Emissions Management Software Market Outlook:

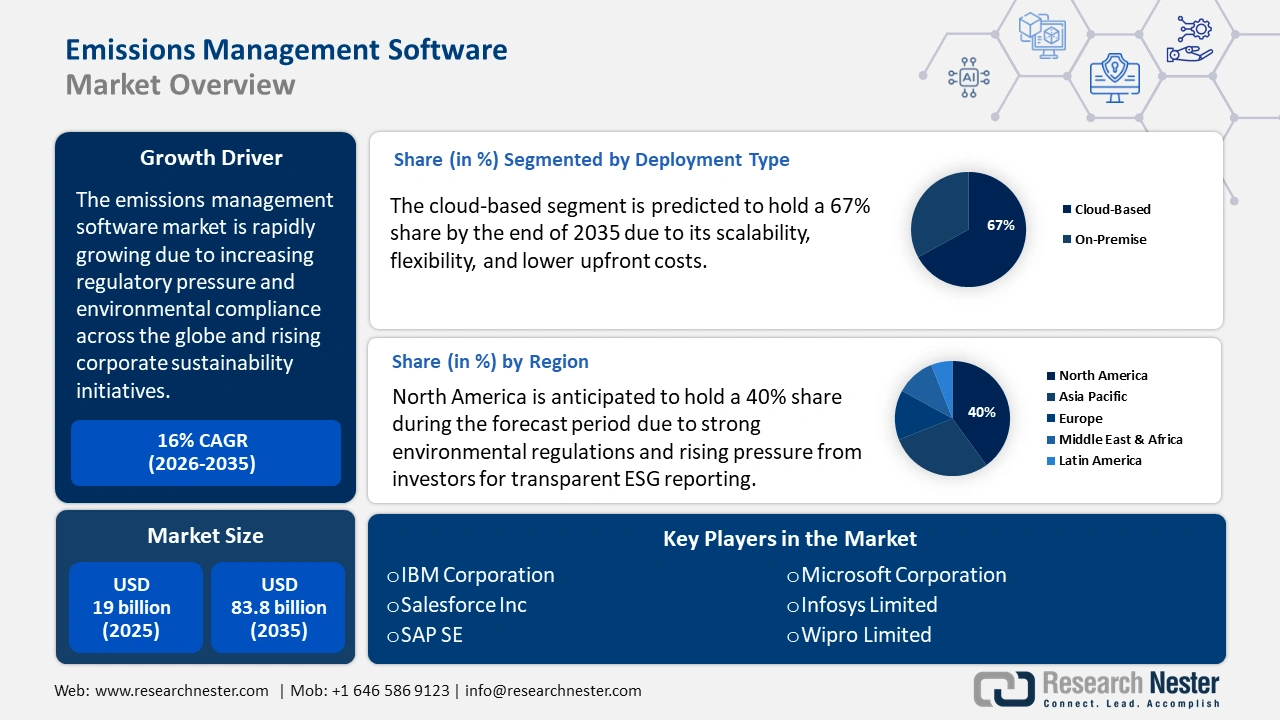

Emissions Management Software Market size was valued at USD 19 billion in 2025 and is projected to reach USD 83.8 billion by the end of 2035, rising at a CAGR of 16% during the forecast period, i.e., 2026-2035. In 2026, the industry size of emissions management software is assessed at USD 22 billion.

The global market is primarily driven by increasing regulatory pressure and environmental compliance across the globe. Governments are no longer dependent solely on voluntary reporting or broad climate targets; they are implementing specific, enforceable rules that require companies to monitor, report, and actively reduce their greenhouse gas (GHG) emissions. These legal frameworks are not just limited to high-emitting sectors of energy or manufacturing but also serve construction, transportation, logistics, agriculture, and financial services.

Emissions management software plays an important role in helping companies navigate these complex regulatory environments. These platforms provide real-time tracking of Scope 1, 2, and Scope 3 emissions, i.e., indirect emissions from supply chains, automated reporting aligned with global standards such as the Greenhouse Gas Protocol, and data analytics for identifying areas of improvement. This helps organizations avoid regulatory penalties, improve efficiency in operations, and maintain compliance with frequently changing laws. For instance, the European Union Fit for 55 packages, introduced in 2021, aim to reduce net greenhouse gas pollution by at least 55% by 2030. This has encouraged the adoption of these emissions tracking tools among EU companies to meet the rising compliance needs.

