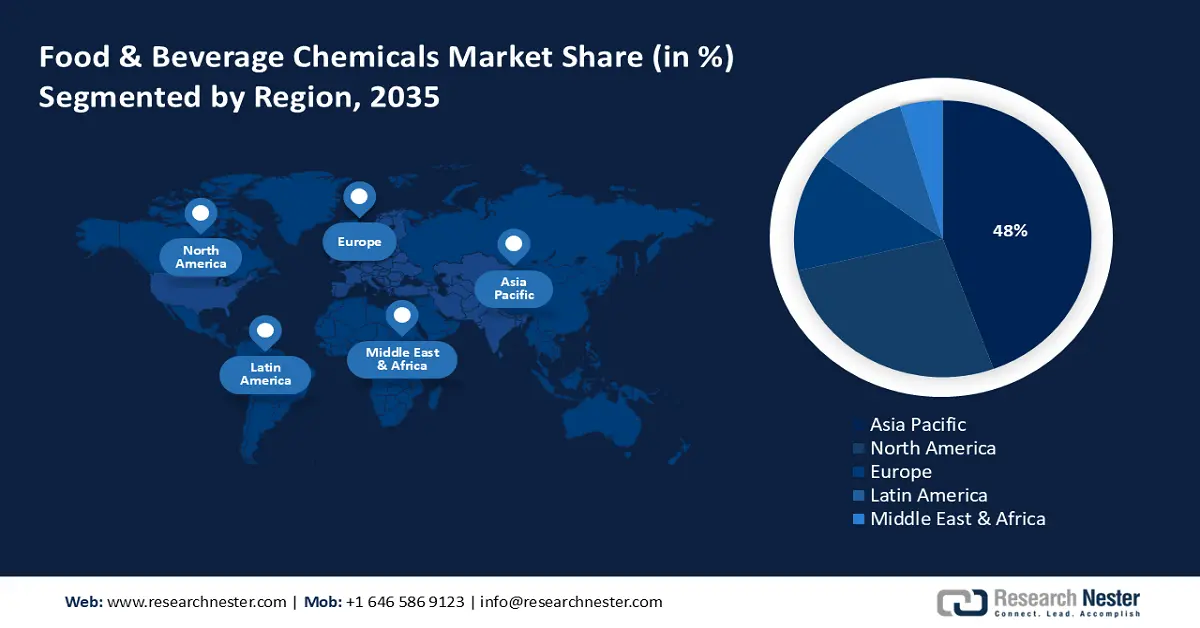

Food and Beverage Chemicals Market - Regional Analysis

Asia Pacific Market Insights

By 2035, the food and beverage chemicals market in the Asia Pacific is expected to hold 48% of the share in the global market, highly driven by growing demand for processed foods, beverages, and functional products. Increasing levels of urbanization, shifts in consumption patterns, and demand for new and innovative ingredients are all contributing to market growth in the region, specifically for preservatives, flavor enhancers, and stabilizers. Both multinational companies and regional manufacturers are focusing their product innovation efforts on sustainability sourcing and offering clean-label products. Additionally, government backing related to safety and modernization of the food and beverage manufacturing process is also leading to market expansion around the region.

Emerging Trade Dynamics of Lecithin and Other Phosphoaminolipids in the Asia Pacific in 2023

|

Country |

Export Value (USD) |

Quantity (Kg) |

|

India |

209,543,510 |

52,465,800 |

|

China |

102,954,500 |

65,191,700 |

|

Japan |

17,085,920 |

228,239 |

|

Korea, Rep. |

12,454,940 |

296,072 |

|

Malaysia |

6,905,780 |

4,253,930 |

|

Singapore |

4,675,310 |

1,280,670 |

|

Other Asia, nes |

7,338,640 |

7,402,110 |

Source: WITS

The market for food and beverage chemicals in China is shaped by rising urbanization, large manufacturing capability, and changing consumer demands. Additives, stabilizers, and emulsifiers are in demand as packaged and functional foods become more popular. Companies are focusing on clean-label, plant-based, and natural formulations to match consumer interest in health. Safety and quality are achieved through regulation, which enables both domestic producers and international companies to increase investments and partnerships in the food processing and beverage sectors in China.

