Electrically Calcined Anthracite (ECA) Market Outlook:

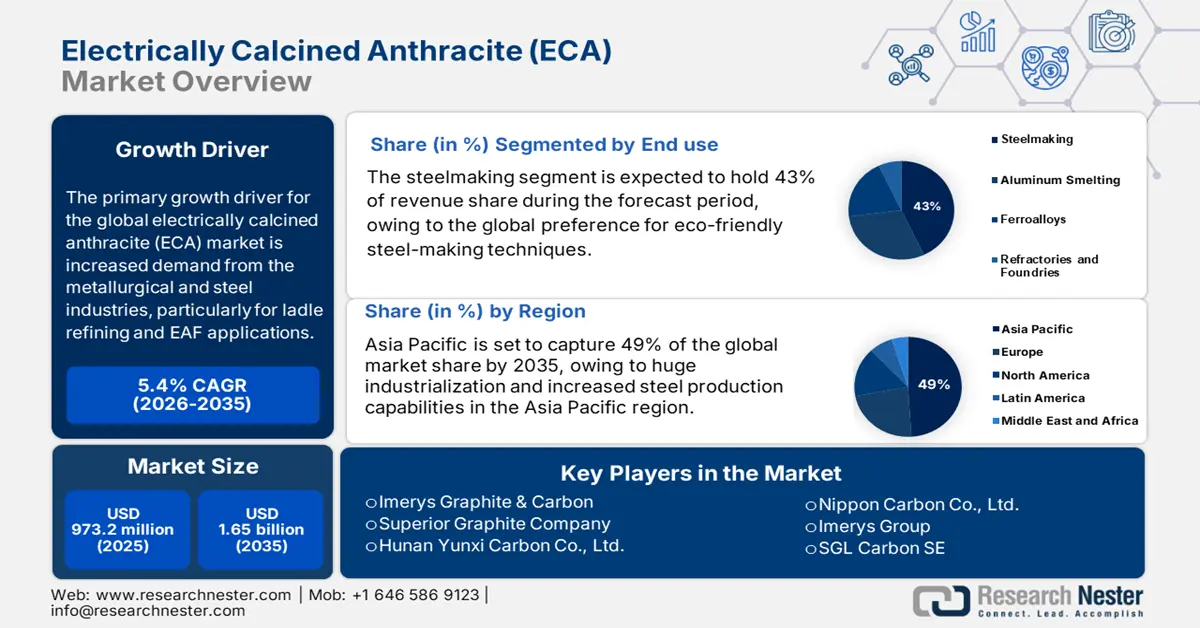

Electrically Calcined Anthracite Market size was valued at USD 973.2 million in 2025 and is projected to reach USD 1.65 billion by the end of 2035, rising at a CAGR of 5.4% during the forecast period, i.e., 2026‑2035. In 2026, the industry size of electrically calcined anthracite is estimated at USD 1.1 billion.

The primary growth driver for the global electrically calcined anthracite (ECA) market is increased demand from the metallurgical and steel business, especially for ladle refining and EAF applications. Government reports indicate that increased global crude steel production and use of low-carbon steelmaking practices necessitate high-purity carbonaceous products with low sulfur content and excellent thermal and electrical conductivity. For instance, the World Steel Association reports that in April 2024, the 71 nations produced 155.7 million tons (Mt) of crude steel, a 5.0% drop from April 2023. Increased application of ECA in carbon injection, electrode paste, and furnace lining processes is being driven by the growth. Materials that contain ECA, such as castings, cathodes, and refractory linings, must be functioning flawlessly in chemically reactive, high-temperature environments, allowing increased material utilization across non-ferrous and ferrous applications.

Raw material supply chains that are used in ECA production are based on high-quality anthracite coal and reliable electricity access, both of which are subject to the uncertainty of costs and regional concentration. According to the FRED, the producer price index for fabricated steel plate was 257.949 in July 2025. The PPI level in carbon-based metallurgical material and allied alloys is high, indicating strain in supply chains. National governments in countries like the U.S. and Canada are offering some incentives in the form of domestic procurement acts (e.g., Buy American Act) to encourage local production of ECA.

