Exoskeleton Market Outlook:

Exoskeleton Market size was valued at USD 584.5 million in 2025 and is projected to reach USD 2.41 billion by the end of 2035, rising at a CAGR of 17.1% during the forecast period, i.e., 2026-2035. In 2026, the industry size of exoskeleton is estimated at USD 684.4 million.

The exoskeleton market is representing strong progress, positively influenced by a rising interest in human augmentation, rehabilitation technologies, and workforce productivity enhancement across sectors such as healthcare, industrial, military, and consumer applications. In this regard, Wandercraft in June 2025 announced the closure of its Series D round by securing a total of USD 75 million to accelerate global deployment of its AI-powered robotics portfolio. The firm also mentioned that this funding will support the commercialization of the Eve personal exoskeleton, expansion of clinical adoption for Atalante X, and industrial rollout of the Calvin-40 humanoid robot. In addition, a strategic partnership with Renault Group, including minority ownership, strengthens large-scale manufacturing capabilities and cost-efficient production. Also, this is efficiently backed by public and private investors, reinforcing Wandercraft’s momentum in this field.

Furthermore, the increasing awareness of workplace safety and the need for mobility assistance is prompting widespread adoption in the exoskeleton market, in turn attracting stronger investments from both public and private entities. As evidence, Auxivo AG in July 2023 announced that it closed a financing round, which was led by Ankaa Ventures and participation from existing investors, to support innovation and international expansion in terms of occupational exoskeletons. Besides, the company also stated that this funding will be utilized for accelerating research and development and scaling market presence across major industries such as logistics, manufacturing, construction, and healthcare. In addition, Ankaa Ventures highlighted Auxivo’s potential to drive innovation and improve workplace health on a global scale, reinforcing the strategic value of the partnership, hence promoting sustainable and healthy physical labor.

Key Exoskeleton Market Insights Summary:

Regional Highlights:

