Pulse Oximeter Market Outlook:

Pulse Oximeter Market size was valued at USD 2.3 billion in 2024 and is projected to reach USD 4.3 billion by the end of 2034, rising at a CAGR of 7% during the forecast period, i.e., 2025-2034. In 2025, the industry size of pulse oximeter is assessed at 2.5 billion.

The global market is driven by the rise in the patient pool suffering from diseases such as chronic respiratory illnesses, cardiovascular disorders, and post-operative complications. According to a World Health Organization (WHO) report, nearly 262.5 million people are affected by chronic obstructive pulmonary disease and require continuous blood oxygen monitoring during hospitalization. However, the requirement for long-term SpO₂ monitoring is also increased among the rising geriatric populations and post-COVID syndrome patients. As per the Centers for Medicare & Medicaid Services data, the rise in remote patient monitoring has increased to 49.3% in 2023, impacting the institutional adoption of devices such as pulse oximeters.

On the supply chain side, the pulse oximeters are manufactured using sensors, microcontrollers, and medical-grade plastic components. Pulse oximeters are mainly imported from Malaysia, Germany and China. The U.S. imported these monitoring devices from China reaching USD 780.4 million in 2023 which is nearly a 60.4% of the total imports. This value impacts the supply chain concentration risks. The producer price index rose to 4.4% in 2024 for electromedical equipment, whereas the consumer price index increased to 1.9% for medical equipment and supplies, impacting the inflation passed to buyers in healthcare institutions. The research and development in pulse oximeters are moderate and are implementing various innovative methods, such as AI-enabled anomaly detection, to enhance the accuracy during monitoring.

Pulse Oximeter Market - Growth Drivers and Challenges

Growth Drivers

-

Government spending on remote monitoring devices: Medicare spending on pulse oximeter devices in the U.S. reached USD 800.4 million, up by 15.3% from 2020. This growth was surged primarily by increased reimbursement policies for Remote Patient Monitoring (RPM) services under CPT codes 99453-99454, as specified by CMS. These policies facilitate oxygen saturation monitoring for older adults and patients with chronic diseases like COPD and heart failure. The expansion enhances access to in-home care and supports Medicare's emphasis on value-driven and preventive healthcare services.

-

Rising patient pool with cardiac and respiratory conditions: Approximately 420.5 million patients need pulse oximetry monitoring due to congestive heart failure, post-COVID, and conditions like COPD and sleep apnea. In Germany, the number of patients using pulse oximeters increased to 4.2 million in 2025, a 26.6% increase over the past decade. The increase is mostly attributed to a growing aging population and using pulse oximeter monitoring in post-discharge care programs. Hospitals are increasingly turning to these devices to detect early hypoxia and decrease readmissions.

Historical Patient Growth Analysis: Foundation for Future Market Expansion

Historical Patient Growth (2010-2020)

|

Country |

2010 (Million Users) |

2020 (Million Users) |

% Growth (2010-2020) |

|

U.S. |

8.4 |

13.9 |

66.2% |

|

Germany |

2.7 |

4.4 |

71.1% |

|

France |

2.2 |

3.7 |

68.8% |

|

Spain |

1.6 |

2.9 |

108.5% |

|

Australia |

0.9 |

1.7 |

114.7% |

|

Japan |

3.8 |

6.5 |

74.5% |

|

India |

5.5 |

12.2 |

131.8% |

|

China |

11.1 |

23.8 |

116.9% |

Strategic Expansion Models for Market

Feasibility Models for Revenue Growth

|

Country |

Feasibility Model |

Revenue Uplift (2022-2024) |

Key Driver |

|

India |

Local healthcare provider partnerships (Ayushman Bharat) |

+12.4% |

Rural expansion & govt subsidies |

|

U.S. |

Medicare RPM reimbursement (CPT 99453-99454) |

+15.5% |

CMS-supported remote care billing |

|

Germany |

OEM tender inclusion via Hospital Future Act (KHZG) |

+9.8% CAGR |

Digital diagnostics funding |

|

Japan |

MHLW-licensed municipal supply chains |

+11.3% |

Aging population & homecare demand |

|

China |

Provincial public kit distribution (Healthy China 2030) |

$420.5M in public contracts |

Mass screening policies |

|

Australia |

RPM integration with My Health Record System |

+11.2% |

Telehealth & digital patient records |

|

France |

Remote monitoring inclusion in social health coverage |

+8.9% |

CNAM reimbursement & e-health incentives |

Challenges

-

Fragmented tendering systems: Public procurement of medical devices in India and China for pulse oximeters is decentralized. Manufacturers face high variable pricing, documentation across provinces, and qualification standards. In India, the price variation ranges from 25.4% to 40.2% for similar products based on the state health department. For suppliers, this variation raises the logistical costs, discourages national scaling, and complicates forecasting. Many global organizations struggle with regional rules, causing inconsistent market access. Unlocking large-scale adoption in densely populated countries still requires integrating procurement regulations.

