- An Outline of the Epoxy Hardener Market

- Market Definition

- Market Segmentation

- Product Overview

- Assumptions and Abbreviations

- Research Methodology & Approach

- Research Process

- Primary Research

- Manufacturers

- Suppliers/ Distributors

- End Users

- Secondary Research

- Market Size Estimation

- Summary of the Report for Key Decision Makers

- Forces of the Market Constituents

- Factors/Drivers Impacting the Growth of the Market

- Market Trends for Better Business Practices

- Key Market Opportunities for Business Growth

- Based on the Type

- Based on the Form

- Based on the Application

- Based on the End User

- Based on Geographical Presence

- Major Roadblocks for the Market Growth

- Government Regulations

- Technology Transition and Adoption Analysis

- Industry Risk Analysis

- Global Economic Outlook: Challenges for Global Recovery and its Impact on Global Epoxy Hardener Market

- Ukraine-Russia Crisis

- Potential US Economic Slowdown

- Impact of COVID-19 on Global Epoxy Hardener Market

- Regional Analysis on Epoxy Hardener Market

- Industry Pricing Benchmarking & Analysis

- Industry Growth Outlook

- Industry Supply Chain Analysis

- EXIM Analysis of Epoxy Resin

- Export Analysis

- Exported Value (USD Thousand)

- Analysis of Key Exporting Countries

- Key Regulation

- Import Analysis

- Imported Value (USD Thousand)

- Analysis of Key Importing Countries

- Key Regulation

- Export Analysis

- End User Analysis

- Competitive Positioning: Strategies to Differentiate a Company from its Competitors

- Competitive Model: A Detailed Inside View for Investors

- Market Share of Major Companies Profiled, 2023

- Business Profiles of Key Enterprises

- Cardolite Corporation

- Evonik Industries AG

- BASF SE

- Mitsubishi Chemical Corporation

- Huntsman International LLC

- Hexion Inc.

- Olin Corporation

- KUKDO CHEMICAL CO., LTD.

- Nouryon Chemicals Holding B.V.

- Incorez Ltd

- Global Epoxy Hardener Market Outlook & Projections, Opportunity Assessment, 2023-2036

- Market Overview

- Revenue by Value (USD Million) and Compound Annual Growth Rate (CAGR)

- Market Revenue by Volume (Kilo Tons) and Compound Annual Growth Rate (CAGR)

- By Type

- Polyamide, Market Value (USD Million), Market Volume (Kilo Tons), CAGR, 2023-2036F

- Aromatic Amine, Market Value (USD Million), Market Volume (Kilo Tons), CAGR, 2023-2036F

- Amino Amine, Market Value (USD Million), Market Volume (Kilo Tons), CAGR, 2023-2036F

- Aliphatic Amine, Market Value (USD Million), Market Volume (Kilo Tons), CAGR, 2023-2036F

- Cycloaliphatic Amine, Market Value (USD Million), Market Volume (Kilo Tons), CAGR, 2023-2036F

- Others, Market Value (USD Million), Market Volume (Kilo Tons), CAGR, 2023-2036F

- By Form

- Solvent-Based, Market Value (USD Million), Market Volume (Kilo Tons), CAGR, 2023-2036F

- Waterborne, Market Value (USD Million), Market Volume (Kilo Tons), CAGR, 2023-2036F

- Solid, Market Value (USD Million), Market Volume (Kilo Tons), CAGR, 2023-2036F

- By Application

- Paints and Coatings, Market Value (USD Million), Market Volume (Kilo Tons), CAGR, 2023-2036F

- Adhesives and Sealants, Market Value (USD Million), Market Volume (Kilo Tons), CAGR, 2023-2036F

- Electronic Encapsulation, Market Value (USD Million), Market Volume (Kilo Tons), CAGR, 2023-2036F

- Composites, Market Value (USD Million), Market Volume (Kilo Tons), CAGR, 2023-2036F

- Others, Market Value (USD Million), Market Volume (Kilo Tons), CAGR, 2023-2036F

