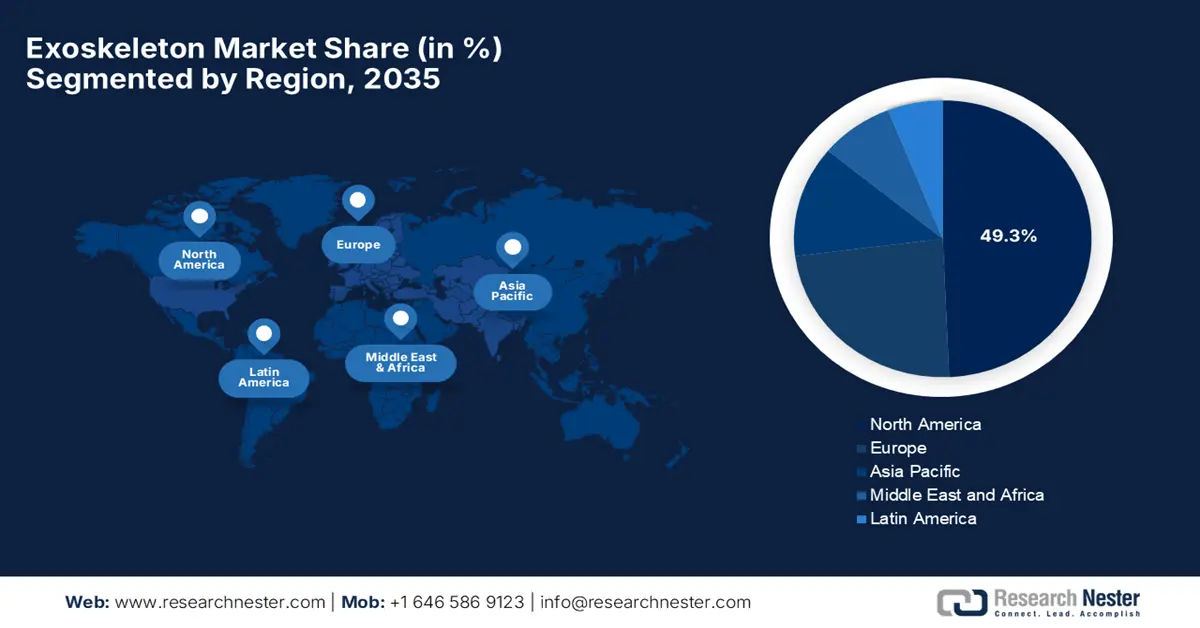

Exoskeleton Market - Regional Analysis

North America Market Insights

North America is predicted to command the largest revenue share of 49.3% in the global exoskeleton market by the end of 2035. The rising research investments and expanding collaborations among the leading pioneers are the key factors driving this leadership. Also, the growing disabilities region-wide wide coupled with technological advancements, are solidifying the region’s prominence in this field. In June 2024, Shepherd Center in Atlanta announced that it had partnered with Ekso Bionics to expand the use of EksoNR and Ekso Indego exoskeleton devices across rehabilitation and community settings, aiming to improve mobility and quality of life for individuals with spinal cord injuries and other complex conditions. Besides, this collaboration will focus on developing research and training programs for both clinical and personal use of Ekso devices, followed by CMS’s reimbursement approval for the Ekso Indego Personal device, hence benefiting the overall market growth.

The U.S. exoskeleton market is identified as a leader in adoption and innovation, primarily fueled by a strong ecosystem of technology developers and early commercialization in both medical and industrial segments. The country’s defense, medical, and industrial sectors are also making investments in performance-enhancing systems for soldier endurance and load support initiatives. In April 2025, Lifeward announced that it had launched the ReWalk 7 personal exoskeleton in the U.S., offering individuals with spinal cord injuries a next-generation device featuring customizable walking speeds, crutch control, and app connectivity for enhanced real-world mobility. The firm also mentioned that this device integrates feedback from clinicians and users to improve control and training efficiency, thereby supporting seamless indoor and outdoor walking, stairs, and curbs. Furthermore, the product received U.S. FDA clearance in March 2025 and Medicare reimbursement approval, making it suitable for standard exoskeleton market growth.

In Canada, the exoskeleton market is rapidly emerging with a prime focus on niche industrial and rehabilitation applications supported by targeted innovation from domestic robotics firms. The country’s market also benefits from the presence of research-driven startups and partnerships with larger international entities that efficiently help accelerate domestic development. ABB Canada, in August 2024, announced the launch of an ergonomics pilot at its Iberville, Quebec facility by deploying UPLIFT passive exoskeletons in collaboration with Mawashi Science & Technology. Besides, the project aims to improve worker posture and enhance endurance for physically demanding tasks in terms of industrial production. Furthermore, based on pilot outcomes, ABB plans to expand exoskeleton integration across other facilities and incorporate the technology into employee training programs, hence attracting more players to establish their footprint in the country.

