Elderly Consumer Market Outlook:

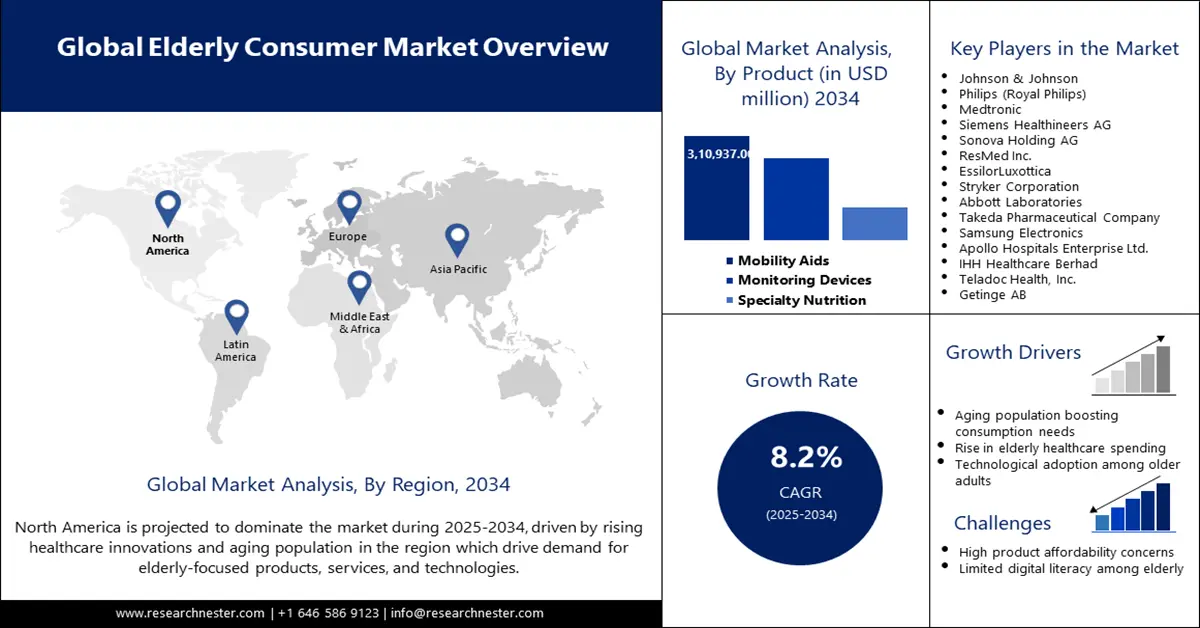

Elderly Consumer Market size was valued at USD 288.7 billion in 2024 and is projected to reach a valuation of USD 675.4 billion by the end of 2034, rising at a CAGR of 8.2% during the forecast period, i.e., 2025-2034. In 2026, the industry size of elderly consumer is estimated at USD 337.7 billion.

The elderly consumer market is experiencing rapid growth, driven by global demographic shifts and a growing emphasis on health, wellness, and technology-enabled independent living. A significant opportunity exists in developing medical technologies tailored to the needs of older adults. By 2030, individuals aged 60 and over are projected to constitute 1.4 billion of the global population, demonstrating a substantial increase in the demographic with significant healthcare needs. This growth illustrates a wider industry trend of adjusting medical devices to address chronic conditions common among the elderly.

The supply chain for this market forms a complex global network that includes pharmaceuticals, specialized medical devices, and assistive technologies. However, it also has considerable vulnerabilities, as noted by the U.S. Food and Drug Administration (FDA), especially concerning shortages of critical devices that can endanger patient care. The Consumer Price Index for Medical Care (CPI-MC) serves as a key indicator, with forecasts suggesting ongoing growth. For example, the CPI-MC was expected to rise by 4.2% yearly from FY 2020 to 6.3% by 2025.

Key Elderly Consumer Market Insights Summary:

Regional Insights:

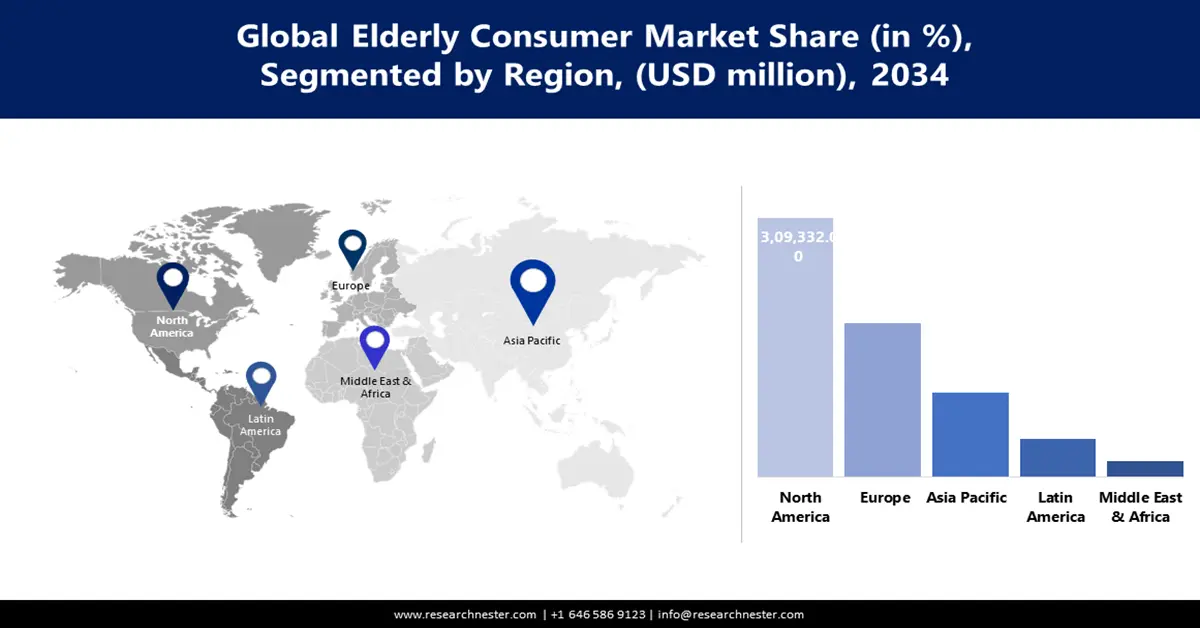

- North America is expected to command a 42.3% share of the Elderly Consumer Market by 2035, propelled by substantial healthcare expenditure, technology adoption among older adults, and supportive senior care policies.

- Europe is projected to record notable expansion during 2025–2034, stimulated by its aging demographic base, strong welfare frameworks, and rising integration of advanced healthcare technologies.

Segment Insights:

- The specialty nutrition segment in the Elderly Consumer Market is anticipated to capture a 35.8% share during 2026–2035, propelled by growing awareness of targeted nutrition solutions for healthy aging.

- The homecare segment is projected to secure a 57.0% share by 2034, spurred by the increasing preference among seniors for independent living supported by telehealth and remote monitoring technologies.

Key Growth Trends:

- Advancements in medical technology and surgical innovation

- Rise of proactive health management and wearable technology

Major Challenges:

- Ensuring cybersecurity in a connected healthcare ecosystem

- Protecting seniors from financial scams and fraud

Key Players:Johnson & Johnson, Philips (Royal Philips), Medtronic, Siemens Healthineers AG, Sonova Holding AG, ResMed Inc., EssilorLuxottica, Stryker Corporation, Abbott Laboratories, Takeda Pharmaceutical Company, Samsung Electronics, Apollo Hospitals Enterprise Ltd., IHH Healthcare Berhad, Teladoc Health, Inc., Getinge AB.

Global Elderly Consumer Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2024 Market Size: USD 288.7 billion

- 2026 Market Size: USD 337.7 billion

- Projected Market Size:USD 675.4 billion by 2034

- Growth Forecasts: 8.2% CAGR (2025-2034)

Key Regional Dynamics:

- Largest Region: North America (42.3% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Australia, Singapore

Last updated on : 23 September, 2025

Elderly Consumer Market - Growth Drivers and Challenges

Growth Drivers

- Advancements in medical technology and surgical innovation: Advancements in medical technology and surgical innovation boost market growth, offering less invasive and more effective treatments for age-related issues. In June 2025, Johnson & Johnson launched the ETHICON 4000 Stapler, a surgical stapling system that delivers a more secure staple line and better manages tissue complexities. Innovations like these improve the safety and outcomes of surgeries, which are common for seniors, and encourage older adults to seek medical treatments. These advanced tools expand treatment options and enhance the quality of care for older individuals.

- Rise of proactive health management and wearable technology: Elderly consumers are increasingly taking a proactive stance on their health. This trend is supported by the rise of wearable technology and digital health platforms. In March 2025, Samsung introduced new health and wellness features for its Galaxy Watch series, such as advanced sleep tracking, blood pressure monitoring, and fall detection. These technologies allow seniors to monitor their health in real time, manage chronic conditions more effectively, and maintain their independence, contributing to growth in the market for connected health devices.