- By End User

- Building and Construction, Market Value (USD Million), Market Volume (Kilo Tons), CAGR, 2023-2036F

- Marine Industry, Market Value (USD Million), Market Volume (Kilo Tons), CAGR, 2023-2036F

- Aerospace, Market Value (USD Million), Market Volume (Kilo Tons), CAGR, 2023-2036F

- Electrical & Electronics, Market Value (USD Million), Market Volume (Kilo Tons), CAGR, 2023-2036F

- Energy & Power, Market Value (USD Million), Market Volume (Kilo Tons), CAGR, 2023-2036F

- Others, Market Value (USD Million), Market Volume (Kilo Tons), CAGR, 2023-2036F

- By Geography

- North America, Market Value (USD Million), Market Volume (Kilo Tons), CAGR, 2023-2036F

- Europe, Market Value (USD Million), Market Volume (Kilo Tons), CAGR, 2023-2036F

- Asia Pacific, Market Value (USD Million), Market Volume (Kilo Tons), CAGR, 2023-2036F

- Latin America, Market Value (USD Million), Market Volume (Kilo Tons), CAGR, 2023-2036F

- Middle East & Africa, Market Value (USD Million), Market Volume (Kilo Tons), CAGR, 2023-2036F

- Cross Analysis of Global Epoxy Hardener Market by Type w.r.t. End User (Value and Volume)

- By Type

- North America Epoxy Hardener Market Outlook & Projections, Opportunity Assessment, 2023 to 2036

- Market Overview

- Market Revenue by Value USD Million) and Compound Annual Growth Rate (CAGR)

- Market Revenue by Volume (Kilo Tons) and Compound Annual Growth Rate (CAGR)

- By Type

- Polyamide, Market Value (USD Million), Market Volume (Kilo Tons), CAGR, 2023-2036F

- Aromatic Amine, Market Value (USD Million), Market Volume (Kilo Tons), CAGR, 2023-2036F

- Amino Amine, Market Value (USD Million), Market Volume (Kilo Tons), CAGR, 2023-2036F

- Aliphatic Amine, Market Value (USD Million), Market Volume (Kilo Tons), CAGR, 2023-2036F

- Cycloaliphatic Amine, Market Value (USD Million), Market Volume (Kilo Tons), CAGR, 2023-2036F

- Others, Market Value (USD Million), Market Volume (Kilo Tons), CAGR, 2023-2036F

- By Form

- Solvent-Based, Market Value (USD Million), Market Volume (Kilo Tons), CAGR, 2023-2036F

- Waterborne, Market Value (USD Million), Market Volume (Kilo Tons), CAGR, 2023-2036F

- Solid, Market Value (USD Million), Market Volume (Kilo Tons), CAGR, 2023-2036F

- By Application

- Paints and Coatings, Market Value (USD Million), Market Volume (Kilo Tons), CAGR, 2023-2036F

- Adhesives and Sealants, Market Value (USD Million), Market Volume (Kilo Tons), CAGR, 2023-2036F

- Electronic Encapsulation, Market Value (USD Million), Market Volume (Kilo Tons), CAGR, 2023-2036F

- Composites, Market Value (USD Million), Market Volume (Kilo Tons), CAGR, 2023-2036F

- Others, Market Value (USD Million), Market Volume (Kilo Tons), CAGR, 2023-2036F

- By End User

- Building and Construction, Market Value (USD Million), Market Volume (Kilo Tons), CAGR, 2023-2036F

- Marine Industry, Market Value (USD Million), Market Volume (Kilo Tons), CAGR, 2023-2036F

- Aerospace, Market Value (USD Million), Market Volume (Kilo Tons), CAGR, 2023-2036F

- Electrical & Electronics, Market Value (USD Million), Market Volume (Kilo Tons), CAGR, 2023-2036F

- Energy & Power, Market Value (USD Million), Market Volume (Kilo Tons), CAGR, 2023-2036F

- Others, Market Value (USD Million), Market Volume (Kilo Tons), CAGR, 2023-2036F

- By Country

- United States, Market Value (USD Million), Market Volume (Kilo Tons), CAGR, 2023-2036F

- Canada, Market Value (USD Million), Market Volume (Kilo Tons), CAGR, 2023-2036F

- By Type

- Europe Epoxy Hardener Market Outlook & Projections, Opportunity Assessment, 2023 to 2036

- Market Overview

- Market Revenue by Value (USD Million) and Compound Annual Growth Rate (CAGR)

- Market Revenue by Volume (Kilo Tons)

- By Type

- By Form

- By Application

- By End-User

- By Country

- United Kingdom, Market Value (USD Million), Market Volume (Kilo Tons), CAGR, 2023-2036F

- Germany, Market Value (USD Million), Market Volume (Kilo Tons), CAGR, 2023-2036F

- France, Market Value (USD Million), Market Volume (Kilo Tons), CAGR, 2023-2036F

- Italy, Market Value (USD Million), Market Volume (Kilo Tons), CAGR, 2023-2036F

- Spain, Market Value (USD Million), Market Volume (Kilo Tons), CAGR, 2023-2036F

- Russia, Market Value (USD Million), Market Volume (Kilo Tons), CAGR, 2023-2036F

- Netherlands, Market Value (USD Million), Market Volume (Kilo Tons), CAGR, 2023-2036F

- Rest of Europe, Market Value (USD Million), Market Volume (Kilo Tons), CAGR, 2023-2036F

- Asia Pacific Epoxy Hardener Market Outlook & Projections, Opportunity Assessment, 2023 to 2036

- Market Overview

- Market Revenue by Value (USD Million) and Compound Annual Growth Rate (CAGR)

- Market Revenue by Volume (Kilo Tons)

- By Type

- By Form

- By Application

- By End-User

- By Country

- China, Market Value (USD Million), Market Volume (Kilo Tons), CAGR & Y-o-Y Growth Trend, 2023-2036F

- India, Market Value (USD Million), Market Volume (Kilo Tons), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Japan, Market Value (USD Million), Market Volume (Kilo Tons), CAGR & Y-o-Y Growth Trend, 2023-2036F

- South Korea, Market Value (USD Million), Market Volume (Kilo Tons), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Singapore, Market Value (USD Million), Market Volume (Kilo Tons), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Australia, Market Value (USD Million), Market Volume (Kilo Tons), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Rest of Asia Pacific, Market Value (USD Million), Market Volume (Kilo Tons), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Latin America Epoxy Hardener Market Outlook & Projections, Opportunity Assessment, 2023 to 2036

- Market Overview

- Market Revenue by Value (USD Million) and Compound Annual Growth Rate (CAGR)

- Market Revenue by Volume (Kilo Tons)

- By Type

- By Form

- By Application

- By End-User

- By Country

- Brazil, Market Value (USD Million), Market Volume (Kilo Tons), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Mexico, Market Value (USD Million), Market Volume (Kilo Tons), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Argentina, Market Value (USD Million), Market Volume (Kilo Tons), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Rest of Latin America, Market Value (USD Million), Market Volume (Kilo Tons), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Middle East & Africa Epoxy Hardener Market Outlook & Projections, Opportunity Assessment, 2023 to 2036

- Market Overview

- Analysis on Govt. Guidelines, Trends in the region & Impact on Y-O-Y Revenue

- Market Revenue by Value (USD Million) and Compound Annual Growth Rate (CAGR)

- Market Revenue by Volume (Kilo Tons)

- Year-on-Year (Y-o-Y) Growth Trend Analysis

- By Type

- By Form

- By Application

- By End-User

- By Country

- Israel, Market Value (USD Million), Market Volume (Kilo Tons), CAGR, 2023-2036F

- GCC, Market Value (USD Million), Market Volume (Kilo Tons), CAGR, 2023-2036F

- South Africa, Market Value (USD Million), Market Volume (Kilo Tons), CAGR, 2023-2036F