Key Electrically Calcined Anthracite Market Insights Summary:

Regional Highlights:

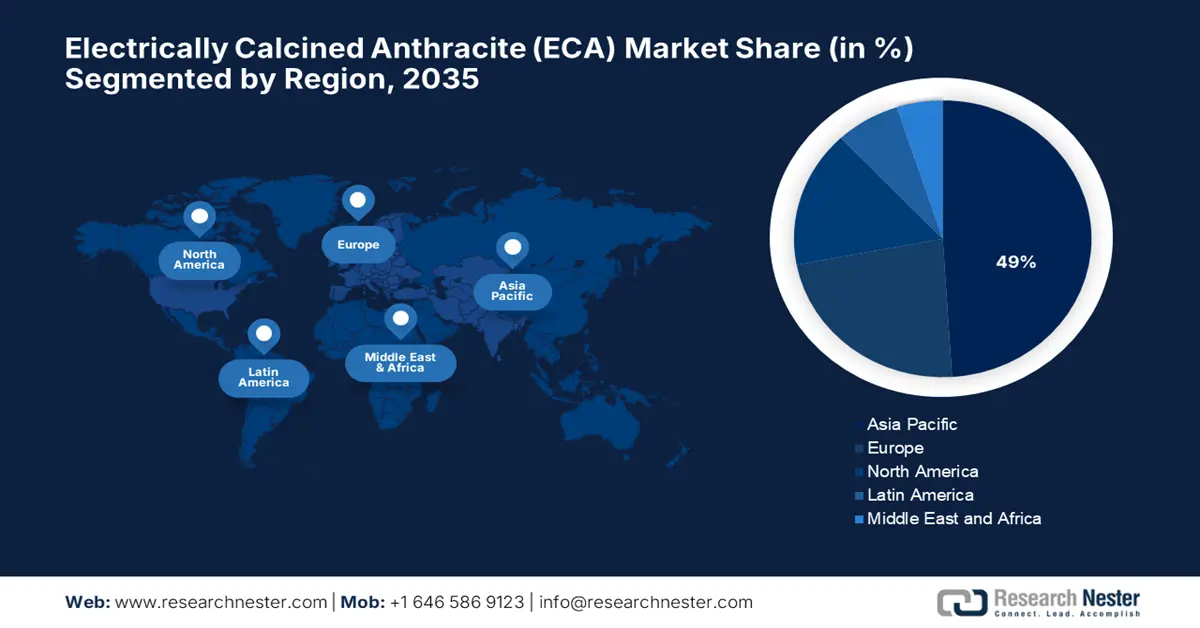

- The Asia Pacific Electrically Calcined Anthracite Market is projected to command about 49% share by 2035, fueled by large-scale industrialization and increasing adoption of electric arc furnace steelmaking technologies.

- Europe is anticipated to hold nearly 23% share by 2035, impelled by stringent emission norms and the rapid transition toward green steel production technologies.

Segment Insights:

- The Steelmaking (Electric Arc Furnace) segment is projected to capture 43% share of the Electrically Calcined Anthracite Market by 2035, propelled by the growing global preference for eco-friendly steelmaking practices.

- The Fine Grade ECA sub-segment is anticipated to account for 39% share by 2035, driven by the rising demand for high-purity and easily blendable carbon additives in precision metallurgical processes.

Key Growth Trends:

- Rising global steel production via electric arc furnaces (EAF)

- Expansion of refractory and aluminum industries

Major Challenges:

- High energy consumption and rising electricity costs

- Raw material supply constraints and geopolitical risks

Key Players: Imerys Graphite & Carbon, Superior Graphite Company, Hunan Yunxi Carbon Co. Ltd., Nippon Carbon Co. Ltd., Imerys Group, SGL Carbon SE, Constellium SE, Qingdao Haida Carbon Co. Ltd., Boral Limited, Graphite India Limited, AMG Advanced Metallurgical Group, POSCO Carbon, Gasi Carbon Technologies.

Global Electrically Calcined Anthracite Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 973.2 million

- 2026 Market Size: USD 1.1 billion

- Projected Market Size: USD 1.65 billion by 2035

- Growth Forecasts: 5.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (49% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: China, Japan, Germany, United States, India

