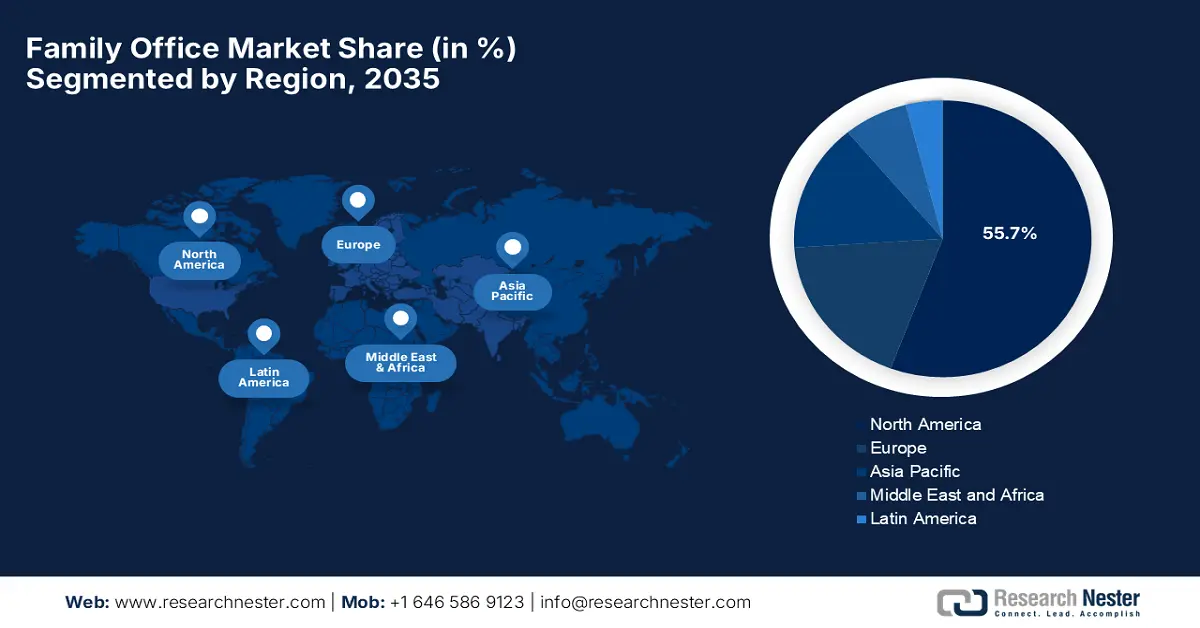

Family Office Market - Regional Analysis

North America Market Insights

North America is expected to register its dominance in the family office market, capturing the largest revenue share of 55.7% by the end of 2035. The leadership of the region is effectively attributable to the well-established financial infrastructure, talent pool, and trust & estate regimes. In November 2025, Matter Family Office and IWP Family Office together announced that they have merged to create a comprehensive multi-family office platform serving more than 140 ultra-high-net-worth families with more than USD 10 billion in assets under advisement. Besides, the combined firm integrates deep public and private investment expertise, family office administration, and proprietary family learning programs, thereby emphasizing generational wealth management and client-centered continuity. Furthermore, the merger is supported by BW Forsyth Partners, and it strengthens service breadth and scalability, positioning the firm to deliver multigenerational wealth solutions across its St. Louis, Denver, and Dallas-Fort Worth offices.

The U.S. is the key contributor to progress in the regional family office market, positively influenced by a large base of ultra-high-net-worth individuals who are looking for wealth management, estate planning, and succession strategies. Besides, the growing interest in impact investing and philanthropy is reshaping the services offered, creating encouraging opportunities for pioneers in this field. The Federal Reserve Bank of ST. Louis in June 2025 disclosed that its analysis of U.S. household wealth highlights stark concentration, in which the top 10% hold USD 8.1 million on average and 67.2% of total wealth, whereas the bottom 50% averaged USD 60,000, owning just 2.5%. It also mentioned that wealth disparities also appear across generations, education, and race, whereas the younger Americans and college-educated households hold disproportionately more wealth. Despite volatility from inflation and pandemic-related pressures, average wealth remains elevated relative to pre-pandemic levels, providing insight into the distributional context, increasing the potential for family offices.

Canada is continuously growing in the regional family office market, efficiently driven by an emphasis on professionalization and partnerships with fintech solutions to streamline operations and enhance reporting. The country’s market also benefits from sustainability, and ESG considerations are which are influencing family office investment decisions. Our Family Office Inc., a purpose-built shared family office which is serving Canada’s ultra-high-net-worth segment, was named a finalist in five categories at the 12th Annual Family Wealth Report Awards 2025, which include multi-family office, outstanding CEO, and outstanding CIO. The report also highlighted that the recognition reflects its dedication to delivering top-tier advice and service, while its integrated, family-owned governance model and holistic wealth approach hence attracted more players to establish their footprint in this field.

