Ergosterol Synthesis Inhibitors Market Outlook:

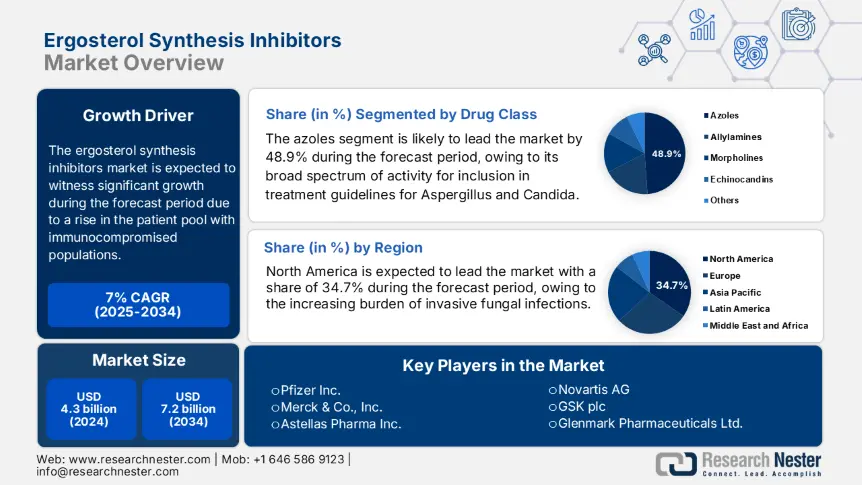

Ergosterol Synthesis Inhibitors Market size was valued at USD 4.3 billion in 2024 and is projected to reach USD 7.2 billion by the end of 2034, rising at a CAGR of 7% during the forecast period 2025-2034. In 2025, the industry size of ergosterol synthesis inhibitors is assessed at USD 4.4 billion in 2025.

The global ergosterol synthesis inhibitors market is continuously growing with the rise in the patient pool with immunocompromised populations, including transplant recipients, oncology patients, and individuals with HIV/AIDS. As per the Centers for Disease Control and Prevention (CDC) report, nearly 74,990 hospitals in the U.S. treat patients suffering from severe fungal infections, including Candida, Aspergillus, and Cryptococcus. Candida auris is a serious public health concern, with infections being reported across more than 35 countries, including the U.S., India, and South Africa. C. auris is listed as a critical priority pathogen by the World Health Organization (WHO), which further aids the clinical need for ongoing antifungal supply and innovation.

On the supply chain side, the manufacturing of ergosterol synthesis inhibitors relies significantly on the global movement of Active Pharmaceutical Ingredients (APIs), which are mainly obtained from India and China. Further, on the pricing view, the U.S. Producer Price Index (PPI) for pharmaceutical preparations increased by 2.6% in 2023 according to the U.S. Bureau of Labor Statistics (BLS), affecting upstream drug manufacturing costs. In contrast, the Consumer Price Index (CPI) for prescription medication crept up by 2.2% in the same period, fueled by inflation-adjusted price controls and rebate structures within public health programs. The market has seen increasing investments in research, development, and deployment (RDD), especially in antifungal-resistant strain targeting.

Ergosterol Synthesis Inhibitors Market - Growth Drivers and Challenges

Growth Drivers

- High prevalence of immunocompromised conditions: The increasing incidence of immunocompromised diseases such as cancer, HIV/AIDS, and post-organ transplant is fueling global demand for ergosterol synthesis inhibitors. According to the Robert Koch Institute, in Germany, more than 2.4 million patients needed antifungal treatment in 2025, which is a 26.3% growth since 2018. Likewise, the CDC projected 970,010 invasive fungal infections in the U.S. in 2023, with systemic azoles as the first-line treatment. This increase is closely related to the growing population of immunocompromised individuals, indicating an urgent need for effective antifungal treatments within public and private healthcare systems.