- Emerging Countries: South Korea, Brazil, Indonesia, Mexico, Turkey

Last updated on : 11 September, 2025

Electrically Calcined Anthracite Market - Growth Drivers and Challenges

Growth Drivers

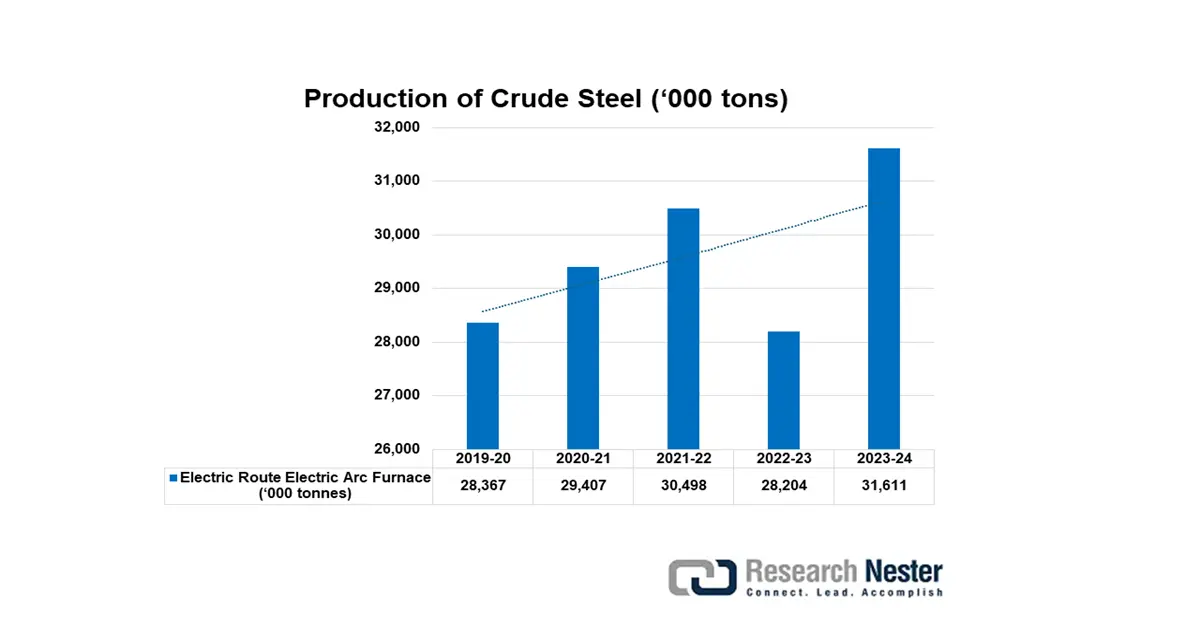

Rising global steel production via electric arc furnaces (EAF): EAF technology relies heavily on carbon additives like ECA to achieve the desired carbon content, thermal stability, and electrical conductivity during steelmaking. As more countries shift toward EAFs for their energy efficiency, lower emissions, and recycling capabilities, demand for high-quality ECA continues to grow. This trend not only strengthens consumption in steel production but also positions ECA as a critical material supporting the global transition to sustainable steelmaking practices. Further, as a major producer of anthracite coal, India has a growing domestic ECA industry poised to supply this demand, reducing reliance on imports.

Source: steel.gov

- Expansion of refractory and aluminum industries: India's primary aluminum production in 2024 increased slightly from 4.13 million tons (mnt) in 2023 to 4.15 mnt, but otherwise was relatively consistent year over year. In 2024, India imported about 2.45 million tons of alumina. The price of alumina surged by more than 70% in 2024 due to disruptions in Guinea, Brazil, and Australia. ECA has widespread use in cathode blocks, riser linings, and conductive pastes for both refractory and smelting operations. Such high-temperature industrial processing is expanding ECA application due to its thermal conductivity and chemical stability.

- Rising demand for graphite electrodes: Graphite electrodes for electric arc furnaces (EAFs) are important inputs for producing steel and high-purity carbon sources like ECA. As the global steel industry shifts to less environmentally aggressive and energy-efficient EAF production, the demand for graphite electrodes and ultimately ECA is increasing. ECA provides durability of electrodes, low ash content, and good conductive properties. The ECA market is growing significantly in relation to the growing reliance on EAFs for sustainable steelmaking in both Europe and North America.

Global Steel Production

Global steel production directly drives the ECA market, as ECA is widely used as a carbon raiser, reductant, and electrode material in steelmaking. Higher steel output increases demand for ECA to improve carbon content, purity, and thermal stability in both blast furnace and electric arc furnace operations. With expanding construction, automotive, and infrastructure projects worldwide boosting steel consumption, the requirement for reliable carbon inputs like ECA rises proportionally. This strong linkage ensures that growth in global steel production remains a primary catalyst for the ECA market.

