Emulsion PVC Market Outlook:

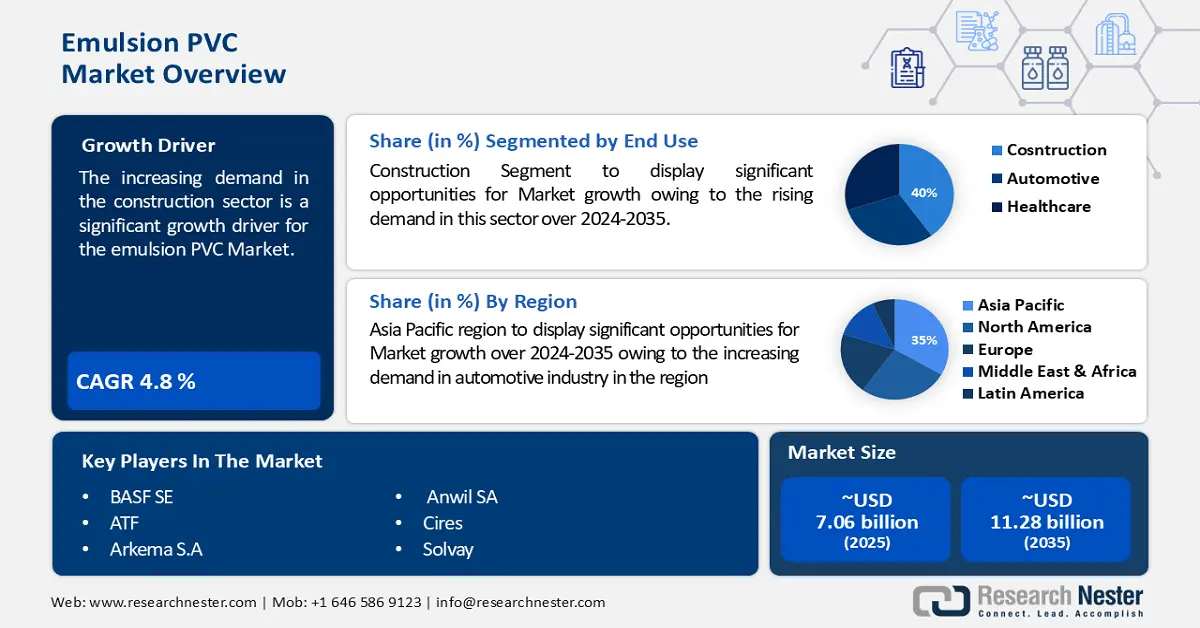

Emulsion PVC Market size was valued at USD 7.06 billion in 2025 and is expected to reach USD 11.28 billion by 2035, registering around 4.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of emulsion PVC is evaluated at USD 7.36 billion.

The growth of this market can be attributed to the escalating global population added up by the increasing demand for consumer goods among the population. Owing to its amazing water resistivity and cheap price emulsion PVC is used on a large scale in the production of consumer products such as sports components, toys, and stationary products. From an estimated 2.5 billion people in 1950, the world's population increased by 1 billion in 2010 and 2 billion since 1998, reaching a total of 8.1 billion by mid-November 2022.

Furthermore, increasing demand for synthetic leather in multiple end-use sectors for example in the automotive, and textile industries are supporting lucrative growth opportunities for the emulsion PVC market in the projected period. Additionally, emulsion PVC is widely utilized in the manufacturing of cushions, seat covers, and jackets.

Key Emulsion PVC Market Insights Summary:

Regional Highlights:

