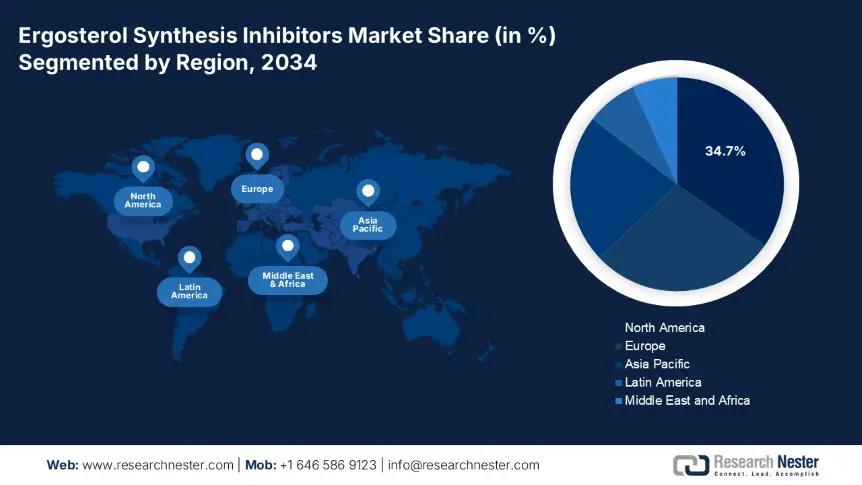

Ergosterol Synthesis Inhibitors Market - Regional Analysis

North America Market Insights

The North America ergosterol synthesis inhibitors market is estimated to lead worldwide, holding a 34.7% share of the overall market at a CAGR of 6.9% by 2034, led by an increasing immunocompromised population, an increasing burden of invasive fungal infections, and robust government-funded healthcare programs. U.S. and Canada benefit with robust surveillance systems (CDC, PHAC) and extensive availability of azole-based treatments through public health programs like Medicaid, Medicare, and provincial drug formularies. Federal centers in the U.S., such as NIH and CDC, invested more than USD 5.5 billion in 2023 in antifungal research, resistance prevention, and outbreak management, while Canada invested USD 3.7 billion in antifungal drug assistance. The region is also experiencing greater use of oral azole treatments because they are cost-effective and possess broad-spectrum efficacy.

The U.S. ergosterol synthesis inhibitors market is growing rapidly with the rise in the number of systemic fungal infections, including candidiasis and aspergillosis in immunocompromised patients. According to the CDC report, nearly 75,010 patients are hospitalized annually due to fungal infections, with Candida auris as an urgent public health threat experienced by both patients and doctors. Further, NIH invested USD 153.5 million in antifungal research in 2023, focusing to ease resistance and develop new azoles. Medicaid on antifungal therapy, including ergosterol synthesis inhibitors, reached USD 1.7 billion in 2024, with 10.4% more patient coverage. On the other hand, Medicare spending increased by 15.5%, amounting to USD 800.5 million, according to reports by KFF and CBO. public hospital and private provider usage of oral azoles is growing due to decreased cost and robust clinical activity.

Asia Pacific Market Insights

The APAC is the fastest-growing region and is estimated to hold a ergosterol synthesis inhibitors market share of 22.5% at a CAGR of 7.9% in the year 2034. The region's growth is fueled by a growing incidence of fungal infections, increased awareness of antifungal drugs, and increased public spending on healthcare. India, China, and Japan have large immunocompromised patient bases due to diseases such as diabetes, cancer, and transplant-related disorders, which stimulate systemic antifungal demand like azoles. Domestic API manufacturing in India and China maintains cost efficiency and supply chain stability, enhancing their position as production hubs. Public-private collaborations and local clinical trials also support APAC's market growth.

China dominates the region and is anticipated to hold the market share of 7.3% in 2034. As per the National Medical Products Administration (NMPA) report, government spending in China on the ergosterol synthesis inhibitors market has increased by 15.5% in the past five years. The rise is mainly driven by growing rates of systemic fungal infections. In 2023, over 1.9 million patients were diagnosed with fungal diseases necessitating antifungal drug treatments. This growth is propelled by the incidence of an aging population, cancer prevalence, and the growing number of immunocompromised patients. Urban pollution and the misuse of antibiotics have also led to more fungal infections. Pharmaceutical corporations are therefore stepping up local production and R&D investment to keep pace with the growing demand.

APAC Government Investment in Ergosterol Synthesis Inhibitor Programs (2021–2025)

|

Country |

Initiative / Policy Name |

Type |

Launch Year |

Investment Value (USD) |

|

Australia |

National Antimicrobial Resistance Strategy – 2020 & Beyond |

Policy / Surveillance Program |

2021 |

$72.6 million (2021–2025) |

|

Japan |

AMED Fungal Infection R&D Acceleration Fund |

R&D Budget via AMED |

2022 |

$280.4 million (2022–2026) |

|

India |

National Program for Fungal Infection Management (MoHFW) |

Budget Allocation for Treatment Access |

2023 |

$2.2 billion annually |

|

South Korea |

KDCA National Antifungal Disease Prevention Strategy |

Policy / Centralized Procurement |

2024 |

$145.5 million (2024–2026) |

|

Malaysia |

National Medicines Policy – Phase 3 (including antifungal access) |

National Drug Policy / Budgeted Rollout |

2025 |

$55.7 million (initial phase) |

Europe Market Insights

The Europe ergosterol synthesis inhibitors market is forecasted to hold 28.3% of global revenue share at a CAGR of 7.1% by 2034, led by increasing awareness, strong surveillance systems, and growing government expenditures on antifungal drug research and availability. Increasing invasive fungal infection cases, especially among the aged and immunocompromised population, are boosting market demand. Countries like Germany, the UK, and France are strategically positioning antifungal therapies high in their public health care systems. As per the European Health Data Space (EHDS) data, the region has increased 10.5% in antifungal medicine demand over the past five years. Growth within the market is also complemented by positive EMA regulatory frameworks, including fast-track opportunities for priority antifungal approvals.

Germany dominates the region and is expected to hold a ergosterol synthesis inhibitors market share of 7.2% by 2034. The country is driven by its strictly organized hospital infrastructure and aggressive infection control measures. According to the Federal Ministry of Health (BMG) and the German Medical Association (BÄK), state expenditure on antifungal drugs was €4.5 billion in 2024, up by 12.7% from 2021. The increase is due to government insurance reimbursement and extensive hospital applications of intravenous azoles for systemic infections. Germany also fronted various EU-funded clinical trials on resistant fungal pathogens under the EU4Health program.

Government Investment and Budget in Europe (2021–2025)

|

Country |

Initiative / Policy Name |

Launch Year |

Investment Value (EUR) |

Government Body / Source |

|

UK |

NHS Antifungal Drug Expansion Plan |

2023 |

€2.3 billion |

NHS, Department of Health and Social Care |

|

France |

National Fungal Resistance Response Plan |

2023 |

€2.6 billion |

Ministry of Solidarity and Health, HAS |

|

Spain |

AEMPS National Drug Access Reform |

2024 |

€1.5 billion |

Spanish Agency for Medicines and Health Products (AEMPS) |

|

Italy |

Italian National Pharmaceutical Access Program (INFAPP) |

2023 |

€1.7 billion |

Italian Medicines Agency (AIFA), Ministry of Health |