Crude Steel Production by Region

|

Region |

Apr 2024 (Mt) |

% change Apr 24/23 |

Jan-Apr2024 (Mt) |

% change Jan-Apr 24/23 |

|

Africa |

1.8 |

1.4 |

7.4 |

6.6 |

|

Asia and Oceania |

114.8 |

-5.8 |

461.8 |

-1.6 |

|

EU (27) |

11.3 |

1.1 |

44.4 |

-0.6 |

|

Europe, Other |

3.4 |

-2.6 |

14.7 |

13.9 |

|

Middle East |

4.6 |

-8.2 |

18.3 |

6.2 |

|

North America |

8.9 |

-5.2 |

35.8 |

-3.7 |

|

Russia & other CIS + Ukraine |

7.4 |

-3.5 |

29.0 |

-0.6 |

|

South America |

3.4 |

-3.9 |

14.0 |

1.2 |

|

Total 71 countries |

155.7 |

-5.0 |

625.4 |

-0.9 |

Source: World Steel

Top 10 Steel-Producing Countries

|

Country |

Apr 2024 (Mt) |

% change Apr 24/23 |

Jan-Apr 2024 (Mt) |

% change Jan-Apr 24/23 |

|

China |

85.9 |

-7.2 |

343.7 |

-3.0 |

|

India |

12.1 |

3.6 |

49.5 |

8.5 |

|

Japan |

7.1 |

-2.5 |

28.5 |

-1.2 |

|

United States |

6.7 |

-2.8 |

26.5 |

-2.2 |

|

Russia |

6.2e |

-5.7 |

24.6 |

-2.5 |

|

South Korea |

5.1 |

-10.4 |

21.2 |

-5.1 |

|

Germany |

3.4e |

6.4 |

13.1 |

6.1 |

|

Türkiye |

2.8 |

4.5 |

12.3 |

22.1 |

|

Brazil |

2.7e |

-2.1 |

11.0 |

4.0 |

|

Iran |

2.7e |

-12.3 |

10.3 |

7.2 |

Source: World Steel

Challenges

- High energy consumption and rising electricity costs: Electric calcining of anthracite is energy-consuming and is based entirely on continuous high-temperature electric furnaces. Increasing global electricity prices from volatile energy markets and more stringent environmental regulations make production more expensive. This discourages profitability to manufacturers, particularly where expensive or volatile power sources are available in certain regions. This means greater operating costs transferred to the customer, which restricts wider application and discourages market growth, especially in cost-conscious developing economies with arguably less secure energy infrastructures.

- Raw material supply constraints and geopolitical risks: Production of ECA depends on a seamless supply of high-grade anthracite coal, which is geographically focused in a limited number of countries such as China, Russia, and Ukraine. Political instability, trade restrictions, and export controls create supply uncertainty and increase sourcing risk. These types of disruptions cause price volatility and reduce the capacity of manufacturers to maintain stable levels of production. Environmental protection laws governing the transportation and mining of coal also contribute to adding to raw material deficiencies, restraining market growth, and discouraging investment in new plants.

Electrically Calcined Anthracite (ECA) Market Key Insights

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.4% |

|

Base Year Market Size (2025) |

USD 973.2 million |

|

Forecast Year Market Size (2035) |

USD 1.65 billion |

|

Regional Scope |

|

Electrically Calcined Anthracite Market Segmentation:

End use Segment Analysis

Steelmaking (Electric Arc Furnace) is expected to hold the largest electrically calcined anthracite market share of 43% in 2035, due to the global preference for eco-friendly steel-making techniques. The EAF steelmaking sector experienced growth due to government initiatives promoting low-emission technologies. With a production capacity of roughly 42 MTPA and an average capacity utilization of 65–68%, EAF can produce roughly 25–28 MT per year. Electricity provides 75–80% of the energy input for EAFs and IFs, with chemical energy accounting for the remaining 20–25%. The Asia-Pacific and Europe dominate the demand due to stringent environmental regulations and a push toward modernization away from blast furnaces and into electric arc furnaces, stimulating higher usage of ECA as the main carbon additive.

Product Type Segment Analysis

The fine grade ECA sub-segment is expected to hold a 39% electrically calcined anthracite (ECA) market share in 2035, by meeting the demand for high-purity, consistent, and easily blendable carbon additives. Its fine particle size ensures better dispersion, reactivity, and carbon recovery, making it particularly suitable for applications in steelmaking, aluminum production, and foundries where precision and efficiency are critical. Industries prefer fine grade ECA for its ability to enhance thermal stability and conductivity while minimizing impurities, thereby supporting higher performance standards. This preference is propelling the fine grade segment as a key contributor to overall market expansion.