- Focus on improving safety and caregiver efficiency in hospitals: Hospitals and long-term care facilities are putting more resources into technologies that improve patient safety and care efficiency, especially for elderly patients. In February 2025, Stryker launched the ProCeed hospital bed, designed with a low height to reduce fall risks and a fifth wheel for easier movement. Such products tackle important safety concerns for both patients and caregivers and help healthcare facilities deal with challenges like nursing shortages and staff burnout. The need for safer, more ergonomic equipment drives innovation and growth in the healthcare sector for elderly consumers.

Challenges

- Ensuring cybersecurity in a connected healthcare ecosystem: A key challenge is protecting sensitive patient data and ensuring healthcare services remain strong in a digitally connected environment. The European Union's updated Directive on security of network and information systems (NIS2), effective January 2023, increases cybersecurity obligations for vital sectors, including healthcare. This regulation underscores the urgent need for strong security measures to protect patient data and health, especially for seniors who may be more susceptible to digital fraud and whose care often relies on interconnected medical devices.

- Protecting seniors from financial scams and fraud: The elderly frequently face financial scams and fraud, which pose serious threats to their well-being and financial stability. In October 2024, the U.S. Federal Trade Commission (FTC) published its Protecting Older Consumers 2023-2024 report, outlining actions and educational campaigns to help seniors recognize, avoid, and report fraudulent activities. Despite these initiatives, the persistence of scams creates fear and distrust, which can deter seniors from engaging with new technologies and services, reducing market potential.

Elderly Consumer Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2034 |

|

CAGR |

8.2% |

|

Base Year Market Size (2024) |

USD 288.7 billion |

|

Base Year Market Size (2034) |

USD 675.4 billion |

|

Regional Scope |

|

Elderly Consumer Market Segmentation:

Product Segment Analysis

The specialty nutrition segment in the elderly consumer market is projected to hold a 35.8% share during the forecast period, fueled by growing recognition of the importance of targeted nutrition for healthy aging. As the global population ages, demand rises for products addressing specific health concerns, such as muscle loss, cognitive decline, and immune system support. In February 2024, Takeda received FDA approval for EOHILIA, the first oral treatment for eosinophilic esophagitis, a chronic inflammatory condition. Although not exclusively for seniors, this development indicates a trend toward specialized treatments for issues that can impact nutrition and overall health in older adults. The growth of specialty nutrition also gains momentum from the increasing prevalence of chronic diseases like diabetes, which require careful dietary management.

Service Segment Analysis

The homecare segment in the elderly consumer market is set to achieve a 57.0% share through 2034, reflecting a strong global preference among seniors to stay in their own homes. The desire for independence, comfort, and familiar surroundings drives demand for home-based services. In September 2023, IHH Healthcare's Gleneagles Hospital in Singapore launched a new Ageing-in-Place program, offering a range of home-based services, including nursing care and physiotherapy. Such programs are becoming more common as healthcare providers respond to the rising demand for personalized care delivered at home. The growth of the homecare segment is also accelerated by advancements in telehealth and remote patient monitoring technologies.

Application Segment Analysis

The heart diseases segment is projected to secure a 43.5% share through 2034, as cardiovascular issues continue to be a leading cause of illness and death among the elderly. The prevalence of conditions, including atrial fibrillation and coronary artery disease fuels the need for advanced diagnostic tools, treatments, and monitoring devices. In August 2021, Abbott announced the U.S. launch of the Amulet Left Atrial Appendage (LAA) Occluder, a device that provides an alternative to blood thinners for reducing stroke risk in individuals with atrial fibrillation, a significant concern for many older adults. The segment growth is further supported by ongoing innovations in pacemaker technology and other cardiac rhythm management devices.

Our in-depth analysis of the elderly consumer market includes the following segments:

|

Segment |

Subsegments |

|

Product |

|

|

Service |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Elderly Consumer Market - Regional Analysis

North America Market Insights

North America elderly consumer market is expected to account for a 42.3% share during the forecast period, driven by high healthcare spending, a tech-savvy aging population, and a strong policy environment that promotes senior care. The region is a hub for medical innovation, home to numerous leading MedTech and pharmaceutical companies. The focus on developing and adopting new technologies to improve seniors' quality of life characterizes the market in North America, positioning it as a significant force in global trends.

The U.S. elderly consumer market emphasizes both technological innovations and policy initiatives that support older adults. In April 2023, the U.S. White House issued an Executive Order on Increasing Access to High-Quality Care and Supporting Caregivers, which included over 50 directives for federal agencies. This proactive government stance, along with the rapid rollout of new medical devices like Johnson & Johnson’s TFN-ADVANCED Proximal Femoral Nailing System for hip fractures, launched in August 2023, fosters a dynamic and vibrant market for products and services aimed at seniors.

