Electrolyzers Market Outlook:

Electrolyzers Market size was over USD 8.4 billion in 2025 and is estimated to reach USD 509.6 billion by the end of 2035, expanding at a CAGR of 57.8% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of electrolyzers is assessed at USD 13.2 billion.

The international electrolyzers market is currently witnessing a paradigm shift and is readily evolving from a niche technological segment to a cornerstone of the clean energy transition. This shift is significantly fueled by the urgent global imperative to enhance energy security and decarbonize hard-to-abate industrial fields. According to the 2025 IEA Organization data report, the electrolysis capacity for dedicated hydrogen production has been continuously growing and reached an installed capacity of 1.4 GW by the end of 2023. Likewise, the electrolyzer manufacturing capacity has also doubled from 2022, and reached 25 GW by the end of the same year. Therefore, projects in the pipeline have led to an installed electrolyzer capacity, ranging between 230 GW to 520 GW by 2030. Besides, the aspect of overall installed electrolysis capacity by technology to achieve net-zero emissions is also ensuring a huge growth opportunity for the overall market globally.

Total Installed Electrolysis Capacity by Technology for Net Zero Emissions

|

Year |

Alkaline (MW) |

PEM (MW) |

Other/Unknown (MW) |

Total (MW) |

|

2020 |

200 |

110 |

20 |

330 |

|

2021 |

370 |

150 |

50 |

570 |

|

2022 |

400 |

240 |

60 |

700 |

|

2023 |

840 |

300 |

250 |

1,390 |

Source: IEA Organization

Furthermore, gigawatt-scale manufacturing, technology hybridization and diversification, a rise in the hydrogen valley, strategic alliances, supply chain consolidation, and increased focus on stack durability and critical materials are also responsible for uplifting the electrolyzers market globally. For instance, according to an article published by the Renewable and Sustainable Energy Reviews in January 2025, there has been a surge in international hydrogen from 20 million tons to 70 million tons in its purest form. In addition, 45 million tons of hydrogen are utilized in the Direct reduction of iron (DRI) process, particularly in the steel sector, which significantly adds up to nearly 115 million tons of yearly hydrogen demand. Besides, it has been estimated that the worldwide hydrogen demand can reach between 500 million tons to 800 million tons by the end of 2050, thereby making it suitable for boosting the market’s exposure.

Key Electrolyzers Market Insights Summary:

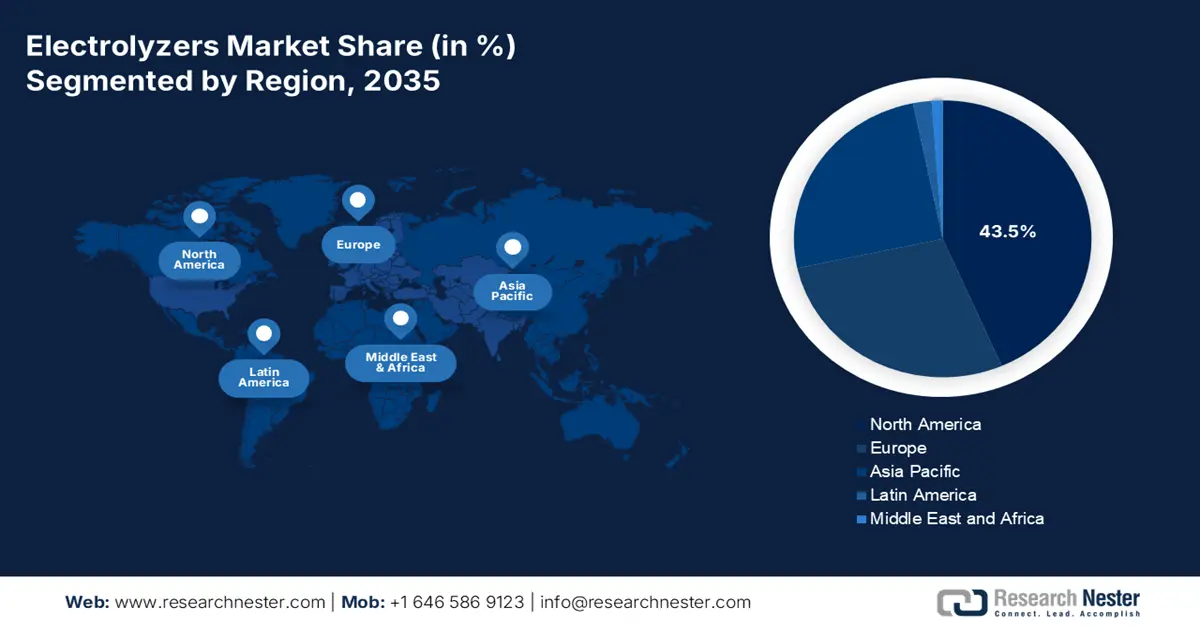

Regional Highlights:

- North America is anticipated to command a 43.5% share by 2035 in the electrolyzers market, bolstered by extensive fiscal incentives and regulatory support reshaping clean-hydrogen project economics.

- The Asia Pacific region is projected to expand rapidly through 2026–2035, supported by rising hydrogen demand across refining and chemical industries driven by industrial decarbonization.

Segment Insights:

- The large-scale (>10 MW) sub-segment within capacity is expected to attain a 76.8% share by 2035 in the electrolyzers market, propelled by its alignment with national industrial strategies accelerating the global hydrogen economy.

- The power-to-x (green hydrogen production) segment is set to secure the second-highest share by 2035, supported by its role in transforming renewable electricity into carbon-neutral energy carriers enabling resilient renewable storage.

Key Growth Trends:

- Corporate decarbonization strategies

- Reduction in renewable energy expenses

Major Challenges:

- Constrained and immature supply chains

- Market Uncertainty and lack of supporting infrastructure

Key Players: Nel ASA (Norway), ITM Power PLC (United Kingdom), McPhy Energy S.A. (France), Siemens Energy AG (Germany), ThyssenKrupp Nucera AG (Germany), John Cockerill (Belgium), Linde plc (United Kingdom), Air Liquide S.A. (France), Bloom Energy Corporation (U.S.), Cummins Inc. (U.S.), Plug Power Inc. (U.S.), Tianjin Mainland Hydrogen Equipment Co., Ltd. (China), Suzhou Jingli Hydrogen Production Equipment Co., Ltd. (China), PERIC Hydrogen Technologies Co., Ltd. (China), Ohmium International, Inc. (U.S.), Hyster-Yale Group (U.S.), Korea Hydro & Nuclear Power (KHNP) (South Korea), Teledyne Energy Systems, Inc. (U.S.), Enapter S.p.A. (Italy), H2B2 Electrolysis Technologies, Inc. (Spain).

Global Electrolyzers Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 8.4 billion

- 2026 Market Size: USD 13.2 billion

- Projected Market Size: USD 509.6 billion by 2035

- Growth Forecasts: 57.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (43.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: India, Australia, United Kingdom, Canada, Netherlands

Last updated on : 1 December, 2025

Electrolyzers Market - Growth Drivers and Challenges

Growth Drivers

- Corporate decarbonization strategies: The presence of energy-efficient sectors, such as refining, steel, and chemicals, is initiating net-zero commitments. This has created a long-lasting and tangible demand for green hydrogen as a reduction agent and clean feedback, which is readily driving the electrolyzers market globally. As per an article published by the Net Zero Climate Organizations in September 2025, there has been a rise in U.S.-based companies by 9%, and these currently represent USD 12 trillion in international revenue, amounting to 64% of the revenue of overall organizations assessed in the Stocktake. In this regard, despite the U.S. federal government’s retrenchment on climate action, 77% of international gross domestic product (GDP) continues to be covered by national net-zero commitments, thus denoting an optimistic outlook for the market.

- Reduction in renewable energy expenses: The continuous decline in the expense associated with wind power and solar PV is considered the single most essential factor for reducing the Levelized Cost of Hydrogen (LCOH), which positively caters to the market’s growth. As stated in an article published by the UN Organization in 2025, USD 2 trillion went into clean energy as of 2025, denoting USD 800 billion over fossil fuels and an increase by nearly 70% within 10 years. Additionally, in 2023, clean energy industries readily drove 10% of international GDP growth. Besides, there has been slow growth in emissions to 0.8%, while the global economy extended by over 3%. However, almost USD 4.5 trillion per year has been projected to be invested in renewable energy until 2030, which includes investments in infrastructure and technology, thus permitting to reach net-zero emissions by the end of 2050.