- Advancements in technology on antifungal delivery: The technological innovations in the market are redefining the strategies in antifungal manufacturing and delivery. The Smart API Manufacturing Platform in 2024 has minimized the batch release times by 25.6% resulting in enhanced supply chain efficiency and product availability. Meanwhile, Astellas improved treatment accuracy and clinical outcomes in 2025 by introducing an AI-powered azole resistance surveillance system that reduced misprescription rates by 22.6%. These innovations address challenges on the supply side in the market, aiding rapid production, better resistance monitoring, and more targeted patient care.

Challenges

- Antifungal resistance resulting in costlier R&D: The azole resistance is increasing rapidly, as the agricultural fungicides are being overused. As per the WHO report, over 40.5% of countries have a high incidence of azole resistance above 20.8%, particularly among Candida and Aspergillus species. In response to this, second- and third-generation azoles with improved profiles for resistance are significantly raising R&D expenditure. These innovations tend to be associated with more expensive drugs, which generate reimbursement resistance in developed and emerging markets. Regulatory agencies also now require extensive resistance profiling before approval, further expanding commercialization timelines.

Ergosterol Synthesis Inhibitors Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2034 |

|

CAGR |

7% |

|

Base Year Market Size (2024) |

USD 4.3 billion |

|

Forecast Year Market Size (2034) |

USD 7.2 billion |

|

Regional Scope |

|

Ergosterol Synthesis Inhibitors Market Segmentation:

Drug Class Segment Analysis

In the segment of the drug class, azoles retain the highest market share and are projected to maintain the market share of 48.9% in 2034. Azoles lead the ergosterol synthesis inhibitors market because of their broad spectrum of activity, long clinical history, and recommendation for inclusion in treatment guidelines for Aspergillus, Candida, and Cryptococcus. Fluconazole and voriconazole are the most commonly prescribed antifungals in hospital and outpatient care. The U.S. CDC also mentions that azoles are first-line drugs in treating cryptococcal meningitis and invasive candidiasis, both of which are on an increasing trend among immunocompromised patients. Their common availability both in generic and branded versions strongly establishes their market leadership.

Route of Administration Segment Analysis

Under the route of administration segment, oral sub-segment dominates the ergosterol synthesis inhibitors market and will hold a revenue share of 42.7% in 2034. Oral preparations hold the largest share in 2034 owing to their high compliance rate among patients, simplicity of storage and distribution, and cost savings. The majority of first-line therapies for superficial and mild-to-moderate systemic fungal infections initiate treatment with oral agents, especially in the outpatient setting. As stated by the National Library of Medicine (NIH), the oral antifungals are the treatment of choice for dermatophytosis and onychomycosis, which are two of the most prevalent fungal infections in the world.

Our in-depth analysis of the global ergosterol synthesis inhibitors market includes the following segments:

|

Segment |

Subsegments |

|

Drug Class |

|

|

Route of Administration |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Ergosterol Synthesis Inhibitors Market - Regional Analysis