APAC Market Insights

Asia Pacific is rapidly expanding in the family office market, efficiently propelled by the preference for wealth preservation and diversification into global investments. Simultaneously, the adoption of technology and digital platforms is readily accelerating, thereby enabling family offices in this region to manage complex portfolios and track international investments. In September 2025, Apex Group announced that it had been appointed to provide fund and operational services for Nezu Asia Capital’s new Japan-focused Engagement Fund, targeting undervalued companies in Japan to unlock shareholder value. The mandate also includes fund administration, custody, and banking services across multiple jurisdictions, leveraging Apex’s Paxus technology platform for proper cross-border operations. Furthermore, this partnership highlights Apex Group’s role in supporting Japan-focused strategies and delivering integrated solutions for asset managers and family offices who are looking for efficient, end-to-end fund services.

China is augmenting its leadership over the regional family office market due to a focus on succession planning, offshore diversification, and alternative investments such as private equity and real estate. In this regard HKSAR government in 2022 reported that Hong Kong has established itself as a prominent hub for family offices, which is hosting a significant concentration of ultra-high-net-worth individuals and providing a credible ecosystem for wealth management. Besides, HKSAR supports this sector through policies such as the capital investment entrant scheme, the Hong Kong Academy for wealth legacy, art storage facilities, philanthropic support, and full profits tax concessions for family-owned investment holding vehicles managed by single-family offices. Hence, these measures, coupled with guidance on structures, compliance, taxation, and governance, make Hong Kong a preferred base for family offices in the country that are looking to operate both nationally and internationally.

India is also efficiently growing in the Asia Pacific’s family office market, owing to the increasing engagement in philanthropy, startup investments, and direct equity participation, reflecting evolving wealth management needs. The sector is also opting for technology solutions to improve operational efficiency by ensuring long-term wealth preservation across generations. In April 2025, UBS announced that it had entered into an exclusive strategic collaboration with the country’s 360 ONE WAM, combining UBS’s global expertise with 360 ONE’s local reach to enhance wealth management for ultra- and high-net-worth clients. Besides, the partnership will offer onshore and offshore investment solutions, potential asset management and investment banking synergies, and involve UBS acquiring a 4.95% stake in 360 ONE. Furthermore, this move strengthens both firms’ positions in India and globally by expanding growth opportunities in the market.

Europe Market Insights

Europe is growing exponentially in the family office market due to a focus on tax optimization and cross-border investment strategies. Strong governance, risk management, and family cohesion remain central in the region, whereas philanthropic advisory and legacy planning are becoming highly essential to service offerings. In February 2025, the SEB Nordic Family Office Summit 2025 in Stockholm showcased strong growth, thereby attracting 200 principals and senior executives from Northern Europe, which marks up 65% from the previous year. The summit also emphasized governance, succession planning, and next-generation engagement, in which the speakers from leading family offices such as the IMAS Foundation, the Messer Family, and Kiilto shared insights on long-term strategy and family-business balance, hence, highlighting the importance of sustainability, innovation, and intergenerational wealth stewardship.

Germany is extensively growing in the family office market, facilitated by the emphasis on long-term wealth preservation, estate planning, and structured investment strategies. ESG-focused investing is growing in the country in which offices are increasingly incorporating sustainability into portfolio allocation, reflecting both regulatory trends and generational priorities. In August 2025, FORUM Family Office announced that it has acquired 100% of ab-data GmbH & Co. KG which is, a Germany-based financial software provider for municipalities, through its holding company FORUM Software Mittelstandsholding SE. Besides, the acquisition secures the continued development of the VOIS|Finanzwesen platform, and this move aligns with the firm’s long-term, family-equity investment approach, supporting succession solutions and sustainable growth for medium-sized companies.

U.K. market is highly developed, which is offering services in investment management, tax planning, philanthropy, as well as estate succession. Besides, London serves as a prime hub for global UHNW families who are seeking access to worldwide markets, alternative investments. Simultaneously, the country’s firms are focused on cross-generational planning and socially responsible investing, thereby reflecting evolving wealth management expectations and global market potential. In this regard, FNZ in December 2025 announced that it has launched an AI study, which is an AI-powered investment firm, analyzing more than 500 financial institutions with USD 74.2 trillion in assets across 16 markets, highlighting the role of AI in transforming wealth and asset management. Also, the research shows that early AI adoption drives growth, efficiency, and risk reduction, whereas integrated platforms and governance frameworks are key differentiators, hence enabling industrial-scale AI adoption across the wealth management value chain.