- Development of technical standards: The aspect of bankability and standardization for guaranteeing the green origin of hydrogen has increased investor confidence and successfully made large-scale projects extremely bankable, which is also bolstering the electrolyzers market globally. According to a data report published by the World Trade Organization in December 2023, at present, hydrogen is largely produced by utilizing natural gas, with trade flow valuation ranging from USD 150 million to USD 200 million every year. Besides, the trade of commodities derived from green hydrogen, specifically methanol and ammonia, is worth USD 14.1 billion and USD 17.5 billion as of 2022. However, the hydrogen supply is projected to expand by 2050 to over 500 million tons every year, thus denoting a positive impact on the market’s growth.

Challenges

- Constrained and immature supply chains: The supply chain system for critical components and materials is not mature enough to support the predicted gigawatt-scale deployment, which poses a huge risk in the electrolyzers market. This is specifically acute for PEM electrolyzers, which depend on platinum group metals (PGMs), such as iridium. Besides, the price volatility and scarcity of these materials can critically cap the PEM technological growth. Beyond materials, the supply chain system for high-quality catalysts, membranes, as well as large-scale balance-of-plant components is also readily stretched. Furthermore, scaling up manufacturing needs a parallel scaling of an internationally resilient and distributed supply base, which comprises significant and long-lasting investments.

- Market Uncertainty and lack of supporting infrastructure: The development of a large-scale hydrogen economy is deliberately hampered by a critical absence of crucial infrastructure for distribution, storage, and transportation. The aspect of transporting hydrogen through pipelines needs expensive refurbishment of current natural gas networks and dedicated pipelines. Besides, liquefaction for shipping is considered an energy-intensive process, and for this, the large-scale salt cavern storage is geographically restricted. This particular infrastructure barrier has created a logistical risk, frequently pressuring projects to be captive, wherein consumption and production need to take place at a similar location, thereby causing a hindrance in the electrolyzers market across different countries.

Electrolyzers Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

57.8% |

|

Base Year Market Size (2025) |

USD 8.4 billion |

|

Forecast Year Market Size (2035) |

USD 509.6 billion |

|

Regional Scope |

|

Electrolyzers Market Segmentation:

Capacity Segment Analysis

The large-scale (>10 MW) sub-segment, which is part of the capacity segment, is anticipated to hold the highest share of 76.8% by the end of 2035. The sub-segment’s upliftment is extremely attributed to its direct reflection of national energy and industrial priorities, which is fueling the hydrogen economy globally. In addition, the pursuit of economies of scale, along with large-scale electrolyzer plants, is also driving the sub-segment, and these can significantly diminish the levelized expense of hydrogen. These projects are not designed for niche applications, but are considered foundational to decarbonize power generation and heavy industry. These are increasingly deployed as core Hydrogen Valleys or are readily integrated with chemical complexes, steel plants, and refineries. Therefore, with all these factors, the sub-segment is continuously gaining increased exposure.

Application Segment Analysis

The power-to-x (green hydrogen production) segment, part of the application, is projected to account for the second-highest share in the electrolyzers market during the stipulated period. The segment’s growth is highly driven by its ability to convert renewable electricity into carbon-neutral energy carriers, such as hydrogen. This enables the storage of intermittent renewable energy and decarbonizes hard-to-electrify sectors, including industry and heavy transport. According to an article published by the IEA Organization in 2024, the hydrogen production has reached 97 million tons as of 2023, of which less than 1% caters to low-emissions. In this regard, low-emissions hydrogen can reach 49 million tons per annum by the end of 2030. Meanwhile, installed water electrolyzer capacity has reached 1.4 GW by the end of 2023, and further reached 5 GW in 2024, thereby denoting a huge growth opportunity for the overall segment.

Product Segment Analysis

Based on the product, the modular stack segment is predicted to cater to the third-highest share in the electrolyzers market by the end of the forecast duration. The segment’s development is effectively fueled by its role as the technological incentive and high-value aspect of the electrolyzer system. While the balance of plant (BoP) comprises crucial components, such as safety systems, gas processing, and power conversion, the stack itself is considered the primary determinant and core IP of system efficiency, performance, and longevity. This particular segment’s high valuation is significantly driven by precision engineering and innovative materials, such as specialized catalysts, porous transport layers, and membranes. Besides, manufacturers are relentlessly making advancements in stack design to enhance the present density, expand operational lifespan, and diminish the utilization of precious metals, thereby uplifting the segment internationally.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Capacity |

|

|

Application |

|

|

Product |

|

|

Supply Mode |

|

|

Technology |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Electrolyzers Market - Regional Analysis

