherapy lasting for less than 4 weeks being effective. Further, the Japanese government, facing a super-aged society, has policies integrating preventive wellness to reduce healthcare costs, creating a formal environment for product integration in care facilities.

Summary of Aromatherapy Effects on Elderly Participants

|

Participants |

Number of subjects |

Aroma types |

Intervention types |

Duration |

|

|

Aromatherapy |

Control |

||||

|

Geriatric inpatients |

40 |

40 |

Lavender, sweet orange, bergamot |

Inhalation |

2 wk |

|

Elderly people in the community |

Group 1: 18 |

20 |

Lavender, sweet orange, bergamot |

Group 1: inhalation |

2 wk |

|

Neurology elderly patients |

35 |

35 |

Lavender, sweet orange, bergamot |

Inhalation |

2 wk |

|

Institutionalized elderly |

46 |

45 |

Chinese medicine sachet |

Inhalation |

8 wk |

Source: NLM December 2024

- Digital health infrastructure and telemedicine expansion: The public investment in digital health infrastructure, a trend solidified during the pandemic, creates new channels for aromatherapy market education and distribution. As telemedicine and wellness apps become more prevalent, they integrate recommendations for complementary practices such as aromatherapy. Government reports such as those from the U.S. The Health Resources and Services Administration's telehealth expansion highlights this shift. This digitally enabled ecosystem enables the aromatherapy brands to directly reach consumers with educational content and product recommendations within a health-focused context. This integration boosts a seamless, evidence-based product discovery path for health-conscious consumers.

Challenges

- Supply chain volatility and sourcing integrity: Securing consistent high-quality botanical raw material is a primary challenge. Climate change, geopolitical instability, and crop-specific diseases cause severe price and supply volatility. For instance, the sandalwood is endangered and highly regulated, requiring CITES certification. Companies such as doTERRA address this by establishing long-term partnerships with growers worldwide to ensure an ethical and stable supply. They also reduce the risk of single-origin dependency that can cripple new entrants lacking such networks.

- High barrier of consumer trust and greenwashing claims: With rising demand for natural products, consumers are increasingly skeptical of greenwashing, exaggerated eco-friendly, or purity claims. Building trust requires transparent, verifiable sourcing and testing. Top companies provide specific test results online. Further, many consumers distrust natural product claims without third-party certification, forcing new entrants to invest in costly certification from day one.

Aromatherapy Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.8% |

|

Base Year Market Size (2025) |

USD 7.9 billion |

|

Forecast Year Market Size (2035) |

USD 15.2 billion |

|

Regional Scope |

|

Aromatherapy Market Segmentation:

Certification Segment Analysis

Within the certification segment, the conventional sub-segment is leading in the aromatherapy market and is estimated to hold a share value of 65.3% by 2035. The segment is driven by significantly lower price points and wider mainstream accessibility in supermarkets and general retail outlets compared to certified organic products. The consumer interest in organic and natural wellness is rising, but the higher cost and more limited supply of certified organic essential oils and blends constrain their market penetration for the average consumer. This is evident in broader agricultural data reporting that the certified organic acreage for lavender, which is a cornerstone aromatherapy crop, accounted for only a small fraction of the total U.S. production, highlighting the scale disparity between conventional and organic cultivation that directly influences the endpoint availability and cost in the wellness sector.

End user Segment Analysis

The individual consumers sub-segment is the undisputed leader in the aromatherapy market and is forecasted to hold the largest revenue share. The segment is fueled by the mainstreaming of self-care routines and the desire to create personal wellness sanctuaries, a trend stimulated by the pandemic. Consumers are actively integrating aromatherapy into their daily lives for stress management, sleep improvement, and home ambiance, facilitated by direct access via e-commerce and also by educational social media content. Government health agencies acknowledge this shift toward personal wellness management. The NLM study in August 2022 indicates that the sales of the aromatherapy products accounted for USD 19.318 million, highlighting the rising consumer awareness and usage, reflecting the broader consumer-driven wellness behaviors that power this segment’s growth.

Product Segment Analysis

In the aromatherapy market, the essential oils are the foundational and leading revenue driver, consistently capturing the largest share in the aromatherapy market. Their centrality is due to their role as the primary versatile raw material used across the topical applications diffusion and as an ingredient in countless blended products such as candles and creams. The demand is propelled by consumers seeking natural solutions for their health and well-being. The NLM study in February 2024 indicates that there are more than 200 compounds present in essential oils. Further, these oils have gained popularity in many industries, such as aromatherapy, natural pharmacological treatments, and food flavoring. This chemical complexity underpins their broad therapeutic appeal and multi-industry utility, securing their market dominance.