APAC Market Insights

Asia Pacific is considered the fastest-growing region in the international exoskeleton market, owing to the rapid diversification across multiple economies. Japan’s aging population and robust robotics industry have resulted in early adoption of autonomous mobility aids, whereas South Korea integrates exoskeletons into industrial and defense uses, prompting continued cash influx in the sector. In addition, governments are proactively promoting advanced manufacturing and workplace automation, thereby catalyzing integration in factories and logistics. At Expo 2025 Osaka, Kansai, Japan, Tsubakimoto Chain showcased its T’s Exoskeleton (Body Enhancement Suit) at the Osaka Healthcare Pavilion, thereby allowing visitors to experience enhanced physical abilities, such as flying through a combination of exoskeleton technology and VR. It also mentioned that since its opening, more than 50,000 people of all ages have tried the interactive exhibit, which emphasizes the company’s philosophy of move, inspire, and the harmony between humans and machines.

China is continuing its growth trajectory in the exoskeleton market, supported by significant investment in robotics innovation and automation across healthcare and industrial sectors. Domestic manufacturers in the country are increasing production scale, which helps reduce unit costs and broadens accessibility in applications ranging from eldercare to high-strain factory operations. In September 2025, Kenqing Technology announced that it had partnered with Haigang Life Insurance to launch its smart elderly care products, which include exoskeleton robots, on the Haibei Bazaar healthcare platform. It also stated that within two days, user engagement and redemptions exceeded expectations, highlighting strong demand for tech-enabled home care solutions. Furthermore, this collaboration aims to enhance safety and convenience for the elderly while promoting wider adoption of exoskeleton-assisted smart care in the country.

India is progressing in the exoskeleton market, in which adoption is efficiently fueled by localized solutions that are suitable for affordability and demand in deployments in neurological rehabilitation and workplace ergonomic support for manual labor sectors. The country also benefits from government hospitals and research centers, which are increasingly trialing these assistive devices. In this regard, Tata Advanced Systems Limited, in February 2025, announced that, in collaboration with the Defence Research and Development Organization (DRDO), it has introduced a passive exoskeleton that is designed to help soldiers carry heavy combat loads across rugged terrains. Besides, the exoskeleton provides mechanical support to key joints by transferring up to 75% of the load to the ground, reducing fatigue as well as injury risk. Hence, this innovation aims to boost soldiers' efficiency and endurance during prolonged missions.

Europe Market Insights

Europe in the exoskeleton market has acquired the most prominent position, highly influenced by strong clinical and research ecosystems that emphasize regulatory compliance and integration with national healthcare systems. The region’s market also benefits from deployment in rehabilitation centers, in which the robotic mobility helps supplement traditional therapies, and in industrial environments that are proactively looking to mitigate injury risk among workforces. In September 2025, Lifeward Ltd. announced that it had received CE mark approval for its ReWalk 7 personal exoskeleton, beginning the commercial sales across the region. Also, this advanced seventh-generation device offers cloud connectivity, customizable walking speeds, and stair navigation, which efficiently enhance mobility for individuals with spinal cord injuries. Furthermore, with strong reimbursement frameworks already established in Germany, the firm aims to expand adoption and revenue growth throughout Europe.

Germany is gaining momentum in the exoskeleton market, backed by increased deployments in automotive and heavy manufacturing sectors. The country’s market also benefits from state-supported R&D initiatives and vocational technology programs that are helping to advance workplace robotics standards. In this regard, the European Investment Bank in December 2022 reported that it made an investment of EUR 15 million (approximately USD 16.4 million) in German Bionic to support R&D for its AI-based smart exoskeleton power suits that are especially designed to aid in logistics and care workers with heavy lifting. Also, this Cray X exoskeleton uses self-learning technology to improve posture, reduce injury risks, and provide real-time ergonomic data, enhancing workplace safety and efficiency. In addition, the funding is backed by the EU’s Invest EU program and aims to strengthen Europe’s leadership in industrial exoskeleton technology and promote sustainable innovation.

In the U.K. exoskeleton market is supported by clinical research and targeted healthcare use cases, industrial sectors, and focused innovation in assistive technologies. Simultaneously, the country’s market benefits from collaboration between academic institutions and robotics firms, which continues to shape the development of solutions suitable for domestic healthcare reimbursement and clinical evidence pathways. In September 2023, XPO Logistics announced that it is expanding the rollout of Hunic exoskeleton suits across the UK and Ireland following a successful pilot trial at multiple sites, including warehouses for Samsung, Volkswagen, and Daimler. The company also notes that the suits assist workers with heavy lifting by promoting correct posture, reducing fatigue, and preventing injury, resulting in a 15% to 20% reduction in unloading time at Samsung operations, prompting XPO to invest in wider deployment for enhanced worker safety and productivity.