Fischer-Tropsch Synthetic Paraffinic Kerosene (FT-SPK) Market Outlook:

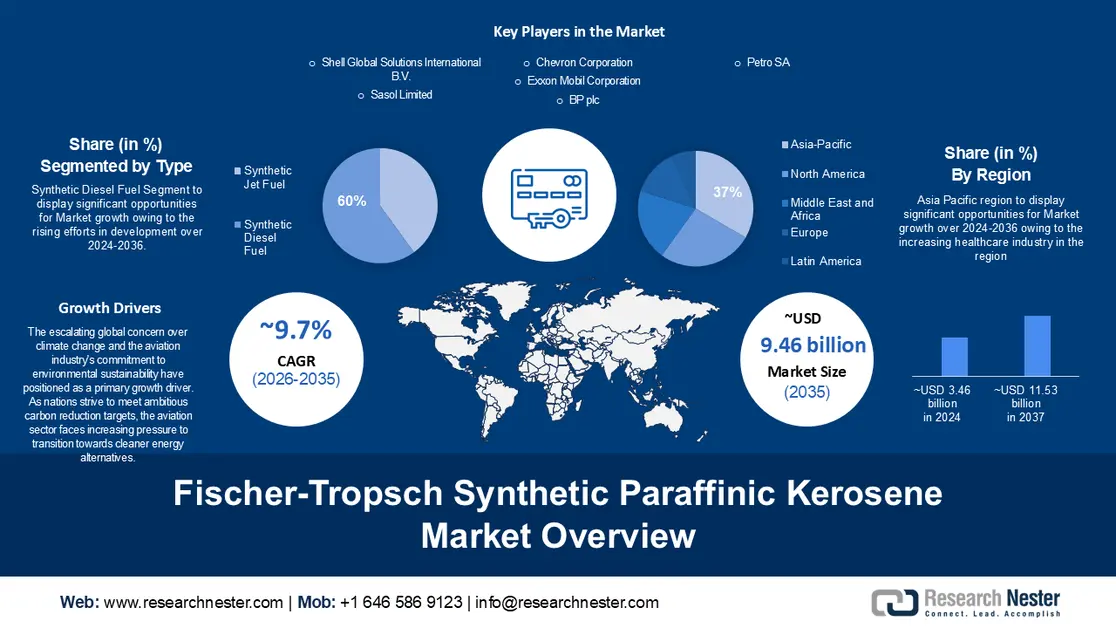

Fischer-Tropsch Synthetic Paraffinic Kerosene (FT-SPK) Market size was valued at USD 3.75 billion in 2025 and is set to exceed USD 9.46 billion by 2035, registering over 9.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of fischer-tropsch synthetic paraffinic kerosene is estimated at USD 4.08 billion.

The escalating global concern over climate change and the aviation industry's commitment to environmental sustainability has been positioned as a primary growth driver. As nations strive to meet ambitious carbon reduction targets, the aviation sector faces increasing pressure to transition towards cleaner energy alternatives. SAFs, including Fischer-Tropsch Synthetic Paraffinic Kerosene (FT-SPK), emerge as a pivotal solution to mitigate the environmental impact of traditional jet fuels. The aviation industry is a significant contributor to greenhouse gas emissions, with traditional jet fuels releasing carbon dioxide and other pollutants into the atmosphere. According to the International Air Transport Association (IATA), airlines are projected to purchase approximately 2 billion gallons of SAFs by 2025, representing a significant leap from previous years.

Major aviation players and industry stakeholders are increasingly committing to sustainable practices, with a focus on incorporating SAFs into their fuel blends. This commitment is not merely driven by regulatory compliance but also by a recognition of the long-term benefits of reducing carbon emissions, enhancing corporate social responsibility, and meeting evolving consumer expectations. Fischer-Tropsch Synthetic Paraffinic Kerosene (FT-SPK) is a type of synthetic aviation fuel derived from the Fischer-Tropsch (FT) process. The Fischer-Tropsch process is a series of chemical reactions that convert carbon monoxide and hydrogen into liquid hydrocarbons.

