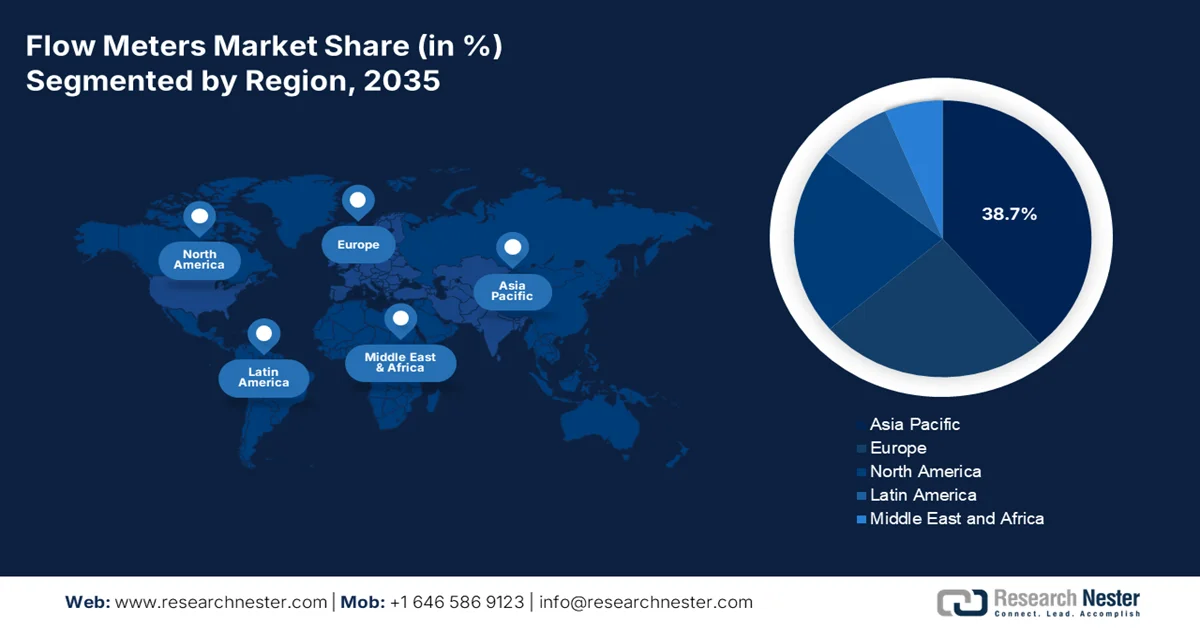

Flow Meters Market - Regional Analysis

APAC Market Insights

The flow meters market in Asia Pacific is the global growth engine and is expected to hold the regional revenue share of 38.7% by 2035. The dominance is due to the massive infrastructure development, industrialization, and pressing water resource management challenges. The government-led initiatives are driving the market and prioritizing the smart water networks and environmental monitoring. Besides, the rapid industrial expansion in sectors such as semiconductors, chemicals, and pharmaceuticals across countries, including South Korea, Japan, and Southeast Asia, demands high-precision process control instrumentation. The trend is the integration of the IoT-enabled meters, mainly in urban smart city projects. On the other hand, the need for energy efficiency and stringent emission controls in manufacturing further propels the adoption of advanced ultrasonic and Coriolis meters.

The market in India is supported by the sustained central government investment in water infrastructure, energy, and industrial modernization. According to the PIB December 2025 report, the Government of India allocated over INR 3.6 lakh crore up to 2024 under the Jal Jeevan Mission to expand household tap water connections, directly increasing the demand for flow measurement across distributed networks and treatment facilities. Further, the data from the India Water Portal in November 2025 shows that nearly 85% of the total freshwater withdrawals are towards agriculture, reinforcing the need for flow meters in irrigation efficiency and groundwater management. On the other hand, Bharat Petroleum’s November 2025 report indicates 20,334 km of natural gas pipelines have been constructed, which supports the gas distribution, driving the flow meter deployment in regulated energy infrastructure.

The China market is underpinned by the sustained government investment in energy infrastructure and industrial efficiency programs. As per the People’s Republic of China report in January 2026, China has invested nearly CNY 1.28 trillion in water conservancy facilities, marking the fourth consecutive year of trillion yuan spending. The execution of 47,563 water projects nationwide and the expansion of the digital systems for flood drought and river management are driving the demand for the flow meters across the reservoirs, canals, and treatment facilities. Additionally, nearly 1.61 billion cubic meters of water traded via 14,000 transactions on the China Water Exchange underscores the growing need for precise flow measurement to support the water allocation and monitoring mechanisms, reinforcing both the new installation and replacement demand.

