Fetal Monitoring Market Outlook:

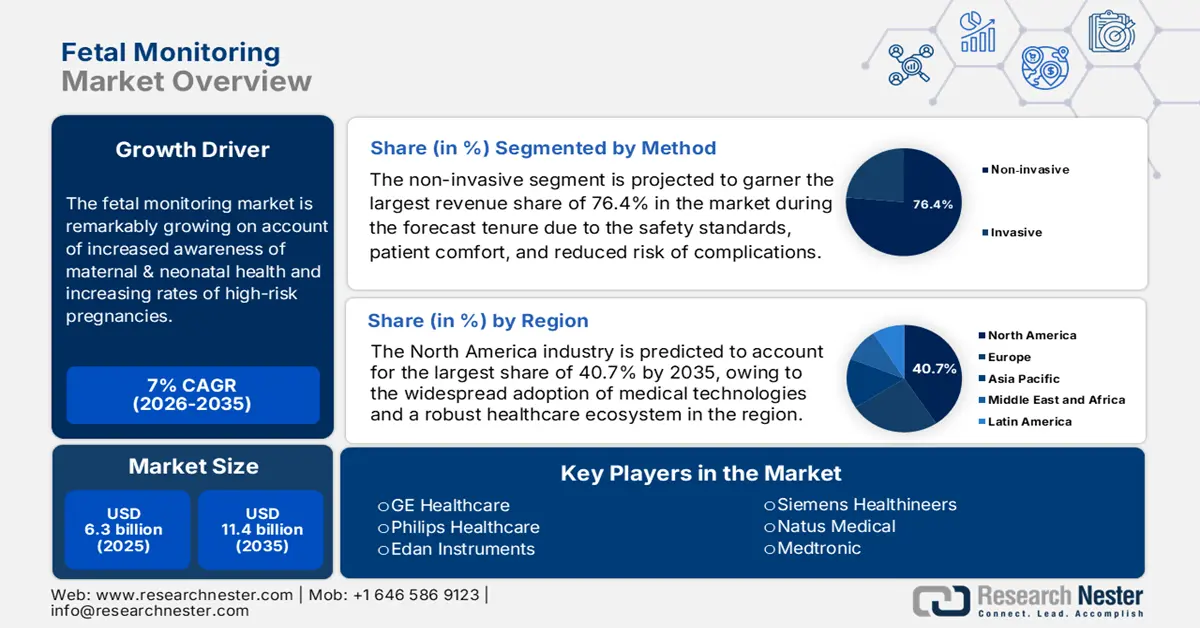

Fetal Monitoring Market size was valued at USD 6.3 billion in 2025 and is projected to reach USD 11.4 billion by the end of 2035, growing at a CAGR of around 7% during the forecast period, i.e., 2026 to 2035. In 2026, the industry size of fetal monitoring is assessed at USD 6.7 billion.

The market is remarkably growing on account of increased awareness of maternal & neonatal health and increasing rates of high-risk pregnancies. Also, the continued technological advancements are an asset of this landscape that are transforming care with enhanced accuracy. As per an April 2025 WHO article, more than 700 women died each day from preventable pregnancy and childbirth-related causes in 2023, with a maternal death occurring nearly every two minutes. The report also stated that Most of these deaths are avoidable with proper medical care, denoting the necessity for fetal monitoring systems.

Furthermore, the revolutionary digital transformation in healthcare is yet another factor that is contributing to the fetal monitoring solution beyond hospital settings. Therefore, the study by AMA in May 2024 observed that remote postpartum blood pressure monitoring led to a 43% increase in achieving normal BP and a 56% rise in BP checks within 20 days of discharge. The report also highlighted that hypertensive disorders affect 16% of pregnancies in the U.S., and 31.6% of delivery-related deaths involve such conditions, highlighting the urgent need for early intervention and remote care solutions.