Key Emissions Management Software Market Insights Summary:

Regional Highlights:

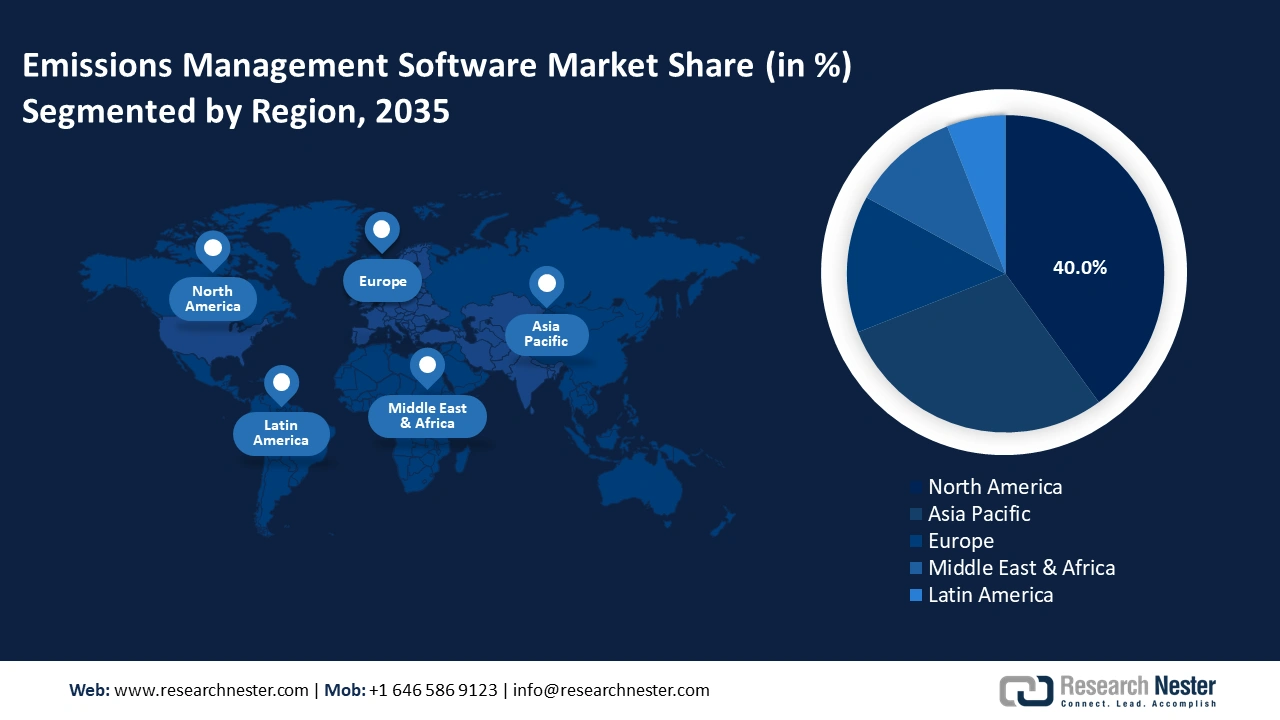

- North America emissions management software market is predicted to hold a 40% share share by 2035 due to strong environmental regulations and rising pressure from investors for transparent ESG reporting.

- APAC market is projected to expand rapidly during the forecast period 2026–2035 due to increased environmental awareness and regional efforts to align with global sustainability standards.

Segment Insights:

- The cloud-based segment in the emissions management software market is projected to account for a 67% share throughout the forecast period 2026–2035, due to its scalability, flexibility, and lower upfront costs.

- The CEMS segment is anticipated to hold a 47% share by 2035, owing to its ability to offer real-time emissions data from industrial processes.

Key Growth Trends:

- Rising corporate sustainability initiatives

- Technological advancements in IoT and cloud computing

Major Challenges:

- Data accuracy and standardization

- High upfront costs and lack of standardized global rules

Key Players: SAP SE, Schneider Electric SE, ENGIE SA, Microsoft Corporation, Salesforce, Inc., Enablon (Wolters Kluwer), Sphera Solutions, Inc., Intelex Technologies, Envirosuite Limited, Infosys Limited, Wipro Limited, DHI Group, Hitachi Ltd., Mitsubishi Electric Corporation.

