Calcined Petroleum Coke Market Outlook:

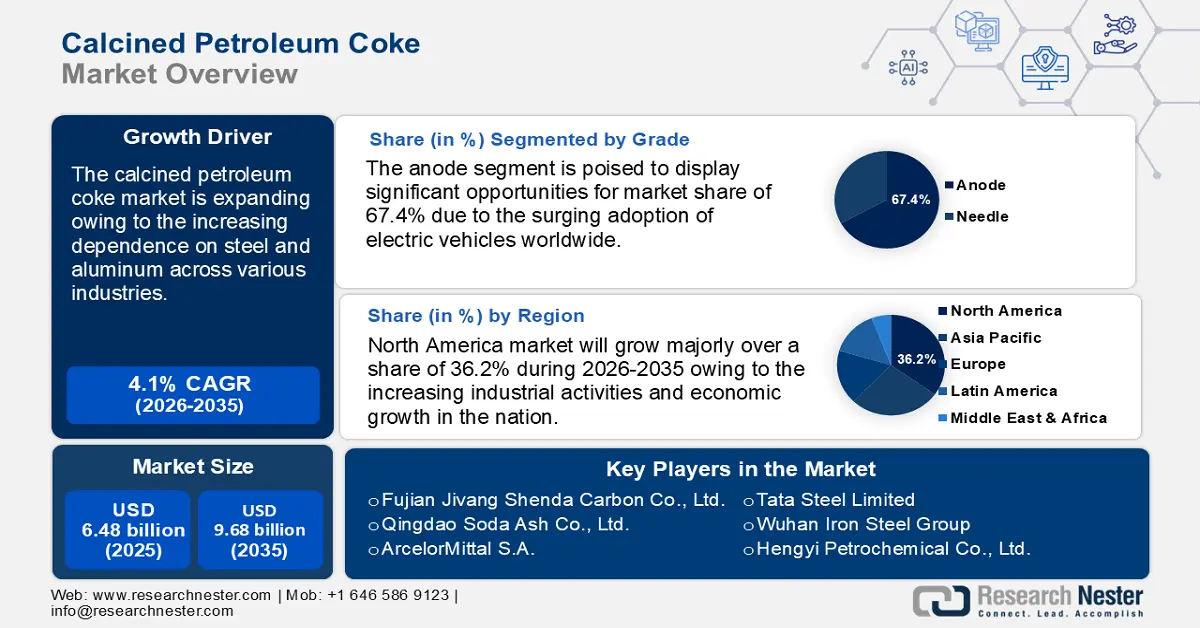

Calcined Petroleum Coke Market size was valued at USD 6.48 billion in 2025 and is set to exceed USD 9.68 billion by 2035, expanding at over 4.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of calcined petroleum coke is estimated at USD 6.72 billion.

The global calcined petroleum coke market is expected to experience significant growth driven by the increasing dependence on steel and aluminum across various sectors. The demand for calcined petroleum coke is projected to rise in response to the expansion of burgeoning industries that are characterized by the production of these materials. This particular type of petroleum coke is utilized as a reducing agent in the electrolytic reduction process within the aluminum industry and serves as a source of carbon in the blast furnace operations of the steel industry. In the forthcoming years, the demand for calcined petroleum coke will be influenced by the growth in steel and aluminum production necessary to satisfy the demands of the population, particularly in the areas of transportation, infrastructure development, and the production of consumer goods.

The Organization for Economic Co-operation and Development revealed that despite the uncertain forecast for steel demand, it is anticipated that global steel capacity will expand by 158 MMT in 2024–2026. Of this capacity development, basic oxygen furnaces (BOF) will make up 42% and lower-emitting electric arc furnaces (EAF) 54%.

Key Calcined Petroleum Coke Market Insights Summary:

Regional Highlights:

