Electric Vehicle Battery Market - Growth Drivers and Challenges

Growth Drivers

- Government policies and subsidies: Through a combination of legislative mandates, subsidies, and strategic investments, government support is significantly contributing to the acceleration of the EV battery market. With a budgetary investment of USD 1.43 billion, the FAME II program is specifically designed to encourage the use of electric vehicles and boost production. In addition, the Ministry of Heavy Industries introduced the PM E-DRIVE Scheme in September 2024 with a budget of USD 1.28 billion to strengthen India's EV ecosystem, encourage electric mobility, and lessen dependency on fossil fuels. The demand for batteries is rising as a result of manufacturers being forced to prioritize EV production due to stricter emissions regulations and ICE phase-out timelines being implemented in several countries. In order to lessen dependency on foreign supply chains, direct financial incentives such as the EU Green Deal Industrial Plan and the U.S. Inflation Reduction Act (IRA) subsidize local battery manufacture, research and development, and the sourcing of essential minerals.

In order to maintain sustainability, governments are also supporting battery recycling initiatives and gigafactories, such as Tesla's Berlin facility, which is supported by German subsidies. Domestic manufacturing is further strengthened via public-private partnerships, such as India's PLI initiative for advanced chemical cells and China's CATL cooperation. Government regulations are actively influencing the future of the EV battery sector by lowering investment risk and maintaining market stability.

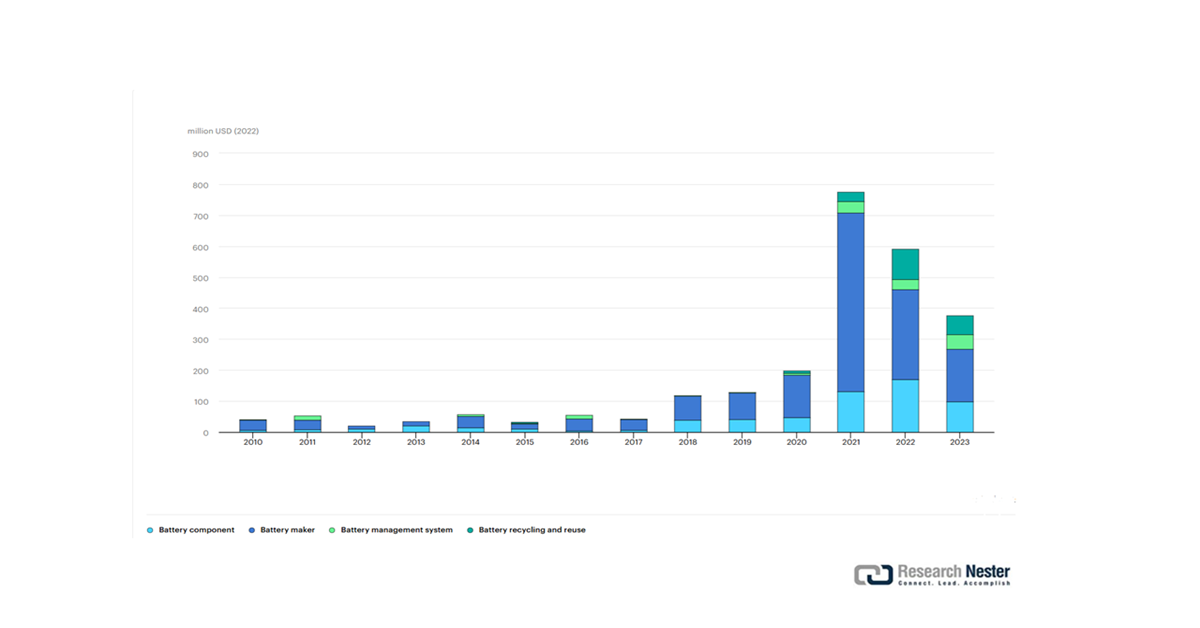

- The surge in venture capital (VC) investments: By allowing entrepreneurs to quickly develop in battery technology, charging infrastructure, and car design, venture capital (VC) funding is propelling the EV battery and vehicle market. These initiatives help lower costs and enhance performance by supporting innovations in solid-state batteries, higher energy density cells, and faster charging solutions. Additionally, traditional automakers are pushed to hasten their own EV roadmaps by VC-backed startups, which increases competitiveness. Funding also promotes developments in environmentally friendly supply chains, like the extraction and recycling of lithium. VCs are essential to increasing production and commercializing cutting-edge technology because they de-risk early-stage R&D. This capital inflow is strengthening the shift to electric transportation, increasing customer choice, and speeding up adoption.

Early-stage venture capital investments in batteries by technology, 2010-2023

(Source: IEC)

- Expansion of charging infrastructure: The rapid build-out of EV charging networks reduces range anxiety and supports higher EV adoption, thereby increasing battery demand. In the US, President Biden’s Bipartisan Infrastructure Law invests $7.5 billion in EV charging, $10 billion in clean transportation, and over $7 billion in EV battery components, essential minerals, and materials. This accelerates EV adoption, consequently increasing the demand for high-capacity EV batteries from companies like CATL and Samsung SDI.