Canada elderly consumer market is growing steadily, backed by a publicly funded healthcare system and a rising focus on innovative care models. Canadian companies and research institutions are actively involved in creating new technologies for seniors. Although specific recent data is lacking, the country’s demographic trends and commitment to high-quality care for its aging population ensure a stable and expanding market. The strong emphasis on home and community-based care creates opportunities for services and technologies that support independent living.

Europe Market Insights

Europe is expected to see significant growth between 2025 and 2034, driven by its aging population, solid social support systems, and a proactive approach to adopting new healthcare technologies. The region's commitment to creating a cohesive eye care platform was highlighted in May 2025, when EssilorLuxottica announced an agreement to acquire Optegra, an ophthalmology platform in several European markets. This acquisition is part of a broader trend to integrate diagnostics, treatments, and surgical options for comprehensive patient care.

Germany elderly consumer market is one of the largest and most dynamic in Europe, known for high care standards and a strong emphasis on technological innovation. German companies lead many areas of medical technology, and the country is quick to adopt new solutions that enhance seniors' quality of life. With an aging population, particularly with individuals aged 65 and over projected to represent over 28% of the total population by 2030, Germany's demographic profile and strong healthcare infrastructure ensure it remains a key market for products and services aimed at older adults, ranging from advanced diagnostics to home care solutions.

In the UK, the elderly consumer market is expanding, with significant public and private sector initiatives aimed at supporting the aging population. The government's influence in shaping the market is crucial, as seen in the July 2023 launch of a new funding model for residential aged care, where annual increases will now reflect expert advice from the Independent Health and Aged Care Pricing Authority. This approach ensures funding is based on real care costs, creating a more stable environment for service providers and investors.

APAC Market Insights

The elderly consumer market in Asia Pacific is projected to expand at a CAGR of 5.5% from 2025 to 2034, driven by rapid economic growth, increased healthcare spending, and a significant and swiftly aging population. Governments in the region are launching ambitious initiatives to support senior citizens. For instance, in July 2025, the China government introduced a subsidy voucher program to aid seniors with disabilities in covering home and community care costs, which aims to stimulate the silver economy.

China elderly consumer market is set for substantial growth, propelled by the large size of its aging population and strong government backing. The nation is investing heavily in establishing a comprehensive senior care system, encompassing healthcare services and consumer products. The July 2025 launch of a nationwide subsidy voucher program for seniors with disabilities clearly signifies the government's commitment to this demographic. As China's economy continues to grow, so will its senior citizens' purchasing power, presenting a vast market for various goods and services.

India is undergoing a notable demographic shift, and its elderly consumer market is poised for rapid growth. The government is taking proactive measures to meet the needs of its expanding senior population. In February 2024, NITI Aayog, the public policy think tank, released a significant report advocating for comprehensive reforms in senior care. This focus on policy and infrastructure development, along with innovative health initiatives like Apollo Hospitals' ProHealth screening program launched in February 2024, is creating a promising market for elderly care products and services.

Key Elderly Consumer Market Players:

- Johnson & Johnson

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Philips (Royal Philips)

- Medtronic

- Siemens Healthineers AG

- Sonova Holding AG

- ResMed Inc.

- EssilorLuxottica

- Stryker Corporation

- Abbott Laboratories

- Takeda Pharmaceutical Company

- Samsung Electronics

- Apollo Hospitals Enterprise Ltd.

- IHH Healthcare Berhad

- Teladoc Health, Inc.

- Getinge AB

The elderly consumer market is highly competitive and diverse, comprising a blend of global pharmaceutical companies, medical technology innovators, consumer electronics businesses, and healthcare service providers. Key players compete through ongoing innovation, strategic acquisitions, and the creation of integrated ecosystems of products and services that meet the various needs of an aging population, from managing chronic diseases to promoting active and healthy living.

Here are some leading companies in the elderly consumer market:

Recent Developments

- In May 2025, Sonova Holding AG announced significant market share gains across all its businesses in its 2024/25 financial year report. The growth was supported by successful new product launches in its hearing aid and cochlear implant segments. The company also announced a planned CEO transition, signaling a new phase of leadership.

- In January 2025, ResMed announced its second-quarter fiscal year 2025 results, highlighting continued growth in its device and mask sales. The company emphasized its ResMed 2030 strategy, which focuses on creating a digital health concierge for individuals seeking better sleep and breathing. This positions ResMed as a key player in managing chronic conditions prevalent in the elderly.

- In February 2025, Medtronic launched a marketing campaign called What If... to explore the role of healthcare technology in a future where humans could live to 150. The campaign was designed to engage consumers in conversations about proactive health management and longevity. It aimed to build brand trust with a target audience enthusiastic about technology's role in health.

- Report ID: 8111

- Published Date: Sep 23, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Elderly Consumer Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.