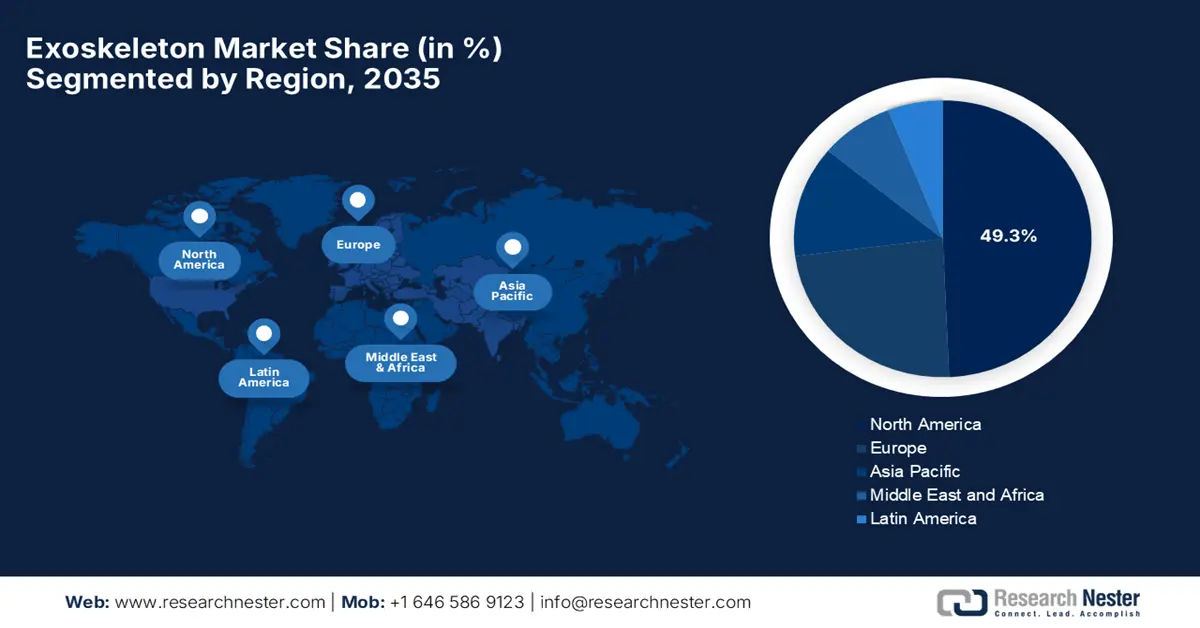

- North America is forecast to dominate the exoskeleton market with a 49.3% revenue share by 2035, supported by escalating research investments, deepening collaborations among technology leaders, and accelerating adoption across rehabilitation ecosystems, reinforced by expanding reimbursement-backed deployment of advanced exoskeleton solutions.

- Asia Pacific is poised to register the fastest growth trajectory by 2035, propelled by rapid industrial diversification, proactive government support for automation, and early adoption of robotic mobility aids across healthcare, industrial, and defense applications, stimulated by strong robotics innovation and aging demographics.

Segment Insights:

- Mobile (by mobility) in the exoskeleton market is projected to capture the largest revenue share of 65.7% by 2035, reflecting strong demand for user-controlled movement across rehabilitation and industrial environments, supported by growing clinical validation of exoskeleton-assisted mobility outcomes.

- Lower body exoskeletons are likely to secure a significant revenue share by 2035, underpinned by rising lower-limb disability prevalence, increasing investments, and expanding geriatric and paralyzed populations, enabled by advancements in lightweight materials, battery efficiency, and AI-driven personalized rehabilitation.

Key Growth Trends:

- Rising demand in healthcare & rehabilitation

- Industrial applications

Major Challenges:

- Technological limitations

- User comfort, training, and acceptance

Key Players: Ekso Bionics Holdings, Inc., ReWalk Robotics Ltd., Cyberdyne Inc., Lockheed Martin Corporation, Panasonic Corporation, Hocoma AG.

Global Exoskeleton Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 584.5 million

- 2026 Market Size: USD 684.4 million

- Projected Market Size: USD 2.41 billion by 2035

- Growth Forecasts: 17.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (49.3% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, South Korea

- Emerging Countries: India, China, Japan, South Korea, Brazil

Last updated on : 19 December, 2025

Exoskeleton Market - Growth Drivers and Challenges

Growth Drivers

- Rising demand in healthcare & rehabilitation: The continuously increasing demand in healthcare & rehabilitation is prompting a profitable business environment for the exoskeleton market. The exoskeletons are utilized to help patients with spinal cord injuries, stroke recovery, neurological disorders, and age-associated mobility impairments. Testifying to this, the article published by WHO in April 2024 revealed that spinal cord injury affects more than 15 million people across the globe and is a result of traumatic causes, such as falls and road traffic injuries, or non-traumatic causes, which include tumors, infections, as well as degenerative conditions. It also stated that the condition can lead to partial or complete loss of motor, sensory, and autonomic functions, often causing long-term disability and secondary health complications. Furthermore, timely medical care, rehabilitation,a and widespread availability of assistive technologies are critical factors supporting the continued adoption in the market.

- Industrial applications: Industries such as manufacturing, logistics, construction, and warehousing are opting for these exoskeletons to reduce worker fatigue, prevent injuries facilitate stronger adoption in the exoskeleton market. SUITX by Ottobock in November 2025 announced that it is launching the IX BACK VOLTON, which is an intelligent exoskeleton especially designed for industrial tasks such as order picking and loading, thereby reducing back strain by up to 17 kg per lift and weighing only 4.8 kg. It is equipped with precise motor technology, intelligent sensors, and a Bosch AMPShare battery system, which lasts up to eight hours, and it provides targeted support without restricting any natural movement throughout an entire work shift. Further, it is developed for dynamic workplaces, wherein the exoskeleton aims to improve employee health, prevent musculoskeletal disorders.