Key Fischer-Tropsch Synthetic Paraffinic Kerosene (FT-SPK) Market Insights Summary:

Regional Highlights:

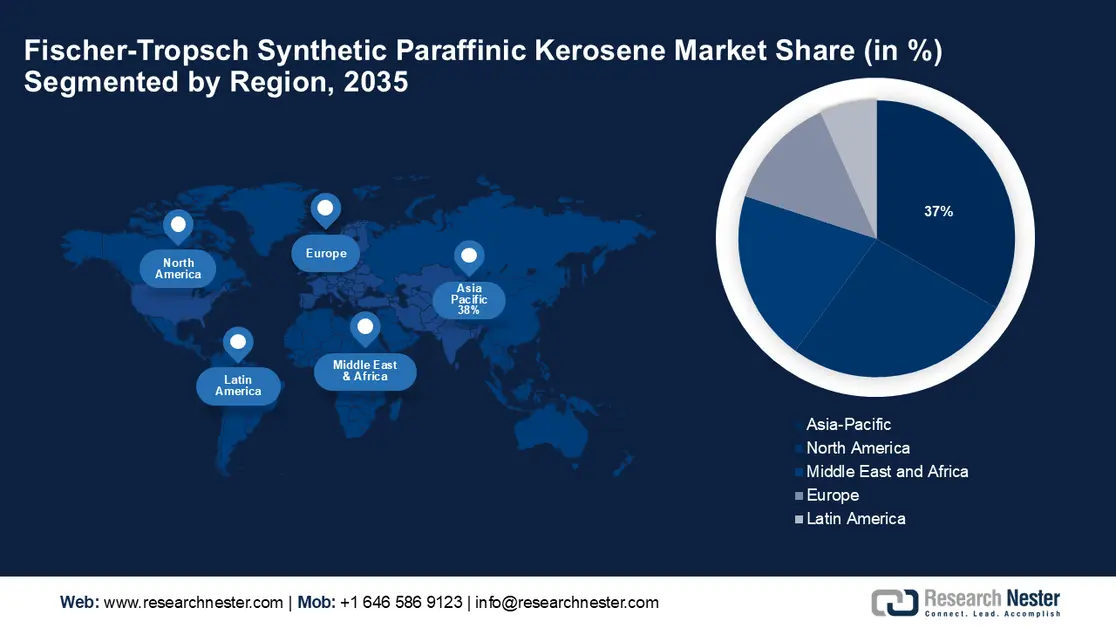

- By 2035, the Asia Pacific fischer-tropsch synthetic paraffinic kerosene (ft-spk) market is forecasted to command a 37% share, underpinned by surging air passenger traffic across the region.

- By 2035, the North American region is expected to secure the second-largest share, sustained by collaborations between aviation players and renewable energy projects.

Segment Insights:

- By 2035, the synthetic diesel fuel segment in the fischer-tropsch synthetic paraffinic kerosene (ft-spk) market is projected to capture a 60% share, propelled by tightening global emission standards.

- By 2035, the commercial segment is set to achieve a notable share, supported by government incentives and regulatory pressures encouraging cleaner transportation technologies.

Key Growth Trends:

- Regulatory Initiatives and Carbon Reduction Mandates

- Corporate Sustainability Commitments

Major Challenges:

- Production Costs and Economic Viability

- Feedstock Availability and Diversity

Key Players: Shell Global Solutions International B.V., Sasol Limited, Chevron Corporation, Exxon Mobil Corporation, BP plc, PetroSA.