Pulse Oximeter Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2034 |

|

CAGR |

7% |

|

Base Year Market Size (2024) |

USD 2.3 billion |

|

Forecast Year Market Size (2034) |

USD 4.3 billion |

|

Regional Scope |

|

Pulse Oximeter Market Segmentation:

Distribution Channel Segment Analysis

The online retail dominates the segment and is poised to hold the revenue share of 44.9% by 2034. Distribution is led by online retail because of the speedy transition towards e-commerce, especially within personal healthcare devices. The ease of direct-to-consumer models and increased access via government-funded telehealth programs, especially in Europe and the U.S., have boosted online sales. As per the Centers for Medicare & Medicaid Services (CMS) report, sales of remote patient monitoring (RPM) devices such as pulse oximeters have increased by 49.4%, driven primarily by online platforms. Federal and international public health agencies, such as NIH and AHRQ, also suggest internet-based monitoring devices that are frequently bundled and marketed through e-retailers.

Product Type Segment Analysis

The fingertip pulse oximeters lead the market and are projected to have a market share of 42.9% by 2034. Fingertip pulse oximeters are driven by their affordability, portability, and extensive usage in clinical and home care settings. As per the FDA, during the COVID-19 pandemic, these devices gained substantial Emergency Use Authorization (EUA) momentum, subsequently gaining permanent consumer demand after 2021. Their compatibility with mobile apps and Bluetooth for remote monitoring fits in with the Centers for Medicare & Medicaid Services (CMS) promotion of Remote Patient Monitoring (RPM) programs under chronic care management programs and further driving adoption (CMS RPM).

Our in-depth analysis of the global pulse oximeter market includes the following segments:

|

Segment |

Subsegments |

|

Product Type |

|

|

Distribution Channel |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

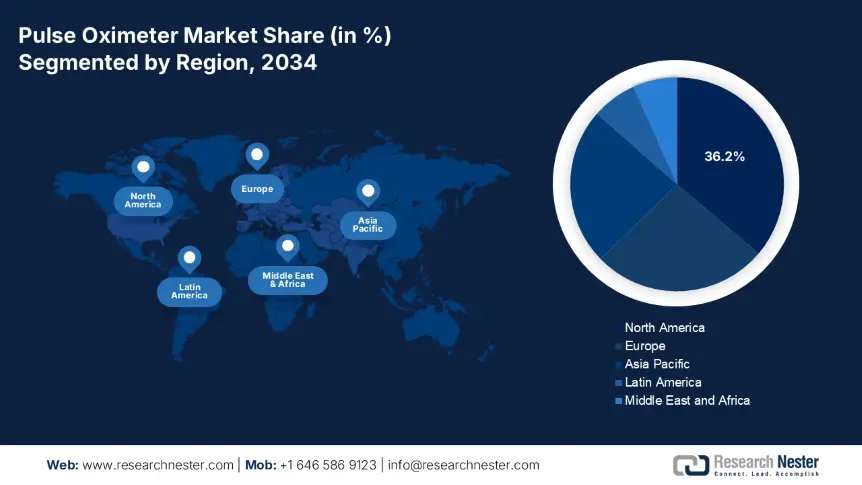

Pulse Oximeter Market - Regional Analysis

North America Market Insights

The pulse oximeter market in North America dominates the market and is expected to maintain the market share of 36.2% at a CAGR of 7% by 2034. Strong public health infrastructure, home healthcare demand, and extensive insurance coverage for remote patient monitoring (RPM) drive the market. Aging populations with a common prevalence of chronic respiratory conditions, and government efforts to decrease hospital burden, have driven the use of pulse oximeters in both clinical and home healthcare environments. Permanent expansion of Medicare's RPM reimbursement policy by the U.S. government and investment in digital diagnostics integration by Canada under provincial care models are key drivers of growth.

