Electrocoagulation Market Outlook:

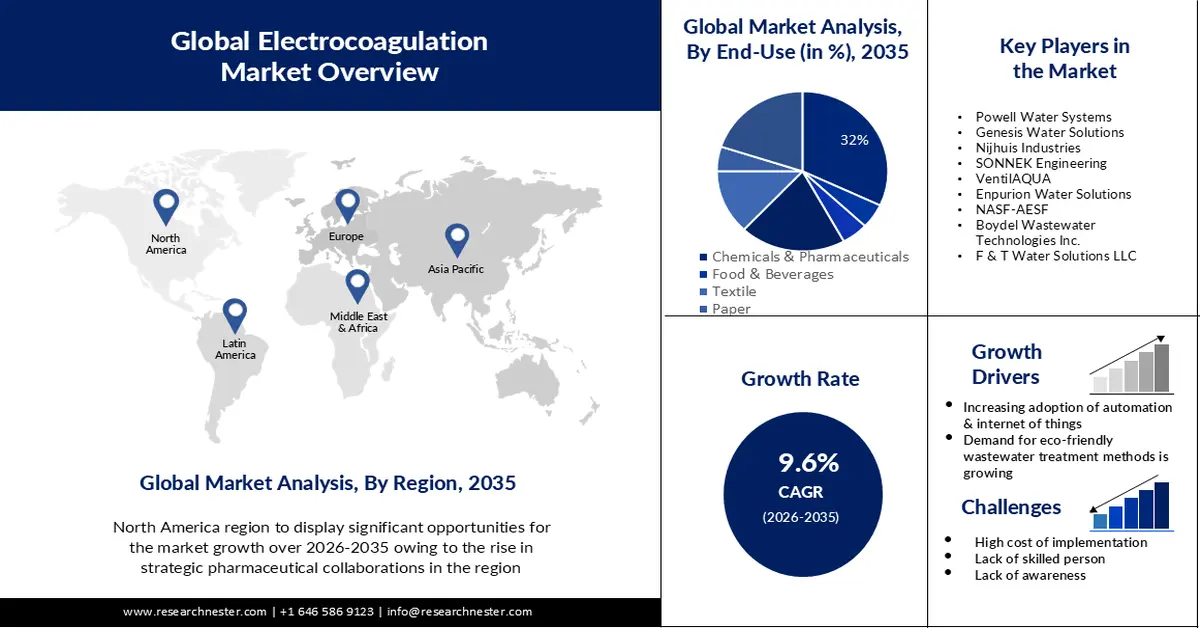

Electrocoagulation Market size was valued at USD 5.14 billion in 2025 and is set to exceed USD 12.85 billion by 2035, expanding at over 9.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of electrocoagulation is estimated at USD 5.58 billion.

The increasing use of automation and Internet of Things technology in electrocoagulation systems can improve their monitoring capabilities, operational efficiency, and remote control, leading to wider industry adoption of these systems. Five or more automated divisions are present in over one-third of businesses.

In addition, manufacturers of electrocoagulation systems and academic institutions working together can promote technological developments and open doors for innovative and new product development.

Key Electrocoagulation Market Insights Summary:

Regional Highlights:

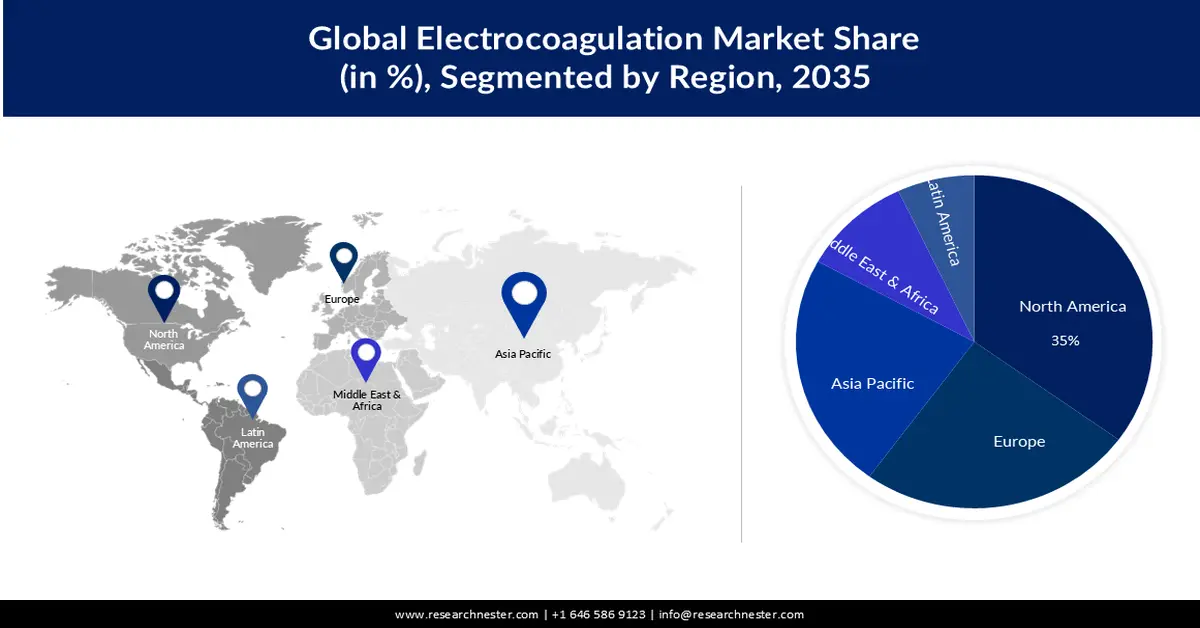

- North America is projected to hold a 35% revenue share by 2035, driven by strategic pharmaceutical collaborations and stringent wastewater treatment regulations.

- Europe is expected to capture the second-largest share of about 25% by 2035, fueled by high water usage in industrial sectors and regulatory compliance for industrial emissions.

Segment Insights:

- The chemicals & pharmaceuticals segment is projected to account for 32% share by 2035 in the electrocoagulation market, driven by the rising need to treat high volumes of wastewater containing pharmaceutical and chemical effluents.

- By 2035, the aluminium electrodes segment is expected to capture a 40% share, supported by its effectiveness in removing colors, organics, and microplastics from wastewater.

Key Growth Trends:

- Demand for Eco Friendly Wastewater Treatment Methods Is Growing

- Advancements in Electrode Materials

Major Challenges:

- High initial investment

Key Players: Powell Water Systems, Genesis Water Solutions, Nijhuis Industries, SONNEK Engineering, VentilAQUA, Enpurion Water Solutions, NASF-AESF, Boydel Wastewater Technologies Inc., F & T Water Solutions LLC.

Global Electrocoagulation Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.14 billion

- 2026 Market Size: USD 5.58 billion

- Projected Market Size: USD 12.85 billion by 2035

- Growth Forecasts: 9.6%

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Singapore, United Arab Emirates

Last updated on : 26 November, 2025

Electrocoagulation Market - Growth Drivers and Challenges

Growth Drivers

- Demand for Eco-Friendly Wastewater Treatment Methods Is Growing- Wastewater from a variety of industries is released, and it must be treated before being utilized again. One of the main problems that many economies face is the scarcity of water. Therefore, in order to recover the vast amounts of industrial wastewater produced by various businesses, it is necessary to develop industrial wastewater treatment systems that are safe, affordable, and environmentally sustainable. Globally, 380 billion cubic meters of municipal wastewater are produced annually. It is anticipated that wastewater output will rise by 24% by 2030 and 51% by 2050. Industrial wastewater poses a threat to the environment. Conventional wastewater treatment methods involve a blend of chemical, biological, and physical processes. Using the principles of electrochemistry, electrocoagulation is a relatively new and exciting technology for treating wastewater. The electrocoagulation market report projects that the next few years will see a boom in the electrocoagulation industry due to the technology's advantages, which include low sludge production, high removal efficiency, and easy operation.

- Advancements in Electrode Materials- Continuous research & development efforts to enhance electrode designs and materials may result in electrocoagulation systems that are more robust and effective, creating new opportunities for market expansion. India's per-capita research and development expenditure climbed from PPP USD 29.2 in 2007–2008 to PPP USD 42.0 in 2020–21. Over time, both GDP and R&D spending have consistently increased in absolute terms.

- Adoption of Strict Wastewater Treatment Regulations- Numerous industrial industries produce copious amounts of wastewater. As a result, governments everywhere have put strict laws into place to eliminate any dangerous material that might be in the water and endanger aquatic life, mankind as a whole, or the environment. Numerous regulatory organizations have made attempts to establish guidelines and rules for the treatment of wastewater and guarantee that the cleaned water is released into different bodies of water or utilized again for different purposes. Because of this, there is a need for affordable, effective water treatment methods that can properly remove dangerous materials from wastewater that is produced. The electrocoagulation market numbers are being further inflated by an increase in expenditure in research and development activities related to electrocoagulation for wastewater treatment.