North America Market Insights

North America is the fastest growing market and is poised to grow at a CAGR of 4.8% during the forecast period 2026 to 2035. The market is sustained by infrastructure modernization and industrial decarbonization. The advancements in the oil and gas, water management industries, and chemical processing sectors are driving the adoption of flow meters. On the other hand, the technological enhancements, including the IoT-enabled devices, wireless connectivity, and real-time data analytics, are prompting purchasing decisions among operations in the utilities and manufacturing sectors. Besides, trends include the integration of the IIoT for predictive maintenance and the rising demand for accurate custody transfer meters, which is expanding the natural gas pipeline network in North America. Moreover, both recurring replacement demand and new installation activity are reinforcing overall market resilience.

The U.S. flow meters market is supported by the sustained federal and state-level spending across the water infrastructure, energy, and industrial modernization programs. The funding for drinking water, wastewater, and pipeline safety upgrades directly increases the procurement of flow measurement equipment. The advancements, such as the Brooks Instrument's introduction of EtherNet/IP in January 2026, are a new non-invasive clamp-on ultrasonic flow meter that is easy to integrate into bioprocessing applications. On the other hand, the June 2023 launch of a new high-pressure gas flow meter for natural gas distribution by SICK. Together, these product introductions highlight how compliance-driven public infrastructure spending is converging with innovation in digital connectivity and high-pressure measurement to support the regulated utility networks and expanding gas distribution systems in the U.S.

Sustained federal funding for water infrastructure, clean energy, and industrial decarbonization drives the market in Canada. According to the Government of Canada report in January 2025, Infrastructure Canada committed USD 33 billion under the Investing in Canada Infrastructure Program, with a significant share directed towards the drinking water, wastewater, and resilience projects that require certified flow measurement for compliance and reporting. Moreover, the IISD February 2023 report indicates that the federal government allocated USD 9.1 billion via clean energy and industrial emissions reduction programs, driving the flow meter adoption in hydrogen, oil, and gas, and power applications. Additionally, the Government of Canada committed significant billions to the Canada Water Agency and freshwater action plans, reinforcing the monitoring requirements across municipal and industrial water systems.

Europe Market Insights

The Europe flow meters market is propelled by the robust EU directives on industrial emissions, water framework management, and energy efficiency that mandate precise monitoring and reporting. The major investments are towards infrastructure modernization, which includes water network upgrades and the digitalization of utilities. A key trend is the adoption of smart water meters, which is supported by the replacement of meters with smart ones, creating a parallel push in water. The transition to a circular economy and hydrogen initiatives also generate a demand for advanced meters in waste management and new energy carrier measurement. The industrial sector, mainly pharmaceuticals and chemicals, under strict good manufacturing practice, further demand for the high integrity sanitary and Coriolis meters.

The sustained public investment in the water infrastructure, energy transition, and industrial decarbonization is driving the market in Germany. According to the German Climate Finance data in March 2025, nearly EUR 6 billion was allocated for water protection, wastewater treatment, and flood resilience programs, directly increasing the demand for flow measurement in municipal and industrial systems. Additionally, the Federal Ministry of Economic Affairs and Energy data in March 2025 has indicated that smart metering systems are installed in many households in Germany, and it is recorded that approximately 1,158,000 smart meters are installed in the nation, driving the adoption and improving the system resilience. Further, the expanding deployment creates a demand for the regulation-compliant and interoperable flow measurement solutions.

The UK flow meters market is expanding significantly and is driven by the sustained government investment in water infrastructure, energy transition, and industrial emissions. According to the Water UK October 2023 report, nearly 96 billion euros is invested in water and sewage infrastructure investment proposed for 2025 to 2030, representing a 90% increase over the current regulatory period and accounting for over 40% of total water investment in Europe. Further, the program will focus on new reservoirs that reduce the leakage by 25%. The investment of 11 billion euros is allocated to sewer overflow mitigation, which requires accurate flow measurement for leakage detection and performance reporting. The planned installation of advanced technologies reduces the overflows by more than 140,000 incidents annually, reinforcing the demand for certified flow meters.

UK Water Infrastructure Investment

|

Investment Area / Metric |

Statistical Detail |

Relevance to Flow Meters Market |

|

Total proposed water & sewage investment |

£96 billion (2025–2030), ~90% increase vs. current period |

Drives large-scale procurement of flow meters for new installations and network upgrades |

|

Share of European water investment |

>40% of total European water infrastructure investment |

Positions the UK as a high-priority regional market for flow measurement suppliers |

|

Leakage reduction target |

>25% reduction by 2030 |

Requires continuous flow monitoring for leakage detection and performance benchmarking |

|

Sewer overflow mitigation |

£11 billion investment; >140,000 fewer spills per year |

Increases demand for flow meters at sewage works, overflow points, and monitoring stations |

|

New water storage assets |

Construction of 10 new reservoirs |

Requires flow measurement for intake, distribution, and regulatory reporting |

|

Workforce expansion |

>30,000 new jobs; 4,000 apprenticeships |

Indicates long-term project execution and sustained equipment deployment cycles |

Source: Water UK October 2023