- Technological advancements: The aspects of robotics, AI, sensors, and lightweight materials are improving performance, whereas AI and IoT enable data-driven control, fueling progress in the exoskeleton market. In this context, ReWalk Robotics, in November 2023, demonstrated a next-generation exoskeleton prototype by integrating advanced sensors and AI for autonomous decision-making, which efficiently enables the device to detect and react to changes in terrain. This product was developed under Israel’s MAGNET program through the human robot interaction consortium, wherein the prototype aims to make exoskeletons safer, easier to use, and applicable to a broader range of daily activities. In addition, by collaborating with universities and leveraging robotics and human-computer interaction research, ReWalk is advancing human-exoskeleton interaction to improve usability and expand adoption.

Challenges

- Technological limitations: There have been continued improvements in technology, despite which the exoskeleton market still faces restraints in reliability, adaptability, and performance. Most of the systems struggle to synchronize with natural human movement, which causes inefficiencies or discomfort. On the other hand, concerns such as limited battery life, heavy components, restricted mobility, and slow response times reduce practical usability. In addition, adaptation of these exoskeletons to different body types, tasks, and environments is also challenging. Furthermore, the existence of technical failures can raise safety concerns among users, particularly in industrial or medical settings, representing reliability as a major factor hindering widespread adoption in this field.

- User comfort, training, and acceptance: User acceptance is yet another obstacle for the progression of the exoskeleton market. Besides, most of the devices are bulky, heavy, or uncomfortable when worn for longer time periods, thereby limiting their practicality in real-world instances. Therefore, proper training is required to ensure safe and effective use, which in turn increases implementation time and costs for employers and healthcare providers. Simultaneously, the aspects of resistance to change, fear of dependency, and concerns about job displacement in industrial environments also affect adoption in this market. In addition, without intuitive design, ergonomic comfort, and clear user benefits, exoskeletons may struggle to gain long-term acceptance among end users.

Exoskeleton Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

17.1% |

|

Base Year Market Size (2025) |

USD 584.5 million |

|

Forecast Year Market Size (2035) |

USD 2.41 billion |

|

Regional Scope |

|

Exoskeleton Market Segmentation:

Mobility Segment Analysis

In the exoskeleton market, mobile in terms of mobility will lead by capturing the largest revenue share of 65.7% over the forecasted years. The dominance of the segment is attributable to the user-controlled movement, important in rehabilitation clinics and industrial environments. As of the November 2025 article published by ClinicalTrials.gov, the Kessler Foundation has begun conducting a study to evaluate the effectiveness of a wearable robotic exoskeleton (Ekso-GT) in improving mobility, gait, and cognitive function in individuals with multiple sclerosis. Besides, participants are randomly assigned to receive gait rehabilitation using either the robotic exoskeleton or conventional therapy, wherein the outcomes are assessed through the 6-minute walk test, cognitive, and other measures. The study aims to determine if the therapy can enhance walking endurance, cognitive processing, and overall functional mobility over 12 weeks. Hence, the successful demonstration of improved mobility with exoskeletons in MS patients could expand clinical adoption and drive revenue growth in the exoskeleton market.

Extremity Segment Analysis

By the conclusion of 2035, the lower body is anticipated to capture a significant revenue share in the exoskeleton market. The increasing investments, coupled with the rising instances of lower-body disabilities, are the key factors behind this leadership. Simultaneously, the geriatric population and paralyzed patients are also enabling a continued revenue stream in this segment. Moreover, advancements in terms of lightweight materials and improved battery technologies are efficiently enhancing the usability and efficiency of lower-body exoskeletons. Also, the integration of AI and sensor-based systems is readily boosting adoption by offering personalized support and rehabilitation for the afflicted population. Furthermore, government initiatives and healthcare programs that promote mobility aids are expected to drive sustained market growth in the years ahead.

Technology Segment Analysis

In the technology segment powered sub-type is likely to grow at a considerable rate in the exoskeleton market over the discussed timeframe. These powered systems provide active mechanical assistance through actuators and control systems, making them highly essential for clinical rehabilitation and industrial strength support. According to the U.S. FDA in December 2025, a powered exoskeleton is a prescription medical device consisting of external, motorized orthotic components that assist movement of one or multiple lower-extremity joints, such as the hip, knee, or ankle. It is classified as a Class II device under product code PHL; it undergoes 510(k) premarket review by the Office of Neurological and Physical Medicine Devices. Furthermore, the product is designed for medical use; the exoskeleton facilitates rehabilitation and mobility for paralyzed or weakened limbs, relying on controllers and sensors to support safe, controlled movement, hence highlighting their clinical significance and safety requirements for rehabilitation use.

