Enterprise Video Conferencing Market Outlook:

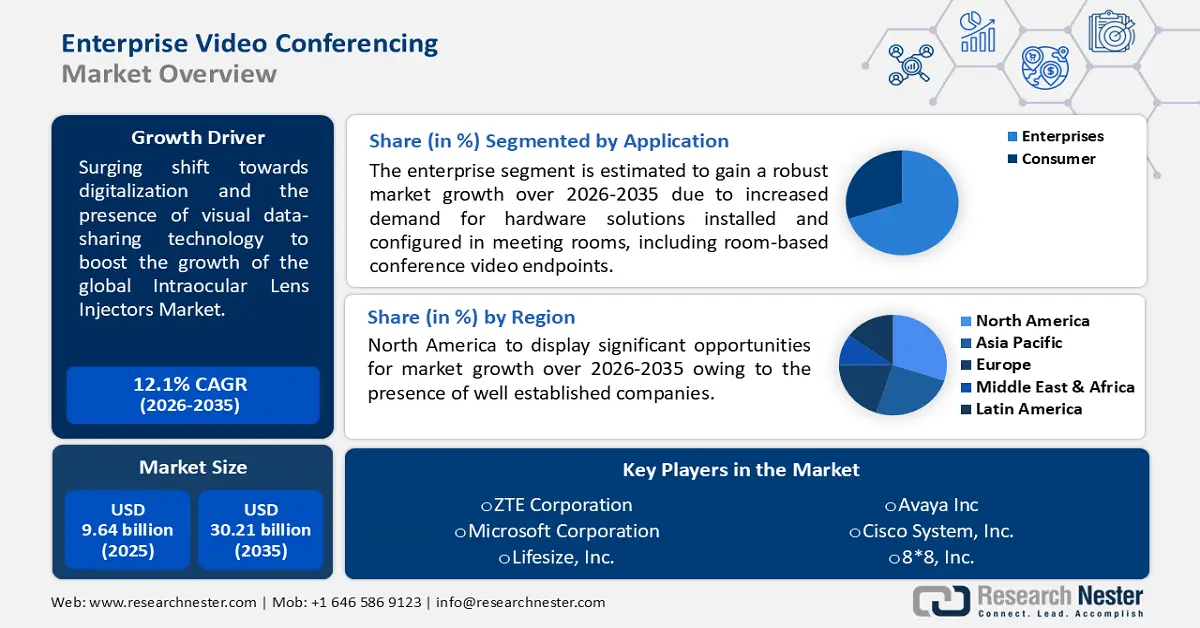

Enterprise Video Conferencing Market size was valued at USD 9.64 billion in 2025 and is expected to reach USD 30.21 billion by 2035, expanding at around 12.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of enterprise video conferencing is evaluated at USD 10.69 billion.

The growth of the market can primarily be ascribed to faster digitization and the presence of visual data-sharing technology backed by the rising prevalence of the internet. According to the data released by the World Bank, until April 2022, the digital economy accounts for 15.5% of global GDP and has grown 2.5 times faster than global GDP over the last 15 years.

As the entire world is moving closer to globalization, multinational corporations are relying more on video conferencing and meetings to get the best information and decisions from their offshore operations. Real-time visual sessions between one or more participants are referred to as video conferencing sessions. Video conferencing solutions assist organizations in achieving their priorities by discussing strategies and providing training via video conference platforms to improve business performance. Furthermore, as businesses and individuals aspire to stay connected, global lockdowns imposed in response to the COVID-19 pandemic have resulted in a significant increase in demand for video conferencing and teleconferencing options. For instance, as a consequence of COVID-19, web conferencing technologies were used for the first time by around 35% of enterprises globally in 2020.

Key Enterprise Video Conferencing Market Insights Summary:

Regional Highlights:

- By 2035, North America is expected to command the largest regional share in the enterprise video conferencing market, supported by well-established enterprises, rapid technological upgrades, and the rising need for uninterrupted visual communication owing to increased demand for constant high-speed connectivity.

Segment Insights:

- Across 2026-2035, the corporate segment within the enterprise video conferencing market is projected to secure a leading share, bolstered by the rapid expansion of geographically dispersed teams and the growing use of video platforms for training and real-time collaboration.

Key Growth Trends:

- Increasing Integration of Cloud Technology

- Growing Use of Artificial Intelligence (AI)

Major Challenges:

- High Cost of Hardware Solutions Deployment

- Data Privacy and Security Concern

Key Players: ZTE Corporation, Microsoft Corporation, Cisco Systems, Inc., NTT Communications Corporation, Avaya Inc., AVer Information Inc., Zoom Video Communications, Inc., Singtel Optus Pty Limited, 8x8, Inc., Lifesize, Inc.