North America Market Insights

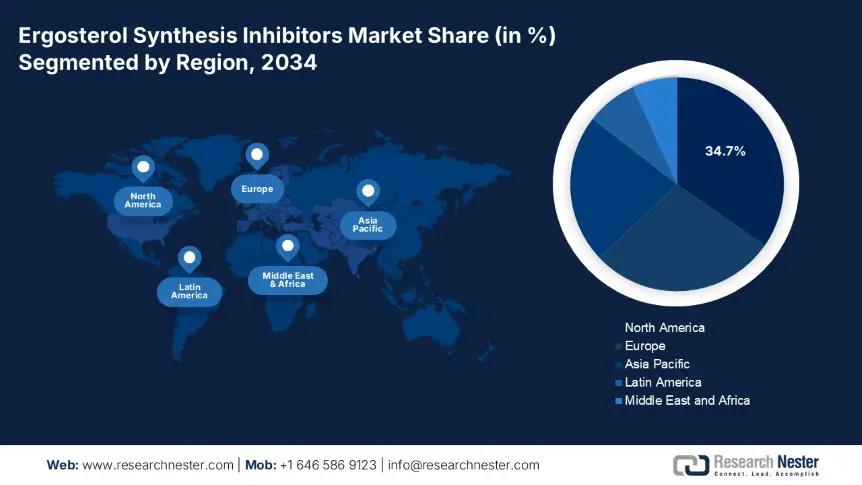

The North America ergosterol synthesis inhibitors market is estimated to lead worldwide, holding a 34.7% share of the overall market at a CAGR of 6.9% by 2034, led by an increasing immunocompromised population, an increasing burden of invasive fungal infections, and robust government-funded healthcare programs. U.S. and Canada benefit with robust surveillance systems (CDC, PHAC) and extensive availability of azole-based treatments through public health programs like Medicaid, Medicare, and provincial drug formularies. Federal centers in the U.S., such as NIH and CDC, invested more than USD 5.5 billion in 2023 in antifungal research, resistance prevention, and outbreak management, while Canada invested USD 3.7 billion in antifungal drug assistance. The region is also experiencing greater use of oral azole treatments because they are cost-effective and possess broad-spectrum efficacy.

The U.S. ergosterol synthesis inhibitors market is growing rapidly with the rise in the number of systemic fungal infections, including candidiasis and aspergillosis in immunocompromised patients. According to the CDC report, nearly 75,010 patients are hospitalized annually due to fungal infections, with Candida auris as an urgent public health threat experienced by both patients and doctors. Further, NIH invested USD 153.5 million in antifungal research in 2023, focusing to ease resistance and develop new azoles. Medicaid on antifungal therapy, including ergosterol synthesis inhibitors, reached USD 1.7 billion in 2024, with 10.4% more patient coverage. On the other hand, Medicare spending increased by 15.5%, amounting to USD 800.5 million, according to reports by KFF and CBO. public hospital and private provider usage of oral azoles is growing due to decreased cost and robust clinical activity.

Asia Pacific Market Insights

The APAC is the fastest-growing region and is estimated to hold a ergosterol synthesis inhibitors market share of 22.5% at a CAGR of 7.9% in the year 2034. The region's growth is fueled by a growing incidence of fungal infections, increased awareness of antifungal drugs, and increased public spending on healthcare. India, China, and Japan have large immunocompromised patient bases due to diseases such as diabetes, cancer, and transplant-related disorders, which stimulate systemic antifungal demand like azoles. Domestic API manufacturing in India and China maintains cost efficiency and supply chain stability, enhancing their position as production hubs. Public-private collaborations and local clinical trials also support APAC's market growth.

China dominates the region and is anticipated to hold the market share of 7.3% in 2034. As per the National Medical Products Administration (NMPA) report, government spending in China on the ergosterol synthesis inhibitors market has increased by 15.5% in the past five years. The rise is mainly driven by growing rates of systemic fungal infections. In 2023, over 1.9 million patients were diagnosed with fungal diseases necessitating antifungal drug treatments. This growth is propelled by the incidence of an aging population, cancer prevalence, and the growing number of immunocompromised patients. Urban pollution and the misuse of antibiotics have also led to more fungal infections. Pharmaceutical corporations are therefore stepping up local production and R&D investment to keep pace with the growing demand.

APAC Government Investment in Ergosterol Synthesis Inhibitor Programs (2021–2025)