Our in-depth analysis of the exoskeleton market includes the following segments:

|

Segment |

Subsegments |

|

Mobility |

|

|

Extremity |

|

|

Technology |

|

|

End use |

|

|

Form |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Exoskeleton Market - Regional Analysis

North America Market Insights

North America is predicted to command the largest revenue share of 49.3% in the global exoskeleton market by the end of 2035. The rising research investments and expanding collaborations among the leading pioneers are the key factors driving this leadership. Also, the growing disabilities region-wide wide coupled with technological advancements, are solidifying the region’s prominence in this field. In June 2024, Shepherd Center in Atlanta announced that it had partnered with Ekso Bionics to expand the use of EksoNR and Ekso Indego exoskeleton devices across rehabilitation and community settings, aiming to improve mobility and quality of life for individuals with spinal cord injuries and other complex conditions. Besides, this collaboration will focus on developing research and training programs for both clinical and personal use of Ekso devices, followed by CMS’s reimbursement approval for the Ekso Indego Personal device, hence benefiting the overall market growth.

The U.S. exoskeleton market is identified as a leader in adoption and innovation, primarily fueled by a strong ecosystem of technology developers and early commercialization in both medical and industrial segments. The country’s defense, medical, and industrial sectors are also making investments in performance-enhancing systems for soldier endurance and load support initiatives. In April 2025, Lifeward announced that it had launched the ReWalk 7 personal exoskeleton in the U.S., offering individuals with spinal cord injuries a next-generation device featuring customizable walking speeds, crutch control, and app connectivity for enhanced real-world mobility. The firm also mentioned that this device integrates feedback from clinicians and users to improve control and training efficiency, thereby supporting seamless indoor and outdoor walking, stairs, and curbs. Furthermore, the product received U.S. FDA clearance in March 2025 and Medicare reimbursement approval, making it suitable for standard exoskeleton market growth.

In Canada, the exoskeleton market is rapidly emerging with a prime focus on niche industrial and rehabilitation applications supported by targeted innovation from domestic robotics firms. The country’s market also benefits from the presence of research-driven startups and partnerships with larger international entities that efficiently help accelerate domestic development. ABB Canada, in August 2024, announced the launch of an ergonomics pilot at its Iberville, Quebec facility by deploying UPLIFT passive exoskeletons in collaboration with Mawashi Science & Technology. Besides, the project aims to improve worker posture and enhance endurance for physically demanding tasks in terms of industrial production. Furthermore, based on pilot outcomes, ABB plans to expand exoskeleton integration across other facilities and incorporate the technology into employee training programs, hence attracting more players to establish their footprint in the country.

APAC Market Insights

Asia Pacific is considered the fastest-growing region in the international exoskeleton market, owing to the rapid diversification across multiple economies. Japan’s aging population and robust robotics industry have resulted in early adoption of autonomous mobility aids, whereas South Korea integrates exoskeletons into industrial and defense uses, prompting continued cash influx in the sector. In addition, governments are proactively promoting advanced manufacturing and workplace automation, thereby catalyzing integration in factories and logistics. At Expo 2025 Osaka, Kansai, Japan, Tsubakimoto Chain showcased its T’s Exoskeleton (Body Enhancement Suit) at the Osaka Healthcare Pavilion, thereby allowing visitors to experience enhanced physical abilities, such as flying through a combination of exoskeleton technology and VR. It also mentioned that since its opening, more than 50,000 people of all ages have tried the interactive exhibit, which emphasizes the company’s philosophy of move, inspire, and the harmony between humans and machines.