Global Fischer-Tropsch Synthetic Paraffinic Kerosene (FT-SPK) Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.75 billion

- 2026 Market Size: USD 4.08 billion

- Projected Market Size: USD 9.46 billion by 2035

- Growth Forecasts: 9.7%

Key Regional Dynamics:

- Largest Region: Asia Pacific (37% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, United Kingdom, Japan

- Emerging Countries: India, Brazil, South Korea, United Arab Emirates, Singapore

Last updated on : 28 November, 2025

Fischer-Tropsch Synthetic Paraffinic Kerosene (FT-SPK) Market - Growth Drivers and Challenges

Growth Drivers

- Regulatory Initiatives and Carbon Reduction Mandates: The global push towards carbon neutrality has intensified regulatory initiatives aimed at reducing greenhouse gas emissions in the aviation sector. Governments and international organizations have implemented stringent policies mandating the use of Fischer-Tropsch Synthetic Paraffinic Kerosene (FT-SPK) and other sustainable aviation fuels. For instance, the European Union Aviation Safety Agency (EASA) has set a target for the aviation sector to use 5% SAFs by 2030 and 63% by 2050. This regulatory impetus creates a conducive environment for the growth of the fischer-tropsch synthetic paraffinic kerosene market, as airlines seek compliance with these mandates.

- Corporate Sustainability Commitments: Airlines and aviation stakeholders are increasingly recognizing the importance of corporate sustainability as a strategic imperative. Many industry leaders have made public commitments to reduce their carbon footprint and achieve sustainability targets. This commitment to environmental responsibility is driving the adoption of Fischer-Tropsch Synthetic Paraffinic Kerosene (FT-SPK) as a viable and sustainable alternative to traditional jet fuels. Airlines are investing in research and partnerships to integrate FT-SPK into their fuel mix and align with their sustainability goals.

- Research and Development Investments: Ongoing investments in research and development (R&D) within the aviation sector play a pivotal role in advancing the production and efficiency of Fischer-Tropsch Synthetic Paraffinic Kerosene (FT-SPK). Companies and governments are allocating significant funds to explore innovative technologies and processes to enhance the scalability and cost-effectiveness of FT-SPK production. These R&D initiatives aim to address technical challenges, improve conversion efficiency, and ultimately make FT-SPK a more attractive and competitive option for the aviation industry.

Challenges

- Production Costs and Economic Viability: The production of FT-SPK involves complex and energy-intensive processes, which can result in higher production costs compared to traditional jet fuels. The economic viability of FT-SPK hinges on achieving cost parity with conventional fuels to make it economically feasible for widespread adoption. Reducing production costs through technological innovation and process optimization is crucial for making FT-SPK competitive in the fischer-tropsch synthetic paraffinic kerosene market. The current production capacity for FT-SPK is limited compared to the overall demand for aviation fuel. Scaling up production to meet the growing needs of the aviation industry requires significant investments in infrastructure and technology.

- Feedstock Availability and Diversity

- Certification and Standardization

Fischer-Tropsch Synthetic Paraffinic Kerosene (FT-SPK) Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

9.7% |

|

Base Year Market Size (2025) |

USD 3.75 billion |

|

Forecast Year Market Size (2035) |

USD 9.46 billion |

|

Regional Scope |

|

Fischer-Tropsch Synthetic Paraffinic Kerosene (FT-SPK) Market Segmentation:

Type Segment Analysis

The synthetic diesel fuel segment in the fischer-tropsch synthetic paraffinic kerosene market is estimated to gain the largest revenue share of 60% by 2035. The increasing stringency of emission standards and regulatory mandates globally is a major driver for the growth of the synthetic diesel fuel segment. Governments and international organizations are imposing strict limits on the carbon footprint of transportation fuels, pushing the adoption of cleaner alternatives. Continuous advancements in Fischer-Tropsch synthesis technology contribute significantly to the growth of the synthetic diesel fuel segment. Improvements in catalysts, reactor designs, and overall process efficiency enhance the production of high-quality synthetic diesel fuels. The evolution of these technologies not only lowers production costs but also facilitates the scalability of synthetic diesel fuel production, making it a more viable and attractive option for the transportation sector.