Key Fetal Monitoring Market Insights Summary:

Regional Highlights:

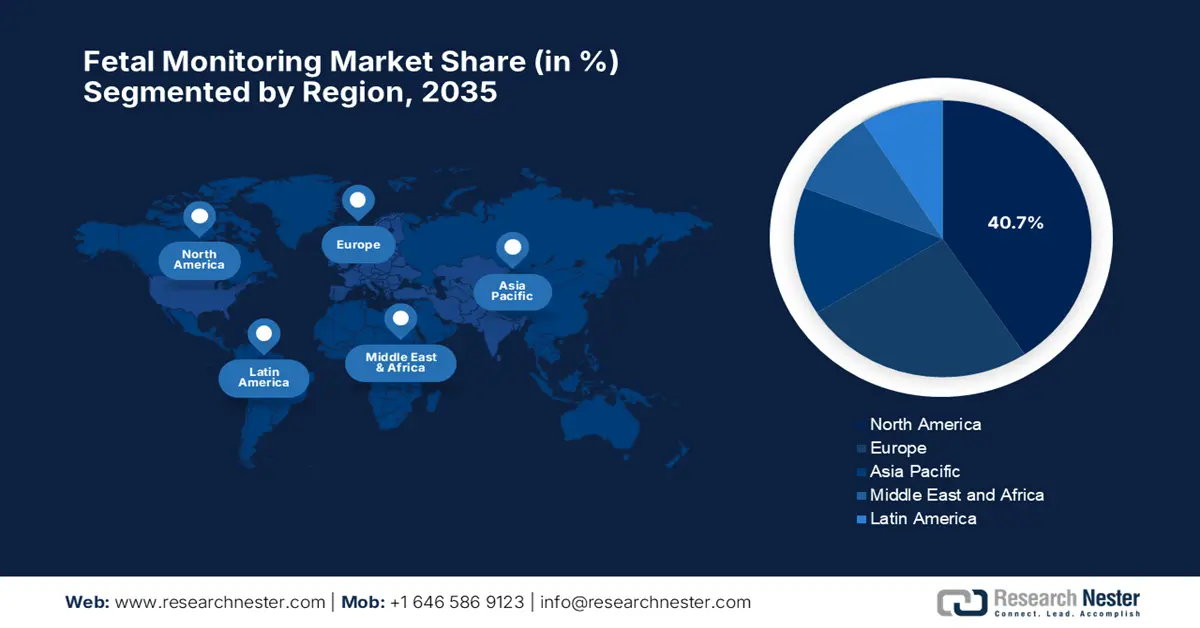

- By 2035, North America in the fetal monitoring market is anticipated to capture a 40.7% share, underpinned by the widespread adoption of medical technologies and a robust healthcare ecosystem.

- By 2035, Asia Pacific is expected to emerge rapidly with accelerating growth, supported by rising maternal–fetal health awareness and strengthened healthcare infrastructure.

Segment Insights:

- By 2035, the non-invasive segment in the fetal monitoring market is projected to command a 76.4% share, propelled by enhanced safety standards, patient comfort, and reduced risk of complications.

- By 2035, the hospitals/maternity hospitals segment is anticipated to secure a 68.4% share, supported by their capacity to manage high delivery volumes and high-risk pregnancies through advanced monitoring technologies.

Key Growth Trends:

- Increasing burden of preterm births

- Continued advances in monitoring devices

Major Challenges:

- Lack of proper healthcare access

- Impact of climate change

Key Players: GE Healthcare, Philips Healthcare, Edan Instruments, Siemens Healthineers, Natus Medical, Medtronic, Huntleigh Healthcare, Analogic Corporation, ArjoHuntleigh, Trismed, Bionet, Mindray, Comen, Cure Medical, Monarch Meditech.