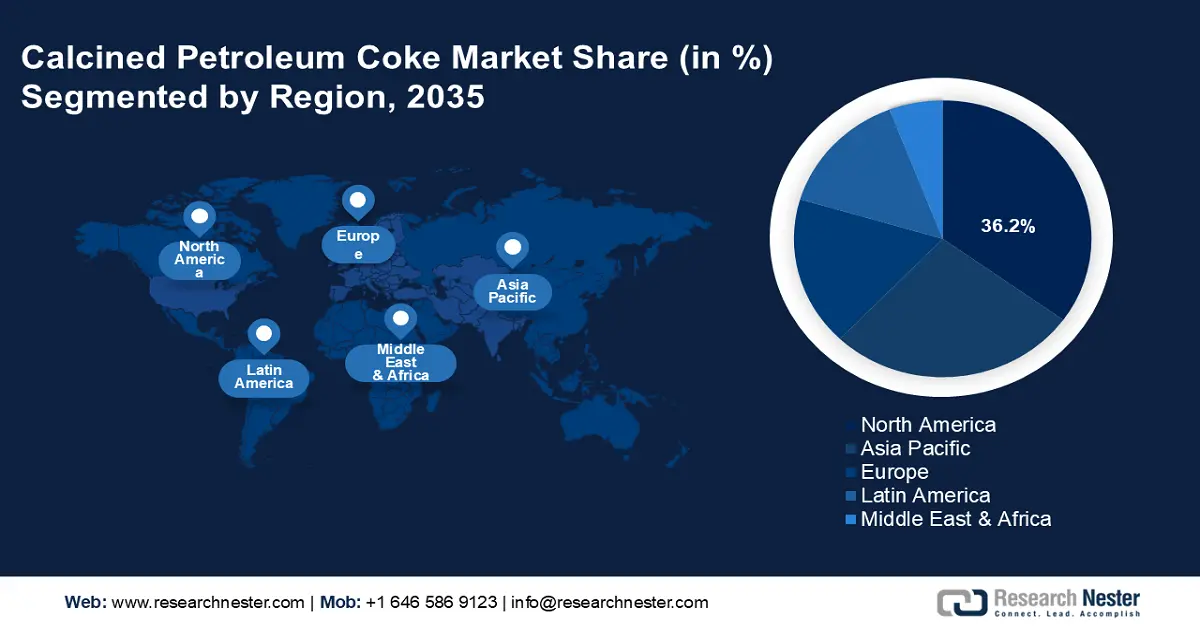

- North America calcined petroleum coke market will account for 36.20% share by 2035, driven by modernization initiatives in steel and aluminum industries, increasing demand for calcined petroleum coke.

- Asia Pacific market will register significant growth during the forecast period 2026-2035, attributed to increased industrialization, aluminum smelting capacity, and adoption of cleaner, efficient steel technologies.

Segment Insights:

- The anode grade segment in the calcined petroleum coke market is expected to capture a 67.40% share by 2035, driven by the low impurity content and suitability for high-quality calcined coke production.

Key Growth Trends:

- Increasing environmental concerns

- Increasing technological advancements

Major Challenges:

- Supply chain disruptions

- Health concerns

Key Players: China Petroleum Chemical Corporation, Tianjin Daguang Chemical Industry Group Co., Ltd., Fujian Jiyang Shenda Carbon Co., Ltd., Jining Shengxin Carbon Co., Ltd., Qingdao Soda Ash Co., Ltd., ArcelorMittal S.A., Tata Steel Limited, Wuhan Iron Steel Group, Hengyi Petrochemical Co., Ltd., Jizhong Energy Group Co., Ltd..

Global Calcined Petroleum Coke Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 6.48 billion

- 2026 Market Size: USD 6.72 billion

- Projected Market Size: USD 9.68 billion by 2035

- Growth Forecasts: 4.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (36.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, India

- Emerging Countries: China, India, Brazil, Mexico, Saudi Arabia

Last updated on : 18 September, 2025

Calcined Petroleum Coke Market Growth Drivers and Challenges:

Growth Drivers

- Increasing environmental concerns: Calcined petroleum coke is becoming more popular as a cleaner substitute for conventional fossil fuels due to environmental restrictions that aim to improve air quality and reduce greenhouse gas emissions. Because calcined petroleum coke has less sulfur than other fossil fuels, it emits less sulfur dioxide. Additionally, fluidized bed combustion systems, which provide reduced emissions and increased combustion efficiency, can use calcined petroleum coke. The demand for calcined petroleum coke in the global calcined petroleum coke market is expected to be driven by the growing adoption of environmental laws.

- Increasing technological advancements: The manufacture of is becoming more efficient and cost-effective due to ongoing technological developments and advancements. In order to increase the quantity and quality of calcined petroleum coke, research and development efforts are concentrated on streamlining the calcination process. Furthermore, the expansion of the global calcined petroleum coke market industry is anticipated to be aided by the creation of new technologies for the use of calcined petroleum coke in a variety of applications.

- Surging demand in the metal industry: Calcined petroleum coke is primarily used in foundries and metallurgy to melt aluminum for use in producing special high-carbon steel. It is also used as a carbon raiser in foundries to produce carbon and a range of graphite and carbon products. A lot of power plants use petroleum coke as fuel to generate electricity. For instance, almost 75% of the petcoke produced worldwide is categorized as fuel-grade and is used to generate power. In order to produce an electrically conductive cement mortar that is used as an energy source in the cement industry, calcined petcoke, an electrically conductive material, can be added to carbon fiber.

Furthermore, various carbon products, such as carbon brushes, graphite electrodes, and other carbon products, are made using petcoke as a feedstock. Additionally, it is used in the production of activated carbon, which is used to make paints, inks, and polymers as well as to filter water and air.

Challenges

- Supply chain disruptions: Since the primary sources of calcined petroleum coke from the petroleum industry are crude oil distillates and residues, the ban on coal mining is expected to impede supply, resulting in a shortage of the product. Producers have occasionally experienced unexpected losses as a result of similar impacts of changes in the price of crude oil on the price of petroleum coke. The expansion of the global calcined petroleum coke market may be hampered by this.

- Health concerns: Petroleum coke is a source of fine particles that can enter the lungs, bypassing the human airway filtering system, and result in major health issues like pneumonia, asthma, and other respiratory ailments. The Environmental Protection Agency claims that petroleum coke contains the dangerous element vanadium. It can be hazardous at trace levels (0.8 micrograms per cubic meter of air). Both burning and storing petcoke pose environmental risks.