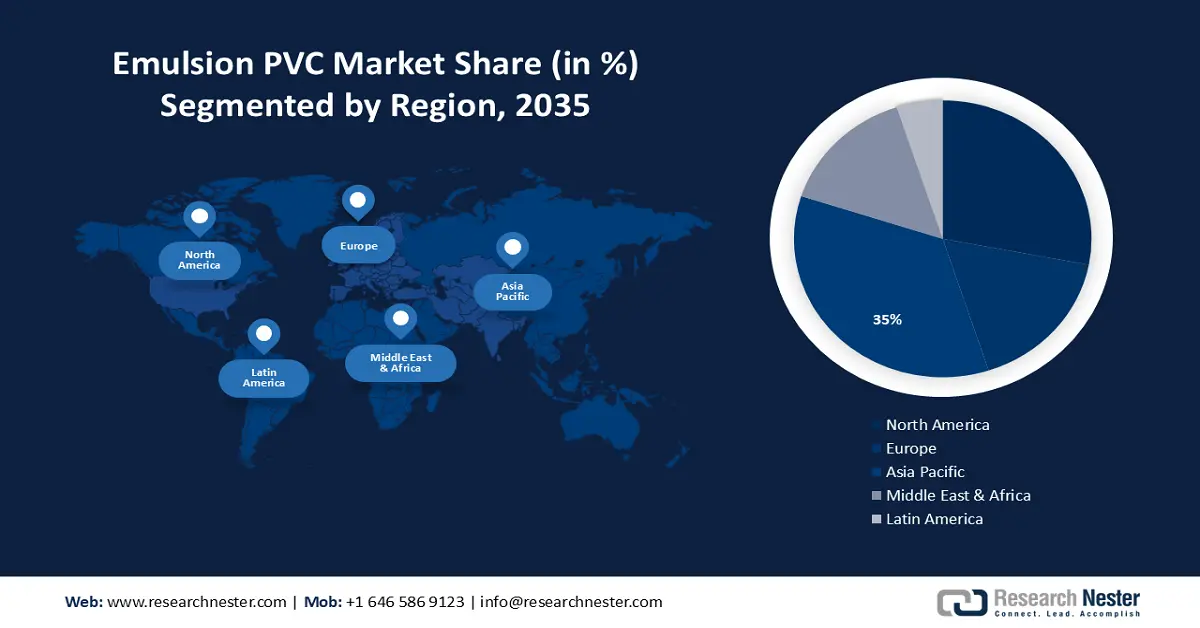

- The Asia Pacific emulsion PVC market is expected to capture 35% share by 2035, attributed to the growing construction and automobile industries in China.

- The North America market will achieve substantial CAGR during 2026-2035, driven by technological advancements and eco-friendly manufacturing processes.

Segment Insights:

- The construction segment in the emulsion pvc market is expected to witness robust growth through 2035, driven by developments in the construction industry.

- The synthetic leather segment in the emulsion pvc market is forecasted to grow steadily, achieving a 30% share by 2035, attributed to the superior qualities of PVC emulsion like flexibility, durability, and water resistance.

Key Growth Trends:

- Expansion of Packaging Industry

- Demand for Eco-friendly Products

Major Challenges:

- Fluctuating Raw Material Prices

- Strict Government Regulations Associated with Production is Set to Hinder the Market Growth in the Upcoming Period

Key Players: Vinnolit GmbH & Co. KG (Westlake Chemical), Formosa Plastics Corporation, Shin-Etsu Chemical Co., Ltd., Mexichem S.A.B. de C.V. (Orbia), Solvay S.A., LG Chem, Ltd., INEOS Group, Kaneka Corporation, Occidental Petroleum Corporation, China National Chemical Corporation (ChemChina).

Global Emulsion PVC Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 7.06 billion

- 2026 Market Size: USD 7.36 billion

- Projected Market Size: USD 11.28 billion by 2035

- Growth Forecasts: 4.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, India

- Emerging Countries: China, India, Brazil, Mexico, Thailand

Last updated on : 16 September, 2025

Emulsion PVC Market Growth Drivers and Challenges:

Growth Drivers

- Expansion of Packaging Industry - The emulsion PVC market is anticipated to develop at a faster rate in the future due to the packaging industry's rising expansion. PVC emulsion is preferred for a variety of items, including items used by the grocery store and e-commerce industries, due to its cost-effectiveness, robustness, and barrier qualities. For example, in May 2022, the German trade group VDMA stated that the food processing and packaging machinery sector in Germany brought in €14.8 billion in sales in 2021-a 7% rise over 2020.

- Demand for Eco-friendly Products - The current state of the emulsion PVC market is dynamic, reflecting the shifting conditions of the chemical sector. As the demand for sustainable practices develops, manufacturers are placing more attention on formulas and production procedures that are ecologically friendly. In addition, rising demand from end-use sectors like construction, automotive, and packaging is driving innovation and dictating the future direction of the emulsion PVC market.