The U.S. pulse oximeter market is actively expanding and is driven by strong institutional purchasing, Medicare/Medicaid reimbursement, and strong adoption of remote monitoring. As per the Centers for Medicare & Medicaid Services (CMS) report, the RPM claims increased 49.3% in the past three years, with pulse oximeters being a primary device category. The NIH and CDC allocated $5.3 billion to oxygen saturation monitoring devices and non-invasive diagnostic devices in 2023 via focused health technology R&D initiatives. Medicare spending on oximeter-based monitoring increased 15.6% since 2020 to $800.2 million in 2024, while Medicaid reached $1.6 billion in pulse oximeter reimbursements, also providing an additional 10.4% of reimbursement beneficiaries. Furthermore, the FDA continues to revise safety advice for fair accuracy on all skin tones, supporting the need for next-generation clinical-grade oximeters.

Asia Pacific Market Insights

The APAC is the fastest-growing region in the pulse oximeter market and is expected to hold the market share of 23.8% at a CAGR of 7.6% in 2034. The market is driven by urbanization, the increasing incidence of chronic respiratory and cardiovascular diseases, and increasing access to healthcare. Regionally, public health reforms, the extensive adoption of mobile health, and the growing penetration of telemedicine are bolstering regional adoption. APAC's dependence on domestic manufacturing of sensor and circuit components has reduced supply chain disruption and made the region a low-cost export and domestic supply hub. Combined with robust government procurement, increased per capita healthcare spending, and increased awareness of chronic disease care, the APAC region will continue to expand its market.

China holds the largest share in the pulse oximeter market in the Asia Pacific region and is anticipated to hold the market share of 7.8% by 2034. According to the National Medical Products Administration (NMPA) report, China's public health system raised the spending on pulse oximeters and other related monitoring devices by 15.4% in the last five years. Over 1.8 million patients were diagnosed using pulse oximetry in 2023, with the individuals suffering from chronic obstructive pulmonary disease (COPD) and long-COVID syndrome complications, reflecting increasing statewide need for affordable respiratory monitoring solutions

Country-wise Government Provinces

|

Country |

Policy / Program |

Launch Year |

Pulse Oximeter-Related Funding / Allocation |

|

Australia |

National COVID-19 Response Plan (Telehealth RPM) |

2021 |

AUD 60.4 million allocated for home-based pulse oximetry monitoring kits |

|

Japan |

AMED Non-Invasive Monitoring R&D Grant |

2022 |

¥390.6 billion R&D support through 2024 |

|

India |

Ayushman Bharat Digital Mission (ABDM) |

2021 |

$1.6 billion digital diagnostic infrastructure funding incl. pulse oximeters |

|

South Korea |

Smart Medical Infrastructure Expansion Plan |

2023 |

KRW 1.5 trillion allocated for connected device distribution |

|

Malaysia |

MyHIX - MyHealth Information Exchange |

2022 |

RM 550.7 million investment for telemonitoring & diagnostics |

Europe Market Insights

The Europe market is experiencing steady growth and is anticipated to hold the market share of 26.5% at a CAGR of 6.5% in 2034. The market is driven by strong public health infrastructure, aging populations, and growing government expenditure on remote monitoring and digital diagnostics. Post-pandemic healthcare reforms and a shift towards home-based management of chronic diseases have increased the requirement for clinical-grade pulse oximeters. Further, rising cases of respiratory diseases and comorbidities, especially in Germany, France, and the UK, are pushing hospitals and national health systems to implement pulse oximetry in inpatient and outpatient settings.

Germany leads the pulse oximeter market in the Europe region and is expected to hold the market share of 7.4% by 2034. Germany is the largest pulse oximeter market in Europe, with combined spending amounting to €4.5 billion in 2024, a 12.3% increase in demand compared to 2021. The Federal Ministry of Health (BMG) and German Medical Association (BÄK) endorsed reimbursement reforms that enabled the purchase of pulse oximeters to be covered through statutory health insurance for monitoring chronic disease. Incorporation into hospital telemonitoring systems, especially in geriatric care and postoperative convalescence, is now the norm within German federal states.