- Rest of Middle East & Africa, Market Value (USD Million), Market Volume (Kilo Tons), CAGR, 2023-2036F

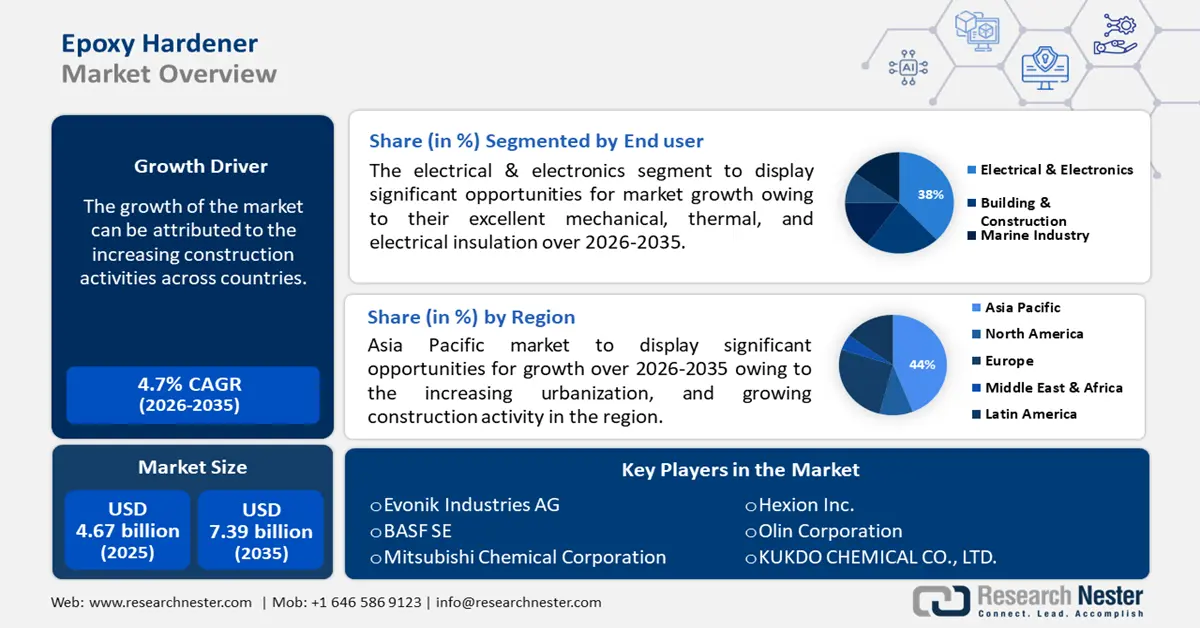

Epoxy Hardener Market Outlook:

Epoxy Hardener Market size was valued at USD 4.67 billion in 2025 and is set to exceed USD 7.39 billion by 2035, registering over 4.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of epoxy hardener is evaluated at USD 4.87 billion.

The growth of the market can be attributed to the increasing construction activities across countries. Furthermore, the continual emphasis on technological innovation in semiconductors and consumer electronics is also contributing to the growth of the epoxy hardener market. For instance, according to the Semiconductor Industry Association (SIA), a U.S.-based trade association, the semiconductor industry sales rose to an estimated USD 49 billion in July 2022 from nearly USD 45 billion in July 2021.

In addition to these, factors that are believed to fuel the market growth of epoxy hardeners include the increasing inclination towards eco-friendly epoxy hardeners, notably in the energy sector. Furthermore, epoxy hardeners are known for their excellent adhesion properties and ability to withstand extreme temperatures and harsh environments. For instance, in April 2020, Chemical Process Services Ltd. (CPS) researched and developed a new series of “green” epoxy hardeners named Furalkamines, a new form of Mannich base epoxy hardeners derived from pentosane-rich biomass.