Application Segment Analysis

The commercial segment in the fischer-tropsch synthetic paraffinic kerosene market is expected to garner a significant share by 2035. Government incentives and regulatory pressures play a pivotal role in driving the adoption of alternative fuels and cleaner technologies in the commercial segment. Many governments around the world offer tax credits, subsidies, and other incentives to businesses that invest in eco-friendly vehicles and technologies. Additionally, regulatory frameworks that impose emission standards and encourage the use of sustainable fuels further drive businesses to adopt cleaner transportation solutions. As of 2021, countries like the United States, the United Kingdom, and various European nations have implemented or proposed policies to encourage the adoption of electric and low-emission vehicles in commercial fleets. For example, the U.S. federal government provides tax credits for the purchase of electric and hybrid vehicles, motivating businesses to invest in cleaner transportation options.

Our in-depth analysis of the global market includes the following segments:

|

Fuel Type |

|

|

Application |

|

|

Feedstock Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Fischer-Tropsch Synthetic Paraffinic Kerosene (FT-SPK) Market - Regional Analysis

APAC Market Insights

The fischer-tropsch synthetic paraffinic kerosene market in the Asia Pacific industry is predicted to dominate majority revenue share of 37% by 2035. One of the key drivers for the growth of the market in the Asia Pacific region is the significant increase in air passenger traffic. The International Air Transport Association (IATA) reported substantial growth in air travel demand in the region over the past decade. As more people choose air travel for business and leisure, airlines are under increasing pressure to reduce their environmental impact. The adoption of sustainable aviation fuels like FT-SPK aligns with this objective. In 2019, Asia Pacific accounted for 38% of global air traffic, making it the largest aviation market. It is projected that by 2035, the region will see an additional 2.7 billion annual passengers, reaching a total of 8.2 billion. Government commitments to sustainable aviation play a crucial role in driving the adoption of Fischer-Tropsch Synthetic Paraffinic Kerosene (FT-SPK) in the Asia Pacific region. Various governments in the region have set ambitious targets to reduce carbon emissions from the aviation sector.

North American Market Insights

The fischer-tropsch synthetic paraffinic kerosene market in the North American region is projected to hold the second largest revenue share during the forecast period. Collaborations between the aviation industry and renewable energy projects contribute to the growth of the market in North America. Partnerships with renewable energy producers and projects that provide sustainable feedstocks for FT-SPK production enhance the availability and reliability of synthetic kerosene. These collaborations strengthen the supply chain and support the scalability of FT-SPK in the region. Growing public awareness and environmental consciousness in North America contribute to the demand for sustainable aviation fuels, including FT-SPK. The public's increasing concern about climate change influences consumer choices and creates a favorable environment for airlines to invest in cleaner alternatives. Airlines responding to this consumer sentiment drive the growth of the market by aligning their operations with environmentally conscious preferences.

Fischer-Tropsch Synthetic Paraffinic Kerosene (FT-SPK) Market Players:

- Shell Global Solutions International B.V.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Sasol Limited

- Chevron Corporation

- Exxon Mobil Corporation

- BP plc

- PetroSA

- Velocys plc

- Neste Corporation

- Elevance Renewable Sciences, Inc.

- REG Synthetic Fuels, LLC

Recent Developments

- Partnership with Microsoft for Azure cloud-based solutions (September 2023): This collaboration aims to develop and deploy scalable, secure, and sustainable solutions for the energy and petrochemical industries, leveraging the Microsoft Azure cloud platform and Shell's industry expertise.

- Launch of "Shell Catalysts & Technologies Venture Fund" (August 2023): This initiative establishes a USD 1 billion fund to invest in early-stage and emerging technologies related to clean energy, circular economy, and advanced materials, promoting innovation and sustainable solutions.

- Report ID: 5777

- Published Date: Nov 28, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Fischer-Tropsch Synthetic Paraffinic Kerosene (FT-SPK) Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.