India's food and beverage chemicals market is driven by the growth of the middle-class population, rising disposable income, and the increase in packaged food consumption. There is an increasing demand for flavoring agents, preservatives, and emulsifiers, which leads to enhancements in the market. The World Food India 2025 event concluded with over 95,000 participants, underscoring India's growing prominence in global agri-food value chains. The summit facilitated the signing of Memorandums of Understanding worth more than ₹1,02,000 crore, marking one of the largest-ever investment commitments in India's food processing sector. Additionally, 26,000 beneficiaries received credit-linked subsidies totaling ₹2,518 crore under the PMFME scheme, reflecting the government's commitment to empowering grassroots entrepreneurs. The growing consumer interest in healthier products is leading to healthy, natural, and clean-label food ingredients. Based on government initiatives in food processing, in tandem with private sector investments, there is innovation and modernization that creates an opportunity for both domestic and international firms in India's evolving market.

North America Market Insights

By 2035, the food and beverage chemicals market in North America, predominantly influenced by the rising demand for clean-label ingredients, natural preservatives, and functional additives. The producers in North America are prioritizing clean-label ingredients, natural additives, and sustainable formulations. Strong supply chain structures, along with collaboration between industry participants and research institutes, sustain advancement in the market. The market is characterized by changing dietary preferences, health trends, and advancements towards functional food and beverage applications.

The U.S. additives and ingredient chemicals market for food and beverages benefits from emerging consumer demand for natural preservatives, flavor enhancers, emulsifiers, and functional ingredients that match clean-label demand. There is an emphasis from companies on research and development to meet shifting dietary expectations from consumers while being accountable under strict federal regulations. The FDA identified its maximum use levels for Propylene glycol alginate in jams and jellies as 0.4%, frozen dairy desserts, fruit and water ices, confections, and frostings as 0.5%, baked goods as 0.5%, gravies and sweet sauces as 0.5%, gelatins and puddings as 0.6%, condiments as 0.6%, cheese as 0.9%, fats and oils as 1.1%, and seasonings and flavors as 1.7%. Nearly every food processing industry is diverse, and the sheer number of potential customers in the U.S. market, coupled with the rapid adoption of sustainable solutions, places the U.S. at the forefront of additive chemical innovation in food and beverage markets.

The market for food and beverage chemicals in Canada demonstrates a growing consumer preference for natural ingredients, sustainable additives to foods and beverages, and formulations that maximize safety and shelf life. The EFSA reassessed lecithin as a food additive for use in foods for infants under 16 weeks of age and follow-on and in foods for all population groups. Considering the dietary exposure to the food additive for infants under 16 weeks of age, it established the maximum use levels of lecithins at 260 mg/kg/day. The industry growth is supported by partnerships among government, academia, and private firms leading to advances in specialty chemicals. The demand is further impacted by consumers´ improved lifestyle and health awareness, and the increase in food processing capabilities.

Europe Market Insights

By 2035, the food and beverage chemicals market in the Europe region is expected to hold a significant market share, driven by strict safety regulations, sustainability goals, and continued innovation in clean-label products. The industry's response is heavily driven by increasing demand for natural additives, functional ingredients and preservatives. Regulatory bodies such as EFSA and REACH play an important role in facilitating compliance with these regulatory measures, while industry players are navigating the challenges created by shifting consumer preferences. Drivers of growth include products marketed on health benefits, plant-based products, and sustainability initiatives funded and backed by the government in line with European Green Deal goals.

In Germany, the market for chemicals in food and beverages shows strong demand for natural flavorings, sweeteners and texturizers based on the health-conscious consumer culture of the country. Germany is characterized by a strong safety profile and full compliance with EU legislation, as well as ongoing sustainability and organic development initiatives, responsive sourcing of eco-friendly materials and the development of new products using natural and organic ingredients, including non-GMO source materials. In Germany, sunflower-based lecithin is gaining traction as a natural, allergen-free alternative to soy lecithin, driven by clean-label trends, sustainable sourcing, and rising demand for plant-based food solutions.

Germany Sunflower Seed Production in 2021

|

Region |

Production % |

|

Brandenburg |

54% |

|

Sachsen-Anhalt |

11% |

|

Sachsen |

9% |

|

Bayern |

9% |

|

Baden-Württemberg |

5% |

|

Thüringen |

5% |

Source: USDA

The UK food & beverage chemicals market is influenced by post-Brexit regulatory landscapes, increasing trends towards clean-label products, and heightened consumer desire for ingredient transparency. There tends to be more emphasis on eliminating artificial additives and improving preservatives and functional ingredients of natural origin. Industry participants are investing support in innovations on plant-based and novel low-calorie and alternative sweeteners as consumer interest in dietary changes heightens and opportunities advance to support health initiatives from the government. Domestic companies are increasingly partnering with global suppliers as they evolve to meet changing health and sustainability targets.