Government Investments, Policies & Funding

|

Country |

Policy / Program |

Launch Year |

Pulse Oximeter-Related Budget / Funding |

|

United Kingdom |

NHS@Home & Virtual Ward Program |

2021 |

£450.3 million NHS England funding for home monitoring including pulse oximeters |

|

France |

National Digital Health Strategy (Ma Santé 2022) |

2022 |

€1.6 billion allocated for digital tools incl. pulse oximeter deployment |

|

Italy |

National Recovery and Resilience Plan (PNRR) |

2021 |

€2.5 billion for telemonitoring devices including pulse oximeters |

|

Spain |

Spain Digital Health Strategy |

2022 |

€675.6 million in funding for remote diagnostics including pulse oximetry |

Key Pulse Oximeter Market Players:

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

The global market is highly competitive with the leading players including Masimo, Medtronic, and Philips. These top players are dominating in high acuity care devices and is combined to hold the market share of 36.4%. companies are following various stratergic moves via product innovation, AI enabled diagnostics, and Bluetooth integration with public health systems to be stay ahead. Further, companies in Asia such as Nihon Kohden and Mindray are actively rising the market presence by providing cost effective solution. Regulatory alignments with EU-MDS and FDA standards, and adoption of home-based healthcare are redefining the competitive strategies.

Below is the list of some prominent players operating in the global market:

|

Company Name |

Country of Origin |

Market Share (%) |

Industry Focus |

|

Masimo Corporation |

U.S. |

15.2% |

High-end hospital-grade and wearable oximeters; known for Signal Extraction Tech |

|

Medtronic plc |

Ireland (U.S. ops) |

11.9% |

Integrated ICU monitors and portable pulse oximeters |

|

Koninklijke Philips N.V. |

Netherlands |

9.8% |

Advanced diagnostic systems; Bluetooth-enabled oximeters |

|

Nihon Kohden Corporation |

Japan |

8.4% |

Hospital-grade devices with multi-parameter monitoring |

|

Nonin Medical Inc. |

U.S. |

7.3% |

Portable and fingertip oximeters; strong telehealth integration |

|

GE HealthCare |

U.S. |

xx% |

High-acuity care monitors and multi-use pulse oximetry systems |

|

Smiths Medical (ICU Medical) |

U.S. / UK |

xx% |

Clinical-grade sensors and oximeters for ambulatory care |

|

OSI Systems, Inc. (Spacelabs) |

U.S. |

xx% |

Remote telemetry and OEM pulse oximetry components |

|

Edan Instruments, Inc. |

China |

xx% |

Tabletop oximeters and mobile diagnostic units |

|

Beurer GmbH |

Germany |

xx% |

Homecare fingertip oximeters with smartphone integration |

|

Schiller AG |

Switzerland |

xx% |

Multi-parameter diagnostics including oximetry in cardiac applications |

|

BPL Medical Technologies |

India |

xx% |

Compact fingertip and pediatric oximeters for emerging markets |

|

Medisana GmbH |

Germany |

xx% |

Consumer-oriented digital oximeters |

|

Omron Healthcare, Inc. |

Japan |

xx% |

Wearable and wireless health monitoring solutions |

|

Aeonmed Group |

China |

xx% |

ICU and OR-based oximeters, including ventilator-integrated models |

|

Mindray Medical Intl Ltd. |

China |

xx% |

Diagnostic oximeters for clinical and emergency use |

|

iHealth Labs, Inc. |

U.S. |

xx% |

Smartphone-compatible oximeters for personal wellness |

|

Microlife Corporation |

Taiwan |

xx% |

Compact pulse oximeters for chronic care management |

|

BioCare Group |

Malaysia |

xx% |

Mid-range fingertip and reusable sensor pulse oximeters |

|

Compumedics Ltd. |

Australia |

xx% |

Sleep diagnostics and pulse oximetry systems integrated with PSG platforms |

Below are the areas covered for each company in the market:

Recent Developments

- In May 2024, Nihon Kohden enlarged its Polymate i-series to include a multi-parameter wearable with enhanced SpO₂ accuracy. The product launch led to a 17.6% rise in diagnostic device revenue.

- In February 2024, Masimo introduced the Radius VSM, a tetherless, wearable patient monitor to track pulse oximetry and respiration rate. The launch has gained an additional 2.5% market share in 2024.

- Report ID: 3120

- Published Date: Jul 21, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Pulse Oximeter Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert