Epinephrine Market Outlook:

Epinephrine Market size was over USD 2.99 Billion in 2025 and is anticipated to cross USD 6.7 Billion by 2035, growing at more than 8.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of epinephrine is assessed at USD 3.22 Billion.

The growth of the market can be attributed to the worldwide growing prevalence of several allergic reactions, along with the surge in neurological disorders. It is observed that every year, around 6 million people worldwide die from neurological disorders. In addition to this, the rising proportion of individuals who are prone to several allergies is another major factor that is estimated to boost the market growth throughout the forecast period.

In addition to these, factors that are believed to fuel the market growth of epinephrine include the upsurge in food allergy stances throughout the world. For instance, in the United States, approximately 33 million individuals are affected by food allergies. Furthermore, epinephrine is used as the first line of treatment to help reverse the effects of anaphylaxis. Individuals suffering from anaphylactic shock frequently use auto-injectors, as they are easy administer by non-medical personnel. Therefore, the rising occurrence of anaphylaxis cases is another significant factor that is estimated to fuel the growth of the market over the forecast period. For instance, anaphylaxis, a severe allergic reaction to food, is thought to cause nearly 91,000 emergency room visits annually in the United States.

Key Epinephrine Market Insights Summary:

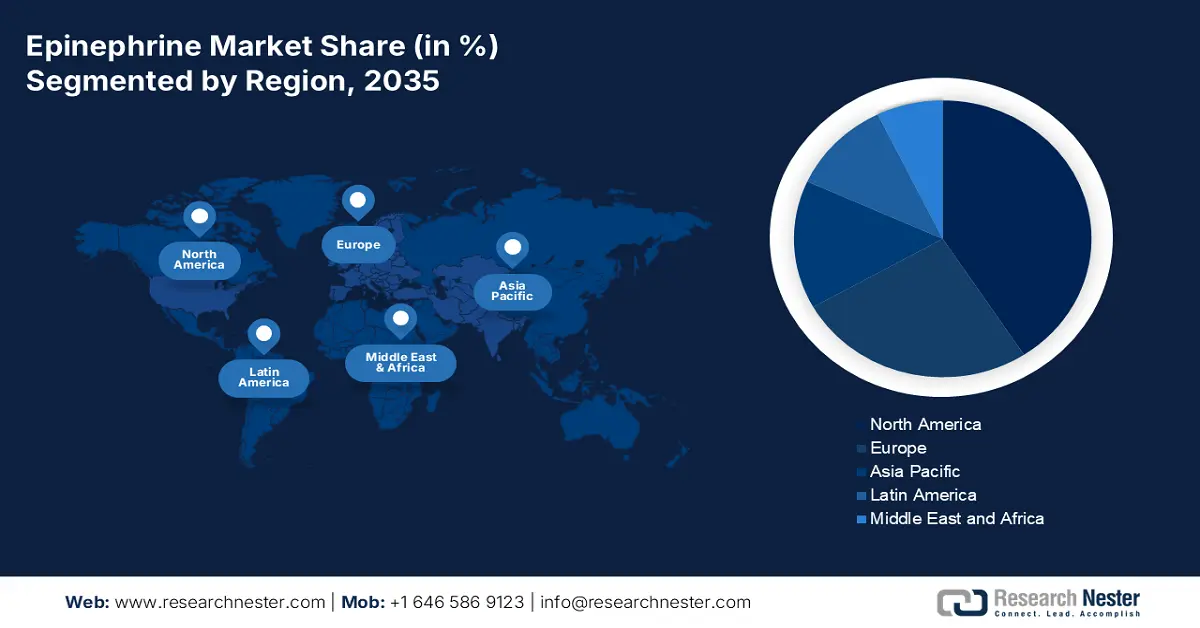

Regional Highlights:

- The North America epinephrine market holds the largest share by 2035, attributed to the rise in asthma and respiratory disease cases.

- The Europe market will register notable growth from 2026 to 2035, driven by the escalating cardiovascular disorder prevalence.

Segment Insights:

- The anaphylaxis segment in the epinephrine market is anticipated to hold the highest market share by 2035, fueled by the rising prevalence of anaphylaxis and the development of advanced treatment products.

- The epinephrine auto-injectors segment in the epinephrine market is expected to capture a significant share by 2035, driven by their ease of use, availability, and high efficiency in acute anaphylaxis treatment.

Key Growth Trends:

- Upsurge in Chronic Respiratory Disorders

- Growing Occurrence of Several Types of Allergic Reactions

Major Challenges:

- Upsurge in Chronic Respiratory Disorders

- Growing Occurrence of Several Types of Allergic Reactions

Key Players: Teva Pharmaceuticals Industries Ltd., Amneal Pharmaceuticals, Inc., Adamis Pharmaceuticals Corporation, Antares Pharma, Inc., Pfizer Inc., kaleo, Inc., ALK-Abelló A/S, Bausch Health Companies Inc., Viatris Inc., Abbott Laboratories.

Global Epinephrine Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.99 Billion

- 2026 Market Size: USD 3.22 Billion

- Projected Market Size: USD 6.7 Billion by 2035

- Growth Forecasts: 8.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 9 September, 2025

Epinephrine Market - Growth Drivers and Challenges

Growth Drivers

-

Upsurge in Chronic Respiratory Disorders - Respiratory disorders refer to a class of pathogenic conditions such as COPD, and asthma, that affect respiration in living organisms. In higher organisms, respiration allows for gas exchange. In a gas exchange, the organism absorbs oxygen and exhales carbon dioxide. The respiratory tract, which comprises the alveoli, bronchi, bronchioles, pleura, pleural cavity, trachea, and breathing muscles and nerves, is where respiratory disease develops itself. Therefore, the global increase in chronic respiratory disorders is expected to boost the growth of the global epinephrine market. As per the World Health Organization (WHO), 3.23 million people died from chronic obstructive pulmonary disease (COPD), the third most common cause of mortality in the world in 2019.