Application Segment Analysis

The carbon additive injection subsegment is expected to hold 37% electrically calcined anthracite (ECA) market share in 2035. It is the best application for furnace temperature control and impurity reduction. It plays an important role in furnace temperature regulation and impurity reduction, ensuring stable metallurgical processes. North America and Asia-Pacific remain the largest adopters, supported by strong developments in steel refining technologies. Growing demand for high-quality steel products in automotive, construction, and heavy engineering industries continues to fuel the preference for this method, reinforcing its importance in global steelmaking operations.

Our in-depth analysis of the global electrically calcined anthracite market includes the following segments:

|

Segments |

Subsegments |

|

End use |

|

|

Application |

|

|

Product type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Electrically Calcined Anthracite Market - Regional Analysis

Asia Pacific Market Insight

The Asia Pacific is expected to represent about 49% of the global electrically calcined anthracite (ECA) market in 2035, due to huge industrialization and increased steel production capabilities in the region. The shifting growth in the use of electric arc furnaces, as well as infrastructure developments and an increase in manufacturing abilities, has accelerated the demand for ECA regionally. China was the world’s largest crude steel producer in 2024 with a production of 1,005.1 MT. China, through its 14th Five-Year Plan, continues to urge the demand for premium ECA products by making strategic investments in green steel technologies as well as new aluminum and automotive industries.

China is projected to account for approximately 71% of the Asia Pacific electrically calcined anthracite market share, which represents 34.5% of the overall global market by 2035. This is a result of colossal industrial modernization projects, over-urbanization to 64.8% in 2023, and stringent environmental regulations encouraging cleaner steel production methods. The national carbon-neutrality and green manufacturing push is propelling high-end electrically calcined anthracite grades. Furthermore, local demand for steel and aluminum, and imports of high-grade ECA, increase consumption within the region.

India is projected to be about 12.2% of the world ECA market value in 2035, growing during 2026-2035. An additional vertical shaft calcination kiln (2,000,000 TPA capacity), eight furnaces for an electrically calcined anthracite plant (75,000 TPA capacity), eight furnaces for graphitizing of calcined petroleum coke (four furnaces for foundry grade and four for anode grade), and the revival of an old carbon paste plant (75,000 TPA capacity) in West Bengal are all part of the expansion of the current 93,744 TPA calcined petroleum coke plant in West Bengal. National Infrastructure Pipeline growth and rising steel manufacturing capacity are the main drivers, whereas electric arc furnace installations rise steadily. Global initiatives such as Make in India and a greater focus on environmentally friendly industrial processes by government policies keep reinforcing growth in demand. Usage by the power, automotive, and construction sectors further fuels electrically calcined anthracite use as a critical metallurgical additive.

India’s Finished Steel (Alloy + Non-Alloy) Production, Trade, and Consumption

|

Year |

Production (MT) |

Import (MT) |

Export (MT) |

Consumption (MT) |

|

2020-21 |

96.204 |

4.752 |

10.784 |

94.891 |

|

2021-22 |

113.597 |

4.669 |

13.494 |

105.752 |

|

2022-23 |

123.196 |

6.022 |

6.716 |

119.893 |

|

2023-24 |

139.153 |

8.320 |

7.487 |

136.291 |

Source: steel.gov

Europe Market Insight

Europe is expected to contribute about 23% of the global electrically calcined anthracite (ECA) market share in 2035, driven by stringent environmental regulations and expansion in the use of electric arc furnace steelmaking technologies. Europe holds almost 20% of the global market revenues up to 2025, mainly through dominant countries such as Germany, France, and Italy. The region's focus on decarbonization has fueled green steel production demand, prompting ECA demand to over USD 850 million in 2025, according to the European Green Deal. An expansion of the automotive and construction industries, along with investment in new metallurgical technologies, also propels the demand for high-purity carbon additives.

Germany is poised to have the highest share in the European electrically calcined anthracite market, with approximately 40.5% regional market share in 2035. Strong steel production facilities that support stringent emission control targets ensure ECA demand will experience growth. In heavy industries (steel, aluminum, glass, cement, ceramics), electric furnaces and ovens are used for high-temperature processes like melting, heat treatment, and sintering. Additionally, the growing machine and automotive industry in Germany is also conducive to the use of high-strength grades of steel. Government support for the Climate Action Program 2030 to promote more use of low-carbon metallurgical processes to fuel the market. The export-based steel industry in Germany also offers guaranteed demand for high-grade ECA to support the quality level to be exported to any part of the world.