Our in-depth analysis of the global aromatherapy market includes the following segments:

|

Segment |

Subsegments |

|

Product |

|

|

Application |

|

|

Mode of Delivery |

|

|

Distribution Channel |

|

|

End user |

|

|

Source |

|

|

Certification |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Aromatherapy Market - Regional Analysis

North America Market Insights

North America is dominating the aromatherapy market and is expected to hold the revenue share of 35.5% by 2035. The market is defined by high consumer awareness and disposable income. The key drivers include the strong integration of complementary health approaches into the mainstream wellness, with substantial consumer expenditure. The regulatory landscape governed by the FDA mandates strict compliance, shaping the product formulation and claims. The primary trend is the shift toward clinical validation and standardization, with research funding from agencies such as the NCCIH supporting studies related to the essential oils for pain and stress management. The market is also defined by the dominant direct-to-consumer and multi-level marketing models alongside rapid growth in e-commerce. The demand for certified organic and sustainably sourced products continues to rise, including the USDA and Canadian Organic standards.

The U.S. aromatherapy market is a mature, high-value sector driven by the deep consumer integration of the essential oils into daily wellness and self-care routines. The demand is propelled by the widespread use of complementary health approaches for stress, sleep, and pain management. The regulatory environment overseen by the FDA for cosmetics and dietary supplements and the FTC for advertising claims necessitates precise product positioning. The key trend is the growth of e-commerce and digital wellness platforms facilitated by federal telehealth expansion. Government research funding indirectly supports the market validation. For instance, the data from the PM&R KnowledgeNow in January 2025 indicates nearly 40% of the U.S. adults used a complementary health approach. This significant portion is related to non-vitamin natural products such as essential oils. This substantial baseline usage highlights the established demand.

Canada’s aromatherapy market operates within a robust regulatory framework as a subset of Natural Health Products governed by Health Canada, which ensures product safety, efficacy, and quality via pre-market licensing. Health Canada permits aromatherapy products containing essential oils to be marketed only if they comply with the official monographs covering ingredient eligibility, concentration limits, routes of administration, safety warning and permissible claims. The Government of Canada report in October 2025 shows that the Balsam essential oil and Balsam fir essential oil are used in aromatherapy to relieve joint/muscle pain related to sprain or rheumatoid arthritis. This official monograph system provides critical regulatory clarity for manufacturers while assuring consumers of product standardization and safety.

APAC Market Insights

The Asia Pacific is the fastest-growing aromatherapy market and is expected to grow at a CAGR of 9.4% during the forecast period 2026 to 2035. The market is defined by the powerful convergence of ancient wellness traditions and modern consumer trends. The primary demand drivers include rapidly expanding middle-class populations with increasing disposable income, a deep-rooted cultural heritage of using botanicals in traditional medicine systems, and a strong youth-driven focus on preventative health and mental wellbeing. The region is also a leading manufacturing hub for essential oils and diffusers, giving it significant supply chain advantages. The key trends shaping the market are explosive growth in social commerce and live stream shopping, the premiumization of products with clinically backed claims, and the rise of cosmetic aromatherapy, where skincare benefits are fused with scent therapy.

The aromatherapy market in China is considered as the largest in the APAC and is primarily fueled by the digital native health preservation trend among its vast urban population. The demand is concentrated on products that address sleep quality, stress relief, and air purification with smart app-connected diffusers and visually appealing gift sets dominating the e-commerce platforms. Nearly 81% of the population in China has used live stream commerce and social platforms to purchase items, according to the Darcy and Roy Press in 2024. The regulatory environment is robust, with the National Medical Products Administration classifying many infused products as cosmetics. The report from the OEC in 2023 indicates that the import value of the essential oil reached USD 348 million, underscoring the massive and stimulating scale of domestic demand. This growth path strongly establishes China as the global demand epicenter.

Japan’s aromatherapy market is a mature one and is defined by an uncompromising consumer demand for purity, scientific validation, and minimalist design. It is deeply integrated into the national wellness culture, complementing practices such as Shrinrin Yoku and serving as a recognized tool for relaxation in a high-pressure society. Products are commonly found in pharmacies, department store and integrated into hospitality and clinical care settings. The market is driven by the aging population and a strong preference for domestic brands with transparent sourcing. The NLM study in August 2022 indicates that the country is expected to have 7 million dementia patients by 2025. The study has demonstrated a measurable cognitive improvement in patients with mild Alzheimer’s disease following structured aromatherapy use, supported by a validated clinical scale (GBS). It strengthens the clinical evidence base that highlights the interest from memory care centers, geriatric clinics, long-term care facilities, and integrative medicine programs.

Europe Market Insights

The Europe’s aromatherapy market operates within an advanced and complex regulatory ecosystem governed by EU-wide directives on cosmetics, health claims, and product safety. A primary market driver is the region’s robust and established wellness culture, which views aromatherapy as a complementary approach to conventional healthcare for stress relief, sleep improvement, and general well-being. This demand is further amplified by an aging population seeking non-pharmacological interventions for chronic pain and mood management. The most significant trend is the rapid expansion of the e-commerce channel, which has democratized access to a wide variety of essential oils and diffusers, fueling direct-to-consumer sales growth. However, this is tempered by robust regulations requires that any therapeutic claims be substantiated with scientific evidence.

Germany represents Europe’s most advanced aromatherapy market and is driven by a deeply ingrained cultural acceptance of plant-based therapies within its complementary healthcare systems. The profession of the non-medical practitioner legally utilizes the essential oils, creating a formal B2B demand and high consumer trust. The OEC 2023 data indicate that Germany imports essentials worth USD 322 million. This established import volume represents a significant portion of Europe's trade and underscores a mature and industrial-scale supply chain. This foundation supports the market leader who invests in clinical-grade quality advanced diffusion technology and pharmacist-endorsed product lines. A key trend is the formalization of aromatherapy protocols within hospital palliative care and corporate wellness programs.