Key Epoxy Hardener Market Insights Summary:

Regional Highlights:

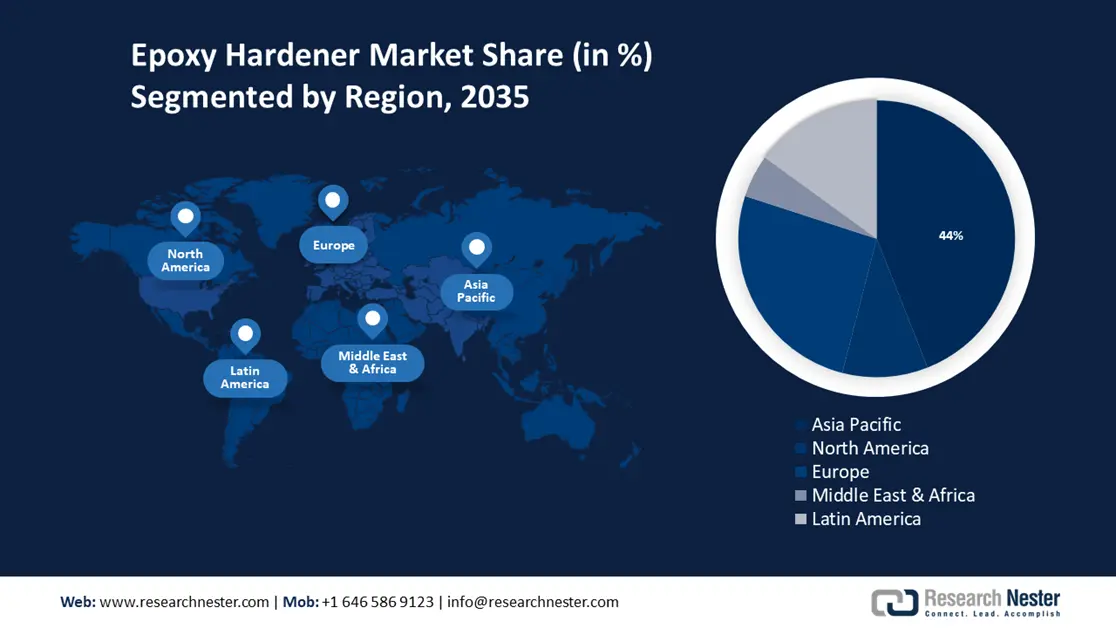

- Asia Pacific epoxy hardener market is poised to capture 44% share by 2035, propelled by increasing urbanization and growing construction activity across Asian countries, notably China.

- Europe market will register significant CAGR from 2026 to 2035, attributed to rising demand for lighter composite components in the aircraft and automotive industry to improve durability, efficiency, and strength.

Segment Insights:

- The solid epoxy hardener segment in the epoxy hardener market is expected to experience substantial growth during 2026-2035, attributed to corrosion resistance and high-quality chemical-resistant coating applications.

- The electrical & electronics segment in the epoxy hardener market is expected to hold the largest share by 2035, driven by high usage of epoxy hardener in electrical composites and PCBs.

Key Growth Trends:

- Increasing Construction Activities across Countries

- Growing Demand across Electronics and Semiconductor Industry

Major Challenges:

- Increasing Construction Activities across Countries

- Growing Demand across Electronics and Semiconductor Industry

Key Players: Cardolite Corporation, Evonik Industries AG, BASF SE, Mitsubishi Chemical Corporation, Huntsman International LLC, Hexion Inc., Olin Corporation, KUKDO CHEMICAL CO., LTD., Nouryon Chemicals Holding B.V., Incorez Ltd.

Global Epoxy Hardener Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4.67 billion

- 2026 Market Size: USD 4.87 billion

- Projected Market Size: USD 7.39 billion by 2035

- Growth Forecasts: 4.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (44% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, South Korea

- Emerging Countries: China, India, Japan, South Korea, Vietnam

Last updated on : 8 September, 2025

Epoxy Hardener Market Growth Drivers and Challenges:

Growth Drivers

-

Increasing Construction Activities across Countries - The growing infrastructure investments by the government, the rising residential sector, and improving living standards are the major factors driving construction growth that is estimated to propel the demand for epoxy hardeners across various applications. For instance, according to the World Bank, the total urban population was 4.4 billion in 2021, which experienced an increase of 2.3% compared to 2020. Moreover, government investments in various public infrastructure projects such as connectivity projects, housing projects, and smart cities are likely to augment the growth of the construction industry.