Global Emissions Management Software Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 7.41 billion

- 2026 Market Size: USD 7.78 billion

- Projected Market Size: USD 12.66 billion by 2035

- Growth Forecasts: 5.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, France, China, Japan

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 7 October, 2025

Emissions Management Software Market - Growth Drivers and Challenges

Growth Drivers

- Rising corporate sustainability initiatives: With companies integrating sustainability initiatives into their business models, driven by stakeholder expectations, investor pressure, and brand reputation, the emissions management software is anticipated to grow. The emissions management software promotes transparent tracking and reporting of carbon footprints, required to achieve corporate Environmental, Social, and Governance (ESG) goals. For instance, in June 2020, Microsoft committed itself to becoming a carbon-negative company by 2030 by leveraging modern emissions management systems to monitor emissions production in its operations worldwide. This depicts a broad scope that encourages software adoption for emissions tracking.

- Technological advancements in IoT and cloud computing: Integration of IoT sensors and cloud-based analytics in emissions management software allows real-time data collection, processing, and actionable insights. This technology boost improves accuracy, scalability, and user accessibility, making emissions monitoring more efficient and cost-effective. For instance, in July 2025, IFS, a leader in enterprise cloud and Industrial AI solutions, entered into a strategic partnership with the carbon intelligence platform Climatiq, alongside the expansion of its new Emissions Management module in IFS Cloud. By embedding a new Emissions Management module into IFS Cloud, the solution uses cloud-based data integration and industrial AI to deliver real-time, carbon-aware insights.

- Growing awareness and demand for carbon neutrality: Increasing public awareness about climate change and consumer preferences for green products are supporting organizations to actively manage and reduce their carbon emissions. This cultural shift is increasing the demand for end-to-end emissions tracking solutions that promote carbon neutrality and net-zero commitments. For instance, in December 2024, Hyundai Motor Company and Kia Corporation launched the Integrated Greenhouse Gas Information System (IGIS), an advanced platform created to monitor, quantify, and manage carbon emissions across the full lifecycle of a vehicle. Using the Life Cycle Assessment (LCA) methodology, IGIS enables precise tracking of emissions from production to supply chain operations, ensuring standardized and transparent data collection. This transparent approach strengthens the sustainability strategies of companies and promotes broader awareness and demand for carbon neutrality, ultimately driving the emissions management software.

Challenges

- Data accuracy and standardization: The lack of standardized and verifiable data across industries and regions is one of the major barriers expected to hamper market growth. Emissions management software depends heavily on accurate inputs to calculate carbon footprints and track progress toward sustainability goals. However, varying reporting frameworks, fragmented supply chain data, and inconsistent measurement methodologies often create gaps or inaccuracies. This reduces the reliability and makes it difficult for businesses to compare results or comply with global regulations.

- High upfront costs and lack of standardized global rules: The high implementation cost for small and medium enterprises is another challenge faced by the emissions management software market. Advanced emissions software requires high investment in infrastructure, integration with existing systems, and employee training. For many SMEs, these high upfront costs can be a hurdle, limiting adoption and slowing overall market expansion despite growing regulatory pressure.

Emissions Management Software Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

16% |

|

Base Year Market Size (2025) |

USD 19 billion |

|

Forecast Year Market Size (2035) |

USD 83.8 billion |

|

Regional Scope |

|

Emissions Management Software Market Segmentation:

Deployment Type Segment Analysis

The cloud-based segment is predicted to hold a 67% share by the end of 2035 due to its scalability, flexibility, and lower upfront costs. It allows real-time access to emissions data across multiple locations, improving decision-making and regulatory compliance. Cloud deployment supports seamless updates, integration with IoT devices, and AI-powered analytics. As remote operations and global sustainability reporting rise, demand for cloud-based solutions rises. Industries favor cloud platforms for their ability to adapt quickly to changing environmental regulations.

Data Source Segment Analysis

The Continuous Emission Monitoring Systems (CEMS) segment is projected to hold a 47% share during the stipulated timeframe owing to its ability to offer real-time emissions data from industrial processes. The growth can be attributed to strict environmental regulations necessitating continuous compliance monitoring. CEMS allows accurate monitoring of pollutants such as SO₂, NOx, and CO₂, which are necessary for automated reporting and regulatory audits.

For instance, in June 2025, Kongsberg Maritime introduced its new CEMS, an advanced solution that enables shipowners and operators to track and manage vessel emissions. The system promotes compliance with strict environmental regulations while helping optimize fuel efficiency. The launch of Kongsberg Maritime’s CEMS shows the rising demand for instant emissions tracking solutions in the shipping sector. Such advanced systems fuel the expansion of the CEMS segment by enabling compliance with stricter environmental regulations. The rising adoption of CEMS in power generation, cement, and chemical industries is further fueling the segment's growth.