Challenges

- Fluctuating Raw Material Prices - The growth of this market is set to be hampered by the increasing fluctuation of raw material prices and the cost required for the production of emulsion PVC is a bit high in comparison with the solvent-based organic products. This is a significant factor hampering the market growth in the upcoming period.

- Strict Government Regulations Associated with Production is Set to Hinder the Market Growth in the Upcoming Period

- Side Effects Associated with it is another important factor restricting the emulsion PVC market growth in the forecast period.

Emulsion PVC Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.8% |

|

Base Year Market Size (2025) |

USD 7.06 billion |

|

Forecast Year Market Size (2035) |

USD 11.28 billion |

|

Regional Scope |

|

Emulsion PVC Market Segmentation:

Application Segment Analysis

Based on application, the synthetic leather segment is predicted to account for 30% share of the global emulsion PVC market by the end of 2035. PVC emulsion is widely used in the production of synthetic leather because of its superior qualities, which include flexibility, durability, and water resistance, which make it the perfect material for the job. Vinyl chloride monomer is the starting point for PVC emulsion, a particular kind of polymer that is created via emulsion polymerization. PVC emulsion is used as a coating substance to a fabric substrate in the production of synthetic leather, giving the material a feel and look like to that of real leather. PVC emulsion coating gives synthetic leather superior qualities including durability, water resistance, and abrasion resistance.

End Use Segment Analysis

Based on end use, construction segment is predicted to account for 40% share of the global emulsion PVC market during the forecast period. The growth of the PVC emulsion market will be strongly supported by developments in the construction industry. The construction industry is composed of sectors that are involved in production and trade, which have an interest in building, maintaining, or improving infrastructure. To provide a barrier against oxygen, moisture, and anticorrosion properties, PVC in construction is used to coat building materials. In 2020, there was a 15.08 percent increase in the construction of residential buildings from 12,00,000 in 2019 to 13 81,000.

Our in-depth analysis of the global market includes the following segments:

|

Product Grade |

|

|

End Use |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Emulsion PVC Market Regional Analysis:

APAC Market Insights

The emulsion PVC market in the Asia Pacific region is set to hold the largest revenue share of 35% during forecast period. In the Asia Pacific region, China has emerged as a leading supplier of emulsion PVC and is likely to maintain its position in the forecast period. The growth of the PVC emulsion industry in this country is supported by growing construction and automobile industries. The construction sector in China is expected to grow by 5% a year, according to the report. By 2023, and the country is increasingly focused on green buildings to support this growth. According to the report, China's National Green Building Council has laid down a standard of green building for government buildings such as hospitals, schools, museums, and sports venues. This is not only contributing to the construction industry's expansion but also giving rise to new possibilities for suppliers of emulsions PVC.

North American Market Insights

The emulsion PVC market in the North America is predicted to grow substantially during the projected period. The growth of this market in the region can be primarily driven by the presence of established industries and growing technological advancement. Growing research and development are offering emulsion PVC with enhanced recyclability and eco-friendly manufacturing processes appealing to an expanding environmentally oriented market segment. Besides this, increasing advancement in emulsion PVC properties such as heat resistance, flame retardancy, and better performance is anticipated to boost the integration of emulsion PVC at various applications in multiple sectors in the region.

Emulsion PVC Market Players:

- Vinnolist GmbH & Co. KG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Kem One

- Mexichem

- INEOS Group Limited

- Solvay

- Cires

- Anwil SA

- Arkema S.A.

- ATF

- BASF SE

Recent Developments

- Customers were informed by Mexico-based PVC manufacturer Orbia that the company will be closing its Pedricktown, New Jersey emulsion-PVC facility because of market and global economic downturn. Orbia informed consumers that the factory will cease by the end of 2024, however some services could be carried out into the first quarter of 2025 in order to fulfill agreements with site partners. The facility can produce 60,000 metric tons of paste-PVC, or E-PVC, annually.

- Kaneka Corporation has launched a new line of Kaneka's PVC Kanevinyl Paste for wallpapers, floors, and other applications that are used in everyday life.

- Report ID: 5908

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Emulsion PVC Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.