China is continuing its growth trajectory in the exoskeleton market, supported by significant investment in robotics innovation and automation across healthcare and industrial sectors. Domestic manufacturers in the country are increasing production scale, which helps reduce unit costs and broadens accessibility in applications ranging from eldercare to high-strain factory operations. In September 2025, Kenqing Technology announced that it had partnered with Haigang Life Insurance to launch its smart elderly care products, which include exoskeleton robots, on the Haibei Bazaar healthcare platform. It also stated that within two days, user engagement and redemptions exceeded expectations, highlighting strong demand for tech-enabled home care solutions. Furthermore, this collaboration aims to enhance safety and convenience for the elderly while promoting wider adoption of exoskeleton-assisted smart care in the country.

India is progressing in the exoskeleton market, in which adoption is efficiently fueled by localized solutions that are suitable for affordability and demand in deployments in neurological rehabilitation and workplace ergonomic support for manual labor sectors. The country also benefits from government hospitals and research centers, which are increasingly trialing these assistive devices. In this regard, Tata Advanced Systems Limited, in February 2025, announced that, in collaboration with the Defence Research and Development Organization (DRDO), it has introduced a passive exoskeleton that is designed to help soldiers carry heavy combat loads across rugged terrains. Besides, the exoskeleton provides mechanical support to key joints by transferring up to 75% of the load to the ground, reducing fatigue as well as injury risk. Hence, this innovation aims to boost soldiers' efficiency and endurance during prolonged missions.

Europe Market Insights

Europe in the exoskeleton market has acquired the most prominent position, highly influenced by strong clinical and research ecosystems that emphasize regulatory compliance and integration with national healthcare systems. The region’s market also benefits from deployment in rehabilitation centers, in which the robotic mobility helps supplement traditional therapies, and in industrial environments that are proactively looking to mitigate injury risk among workforces. In September 2025, Lifeward Ltd. announced that it had received CE mark approval for its ReWalk 7 personal exoskeleton, beginning the commercial sales across the region. Also, this advanced seventh-generation device offers cloud connectivity, customizable walking speeds, and stair navigation, which efficiently enhance mobility for individuals with spinal cord injuries. Furthermore, with strong reimbursement frameworks already established in Germany, the firm aims to expand adoption and revenue growth throughout Europe.

Germany is gaining momentum in the exoskeleton market, backed by increased deployments in automotive and heavy manufacturing sectors. The country’s market also benefits from state-supported R&D initiatives and vocational technology programs that are helping to advance workplace robotics standards. In this regard, the European Investment Bank in December 2022 reported that it made an investment of EUR 15 million (approximately USD 16.4 million) in German Bionic to support R&D for its AI-based smart exoskeleton power suits that are especially designed to aid in logistics and care workers with heavy lifting. Also, this Cray X exoskeleton uses self-learning technology to improve posture, reduce injury risks, and provide real-time ergonomic data, enhancing workplace safety and efficiency. In addition, the funding is backed by the EU’s Invest EU program and aims to strengthen Europe’s leadership in industrial exoskeleton technology and promote sustainable innovation.

In the U.K. exoskeleton market is supported by clinical research and targeted healthcare use cases, industrial sectors, and focused innovation in assistive technologies. Simultaneously, the country’s market benefits from collaboration between academic institutions and robotics firms, which continues to shape the development of solutions suitable for domestic healthcare reimbursement and clinical evidence pathways. In September 2023, XPO Logistics announced that it is expanding the rollout of Hunic exoskeleton suits across the UK and Ireland following a successful pilot trial at multiple sites, including warehouses for Samsung, Volkswagen, and Daimler. The company also notes that the suits assist workers with heavy lifting by promoting correct posture, reducing fatigue, and preventing injury, resulting in a 15% to 20% reduction in unloading time at Samsung operations, prompting XPO to invest in wider deployment for enhanced worker safety and productivity.

Key Exoskeleton Market Players:

- Ekso Bionics Holdings, Inc. (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- ReWalk Robotics Ltd. (Israel)

- Cyberdyne Inc. (Japan)

- Lockheed Martin Corporation (U.S.)

- Panasonic Corporation (Japan)

- Hocoma AG (Switzerland)

- Parker Hannifin Corporation (U.S.)