Industry Segment Analysis

The manufacturing segment is emerging as a major adopter of emissions management software as industrial facilities face mounting pressure to monitor, report, and cut greenhouse gas emissions. This growth can be attributed to stricter regulatory frameworks, rising energy costs, and government-backed initiatives that promote digital tools for real-time emissions tracking. The U.S. Department of Energy’s Better Plants Program helps manufacturers use software tools like VERIFI, developed by Researchers at Oak Ridge National Laboratory, to easily monitor and download data related to their energy use and carbon emissions.

According to the latest progress report from DOE’s Better Buildings Initiative, ORNL’s support for the Better Plants program has enabled partners to realize USD 11.8 billion in cost savings, save 2.4 quadrillion British thermal units of energy, and avoid 147 million metric tons of carbon dioxide emissions. The program has also resulted in an average annual improvement of 1.8% in energy intensity, a core metric that measures how much energy an industry consumes to produce a product or service. Together, these efforts depict how regulatory and financial incentives are accelerating the adoption of emissions management software in manufacturing.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Deployment Type |

|

|

Data Source |

|

|

Application |

|

|

Industry |

|

|

Component |

|

|

Services |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Emissions Management Software Market - Regional Analysis

North America Market Insights

The emissions management software market in North America is anticipated to hold a 40% share during the forecast period due to strong environmental regulations and rising pressure from investors for transparent ESG reporting. Major oil and gas, manufacturing, and transportation industries are adopting advanced software solutions to ensure compliance with evolving federal and state emission standards. The overall adoption in the region has been supplemented by the presence of industry-leading companies and a well-established technological infrastructure. Additionally, ESG goals have pushed businesses to hasten the adoption of analytics tools and live monitoring platforms. The integration of these trends has ensured a sustained expansion of the North America market.

The U.S. emissions management software market is expected to register rapid growth, driven by stringent environmental regulations and a rise in clean energy investments. In Q2 2025, clean energy and transportation investments in the U.S. totaled 68 billion, holding 4.8% of total private investments in structures, equipment, and durable consumer goods. This surge of capital is encouraging the adoption of emissions management solutions across industries. Additionally, the market is bolstered by advancements in AI and IoT technologies, allowing real-time emissions tracking and compliance with changing regulatory frameworks.

The Canada emissions management software market is expected to surge rapidly, driven by government initiatives and an increasing emphasis on sustainability in industries. The federal government’s 2030 Emissions Reduction Plan depicts a sector-by-sector approach to achieve a 40% reduction in emissions from 2005 levels by 2030, with a long-term goal of net-zero emissions by 2050. This future-oriented strategy is encouraging demand for advanced emissions management solutions. In addition, Canada's Carbon Management Strategy aims to develop a world-class, multi-billion-dollar carbon management sector, supporting high-value employment and a sustainable economy. Such initiatives are creating a favorable environment for the growth of emissions management software, as businesses seek tools to comply with regulations and achieve their carbon reduction targets.

Asia Pacific Market Insights

Asia Pacific is anticipated to exhibit the fastest growth during the forecast period due to increased environmental awareness and regional efforts to align with global sustainability standards. Governments are introducing stricter emissions regulations, especially in sectors such as power generation, cement, and transport. The rapid digital transformation across industries is also making it easier to implement real-time emissions tracking solutions. Additionally, the growing investor interest in green investments is forcing companies toward developed emissions reporting.

The China emissions management software market is projected to hold a significant share during the forecast period due to the focus on climate goals and industrial decarbonization. The enforcement of national carbon trading and environmental inspections is forcing heavy industries to take up digital emissions monitoring solutions. China’s recent launch of zero-carbon industrial parks in June 2025 by the National Development and Reform Commission (NDRC), the Ministry of Industry and Information Technology (MIIT), and the National Energy Administration (NEA) is increasing demand for emissions management software. The policy necessitates digital carbon management platforms to monitor, forecast, and streamline emissions across industrial operations, assuring compliance and efficiency. This nationwide initiative is building a strong market push, as businesses adopt advanced software to meet regulatory goals and support China’s decarbonization strategy.