Electric vehicle (EV) charging infrastructure in the U.S. (2024)

|

Metric |

Q1 (% increase) |

Q2 (% increase) |

|

Total Charging Ports |

4.6% |

6.3% |

|

Public Ports |

4.8% |

6.5% |

|

Private Ports |

3.2% |

4.4% |

|

DC Fast Charging Ports |

8.2% |

7.4% |

(Source: U.S. Department of Energy)

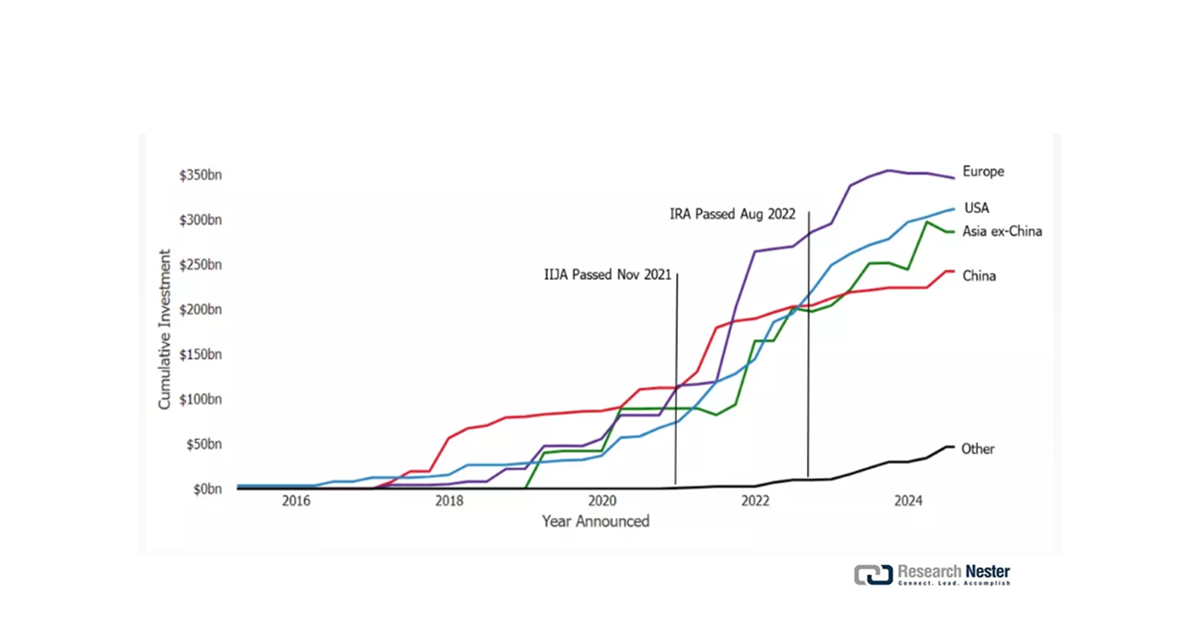

Electric Vehicle Battery Investment Trends

The U.S. is the leading country for attracting investments in electric vehicle (EV) and battery manufacturing, outpacing China and other countries worldwide. Companies have announced $312 billion worth of investments in the U.S, up from approximately $75 billion in 2021. Of the $312 billion of investments for the United States, $223 billion is dedicated to specific facilities or initiatives, an increase of roughly $66 billion since January 2023, suggesting that firms are putting their prior commitments into action. More than half of that investment ($133 billion) is designated for battery manufacturing and recycling; 32%, or approximately $70 billion, for EV manufacturing; and $21 billion is allocated to facilities producing components further down the supply chain, such as EV parts and critical minerals.

Total Investments by EV and EV Battery Manufacturers, by Region

(Source: NRDC)

Challenges

- Raw material supply constraints: The production of EV batteries heavily depends on rare minerals such as lithium, cobalt, and nickel. The global supply chain for these materials is limited and only concentrated in a few countries. This creates vulnerability to geopolitical risks, trade restrictions, and market volatility. As EV demand grows, securing a consistent and ethical supply of raw materials becomes tough, potentially leading to higher costs and production delays. Further, the growth of the EV battery market is hampered by the lack of adequate charging infrastructure in several regions, as the absence of sufficient charging stations discourages consumers from transitioning to electric vehicles, affecting battery demand.

- Battery recycling and sustainability issues: With millions of electric vehicles anticipated to be on the road in the coming years, handling end-of-life batteries is a rising concern. As recycling infrastructure is still underdeveloped in many regions, extracting valuable materials from used batteries becomes expensive and inefficient. Thus, without scalable recycling solutions, the industry may cause environmental damage and resource depletion, which can undermine the sustainability goals of electric mobility.

Electric Vehicle Battery Market Size and Forecast:

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

14.1% |

|

Base Year Market Size (2025) |

USD 81.41 billion |

|

Forecast Year Market Size (2035) |

USD 299.6 billion |

|

Regional Scope |

|