Challenges

- High initial investment- Growth in the market may be hampered by the high initial cost of setting up electrocoagulation systems, particularly for small and medium-sized businesses.

- The expansion of the electrocoagulation market may be impeded by the lack of qualified specialists needed for the operation and maintenance of electrocoagulation systems.

- The lack of understanding among end users and their inclination towards conventional treatment procedures can impede the growth of the electrocoagulation industry, even with its advantages.

Electrocoagulation Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

9.6% |

|

Base Year Market Size (2025) |

USD 5.14 billion |

|

Forecast Year Market Size (2035) |

USD 12.85 billion |

|

Regional Scope |

|

Electrocoagulation Market Segmentation:

End-Use Segment Analysis

The chemicals & pharmaceuticals segment in the electrocoagulation market is anticipated to hold the largest revenue share of about 32% during the forecast period. Wastewater from the chemical and pharmaceutical sectors is produced in massive quantities. Pharmaceutical effluents, which often contain a high concentration of antibiotics, chemicals, organics, and solid materials, have increased as a result of the pharmaceutical industry's growth. There have previously been some drug traces discovered in water. Both individuals and the surrounding ecosystem are at risk because of this. Due to insufficient removal during the wastewater treatment process, these medications frequently find their way into water. As a result, electrocoagulation systems are becoming more popular in the treatment of wastewater and water. This is driving the growth of the electrocoagulation market. According to this study, 359.4 billion m3 of wastewater are produced worldwide each year, of which 63% (or 225.6 billion m3 annually) are collected and 52% (188.1 billion m3 annually) are treated.

Type Segment Analysis

The electrocoagulation market was dominated by the aluminium electrodes type segment with about 40% share during the forecast period. The most popular electrode for electrocoagulation is aluminum, which effectively removes colors, organic materials, microplastics, and other materials. During the forecast period, there will likely be an increase in demand for aluminum electrodes used in electrocoagulation.

Our in-depth analysis of the global electrocoagulation market includes the following segments:

|

Type |

|

|

End-Use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Electrocoagulation Market - Regional Analysis

North American Market Insights

North America industry is poised to dominate majority revenue share of 35% by 2035. This can be attributed to the rise in strategic pharmaceutical collaborations in the area, particularly between early-stage and well-established businesses. Due to the implementation of strict wastewater treatment rules and the expansion of the industrial sector in the region, the electrocoagulation market size in North America is expected to expand steadily over the course of the forecast period. The United States Environmental Protection Agency (US EPA) estimates that between 23,000 and 75,000 sanitary sewer overflows occur annually. Sewage treatment plants release between 3 and 10 billion gallons of untreated effluent annually.

European Market Insights

Electrocoagulation market in the Europe region is projected to hold the second largest share of about 25% during the projected period. The significant water use in sectors like sugar & ethanol and petrochemicals drives market expansion in the region. Among the industrial chemicals used for water treatment in Europe are solvents, corrosion inhibitors, coagulants and flocculants, and antiscalants. Water treatment chemical development in the European Union was greatly influenced by regulations created by the Europe Industrial Emission Directive to control industrial emissions. The European market for water treatment chemicals is expanding, and one of the main reasons for this is the growing demand for energy in places like Germany, France, and the United Kingdom.

Electrocoagulation Market Players:

- NaturalShrimp Holdings, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Powell Water Systems

- Genesis Water Solutions

- Nijhuis Industries

- SONNEK Engineering

- VentilAQUA

- Enpurion Water Solutions

- NASF-AESF

- Boydel Wastewater Technologies Inc.

- F & T Water Solutions LLC

Recent Developments

- NaturalShrimp, Inc. developed and patented the first shrimp-focused commercially operational Recirculating Aquaculture System (RAS). Funded by the Fisheries Research and Development Corporation (FRDC) and the Australian Prawn Farmers Association, this system was developed to evaluate the company’s patented electrocoagulation technology for the coagulation of microalgae and reduction of total nitrogen in wastewater.

- NASF-AESF Foundation selected a project that demonstrated the problem of per- and polyfluoroalkyl substances (PFAS) and related chemicals in plating wastewater streams. It also stated advanced methods to eliminate PFAS from the water via electrooxidation and electrocoagulation.

- Report ID: 5486

- Published Date: Nov 26, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Electrocoagulation Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.