The UK’s aromatherapy market is defined by a strong consumer-led demand integrated into mainstream wellness and self-care routines. It operates within a clear post Brexit regulatory framework where products are predominantly governed by retained EU cosmetics regulations prohibiting unauthorized medical claims. The key drivers include the widespread retail and online availability of products, a focus on mental well-being, and the premiumization of brands offering clinical-grade blends and sustainable sourcing. Government health data highlights the context for this demand. The Mental Health Foundation report in 2025 highlights that the 37.1% of women and 29.9% of men described high levels of anxiety, a primary condition for which consumers turn to aromatherapy, sustaining consistent market growth. This demographic trend creates a robust, sustained consumer base for stress-relief products.

Key Aromatherapy Market Players:

- Young Living (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- doTERRA (U.S.)

- Mountain Rose Herbs (U.S.)

- Aura Cacia (U.S.)

- Neal's Yard Remedies (UK)

- Tisserand (UK)

- PRANARÔM (Belgium)

- Farfalla (Switzerland)

- Florihana (France)

- Oshadhi (Germany)

- Laboratoire (France)

- Shizen Ryoho (Japan)

- L'Occitane en Provence (France)

- In Essence (Australia)

- ECO. Modern Essentials (Australia)

- Aromatica (South Korea)

- Moksha Lifestyle (India)

- VedaOils (India)

- The Body Shop (UK)

- NOW Foods (U.S.)

- Young Living is a pioneer in the direct-to-consumer aromatherapy market and has advanced its position by vertically integrating the supply chain from the seed to seal. This control over cultivation, distillation, and distribution ensures purity and brand loyalty. Further, this allows them to optimize essential oil potency and build a global community of independent distributors who provide personalized product education outside traditional retail environments.

- doTERRA dominates the competitive aromatherapy market via its co-impact sourcing model and advanced scientific validation. The company has made significant advancements by investing in third-party GC/MS testing for every batch of oil and funding clinical research. This ensures therapeutic-grade quality and builds trust with consumer optimizing the integration of essential oils into daily wellness routines via a powerful network marketing structure. According to the 2024 impact report, nearly 13 million people are using the company’s essential oil and wellness products globally.

- Mountain Rose Herbs has carved a unique niche in the aromatherapy market as a leading bulk supplier for both consumers and businesses. They have advanced the market by championing organic, fair trade, and sustainably wildcrafted sourcing long before it was mainstream. This commitment, coupled with the extensive educational content, ensures the practitioners and makers have access to the ethically sourced raw materials, boosting a responsible and informed community around botanical wellness.

- Aura Cacia, a flagship brand of Frontier Co-op, has democratized access within the aromatherapy market via its presence in mainstream grocery and natural food stores. The brand has advanced by implementing rigorous quality in action testing standards and transparent sourcing stories for each oil. This ensures affordable, reliable purity for everyday use, effectively bringing aromatherapy out of specialty shops and into the homes of a brand consumer base.

- Neal’s Yard Remedies stands as a heritage leader in the organic aromatherapy market, renowned for its holistic approach. The company has advanced the market by achieving pioneering organic certifications and integrating essential oils into a complete range of skincare and wellness products. This ensures a consistent brand philosophy of natural wellbeing, optimizing the therapeutic experience via synergistic product formulations sold in their distinctive brand-owned retail environments. In January 2025, the company won the Brand of Decade award for its commitment to sustainability.

Here is a list of key players operating in the global market:

The global aromatherapy market is fragmented, with the leaders such as U.S. MLMs Young Living and doTERRA dominating via direct sales and vertical integration. European players compete in the therapeutic heritage organic certification and B2B essential oil supply. Strategic initiatives across key players focus on the sustainability and traceability in sourcing to ensure the purity, aggressive digital marketing, and D2C e-commerce expansion, and significant product diversification into cosmetics, wellness, and pet care. For example, in June 2025, Biossentials, known for its high-purity natural aromatherapy spa, body, and beauty products, appointed NanoViz Vietnam Company Limited as its exclusive distributor for the Vietnam market. Partnerships with spas, hotels, and wellness centers are also vital for the brand's visibility and market penetration.

Corporate Landscape of the Aromatherapy Market:

Recent Developments

- In July 2025, IFF, a global leader in flavors, fragrances, food ingredients, health and biosciences has announced the expansion of its new Immersive Experience Hub located within its Singapore Innovation Center.

- In March 2025, AERON Lifestyle Technology, recognized for its advanced work in home and car fragrance, has announced a series of pop-up stores that will feature its well-loved Belle Aroma and Drive Time products.

- In March 2023, BASF has announced that it has invested in its aroma ingredients business by expanding its global production footprint with new plants in China and Germany. The expansion aims towards a strong commitment to sustainability transformation.

- Report ID: 4260

- Published Date: Jan 07, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Aromatherapy Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.