Flow Meters Market - Growth Drivers and Challenges

Growth Drivers

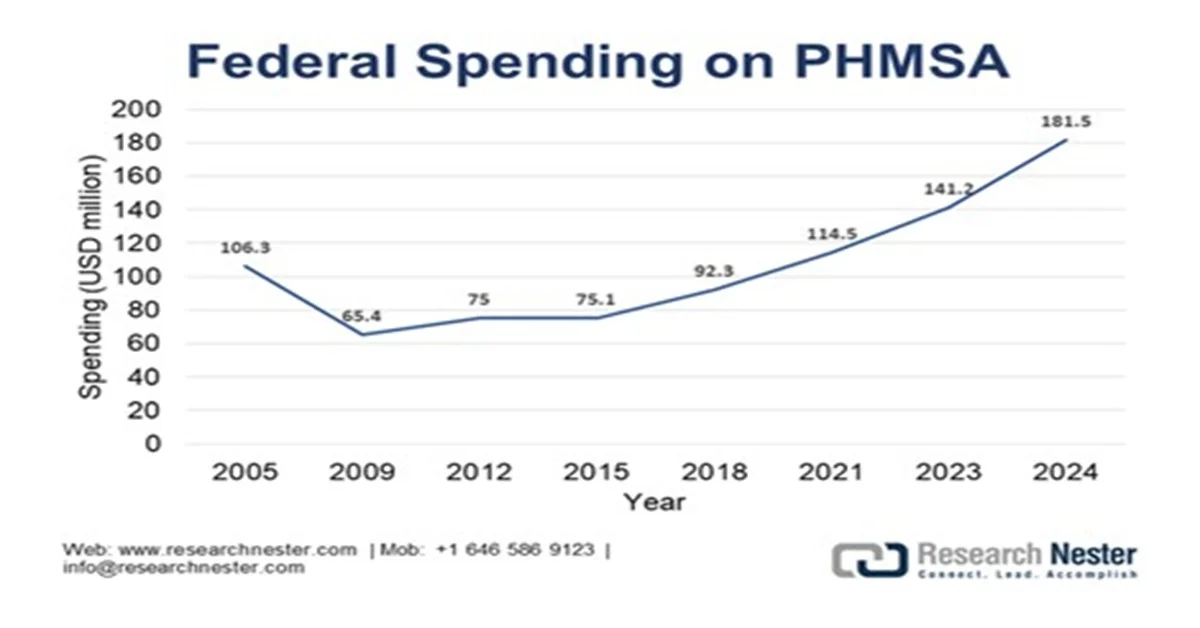

- Oil and gas regulatory reporting and pipeline safety: Despite the ongoing energy transition, the regulatory oversight in the oil and gas sector continues to underpin the sustained demand for the flow meters market. The U.S. agencies, such as the Pipeline and Hazardous Materials Safety Administration, require accurate flow measurement for custody transfer, emissions reporting, leak detection, and operational safety across the hydrocarbon value chain. According to the USA Facts 2024 report, the federal spending on the pipeline and hazardous materials safety administration (PHMSA) program allocated USD 181.5 million in 2024, reinforcing the mandatory inspection, reporting, and monitoring requirements for operators. Flow meters are therefore deployed extensively in upstream production facilities, midstream transmission pipelines, storage terminals, and federally approved LNG export infrastructure.

Source: USA Facts 2024

- Agricultural water management and irrigation programs: Agriculture represents the largest global consumer of freshwater, and governments are funding measurement-driven conservation programs. The FAO 2026 report indicates that over 70% of the global freshwater withdrawals are used by agriculture. The national irrigation modernization programs in China, India, and the U.S. increasingly require flow meters to monitor usage and allocate subsidies. The report from the National Water Withdrawals in February 2023 indicates that India uses 688 10^9 m3 per year of water for agriculture. Moreover, these government-backed programs link subsidy eligibility and compliance reporting directly to verified flow data, stimulating the adoption of the durable field-ready flow meters across canals, pumping stations, and farm-level distribution networks.

Agriculture Water Withdrawal (10^9 m3/yr)

|

Country |

Withdrawal |

|

China |

358 |

|

India |

688 |

|

Russia |

13.2 |

|

Brazil |

31.7 |

|

U.S. |

192.4 |

|

Germany |

0.081 |

Source: National Water Mission, February 2023

- Industrial energy efficiency and emissions monitoring mandates: The governments are increasingly relating the industrial funding and permits to the energy efficiency and emissions monitoring, driving the adoption of flow meters in manufacturing sectors. The U.S. supports the adoption of market efficiency upgrades across the energy-intensive industries, such as cement, chemicals, and metals. According to the U.S. EIA July 2023 data, the industry accounts for nearly 33% of total energy consumption, making flow measurement significant for optimization and reporting. Similar requirements exist under the EU Industrial Emissions Directive. Further, the flow meters are being deployed not only for control but also for auditable emissions and energy reporting. This shift is increasing the demand for high-accuracy, traceable flow meters that can integrate with regulatory reporting systems and withstand third-party audits in decarbonization projects

Challenges

- Stringent industry-specific certification and compliance: Flow meters used in the custody transfer of food beverage, or pharmaceuticals must meet a robust global standard. In the flow meters market, obtaining these certifications is costly and time-consuming. The top players dedicate their entire department to this with the advanced technology designed to meet the strict safety instrumented systems standards. A new entrant may spend years and millions to certify a single product line for one industry, a prohibitive hurdle that protects established players with pre-approved portfolios.

- Price sensitivity in key volume-driven markets: In high volume cost-sensitive segments, such as municipal water in emerging economies, purchase decisions are heavily price-driven. The governments often run tenders selecting the lowest compliant bidder. The dominating companies in the market address this by offering a tiered product line. Further, this reduces the margins, making it difficult for the new suppliers to compete without a low-cost manufacturing base, often driving them to outsource and risk quality perception.

Flow Meters Market Size and Forecast:

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.4% |

|

Base Year Market Size (2025) |

USD 9.9 billion |

|

Forecast Year Market Size (2035) |

USD 20.2 billion |

|

Regional Scope |

|

Browse key industry insights with market data tables & charts from the report:

Frequently Asked Questions (FAQ)

In the year 2025, the industry size of the flow meters market was over USD 9.9 billion.

The market size for the flow meters market is projected to reach USD 20.2 billion by the end of 2035, expanding at a CAGR of 7.4% during the forecast period i.e., between 2026-2035.

The major players in the market are Honeywell International Inc., Emerson Electric Co., Siemens AG, and others.

In terms of the end user segment, the industrial sub-segment is anticipated to garner the largest market share of 80.3% by 2035 and display lucrative growth opportunities during 2026-2035.

The market in APAC is projected to hold the largest market share of 38.7% by the end of 2035 and provide more business opportunities in the future.