Global Fetal Monitoring Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 6.3 billion

- 2026 Market Size: USD 6.7 billion

- Projected Market Size: USD 11.4 billion by 2035

- Growth Forecasts: 7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40.7% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, United Kingdom, Japan

- Emerging Countries: India, Brazil, South Korea, Mexico, Indonesia

Last updated on : 25 August, 2025

Fetal Monitoring Market - Growth Drivers and Challenges

Growth Drivers

- Increasing burden of preterm births: There has been a constant rise in preterm births and complications, which is a major driving factor for this landscape. An UNICEF article published in May 2023 revealed that around 13.4 million babies were born pre-term in a year, wherein nearly 1 million died from preterm complications. It also stated that it is equal to 1 in 10 babies born early, i.e., before 37 weeks of pregnancy across all nations, which implies the extreme necessity of early detection.

- Continued advances in monitoring devices: The adoption of wireless, non-invasive, and AI-enabled monitoring systems is making these systems highly adoptable across healthcare settings. In January 2022, Philips finalized the acquisition of Vesper Medical to enhance its Image Guided Therapy portfolio. Besides, the upfront purchase price was EUR 227 million, which is expected to expand Philips’ capabilities in vascular treatment and advanced cardiac monitoring, hence denoting a positive market outlook.

- Government focus on maternal & neonatal health: Global health agencies and national governments are readily making investments in maternal health programs and promoting early detection of fetal concerns. In this context study by PMNCH in April 2025 revealed that in 2023, 4.8 million children under five died, nearly half in their first month, and 260,000 women died from pregnancy complications on a yearly basis. Sub-Saharan Africa bears the highest burden, with 70% of maternal deaths and 56% of under-five deaths. Therefore, it notes that governments are urged to invest 1% to 2% of GDP in healthcare to improve access.

Impact of Incentivized Self-Monitoring on Blood Pressure Reporting During and After Pregnancy 2024

|

Parameter |

Control Group |

Regular SMBP Group |

Incentivized SMBP Group |

|

Participants (n) |

30 |

30 |

31 |

|

Engagement Weeks (out of total) |

5 / 304 weeks |

56 / 245 weeks |

76 / 254 weeks |

|

Engagement Rate |

~1.6% |

~22.9% |

~29.9% |

|

Incentive Provided |

None |

SMBP education + support |

SMBP + $25 gift card |

Source: AHA 2024

Revenue Opportunities for Manufacturers

|

Strategy |

Projected Revenue Growth |

Market Expansion |

|

ZOLL acquires Vyaire’s ventilator business (2024) |

Significant (2025 to 2027) |

Expands global respiratory and critical care portfolio |

|

GE deploys Edison platform in Korea (2022–ongoing) |

Steady (2023 to 2026) |

Boosts digital health and AI presence in Korea |

|

Neoventa partners with YMS in South Africa (2025) |

Moderate (2025 to 2028) |

Enters the South Africa market through a local distributor |

Source: Company Official Press Releases

Challenges

- Lack of proper healthcare access: The fetal monitoring market faces significant disparities in terms of inadequate healthcare access and funding shortages. This has further led to an increased maternal and child mortality, wherein there are critical programs at risk of closure. On the other hand, debt burdens force governments to divert funds from health to debt servicing, thereby leaving families to pay exacerbated costs that ultimately limit access.

- Impact of climate change: Despite the presence of a reliable consumer base, the fetal monitoring sector is facing risks in terms of climate change and conflicts, which disrupt the healthcare system's infrastructure. Besides this results in displacing health workers, creating barriers to maternal and newborn care. On the other hand, in crisis zones such as Cox’s Bazar and Gaza, providing consistent maternal health services becomes challenging, which increases vulnerability among mothers and children, necessitating urgent, adaptable healthcare solutions.

Fetal Monitoring Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7% |

|

Base Year Market Size (2025) |

USD 6.3 billion |

|

Forecast Year Market Size (2035) |

USD 11.4 billion |

|

Regional Scope |

|

Fetal Monitoring Market Segmentation:

Method Segment Analysis

Based on the method, the non-invasive segment is projected to garner the largest revenue share of 76.4% in the fetal monitoring market during the forecast tenure. The safety standards, patient comfort, and reduced risk of complications are the key factors behind this proprietorship. In March 2023, researchers from Washington University introduced a non-invasive tool called electro myometrial imaging (EMMI) to visualize uterine contractions in 3D. This was funded by NIH, and the technology maps contraction patterns during labor, which enables better labor management and preterm birth care, hence a wider scope.