France is expected to hold 30.5% of the European ECA Market in 2035, with consistent growth backing the upgrades in steel and aluminum smelting. Related emission reduction subsidies from governments and circular economy measures propel ECA's wider acceptance. Rising demand for aerospace, automotive, and infrastructure development supports the higher regional consumption. Decarbonization of industry in France is achieved through strategic investment in the National Low-Carbon Strategy (SNBC) that supports the use of more ECA-based steel production. Additionally, increased green production and renewable energy operations within the nation increase the demand for cleaner inputs utilized in metallurgy, such as electrically calcined anthracite.

Export of Industrial & Laboratory Electric Furnaces in 2023

|

Region / Country |

Export Value (USD thousands) |

|

United Kingdom |

2,694.51 |

|

Germany |

105,201.28 |

|

France |

46,370.67 |

|

Italy |

47,664.96 |

|

Spain |

3,696.25 |

Source: WITS

North America Market Insight

North America is expected to contribute about 16% of the global electrically calcined anthracite (ECA) market share in 2035, due to the share of demand arising from steel and aluminum manufacturing industries, mainly electric arc furnace technology adoption. ECA consumption grows steadily with the drive from the U.S. and Canada on industrial infrastructure modernization while abiding by more stringent environmental regulations. Further, the market growth is amplified by government initiatives that back domestic sourcing and sustainable manufacturing processes, coupled with the thriving construction and automotive industries. Also, owing to a strong supply chain, technological innovations in metallurgical applications have placed North America as a leading location in the ECA market.

In August 2025, domestic raw steel production in the U.S. was 1,780,000 net tons, with a 78.6% capability utilization rate, which is a 3.1% increase from 1,726,000 net tons and a 77.7% utilization rate in the same week of 2024. Compared to the previous week ending August 16, 2025, raw steel production increased by 0.3%, from 1,774,000 net tons and a 78.3% capability utilization. Year-to-date raw steel production through August 23, 2025, totaled 57.7 million net tons at a 76.6% capability utilization, up 1.3% from 56.9 million net tons for the same period in 2024.

Key Electrically Calcined Anthracite Market Players:

- Imerys Graphite & Carbon

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Superior Graphite Company

- Hunan Yunxi Carbon Co., Ltd.

- Nippon Carbon Co., Ltd.

- Imerys Group (Europe Headquarters)

- SGL Carbon SE

- Constellium SE

- Qingdao Haida Carbon Co., Ltd.

- Boral Limited

- Graphite India Limited

- AMG Advanced Metallurgical Group

- POSCO Carbon

- Gasi Carbon Technologies

The electrically calcined anthracite market is highly competitive, with a mix of multinational corporations and regional specialists driving innovation and capacity expansions. Leading players like Imerys Graphite & Carbon and Superior Graphite leverage advanced production technologies and global supply networks to maintain dominance. Strategic initiatives include increasing investments in sustainable calcination processes and expanding production facilities closer to end-user industries. Companies such as Nippon Carbon and Tokai Carbon focus heavily on R&D to develop higher-purity ECA grades tailored for evolving steel and aluminum manufacturing needs. Partnerships and joint ventures across Asia-Pacific and Europe are common strategies to enhance market penetration and comply with stringent environmental regulations.

Top Global Electrically Calcined Anthracite (ECA) Manufacturers

Recent Developments

- In March 2024, Imerys Graphite & Carbon launched an advanced electrically calcined anthracite product with enhanced purity and lower sulfur content, designed to improve electric arc furnace steel quality. This innovation led to a 14% increase in adoption across European and North American steel mills, boosting operational efficiency and reducing emissions. The new product aligns with growing industry demands for sustainable raw materials, positioning Imerys as a leader in eco-friendly metallurgical inputs worldwide.

- In January 2024, Superior Graphite Company announced the expansion of its ECA production capacity by 25% at its U.S. facilities, supported by a $50 million investment. The ramp-up addresses rising demand from aluminum and steel manufacturers adopting electric arc furnace technology. The upgrade also incorporates energy-efficient calcination methods, reducing the plant’s carbon footprint and enhancing product consistency, strengthening the company’s competitive position globally.

- Report ID: 8095

- Published Date: Sep 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.