North America Market Insights

North America market is anticipated to garner the highest share of 43.5% by the end of 2035. The market’s upliftment in the region is highly attributed to the fiscal support from the U.S., along with the unprecedented regulatory assistance. In addition, the U.S. Inflation Reduction Act (IRA) has successfully established a production tax credit for clean hydrogen with fundamentally altering project economics. According to an article published by the IEA Organization in 2025, the U.S. readily approved USD 1.7 billion for six hydrogen-based projects under the Industrial Demonstration Program. Besides, the tactical colocation of a gigawatt-scale electrolyzer infrastructure with present refinery and chemical centers along with the Midwest and Gulf Coast is another notable trend, which has significantly enabled decarbonization of incumbent processes and developing the latest green export value chains.

The U.S. in the electrolyzers market is growing significantly, owing to the direct fiscal incentives through the IRA, the presence of the DOE's Hydrogen Shot and Regional Clean Hydrogen Hubs (H2Hubs) program, and the crucial role of administrative agencies to encourage the adoption of sustainable chemical processes. As per an article published by the Warner Senate Government in September 2022, the U.S. Department of Energy (DOE) successfully generated USD 7.0 billion in funding for clean hydrogen centers across the country. The fund’s purpose is to develop a suitable power source in the overall region’s future clean energy economy, which accelerated the national deployment of clean hydrogen fuel. As stated in the August 2025 White House Government article, AbbVie declared a USD 10.0 billion investment for more than 10 years, with the intention of supporting volume growth and adding 4 latest manufacturing facilities to its own network. This further included a USD 195 million investment to extend its domestic drug production capacity. Besides, other companies also made generous investments, which are readily bolstering the market.

U.S.-based Investments by Organizations (2025)

|

Company Name |

Investment Amount |

Explanation |

|

Apple |

USD 600 billion |

Additional components of its advanced manufacturing and supply chain system |

|

IBM |

USD 150 billion |

Ensuring domestic growth and manufacturing operations in upcoming 5 years |

|

Johnson & Johnson |

USD 55 billion |

Investment for manufacturing, research, development, and technology for 4 years |

|

Bristol Myers Squibb |

USD 40 billion |

Optimize research, development, technology, and manufacturing operations |

|

Eli Lilly and Company |

USD 27 billion |

Doubling the regional manufacturing capacity |

|

Venture Global LNG |

USD 18 billion |

Ensuring liquefied natural gas infrastructure in Louisiana |

Source: White House Government

Canada market is also growing due to the hydrogen strategy, the Strategic Innovation Fund (SIF), low-cost and abundant renewable electricity potential, regulatory certainty, and carbon pricing. As stated in an article published by Mission Innovation in August 2022, the country presently produces approximately 3 million tons of hydrogen every year, denoting 4% of international hydrogen production. Besides, the nation has also identified barriers to this particular production method and has currently legislated the Canada Net Zero Emissions Accountability Act to shift to net-zero by the end of 2050. Meanwhile, the National Research Council (NRC) has estimated that between CAD 5 billion to CAD 7 billion of private and public sector investment. This is readily required to develop the country’s hydrogen economy and ensure different funding mechanisms for hydrogen’s research, development, and deployment.

APAC Market Insights

The Asia Pacific market is projected to emerge as the fastest-growing region during the stipulated timeline. The market’s development in the region is highly fueled by energy security to industrial decarbonization, the existence of manufacturing activities, which lead to a substantial need for hydrogen in refining and chemical industries. As per a report published by the Economic Research Institute for ASEAN and East Asia in January 2024, the increasing demand for notable energy applications has resulted in employing ammonia as a fuel and hydrogen for fuel cells, which is projected to experience a 1.2% growth every year by the end of 2030. This is further followed by a rapid CAGR boost of 6.4% per year between 2030 and 2050, which caters to effectively uplifting and deliberately initiating expansion for the overall market in the region.