End user Segment Analysis

In terms of end user hospitals/maternity hospitals segment is growing at a considerable rate with a share of 68.4% in the market by the end of 2035. The settings handle a high volume of deliveries and high-risk pregnancies with advanced monitoring technologies, allowing a steady business flow. Therefore, in June 2025, Yashoda Hospital highlighted a protocolised, multi-system care framework for managing complex obstetric cases, which is a collaborative model that integrates intensivists, cardiologists, and other specialists to anticipate and address complications early.

Product Segment Analysis

Based on the product, the ultrasound devices segment is anticipated to gain a significant share of 52.6% in the fetal monitoring market during the discussed timeframe. The segment’s growth originates from a shift towards non-invasive prenatal care that includes advanced 3D or 4D imaging enhances diagnostic clarity. For instance, in November 2022, Philips introduced its Ultrasound Compact System 5000 Series at RSNA, which is designed to bring first-time-right diagnosis to reach out wider audience group. Also, the compact unit offers premium image quality in a portable form, making it ideal for point-of-care use.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Method |

|

|

End user |

|

|

Product |

|

|

Portability |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Fetal Monitoring Market - Regional Analysis

North America Market Insights

North America in the fetal monitoring market is expected to grow by capturing the largest revenue share of 40.7% by the end of 2035. This upliftment is readily propelled by the widespread adoption of medical technologies and a robust healthcare ecosystem. Therefore, NIH in September 2023 introduced a USD 2 million RADx Tech Fetal Monitoring Challenge to promote innovation in point-of-care and home-based fetal diagnostic technologies, which was sponsored by NIBIB, NICHD, and the Bill & Melinda Gates Foundation. The key emphasis is to improve fetal health outcomes, particularly in low-resource settings.

In the U.S., the fetal monitoring industry has become the key component in terms of both prenatal and perinatal care, which is extensively supported by a huge network of medical facilities. In this regard, UNICEF in May 2025 reported that it is supporting CareNX Innovations in expanding AI-driven fetal monitoring to ensure that no mother or baby is left behind due to a lack of access to quality care. The report also highlighted CareNX’s flagship product called Fetosense, which is a portable, AI-powered fetal monitoring system designed to enable early detection of fetal concerns, especially in underprivileged areas, hence benefiting the overall market.

Canada in the fetal monitoring market is displaying notable growth that benefits from the presence of a universal healthcare system, deliberately emphasizing preventive care and maternal health services. In June 2024, Clarius Mobile Health reported that it received FDA clearance for its Clarius OB AI, an AI-powered fetal biometric measurement tool integrated with its handheld Clarius C3 HD3 ultrasound scanner. The product is exclusively designed to automate critical obstetric calculations such as fetal age, weight, and growth, hence a positive market outlook.

Maternal and Infant Health Initiatives, Resources, and Key Data

|

Initiative / Resource |

Year(s) |

Key Focus / Data Points |

|

MIHI Webinar Series |

May-Aug 2024 |

Maternal mental health, substance use disorder (SUD), hypertension control, AIM bundles |

|

Affinity Groups |

Fall 2024 |

Maternal mental health & SUD; maternal hypertension & cardiovascular health |

|

Maternal Health Infographic |

2024 |

Medicaid covers ~42% of US births; 2/3 of adult women on Medicaid are of reproductive age (19 to 44) |

Source: Medicaid

APAC Market Insights

Asia Pacific in the fetal monitoring market is considered to be the fastest-growing region due to the growing awareness about maternal and fetal health. Also, there have been remarkable improvements in healthcare infrastructure, which in turn increases the adoption of advanced medical technologies, thereby making it suitable for standard market upliftment. Furthermore, the region also benefits from a rapidly growing consumer base and an increasing number of hospitals and maternity care centers focusing on prenatal care.