-

Growing Occurrence of Several Types of Allergic Reactions - For instance, every year, more than 51 million individuals in the United States deal with various allergies. These allergic reactions are the region's sixth most common cause of chronic illness.

-

Escalation in Cardiac Arrests - It is observed that, in the United States, there are over 357,000 out-of-hospital cardiac arrests (OHCA) each year, with nearly 89% of them life-threatening.

-

Increasing Development in Auto-Injectors - For instance, until now, nearly 81 auto-injectors have been developed by more than 22 drug manufacturers across the globe. For use with auto-injectors, about 49 medicines are created as combination products. Out of these, disposable auto-injectors make up nearly 61% of the total. Reusable auto injectors with various doses are being developed at a remarkable rate.

-

Increasing Healthcare Expenditure - As per the World Bank data, in 2019, global healthcare expenditures expanded by 9.83%.

Challenges

- High Cost of Auto-Injectors - Worldwide rising demand for effective treatment for several allergic reactions is propelling the demand for these auto-injectors. However, the advanced and popular versions of these auto injectors such as needle-free auto-injectors and AI- enabled auto-injectors are high in cost. Therefore, the high cost of these injectors is estimated to hamper the market growth during the projected time frame.

- Lack of Availability of Approved Medicines

- Inadequate Reimbursement in Developing Nations

Epinephrine Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.4% |

|

Base Year Market Size (2025) |

USD 2.99 Billion |

|

Forecast Year Market Size (2035) |

USD 6.7 Billion |

|

Regional Scope |

|

Epinephrine Market Segmentation:

Application Segment Analysis

The global epinephrine market is segmented and analyzed for demand and supply by application into cardiac arrest, anaphylaxis, superficial bleeding, respiratory disorders, and others. Out of these five types of segments, the anaphylaxis segment is anticipated to hold the highest share over the forecast period. The growth of the segment can be attributed to the rising development of technologically advanced products from the key players, and the globally increasing prevalence of anaphylaxis in pediatrics as well as in adults. For instance, in a clinical study, it was observed that the prevalence of anaphylaxis in children ranges from 1 to 762 per 100,000 person-years. This prevalence rate varied throughout continents; such, in Europe it ranged from 2.4 to 762 per 100,000 person-years, whereas it ranges between 0.8 to 72 per 100,000 person-years in North America. Moreover, the anaphylaxis incidence rate in the pediatric population ranges from 0.05% to 1.7% throughout the world.

Type Segment Analysis

The global epinephrine market is also segmented and analyzed for demand and supply by type into epinephrine prefilled syringes, epinephrine auto-injectors, ampoules & vials, and others. Amongst these segments, the epinephrine auto-injectors segment is expected to garner a significant share. The growth of the segment can be attributed to their easy availability, easy to use, and great efficiency in treating acute anaphylaxis. On the other hand, the prefilled syringes segment is projected to witness notable growth during the forecast period, owing to its surging demand in hospitals and clinics for treating several illnesses, coupled with its rapid responsive rate in the treatment of emergency allergic reactions.

Our in-depth analysis of the global market includes the following segments:

|

By Type |

|

|

By Application |

|

|

By Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Epinephrine Market Regional Analysis:

North American Market Insights

The North America epinephrine market, amongst the market in all the other regions, is projected to hold the largest market share by the end of 2035. The growth of the market can be attributed majorly to the escalating count of patients suffering from respiratory diseases such as asthma, coupled with the rapidly expanding population in the region. According to a health survey conducted between 2018 - 2020, in the United States, the surge of asthma cases in young individuals aged 18+ years reached 21,030,480 which denotes nearly 8.3% growth. Further, the rising awareness about allergies, along with the growing prevalence of cardiac arrests among people is another significant factor that is anticipated to push the market growth further throughout the forecast period in the region.

Europe Market Insights

Further, the Europe epinephrine market is projected to display notable growth over the forecast period on the back of the escalating prevalence of cardiovascular disorders, along with a surging ratio of anaphylaxis in the region. For instance, in Europe, cardiovascular disorders continue to be the main cause of death, contributing to almost 47% of all mortalities. Every year, more than 5 million people die from cardiovascular disorders in the European region. Additionally, the surge in technological advanced products is another major factor that is projected to spur the epinephrine market size over the projected time frame in the region.

Epinephrine Market Players:

- Teva Pharmaceuticals Industries Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Amneal Pharmaceuticals, Inc.

- Adamis Pharmaceuticals Corporation

- Antares Pharma, Inc.

- Pfizer Inc.

- kaleo, Inc.

- ALK-Abelló A/S

- Bausch Health Companies Inc.

- Viatris Inc.

- Abbott Laboratories

Recent Developments

-

Pfizer Inc. announced that it is in coordination with FDA to extend the expiration dates of certain lots of EpiPen 0.3 mg Auto-Injectors after reviewing the stability data. Pfizer works to stabilize the supply of these particular lots of products so that patients feel confident using them.

-

Teva Pharmaceuticals Industries Ltd. announced the accessibility of the FDA-approved generic version of EpiPen Jr 1 (epinephrine injection, USP) Auto-Injector, 0.15 mg, in the U.S. Currently, the product is available in pharmacies nationwide.

- Report ID: 4413

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Epinephrine Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.