Expanded Thermoplastic Polyurethane Market Outlook:

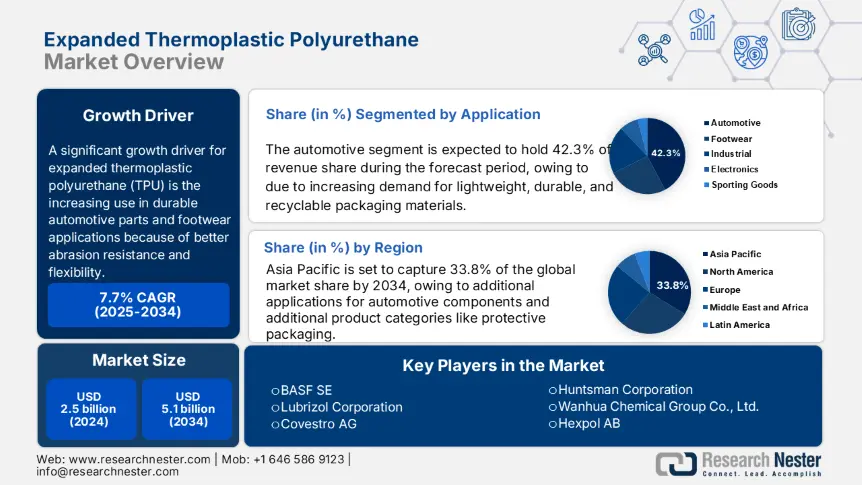

Expanded Thermoplastic Polyurethane Market size was estimated at USD 2.5 billion in 2024 and is expected to surpass USD 5.1 billion by the end of 2034, rising at a CAGR of 7.7% during the forecast period, i.e., 2025-2034. In 2025, the industry size of expanded thermoplastic polyurethane is assessed at USD 2.7 billion.

A significant growth driver for expanded thermoplastic polyurethane (TPU) is the increasing use in durable automotive parts and footwear applications because of better abrasion resistance and flexibility. The U.S. Bureau of Labor Statistics indicated that the Producer Price Index (PPI) on “thermoplastic resins and plastics materials” rose from 272.925 in February 2025 to 277.108 in March 2025, due to increases in production costs from raw material demand. The U.S. Government Accountability Office referenced investments from the National Science Foundation and Department of Energy into biodegradable and bio-based forms of TPU. Research investment in these sectors has increased by more than 21% since 2023.

Semi-raw materials that go into expanded TPU, specifically diisocyanate and polyether/polyester polyol, are as of now facing supply challenges as petrochemical producers have moved to producing higher-value chemicals, according to an analysis by the U.S. ITC. While capacity expansions are notable, including a $13.8 million new investment being made by the INOAC Group’s plant in Kentucky, where they will install TPU and composite production lines for the auto sector, the demand is high. Exports for plastic resins from the U.S. were 9% Y/Y in Q1, 2025, while TPU intermediate polyols imported posted a 13% increase-both suggest a constrained global supply chain, and support that assembly line is running at full capacity across North America and Europe. All continuous RDD expenditures in this area, to date, are funded from DOE grants. The objective is to decrease polymer lifecycle emissions and improve degradability post-end-of-line use.