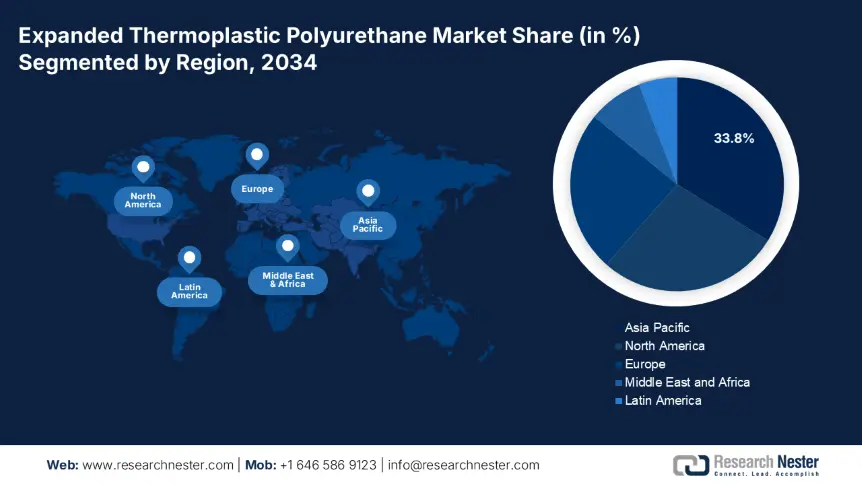

Expanded Thermoplastic Polyurethane Market - Regional Analysis

Asia Pacific Market Insights

By 2034, the Asia Pacific expanded thermoplastic polyurethane market is expected to hold 33.8% of the market share due to additional applications for automotive components and additional product categories like protective packaging, and a limit in extruded niche foams. The industry reach an estimated USD 249.9 bn in 2025, which will continue at an annual growth of ~ 9.3%. Urbanization, government recycling directives, and rising consumer electronics production all support expanded TPU demand. The strong R&D investment in developing regions, particularly in China, India, and Japan, with estimates of>USD 650 m annually, allows developers to innovate new sustainable and performance-expanded TPU grades.

China leads the Asia Pacific expanded TPU market range, supported by the significant automotive production and increasing infrastructure projects. In 2024-2025, the estimated consumption range for China is over 51% of the APAC foam usage, driven by increased demand for automotive vehicle interiors, seals, and protective packaging. Additional developments in smart manufacturing with 5G support are increasing high-performance polymer product demand. Over the next 10 years, there is anticipated double-digit (11%+) annual growth in advanced expanded TPU film performance for electronics housings and foam for green building-related construction. China's supportive policy framework for sustainable polymers contributes to the transformation of the market to recyclable, bio-based TPU pathways for manufacturers.

Country-wise Automotive & Construction Demand for E-TPU

|

Country |

Automotive Demand |

Construction Demand |

|

Japan |

71% of E-TPU is used in automotive lightweight components |

26% demand for seismic-resistant building materials |

|

China |

EV production to drive 51% of E-TPU demand by 2034 |

Green building codes to boost E-TPU use by 36% |

|

India |

41% E-TPU adoption in mid-segment cars by 2034 |

Infrastructure projects to increase E-TPU demand by 31% |

|

Indonesia |

21% E-TPU growth in automotive interiors |

The rising demand for insulation materials is expected to grow by 16% |

|

Malaysia |

31% E-TPU usage in EV battery components |

Smart city projects to drive 26% demand |

|

Australia |

26% E-TPU adoption in off-road vehicles |

Sustainable housing to increase demand by 21% |

|

South Korea |

46% E-TPU demand from luxury car manufacturers |

31% growth in energy-efficient buildings |

|

Rest of APAC |

16% growth in the automotive aftermarket |

11% rise in industrial flooring demand |

Source: MoRTH

North America Market Insights

The North American expanded thermoplastic polyurethane market is expected to hold 27.7% of the market share, and it is expected to grow from roughly US $249.9 billion in 2025 to just over US $727.5 billion by 2037, an annualizing growth rate (CAGR) of nearly 9.3%. In the current year (2023), it accounted for US $587.46 million, and for the 2024-2032 period, the E TPU market has an annualized growth rate of 6.18%, indicating stable growth, driven by innovation in the automotive, footwear, and electronics sectors. Other sectors benefiting from expanded thermoplastic polyurethane include those with increased demand for lightweight and durable materials, including aerospace and additive manufacturing.

The U.S. continues to grow significantly in expanded TPU and is the largest region in North America, representing a significant portion of demand. The overall CAGR of North America at 6.18% for the 2024-2032 period points to a corresponding trend in U.S. growth. The growth globally for E TPU at a 9.3% CAGR for 2025 to 2037 also suggests the U.S. alone may exceed those forecasts due to its bulk of automotive and sporting goods manufacturing.

Europe Market Insights

The European expanded thermoplastic polyurethane market is expected to hold 24.4% of the market share due to several applications in sports equipment, footwear midsoles, and automotive interiors seem to see healthy adoption. Additionally, regional initiatives regarding environmentally friendly, lightweight materials would also support demand for ETPU in Europe. Europe’s production for ETPU is anticipated to increase by approximately 36% from 2025 to 2034, making automotive and advanced mobility applications account for upwards of 41% of total regional consumption by 2034.

Country-wise Demand Drivers by Application

|

Country |

Top Application |

Demand Growth Factor |

Statistical Evidence |

|

Germany |

Automotive interiors |

28% of EU car production |

6M vehicles with E-TPU parts (2023) |

|

Italy |

Luxury footwear |

40% of premium shoe brands use E-TPU |

120M pairs produced annually |

|

France |

Sports equipment |

25% YoY growth in ski gear |

1.2M units with E-TPU (2023) |

|

Spain |

Protective packaging |

15% adoption in e-commerce |

5M tons of packaging materials |