China is also witnessing robust advancements in its healthcare sector, which is positively impacting the market. The country’s enhanced government and private sector activities are providing an encouraging opportunity to capitalize on this sector. Shenzhen Luckcome Technology Inc., Ltd., in May 2023, announced that it will participate in CMEF 2023, and will showcase its newly launched Jaundice Detector, which is portable and easy to use, comprising a unique pressure calibration algorithm, and can store 20 sets of data.

India in the market has become the targeted hub due to the significant government initiatives that are readily propelling a profitable business environment. In October 2024, MOH&FW reported that the country’s government, under the National Health Mission, implements various programs to improve maternal and child health, especially for underserved communities. The report also underscored that tribal areas benefit from relaxed norms for setting up health facilities, deploying ASHAs, and operating Mobile Medical Units with a special focus on high-risk pregnancies, early child care, immunization, and healthcare access in remote and tribal regions.

Europe Market Insights

Europe in the fetal monitoring market is immensely supported by the well-established healthcare systems and widespread adoption of advanced prenatal technologies with a supportive regulatory framework. In September 2024, St. Vincent’s Private Hospital declared that it entered into a 10-year, €40 million Value Partnership with Siemens Healthineers, which marks the first-of-its-kind collaboration in Ireland’s private healthcare sector. Besides, this partnership enhances care by integrating with advanced AI technologies to enhance diagnostic and treatment capabilities.

The U.K. holds a strong position in the fetal monitoring sector that is proactively shaped by National Health Service protocols and guidelines that standardize care across the country. The pioneers in the country are also putting constant efforts to strengthen the ecosystem extremely supported emphasis on personalized maternity care. In September 2024, Comen introduced CF5/CF8 Fetal and Maternal Monitors, which are especially designed for advanced, stable, and streamlined monitoring. Also, they are equipped with intelligent algorithms that minimize false alarms due to fetal movement and feature a detailed CTG scoring system based on seven clinical criteria.

Germany is gaining traction in the market, which is both robust and technologically advanced, facilitated by widespread adoption. In July 2022, Siemens Healthineers stated that at the European Congress of Radiology, it unveiled its most comprehensive ultrasound portfolio, which features 12 new transducers across four ultrasound systems called Acuson Sequoia, Redwood, Juniper, and P500, along with major software enhancements and expanded AI-powered tools. Hence, such moves contribute to the steady demand for fetal monitoring equipment in the country.

Key Fetal Monitoring Market Players:

- GE Healthcare

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Philips Healthcare

- Edan Instruments

- Siemens Healthineers

- Natus Medical

- Medtronic

- Huntleigh Healthcare

- Analogic Corporation

- ArjoHuntleigh

- Trismed

- Bionet

- Mindray

- Comen

- Cure Medical

- Monarch Meditech

The international market of fetal monitoring is extremely consolidated, wherein the pioneers GE Healthcare and Philips are leading through AI-based innovations and telehealth partnerships. Meanwhile, the firms from the U.S. and Europe are dominating by emphasizing premium-priced devices, whereas the Asia-based organizations, such as Edan and Trismed, are targeting the cost-sensitive markets. On the other hand, Japan’s industry is deliberately focusing on precision ultrasound and hospital integration, hence suitable for standard market growth.

Below is the list of some prominent players operating in the global market:

Recent Developments

- In September 2024, Raydiant Oximetry, Inc. reported that it had secured a USD 1 million grant from the Bill & Melinda Gates Foundation to advance its Lumerah technology. It has a non-invasive fetal pulse oximeter that aims to improve the detection of fetal distress during childbirth.

- In February 2024, GE HealthCare announced that it received FDA 510(k) clearance for its Novii Wireless Maternal and Fetal Monitoring Solution, which is currently approved for use in approximately 95% of eligible U.S. births. The device productively tracks fetal heart rate, maternal heart rate, and uterine activity for patients at ≥34 weeks of gestation.

- Report ID: 4864

- Published Date: Aug 25, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Fetal Monitoring Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.