The emissions management software market in India is expected to gain rapid momentum, driven by new carbon pricing reforms and regulatory mandates. In July 2024, India introduced the Carbon Credit Trading Scheme (CCTS), a rate-based Emissions Trading System covering energy-intensive sectors, which compels firms to track and validate emissions data. Additionally, initiatives such as the National Green Hydrogen Mission, backed by huge financial budgets, are forcing industries to adopt cleaner processes and digital tools to measure carbon footprints. India’s long-term climate commitments are serving as a major push for the growth of the market.

The government’s targets to raise non-fossil fuel energy capacity to 500 GW and fulfill 50% of national energy demand from renewable sources by 2030 are fueling the need for precise monitoring and reporting mechanisms. Additionally, commitments to decrease one billion tons of carbon emissions and reduce carbon intensity by over 45% within the same timeframe create demand for advanced digital tools to guarantee compliance, transparency, and efficiency across industries. Looking ahead, the nation's commitment to achieve carbon neutrality by 2070 is bolstering the demand for robust emissions management software, making it a critical enabler of the country’s net-zero transition strategy.

Europe Market Insights

The emissions management software market in Europe is predicted to expand at a steady pace between 2026 and 2035 as stricter regulations under the Green Deal and the Industrial Emissions Directive and Industrial Emissions Portal Regulation (IEPR) push industries to enhance how they track and disclose emissions, resource consumption, and pollutant emissions. The updated IEPR, effective May 2024, requires standardized electronic reporting and greater transparency, which is fueling the need for advanced digital tools. At the same time, the European Green Digital Coalition has issued methodologies for measuring the climate impact of ICT solutions, helping software providers prove their role in emissions reduction and encouraging wider adoption.

Emissions management software is growing in the UK as government support combines digital innovation with industrial decarbonization funding. The UK has invested in AI-driven tools to support industries in optimizing energy use and cutting carbon emissions, while the Industrial Energy Transformation Fund (IETF) provides grants for efficiency and emissions-reduction projects. The IETF, introduced in 2020, is structured into three phases and is stated to provide USD 584.39 million in funding till 2028. Together, these initiatives lower costs and drive adoption of advanced software solutions across energy-intensive sectors. These moves are reinforcing corporate commitments and regulatory compliance, pushing demand for emissions management platforms that integrate datasets, forecasts, and verification for both internal use and compliance.

In Germany, the adoption of emissions management software is rapidly expanding, driven by national industrial digitization strategies, investments in digital data ecosystems, and regulatory mandates to cut greenhouse gas emissions in key manufacturing sectors. A USD 2.57 billion state aid program is backing industrial decarbonization through electrification and hydrogen-based processes, which depend heavily on software for modeling, monitoring, and reporting progress. According to the European Investment Bank’s February 2025 survey, over 90% of German companies have taken steps to reduce greenhouse gas emissions, while about 80% have invested in energy efficiency improvements, placing them ahead of many European peers.

Key Emissions Management Software Market Players:

- IBM Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- SAP SE

- Schneider Electric SE

- ENGIE SA

- Microsoft Corporation

- Salesforce, Inc.

- Enablon (Wolters Kluwer)

- Sphera Solutions, Inc.

- Intelex Technologies

- Envirosuite Limited

- Infosys Limited

- Wipro Limited

- DHI Group

- Hitachi Ltd.

- Mitsubishi Electric Corporation

The EMS market features both global giants like IBM, SAP, and Schneider Electric, and rising regional players from Australia, India, and Malaysia. Leading companies use AI and cloud technologies to improve emissions tracking, while regional firms focus on local regulatory needs. Although Japanese companies hold smaller shares, their presence shows growing Asia Pacific interest. The market is rapidly expanding, fueled by stricter environmental rules and the worldwide move toward sustainability. Given below is a table of the top players in the market with their respective shares.

Here is a list of key players operating in the global market:

Recent Developments

- In June 2025, Optera introduced Operator, its new emissions management platform designed for enterprise Scope 1-3 accounting. The platform emphasizes automation, adaptability, and actionability, using AI-powered data ingestion to speed data consolidation and maintain audit transparency. Operator enables organizations to organize emissions data flexibly, identify hotspots, and generate actionable insights to support decarbonization strategies.

- In February 2025, IBM’s Envizi ESG Suite was adopted by Astellas Pharma to support their environmental and sustainability reporting. IBM is working with Accenture to establish the software setup, making it convenient for companies to handle and form their emissions data.

- Report ID: 3226

- Published Date: Oct 07, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.