- Growing Demand across Electronics and Semiconductor Industry - Epoxy resins are the major component of durable epoxy compounds used in semiconductor packaging assemblies and printed circuit boards since they protect the semiconductor from factors in the external environment, such as moisture, heat, and shock. Furthermore, the continuous technological innovation in semiconductors and consumer electronics is fueling the market demand for epoxy hardeners. According to the India Brand Equity Foundation, the production of electronics hardware in the country stood at USD 63.39 billion in 2021.

- Increasing Utilization in Energy Sector - Epoxy resin-based composite materials have become established as material for rotor blades. Wind energy is on the rise as a climate-friendly source of energy. For instance, 24,000 tons of Bisphenol A (BPA)-based epoxy resin are used in rotor blades in Europe annually (out of which 52,000 tons of the resins are used in overall wind turbine design overall).

- Surging Adoption of Epoxy Hardener in Automobile Industry - Epoxy hardener is used in automotive coatings owing to its chemical properties, such as mechanical strength, adhesion to metals, and heat resistance. These properties protect car bodywork from corrosion and other damages, sometimes doubling the lifetime of a car. Besides, it is used to manufacture composite parts of automobiles. According to the International Organization of Motor Vehicle Manufacturers (OICA), 80,145,988 automobiles were manufactured in 2021, and 77,621,582 were manufactured in 2020. The increasing production rate in the automobile industry is expected to flourish the global epoxy hardener market.

Challenges

- Toxicity Effect Owing to Volatile Organic Compound Emissions - Epoxy resins and their hardeners are complex chemical compounds that, in some cases, can cause injury if handled improperly. Amine-based epoxy hardeners release VOCs, potentially becoming hazardous air pollutants. They can cause several health issues, including eye irritations, burns, nose or throat allergies, asthma, and sometimes skin cancer. Besides, they can cause other effects, such as headaches, dizziness, and confusion. When it comes to skin contact, it is usually where the problems arise. It can be an irritant, which can give toxic eczema, or a sensitizer, which can give allergic contact dermatitis. Among the hardeners, aliphatic polyamines can cause the most skin lesions. For instance, according to the World Health Organization (WHO), approximately 2-3 million cases of non-melanoma skin cancers and 132 million cases of melanoma skin cancers are recorded worldwide annually. Moreover, 1 in 3 cancers diagnosed is skin cancer.

- High Fluctuation in the Prices of the Raw Materials

- Easy Availability of Alternatives

Epoxy Hardener Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.7% |

|

Base Year Market Size (2025) |

USD 4.67 billion |

|

Forecast Year Market Size (2035) |

USD 7.39 billion |

|

Regional Scope |

|

Epoxy Hardener Market Segmentation:

End-user

The electrical & electronics segment is estimated to have the largest epoxy hardener market revenue in the year 2035. This can be attributed to the frequently used of epoxy hardener in creating electrical composites owing to their excellent mechanical, thermal, and electrical insulation. Moreover, these are also utilized in electronic components like printed circuit boards (PCBs), fiber optics, LEDs, and other adhesive applications owing to their quick cycle times, great insulating qualities, low shrinkage, excellent impregnation, hydrophobicity, vibration dampening, low exotherm, high thermal conductivity, superb toughness, and high strength. In addition, epoxy hardeners are primarily in demand for the fabrication of PCBs, which are used in a variety of electronic products, including smartphones, hard drives, optical communication, drones, wearables, and other consumer electronics, leading to the growth of the epoxy hardener market.