|

Country |

Initiative / Policy Name |

Type |

Launch Year |

Investment Value (USD) |

|

Australia |

National Antimicrobial Resistance Strategy – 2020 & Beyond |

Policy / Surveillance Program |

2021 |

$72.6 million (2021–2025) |

|

Japan |

AMED Fungal Infection R&D Acceleration Fund |

R&D Budget via AMED |

2022 |

$280.4 million (2022–2026) |

|

India |

National Program for Fungal Infection Management (MoHFW) |

Budget Allocation for Treatment Access |

2023 |

$2.2 billion annually |

|

South Korea |

KDCA National Antifungal Disease Prevention Strategy |

Policy / Centralized Procurement |

2024 |

$145.5 million (2024–2026) |

|

Malaysia |

National Medicines Policy – Phase 3 (including antifungal access) |

National Drug Policy / Budgeted Rollout |

2025 |

$55.7 million (initial phase) |

Europe Market Insights

The Europe ergosterol synthesis inhibitors market is forecasted to hold 28.3% of global revenue share at a CAGR of 7.1% by 2034, led by increasing awareness, strong surveillance systems, and growing government expenditures on antifungal drug research and availability. Increasing invasive fungal infection cases, especially among the aged and immunocompromised population, are boosting market demand. Countries like Germany, the UK, and France are strategically positioning antifungal therapies high in their public health care systems. As per the European Health Data Space (EHDS) data, the region has increased 10.5% in antifungal medicine demand over the past five years. Growth within the market is also complemented by positive EMA regulatory frameworks, including fast-track opportunities for priority antifungal approvals.

Germany dominates the region and is expected to hold a ergosterol synthesis inhibitors market share of 7.2% by 2034. The country is driven by its strictly organized hospital infrastructure and aggressive infection control measures. According to the Federal Ministry of Health (BMG) and the German Medical Association (BÄK), state expenditure on antifungal drugs was €4.5 billion in 2024, up by 12.7% from 2021. The increase is due to government insurance reimbursement and extensive hospital applications of intravenous azoles for systemic infections. Germany also fronted various EU-funded clinical trials on resistant fungal pathogens under the EU4Health program.

Government Investment and Budget in Europe (2021–2025)

|

Country |

Initiative / Policy Name |

Launch Year |

Investment Value (EUR) |

Government Body / Source |

|

UK |

NHS Antifungal Drug Expansion Plan |

2023 |

€2.3 billion |

NHS, Department of Health and Social Care |

|

France |

National Fungal Resistance Response Plan |

2023 |

€2.6 billion |

Ministry of Solidarity and Health, HAS |

|

Spain |

AEMPS National Drug Access Reform |

2024 |

€1.5 billion |

Spanish Agency for Medicines and Health Products (AEMPS) |

|

Italy |

Italian National Pharmaceutical Access Program (INFAPP) |

2023 |

€1.7 billion |

Italian Medicines Agency (AIFA), Ministry of Health |

Key Ergosterol Synthesis Inhibitors Market Players:

- Pfizer Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Merck & Co., Inc.

- Astellas Pharma Inc.

- Novartis AG

- GSK plc

- Glenmark Pharmaceuticals Ltd.

- Sun Pharmaceutical Industries Ltd.

- Bayer AG

- Teva Pharmaceutical Industries Ltd.

- Cipla Ltd.

- Dr. Reddy’s Laboratories

- Hikma Pharmaceuticals

- Abbott Laboratories

- Viatris Inc. (formerly Mylan)

- Cadila Healthcare (Zydus Lifesciences)

- Eisai Co., Ltd.

- Biocon Ltd.

- Dong-A ST

- Biocon Sdn Bhd

- CSL Limited

The global ergosterol synthesis inhibitors market is very competitive, with multinational pharma majors and generic players from Asia. Market leaders like Pfizer, Merck, and Astellas are followed by Indian generics-driven market players like Glenmark, Sun Pharma, and Cipla. Further, market leaders are focusing on strategies like API localization, R&D on antifungal resistance, regional collaborations, and increased production in emerging countries. Government partnerships, particularly in Japan and Europe, are facilitating fast-track drug approvals and funding for aggressive fungal infections, increasing competition throughout all levels of the market.

Below is the list of some prominent players operating in the global ergosterol synthesis inhibitors market:

Recent Developments

- In May 2024, Glenmark launched Itraconazole NP capsules to address absorption challenges in patients with chronic fungal infections. The post launch has shown a 14.5% rise in the sales audit.

- In March 2024, Pfizer announced the commercial rollout of the long-acting injectable formulation of Fluconazole for hospital and outpatient use in high-risk immunocompromised patients. The launch contributed to a 7.9% increase in Pfizer’s hospital antifungal segment revenue

- Report ID: 3111

- Published Date: Jul 21, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert