Flame-resistant Fabrics Market Outlook:

Flame-resistant Fabrics Market size was over USD 4.51 billion in 2025 and is anticipated to cross USD 8.15 billion by 2035, witnessing more than 6.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of flame-resistant fabrics is assessed at USD 4.76 billion.

The growth of the market can be attributed to the rising cases of fire incidents, that demand the presence of firefighter assistance. Flame-resistant fabrics are highly used in the uniforms of these firefighters. These uniforms are made to endure tough and extreme situations in order to protect the clothes underneath the uniforms and also protect the firefighters. For instance, in the US around 3,800 civilian deaths and nearly 14,700 injuries were caused by 1,353,500 fires in 2021.

In addition to this, factors that are believed to fuel the flame-resistant fabrics market growth of flame-resistant fabrics include rising cases of residential and commercial building fires. Furthermore, there are various construction materials that have fire-retardant abilities. Moreover, now flame-resistant fabrics are used in the home furniture. Around 64% of civilian fatalities and nearly 54% of civilian injuries are caused by fires in one- and two-family homes. Fires in apartment buildings are to blame for about 11% of fatalities and 21% of injuries. Moreover, 8 fatalities per 1,000 reported home fires in 2021. Additionally, the rising production of automobiles is expected to boost flame-resistant fabrics market growth. Car seats do not normally catch fire, as they are made up of materials that have high resistance to both heat and fire flames. Nearly 80 million automobiles were produced globally in 2021. Comparing this number to the prior year, a rise of about 3% may be calculated. The top three auto and commercial vehicle makers in 2020 were China, Japan, and Germany.

Key Flame-resistant Fabrics Market Insights Summary:

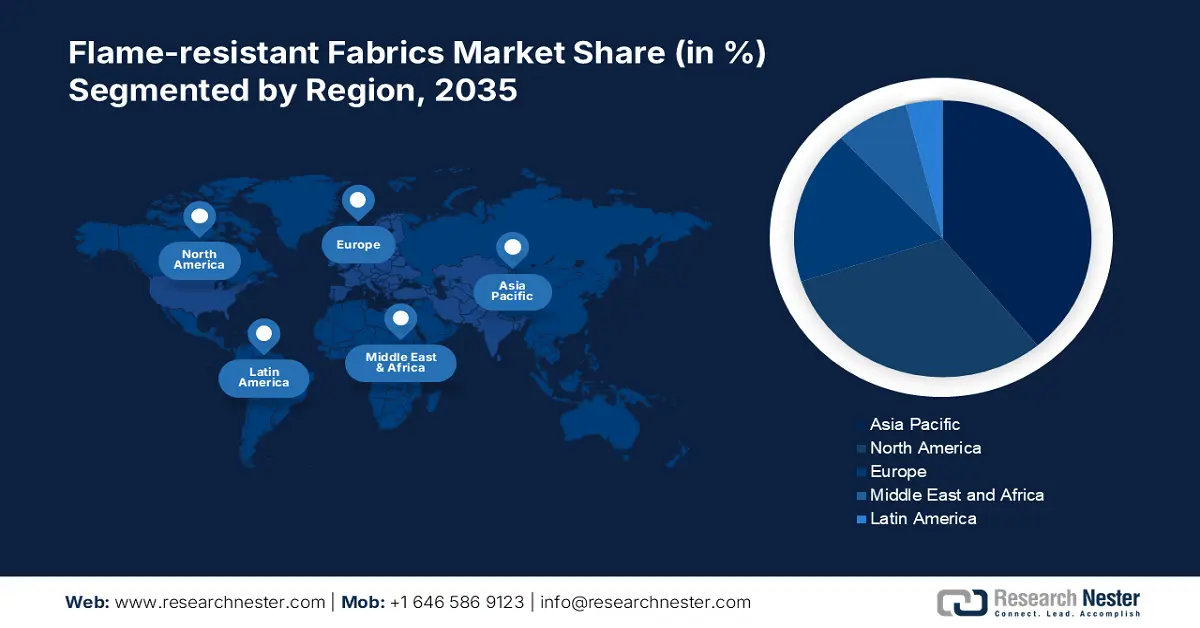

Regional Highlights:

- Asia Pacific flame-resistant fabrics market holds the largest share by 2035, driven by frequent industrial fire incidents, investment in automotive and rail infrastructure, and demand for durable protective fabrics.

Segment Insights:

- The oil & gas segment in the flame-resistant fabrics market is expected to secure the largest share by 2035, attributed to the number of oil reserves and high employment in the oil & gas industry.

- The apparel segment in the flame-resistant fabrics market is expected to hold a significant share by 2035, driven by increasing number of firefighters and their need for protective uniforms.

Key Growth Trends:

- Rising Instances of Fire Incidents

- Rising Investment in Electric Automotive Sector

Major Challenges:

- High manufacturing and installation costs of new equipment

- The process of the raw materials used for manufacturing the flame-resistant fabric is escalating

Key Players: DuPont de Nemours, Inc., Evonik Industries AG, Huntsman International LLC, Kaneka Corporation, Lenzing AG, Milliken & Company Group, PBI Performance Products, Solvay, Toyobo Co., Ltd., Teijin Aramid B.V.

Global Flame-resistant Fabrics Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4.51 billion

- 2026 Market Size: USD 4.76 billion

- Projected Market Size: USD 8.15 billion by 2035

- Growth Forecasts: 6.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 10 September, 2025

Flame-resistant Fabrics Market Growth Drivers and Challenges:

Growth Drivers

- Rising Instances of Fire Incidents – With the recent developments in various end-use industries, the probability of infrastructure having fire-related accidents has increased considerably. As flame-resistant fabrics have inherent fire-resistant properties, they make them a suitable shield against fire in an accident. Thus, the rising number of structural cases across the world, and it is forecasted to augment the market growth. Recent statistics reported that in 2020, there were almost 500,000 structure fires in the United States, an increment of 2 percent from 2019. Also, the structure fires caused approximately USD 12 billion in property damage in the same period.

- Rising Investment in Electric Automotive Sector – The car seat covers are made from flame-resistant material and it is anticipated to boost the global flame-resistant fabrics market. Moreover, EV are the fastest-growing vertical in the automotive industry. Out of the total investment in the transport sector in 2021, approximately 65% of the share is attributed to electric vehicles. Moreover, by 2030, car-makers are expected to invest around USD 1 trillion with the aim of manufacturing nearly 54 million electric vehicles in the next few years across the globe.

- Fire Incidents in the Oil & Gas Industry– In the Cuban city of Matanzas, a fire started by a lightning strike at an oil storage facility raged out of control on August 2022, causing 121 injuries from four explosions and flames, while 17 firefighters are still missing.

- Growing Expenditure on Advanced Materials and Chemicals– In 2019, the global research and development expenditure spending on advanced materials and chemicals accounted for USD 40 billion. Moreover, in 2022, the sector spent nearly USD 42 billion on R&D globally.

- High Employment Rate in Material Science Field – In May 2019, there were 6,700 active materials scientists working in the country, according to the U.S. Bureau of Labor Statistics. Moreover, it is expected that, between 2020 and 2030, the employment rate of chemists and materials scientists in the area will increase by 6%. Over the following ten years, there are expected to be over 9,100 opportunities for chemists and materials scientists combined globally.

Challenges

- High manufacturing and installation costs of new equipment- The flame-resistant fabrics market is constrained by high manufacturing costs and significant expenditures on new technology innovation and installation. For investors and manufacturers in the flame-resistant fabrics business, the high costs of maintenance along with the increased expenditure on research and development activities are providing a barrier.