- Sarcos Technology and Robotics Corporation (U.S.)

- German Bionic (Germany)

- Honda Motor Co., Ltd. (Japan)

- RB3D (France)

- Ottobock SE & Co. KGaA (Germany)

- Levitate Technologies, Inc. (U.S.)

- Fourier (China)

- B‑Temia Inc. (Canada)

- Ekso Bionics is one of the leading players in the exoskeleton market, which is developing wearable exoskeletons for medical as well as industrial applications. Most prominent products of the firm include the Ekso Indego Personal and EksoWorks industrial exoskeletons, which enhance mobility for spinal cord injury patients and their support workers in industrial environments. Further, Esko is also focused on developing user-friendly designs for performance optimization, hence strengthening its position in both healthcare and industrial sectors.

- ReWalk Robotics specializes in terms of lower-limb exoskeletons for individuals with spinal cord injuries, providing FDA-approved wearable devices for home, community, and rehabilitation use. The company is focused on clinical validation and user training programs, which ensure both safety and efficacy. Furthermore, ReWalk proactively pursues strategic collaborations with rehabilitation centers and insurance providers to facilitate adoption and reimbursement.

- Cyberdyne Inc. is identified as yet another dominant force in robotic exoskeletons, which leverages HAL (Hybrid Assistive Limb) technology that integrates brain and muscle signals to aid in movement. The company is primarily focused on both medical rehabilitation and industrial assistance, combining robotics with biofeedback systems. Furthermore, Cyberdyne makes stronger investments in terms of research and development to enhance adaptability, and it also collaborates with hospitals and care facilities, positioning it as a predominant leader in this field.

- German Bionic is focused on industrial exoskeletons, which are designed to increase human strength and endurance in physically demanding situations. Besides, the company has an Apogee ULTRA exoskeleton that provides lifting support, active walking assistance, making it highly suitable for logistics, construction, as well as manufacturing sectors. Furthermore, German Bionic is opting for machine learning for continuous updates, thereby enhancing both comfort and performance for users.

- Sarcos Technology and Robotics is a central player in this field that develops robotic exoskeletons and full-body wearable systems for industrial as well as defense applications. The company has a Guardian series that efficiently enhances human strength and endurance, allowing operators to lift heavy loads safely. In addition, collaborations with defense contractors, construction firms, and logistics providers to deploy exoskeletons at scale are a few strategies opted for by the firm to secure its market position.

Below is the list of some prominent players operating in the global exoskeleton market:

The global exoskeleton market is extremely competitive, in which the major players are focused on technological innovation, strategic partnerships, and application expansion across healthcare, industrial, and defense sectors. Pioneers such as Ekso Bionics and ReWalk Robotics are dominating this field with FDA-cleared medical devices, whereas industrial and military players such as Sarcos, German Bionic, and Lockheed Martin invest in terms of high-performance systems. In April 2025, Ekso Bionics announced that it had partnered with Bionic P&O as the first distributor of its Ekso Indego Personal exoskeleton within the orthotics and prosthetics industry. Besides, the wearable device enables certain spinal cord injury patients to stand and walk independently, featuring a lightweight, modular design for easy use. Furthermore, this alliance combines Ekso Bionics’ advanced robotics expertise with Bionic P&O’s deep clinical knowledge, thereby aiming to enhance patient independence and transform the market.

Corporate Landscape of the Exoskeleton Market:

Recent Developments

- In February 2025, Chulalongkorn University introduced the exoskeleton wheelchair, which is a robotic suit designed to help people with mobility issues sit, stand, and walk, and the innovation combines mechanics with human anatomy, allowing a wheelchair to transform into a wearable exoskeleton, enabling users to navigate stairs and buses.

- In January 2025, German Bionic announced the launch of the Apogee ULTRA, which is the world’s most powerful exoskeleton, providing up to 36 kg of lifting support to assist workers in logistics, manufacturing, construction, and healthcare.

- Report ID: 5103

- Published Date: Dec 19, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Exoskeleton Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.