The electrolyzers market in China is gaining increased exposure due to the state-driven and centralized industry policy, huge domestic demand from the chemical sector, and unparalleled scale of manufacturing. Additionally, the National Development and Reform Commission (NDRC), along with the Ministry of Industry and Information Technology (MIIT), recognized green hydrogen as a tactical emerging sector. As mentioned in an article published by the Climate and Energy Partnership Organization in September 2025, the country’s hydrogen consumption is predicted to reach 60 million tons by the end of 2050, as well as 100 million tons by 2060. By this duration, the majority of the demand is anticipated to remain in the chemical sector, accounting for 60%. Meanwhile, the transportation industry’s share is predicted to make small portions, with 5% and 4% of hydrogen utilization, thus making it suitable for the market’s upliftment.

The electrolyzers market in India is also developing, owing to the government’s National Green Hydrogen Mission, the availability of mandates for sectoral consumption, demanding notable sectors, such as fertilizers and refining, which is followed by huge consumers’ demand for grey hydrogen. According to an article published by the Ministry of New and Renewable Energy in November 2025, an outlay of ₹17,490 crore will be provided between 2029 and 2030 as an incentive for manufacturing electrolyzers and production for green hydrogen. Moreover, an outlay of 455 crore within the same year has been allocated for low-carbon steel projects, 496 crore between 2025 and 2026 for mobility pilot projects, and ₹115 crore for shipping pilot projects. Therefore, with such generous funding provision, there is a huge growth opportunity for the market in the country.

Europe Market Insights

Europe in the electrolyzers market is projected to witness steady growth by the end of the forecast duration. The market’s growth in the region is highly driven by the aggressive and cohesive policy framework, with increased focus on the REPowerEU Plan. According to an article published by the Ammonia Energy Association in June 2022, the Europe Commission has declared its newest plan to diminish the region’s reliance on the REPowerEU, which is poised to target the regional production of 10 million tons of renewable hydrogen every year by the end of 2030. In addition, this model significantly suggests 4 million tons annually for hydrogen as ammonia, which will be successfully imported by the same year. Further, this approximately equates to almost 20 million tons of ammonia, which is proposed to be suitable for the Fit-for-55 package, which is positively impacting the overall market in the region.

RePowerEU and Fit-for-55 Package Comparison for Hydrogen Utilization by the Regional Sector in 2030

|

Sector Type |

RePowerEU (Million Tons) |

Fit-for-55 Package (Million Tons) |

|

Ammonia/Derivatives Imports |

4.0 |

- |

|

Blending |

1.3 |

- |

|

Synthetic Fuels |

1.8 |

1.9 |

|

Blast Furnaces |

1.5 |

1.2 |

|

Petrochemicals |

3.2 |

1.3 |

|

Transport |

2.3 |

0.9 |

|

Industrial Heat |

3.6 |

0.8 |

|

Refineries |

2.3 |

0.6 |

Source: Ammonia Energy Association

Germany’s electrolyzers market is gaining increased traction, owing to the presence of a massive industrial base, a wide-ranging hydrogen strategy, along with the government identifying hydrogen as crucial for decarbonizing its cornerstone sectors, such as refining, steel, and chemicals. As stated in an article published by the Federal Government in 2025, the country’s government possesses an expectation that its regional demand for hydrogen derivatives and hydrogen is projected to reach from 95 TWh to 130 TWh by the end of 2030. It is further expected that almost 50% to 70%, which is 45 TWh to 90 TWh, of overall hydrogen products are needed to be imported from international countries or regions. Moreover, the demand for hydrogen and its derivatives is intended to increase between 360 TWh to 500 TWh, while an estimated 200 TWh of hydrogen derivatives is predicted to increase by the end of 2045.

Spain’s market is also growing due to the unparalleled competitive edge in low-cost wind and solar energy, that has the ability to power electrolyzers at a reduced Levelized Cost of Hydrogen (LCOH). According to an article published by the Renewable Institute Organization in 2025, the Spanish government has currently accepted an increase in the target to successfully install 12 gigawatts of electrolyzers, which is predicted to produce green hydrogen by the end of 2030. This is considered to be part of the current updated National Integrated Energy and Climate Plan 2023 to 2030, and is thrice the amount of the previous target set as of 2020, with the last 4 GW objective. Furthermore, the Ministry for the Ecological Transition and the Demographic Challenge (MITECO) has also streamlined the aspect of permitting renewable hydrogen projects and is proactively channeling regional NextGeneration recovery funds.