- The process of the raw materials used for manufacturing the flame-resistant fabric is escalating

- The technology used for production is complicated

Flame-resistant Fabrics Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.1% |

|

Base Year Market Size (2025) |

USD 4.51 billion |

|

Forecast Year Market Size (2035) |

USD 8.15 billion |

|

Regional Scope |

|

Flame-resistant Fabrics Market Segmentation:

End-user Segment Analysis

The global flame-resistant fabrics market is segmented and analyzed for demand and supply by the end-user industry into industrial, oil & gas, building & construction, defense & public safety services, and transportation. Out of the five types of end-use industry, the oil & gas segment is estimated to gain the largest market share over the projected time frame. The growth of the segment can be attributed to the higher number of oil reserves in the world, followed by a higher number of people employed in the oil & gas industry. There are around 1240 billion barrels in OPEC countries and nearly 3 billion in non-OPEC countries. Furthermore, according to the International Labor Organization, the petroleum industry directly employs close to 6 million people, while it indirectly generates over ten times that many jobs. Moreover, owing to gaseous air or liquid leaks, the possibility of fire exists in the majority of operations. Therefore, it is necessary for workers in the oil and gas industry to wear clothing made up of heat-and-flame resistance fabric.

Application Segment Analysis

The global flame-resistant fabrics market is also segmented and analyzed for demand and supply by application into apparel and non-apparel. Amongst these two segments, the apparel segment is expected to garner a significant share. The growth of the apparel segment is ascribed to a rise in the number of firefighters employed for public safety. Along with public safety, they are also responsible for their own safety. Flame-resistant fabrics are the most commonly used for making jackets and uniforms for firefighters, these uniforms are fire and shockproof, helping to prevent the firefighter from catching on fire or getting burned by a nearby fire. The National Fire Department Registry has 27,183 fire departments in the United States. Moreover, in 2020, there were around 1,041,200 career and volunteer firefighters in the United States. Out of which, a total of 676,900 volunteer firefighters and 364,300 career firemen made up the total number of firefighters. Furthermore, the overall number of firefighters working in Japan in 2021 was roughly 167 thousand, a small increase from 166 thousand the year before.

Our in-depth analysis of the global flame-resistant fabrics market includes the following segments:

|

By Type |

|

|

By Application |

|

|

By End-Use Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Flame-resistant Fabrics Market Regional Analysis:

APAC Market Insights

The Asia Pacific flame-resistant fabrics market is projected to hold the largest revenue share by the end of 2035. The growth of the market can be attributed majorly to the fire incident that takes place in various industries, such as oil & gas, automobiles, and others. The workers in these industries can be helped with clothes made up of flame-resistant fabrics. For instance, a massive fire breakout at the Indian Oil Corporation (IOC) Haldia Refinery in West Bengal resulted in at least three worker fatalities and more than 44 injuries. Along with this, the majority of workers had suffered serious injuries and many employees were also at the critical stage of burning. Additionally, a similar incident took place at the textile and industrial goods plants in China, the fire was ignited from welding work and wrapped around 38 workers to death and 2 people suffered grave injuries. The flame-resistant fabrics market size in the region is also expected to expand on account of rising investment in the automotive industry. Apart from giving just protection against fire, the flame-resistant fabrics have amazing durability for the seat covers as well. By 2030, around USD 715 billion would be invested in rail infrastructure in India.

Flame-resistant Fabrics Market Players:

- DuPont de Nemours, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Evonik Industries AG

- Huntsman International LLC

- Kaneka Corporation

- Lenzing AG

- Milliken & Company Group

- PBI Performance Products

- Solvay

- Toyobo Co., Ltd.

- Teijin Aramid B.V.

Recent Developments

-

LENZING AG, sub-brand TENCEL LUXE for lyocell filament yarn saw sales soar by five times as much in 2021 as they had in 2020, and it is on pace to double current production capacity by 25 percent in 2022 to meet rising demand.

-

Kaneka Corporation announced the collaboration with Kashima Antlers F.C. Co., Ltd., and both companies signed an official partnership agreement. Kaneka believes in putting wellness first, so through this collaboration, they intend to build a sustainable future and develop human and environment healthy symbiosis.

- Report ID: 4676

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Flame-resistant Fabrics Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.