Global Enterprise Video Conferencing Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 9.64 billion

- 2026 Market Size: USD 10.69 billion

- Projected Market Size: USD 30.21 billion by 2035

- Growth Forecasts: 12.1%

Key Regional Dynamics:

- Largest Region: North America

- Fastest Growing Region: North America

- Dominating Countries: United States, China, United Kingdom, Germany, Japan

- Emerging Countries: India, Brazil, South Korea, Indonesia, Mexico

Last updated on : 19 November, 2025

Enterprise Video Conferencing Market - Growth Drivers and Challenges

Growth Drivers

- Increasing Integration of Cloud Technology - Cloud computing or cloud technology refers to connecting to online services hosted on the cloud via the internet. These services range from basic cloud storage to cloud infrastructure channels. The integration of cloud technology is highly influencing enterprise video conferencing.

- By 2021, cloud data centers are estimated to manage approximately 91% of all workloads.

- Growing Use of Artificial Intelligence (AI) – Emerging use of Artificial Intelligence (AI) in Natural Language Processing (NLP) is paving a way to create more advanced tools i.e., language translation, voice-to-text transcription, report generation to make video conferencing an easy and advanced medium to stay connected. So, the rise in implementation of Artificial Intelligence is leading the enterprise video conferencing a step ahead.

- For instance, by 2022, more than 46% of businesses are projected to use several aspects of AI to efficiently use big data.

- Increasing Deployment of Internet of Things (IoT) - Over 9 billion Internet of Things (IoT) devices were connected as of 2021 and this number is estimated to cross approximately 25 billion IoT connections by the end of 2025.

- Rising Trend of Remote Work – Since the COVID-19, the work from home model has been much popularized. Now lots of people and organizations have been working remotely and seeking the advantages of this concept in the presence of various type of technological tools i.e., video conferencing.

- For instance, by January 2022, approximately 58% of global businesses have embraced the fully remote or hybrid working model.

- Expanding 5G Network - 5G has brought some amazing turns in virtual world. It outperforms 4G LTE networks in terms of speed, connectivity, and capabilities. For instance, globally, the total number of 5G smartphone subscriptions are estimated to reach approximately 1.5 billion in 2022.

Challenges

- High Cost of Hardware Solutions Deployment

- Data Privacy and Security Concern

- The possibility of a data breach is still present and is a major concern where personal chats and documentation can be exposed to third parties. Furthermore, many hackers across the globe always finding ways to penetrate the system to steal significant file or statements of firms. Hence, this factor is estimated to propel the growth of the enterprise video conferencing market over the forecast period.

- Lack of Skilled Software Engineers and Developers

Enterprise Video Conferencing Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

12.1% |

|

Base Year Market Size (2025) |

USD 9.64 billion |

|

Forecast Year Market Size (2035) |

USD 30.21 billion |

|

Regional Scope |

|

Enterprise Video Conferencing Market Segmentation:

End-user Segment Analysis

The global enterprise video conferencing market is segmented and analyzed for demand and supply by end-user into education, corporate, healthcare, government & defense, media & entertainment, BFSI, and others, out of which, the corporate segment is anticipated to grow at a significant rate over the forecast period owing to an increase in the number of geographically diverse corporate teams to attend training sessions, collaborate and work together. By 2022, 77% of corporate businesses have been using video conferencing software.

Our in-depth analysis of the global enterprise video conferencing market includes the following segments:

|

By Component |

|

|

By Deployment |

|

|

By Enterprise Size |

|

|

By Application |

|

|

By End-User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Enterprise Video Conferencing Market - Regional Analysis

North America Market Insights

The North America enterprise video conferencing market, amongst the market in all the other regions, is projected to hold the largest market share by the end of 2035. The growth of the market can be ascribed to well-established businesses in the region, constant technological expansions, and increased demand for constant high internet connectivity and visual meetings. For instance, nearly 91% of American companies are estimated to invest in video conferencing technology by 2022.

Enterprise Video Conferencing Market Players:

- ZTE Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Microsoft Corporation

- Cisco Systems, Inc.

- NTT Communications Corporation

- Avaya Inc.

- AVer Information Inc.

- Zoom Video Communications, Inc.

- Singtel Optus Pty Limited

- 8x8, Inc.

- Lifesize, Inc.

Recent Developments

-

Microsoft Corporation announced Barclays has selected Microsoft Teams as its ideal collaboration platform for more than 120,000 colleagues and service partners across the globe.

-

Avaya Inc., revealed new competencies for its modern workstream collaboration platform - Avaya Spaces that projected to offer enhanced Unified Communications capabilities. With Avaya OneCloud CPaaS (Communications Platform as a Service), meetings are enhanced by artificial intelligence, and voice and video calling are simplified.

- Report ID: 164

- Published Date: Nov 19, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.