Calcined Petroleum Coke Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.1% |

|

Base Year Market Size (2025) |

USD 6.48 billion |

|

Forecast Year Market Size (2035) |

USD 9.68 billion |

|

Regional Scope |

|

Calcined Petroleum Coke Market Segmentation:

Grade Segment Analysis

Anode segment is expected to account for more than 67.4% calcined petroleum coke market share by the end of 2035. Low in metals and sulfur, anode-grade pet coke—also referred to as raw pet coke (RPC) or green pet coke (GPC)—needs to be calcined before being baked into anodes. Anode-grade petcoke, for example, is often a green, calcinable petcoke with a sulfur level of more than 2%, minimal ash, and minimal metal content. Calcined petcoke (CPC), a low-quality product with a high carbon content, is produced by heating anode-grade petcoke below its melting point to eliminate moisture and volatile impurities. Additionally, most anode-grade petroleum coke has comparatively few impurities, which makes it burn cleaner and have better resistance to abrasion than other fuels.

End user Segment Analysis

The electric arc & induction furnaces segment in calcined petroleum coke market is anticipated to garner a significant share during the assessed period. High-purity solid carbonaceous materials like calcined petroleum coke are used to create electrodes for electric and induction furnace building. For example, the calcined pet coke used to create graphite electrodes is heated to over 1400°C in a forging smelting furnace and contains about 98% carbon. Additionally, an electrode is a device used mostly in the steel industry that transports energy into an electric arc furnace. Furthermore, due to their tight chemical composition and high mechanical performance, steels such as special tool steel, aircraft steel, stainless steel, and others can be melted in electric arc furnaces, which are mainly used to melt or extract ferrous or non-ferrous metals.

Our in-depth analysis of the global calcined petroleum coke market includes the following segments:

|

Grade |

|

|

End user |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Calcined Petroleum Coke Market Regional Analysis:

North America Market Insights

North America in calcined petroleum coke market is anticipated to account for around 36.2% revenue share by 2035. Using cutting-edge materials like calcined petcoke is a common part of modernization initiatives in the steel sector. The growing demand for calcined petcoke as a raw material for steel electrodes is a result of increased steel production efficiency. A greater need for calcined petcoke, a crucial component of carbon anodes required for aluminum smelting, is indicated by increased capacity for producing aluminum. These industries' expansion is directly related to industrial activity and economic growth. Using cutting-edge materials like calcined petcoke is a common part of modernization initiatives in the steel sector.

APAC Market Insights

Asia Pacific calcined petroleum coke market is expected to grow at a significant rate during the projected period. A greater need for calcined petcoke, an essential ingredient in the creation of carbon anodes, is indicated by increased aluminum smelting capacity. The region's total industrialization and economic growth are strongly correlated with this growth driver. Adoption of cutting-edge materials and technologies is a common component of modernization initiatives in the steel sector. Because of its high carbon content, calcined petcoke is crucial to the production of steel electrodes, which boosts efficiency. Applications for calcined petcoke can be found in renewable energy projects, specifically in the manufacturing of electrodes for specific energy-intensive processes. The focus on cutting carbon emissions is consistent with calcined petcoke's characteristics. Cleaner and more efficient technology is adopted by the industry due to strict emission limits.

Calcined Petroleum Coke Market Players:

- China Petroleum Chemical Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent developments

- Regional Presence

- SWOT Analysis

- Tianjin Daguang Chemical Industry Group Co., Ltd.

- Fujian Jiyang Shenda Carbon Co., Ltd.

- Jining Shengxin Carbon Co., Ltd.

- Qingdao Soda Ash Co., Ltd.

- ArcelorMittal S.A.

- Tata Steel Limited

- Wuhan Iron Steel Group

- Hengyi Petrochemical Co., Ltd.

- Jizhong Energy Group Co., Ltd.

Major players in the calcined petroleum coke market are constantly trying to appeal to their target clients by creating and implementing suitable goods and services. Through mergers and acquisitions, the multinational rivals are likewise putting emphasis on expanding their market dominance in other markets. The calcined petroleum coke market is anticipated to expand quickly in the next years due to the rising demand from end-use segments.

Recent Developments

- In February 2025, ArcelorMittal announced the construction of a state-of-the-art facility in Alabama for the production of non-grain-oriented electrical steel (NOES). Depending on the product mix, the new ArcelorMittal-owned facility will be able to produce up to 150,000 metric tons of NOES annually to support the production of renewable electricity, automobiles and mobility, and other industrial and commercial uses of NOES, such as electric motors, generators, and specialized applications.

- In September 2023, Tata Steel and the UK government have reached an agreement to invest in state-of-the-art Electric Arc Furnace steelmaking at the Port Talbot site for a capital cost of USD 1.42 billion, including a grant of up to USD 569.44 million from the UK government, subject to relevant regulatory approvals, information and consultation processes, and the finalisation of detailed terms and conditions.

- Report ID: 7532

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Calcined Petroleum Coke Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.