Key Electrolyzers Market Players:

- Nel ASA (Norway)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- ITM Power PLC (United Kingdom)

- McPhy Energy S.A. (France)

- Siemens Energy AG (Germany)

- ThyssenKrupp Nucera AG (Germany)

- John Cockerill (Belgium)

- Linde plc (United Kingdom)

- Air Liquide S.A. (France)

- Bloom Energy Corporation (U.S.)

- Cummins Inc. (U.S.)

- Plug Power Inc. (U.S.)

- Tianjin Mainland Hydrogen Equipment Co., Ltd. (China)

- Suzhou Jingli Hydrogen Production Equipment Co., Ltd. (China)

- PERIC Hydrogen Technologies Co., Ltd. (China)

- Ohmium International, Inc. (U.S.)

- Hyster-Yale Group (U.S.)

- Korea Hydro & Nuclear Power (KHNP) (South Korea)

- Teledyne Energy Systems, Inc. (U.S.)

- Enapter S.p.A. (Italy)

- H2B2 Electrolysis Technologies, Inc. (Spain)

- Nel ASA is regarded as an international pioneer and one of the largest pure-play electrolyzer manufacturers, well-known for its strong alkaline and PEM electrolysis technology. The organization is strongly upscaling its automated production capacity to gigawatt-scale to maintain its leadership in the expanding market. Besides, as per its 2024 annual report, the organization unveiled the 500MW PEM production line, which can produce 10 times stacks at a 30% lower unit expense.

- ITM Power PLC significantly specializes in PEM electrolyzers by focusing on offering flexible solutions for renewable energy integration as well as refueling applications. The firm has successfully established one of the world’s largest dedicated PEM electrolyzer factories to cater to the need for rapid-response and high-output systems.

- McPhy Energy S.A. provides both PEM electrolyzer and alkaline technologies, with a robust focus on refueling stations and integrated hydrogen production. The organization is considered a notable Europe-based player, proactively extending its industrial-scale manufacturing capabilities in Germany and France. Based on these, and as stated in its 2024 annual report, the organization generated €13.1 million in revenue, which has further increased to €17.1 million. Additionally, the organization’s electrolyzer business increased by over 15%, amounting to €15.8 million, which represents 99% of the overall revenue.

- Siemens Energy AG is considered an industrial powerhouse, readily leveraging its massive engineering expertise to deploy and develop multi-megawatt-scale PEM electrolyzers, frequently for large-scale Power-to-X projects and integrated energy solutions. The company’s strength remains in bundling electrolysis with its grid technology and renewable energy.

- ThyssenKrupp Nucera AG is one of the leaders in large-scale alkaline water electrolysis, leveraging decades of chlor-alkali to offer industrial-grade plants for huge green hydrogen production, especially in refining and chemical industries. The firm’s scalable and standardized modules are effectively designed for gigawatt-based projects, thereby making it a notable partner for decarbonizing heavy industry.

Here is a list of key players operating in the global market:

The worldwide electrolyzers market is extremely dynamic and characterized by a mix of established industrial gas firms, emerging manufacturers from Asia, and specialized technology pure plays. The market’s competitive landscape is readily defined by the need for technological advancement and gigawatt-scale manufacturing capacity. Moreover, notable tactical approaches, such as de-risking supply chains and forming standard alliances to gain a project pipeline, have been observed with deals between companies, such as ITM and Linde. Besides, in February 2024, Toyota Motor Corporation and Chiyoda Corporation successfully agreed to jointly create a large-scale electrolysis system and initiate a strategic partnership for signing a basic deal on cooperation. The objective is to contribute to readily gaining governmental targets for launching electrolysis equipment in both Japan and other nations, which is positively uplifting the market.

Corporate Landscape of the Electrolyzers Market:

Recent Developments

- In September 2024, Asahi Kasei effectively signed a memorandum of understanding (MOU) with De Nora, regarding the joint development, evaluation, sale, and study of small-scale pressurized alkaline water electrolyzers.

- In October 2024, BASF provided a unique partnership to the overall energy industry to ensure a tailored portfolio of polyarylethersulfones for components in water electrolyzers, which are significantly utilized for producing green hydrogen.

- In February 2024, Toshiba Energy Systems and Solutions Corporation and Bekaert successfully entered into an international partnership that comprises a tactical cooperation deal, along with a manufacturing technology license for Membrane Electrode Assemblies to accelerate green hydrogen production.

- Report ID: 3485

- Published Date: Dec 01, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Electrolyzers Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.