Form

The solid epoxy hardener segment is expected to grow at a substantial CAGR during the forecast period. Solid epoxy hardeners are suitable for coatings on concrete where the solvent cannot, in addition to corrosion protection applications on steel. These make an excellent foundation for various high-quality chemical-resistant coatings that can tolerate exposure to corrosive environments. Furthermore, the prices are comparatively cheaper than waterborne epoxy hardeners, which makes them attractive across every application. High penetration of these epoxy hardeners in paints and coatings applications is expected to benefit the segmental market growth.

Our in-depth analysis of the global market includes the following segments:

|

By Type |

|

|

By Form |

|

|

By Application |

|

|

By End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Epoxy Hardener Market Regional Analysis:

APAC Market Insights

The Asia Pacific industry is anticipated to hold largest revenue share of 44% by 2035. The growth of the market can be attributed majorly to the increasing urbanization, and growing construction activity across Asian countries, notably China. China accounts for about 50 percent of the world’s production of printed circuit boards (PCBs). For instance, in 2020, China exported USD 17.2 Billion in printed circuit boards, making it the world's 1st largest exporter of printed circuit boards. In 2020, China imported USD 6.11 billion in printed circuit boards, becoming the 2nd largest importer of printed circuit boards. In addition, Moreover, energy control policy had a positive impact on the Chinese epoxy resin market as the policy pushed the consumers to focus more on renewable energy sources.

Europe Market Insights

Europe region is set to witness significant growth till 2035. Demand for lighter composite components in the aircraft and automotive industry is a key demand driver in the region since such features contribute to lowering emissions and improving durability, efficiency, strength, and reliability. Besides, the strong presence of leading aircraft component manufacturing companies across the country bolstered the sale of epoxy hardeners. For instance, according to the European epoxy resin committee, the weight savings achieved by using epoxy composites are estimated to reduce fuel usage by some 230 million kg per year, saving USD 147.9 million in fuel costs and 720,000 of CO2 aircraft emissions per year. The European transport sector uses about 49,000 tons of epoxy resins produced annually by epoxy resin committee members.

Latin America Insights

Latin America region is projected to register substantial growth through 2035. Rising demand for lighter composite components, paints, and coatings and rising investments in the automotive industry are key demand drivers in the region. Epoxy-based coating provides significant advantages in preventing rust and corrosion on vehicles’ bodies and critical metal parts. Epoxy-based composite components offer better fuel efficiency owing to their reduced weight. For instance, according to the International Organization of Motor Vehicle Manufacturers, motor vehicle production in Latin America was 3,337,795 in 2019, 2,318,523 in 2020, and 2,723,770 in 2021. Besides, in July 2022, Renault announced its plan to invest USD 377.1 million in Brazil to produce a new SUV and a new 1.0-liter turbocharged engine.

Epoxy Hardener Market Players:

- Cardolite Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Evonik Industries AG

- BASF SE

- Mitsubishi Chemical Corporation

- Huntsman International LLC

- Hexion Inc.

- Olin Corporation

- KUKDO CHEMICAL CO., LTD.

- Nouryon Chemicals Holding B.V.

- Incorez Ltd

Recent Developments

- Cardolite Corporation launched NX-8402 a new waterborne curing agent that does not contain any solvent and does not require co-solvents to form a film properly. Since this epoxy curing agent is supplied as an emulsion, it can be easily diluted in water as is and after mixing with epoxy resins. As a result, NX-8402 enables zero and low VOC formulations that meet many industrial applications' requirements. Moreover, NX-8402 is compatible with various epoxy dispersion resins, including standard liquid epoxy. The good handling properties of NX-8402 give formulators latitude to work.

- Nouryon announced its plans to build a new production facility to meet the increasing global demand for innovative and sustainable additives for the rapidly growing paints and coatings end market and other high-growth end markets. The new facility will be situated in Southeast Asia. With a 15-20 kilotons capacity, it will expand Nouryon’s business to multinational and regional customers.

- Report ID: 3398

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Epoxy Hardener Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.