Part 01

- An Outline of the Global Elastomeric Infusion Pumps Market

- Market Definition

- Market Segmentation

- Product Overview

Part 02

- Assumptions and Abbreviations

Part 03

- Research Methodology & Approach

- Research Process

- Primary Research

- Manufacturers

- End Users

- Secondary Research

- Market Size Estimation

Part 04

- Summary of the Report for Key Decision Makers

Part 05

- Forces of Market Constituents

- Factors/Drivers Impacting the Growth of the Market

- Market Trends for Better Business Practices

Part 06

- Market Opportunities for Business Growth

Part 07

- Major Roadblocks for the Market Growth

Part 08

- Government Regulation

Part 09

- Technology Transition and Adoption Analysis

Part 10

- Industry Risk Analysis

Part 11

- Global Economic Outlook

Part 12

- Industry Pricing Benchmarking & Analysis

Part 13

- Decarbonization Strategy and Carbon Credit Benefits for Market Players

Part 14

- Industry Growth Outlook

Part 15

- Industry Supply Chain Analysis

Part 16

- Treatment Analysis

Part 17

- SWOT Analysis

Part 18

- Regional Demand Analysis

Part 19

- Patent Analysis

Part 20

- Competitive Landscape

Part 21

- Competitive Model: A Detailed Inside View for Investors

- Market share of major companies profiled, 2023

- Business Profiles of Key Enterprises

- Nipro Corporation

- Daiken Medical Co., Ltd

- Leventon, S.A.U.

- B. Braun Medical Inc.

- Ace-medical

- Avanos Medical, Inc.

- VYGON UK Ltd.

- Woo Young Medical Co.

- PROMECON GmbH

- Baxter International Inc.

- Owens and Minor’s / Halyard Health, Inc.

- Adriamed SRL

Part 22

- Global Elastomeric Infusion Pumps Market Outlook & Projection, Opportunity Assessment, 2023 to 2036

- Market Overview

- Market Revenue by Value (USD Million), Compound Annual Growth Rate (CAGR)

- Year-on-Year (Y-o-Y) Growth Trend Analysis

- Global Elastomeric Infusion Pumps Market Outlook & Projection, Opportunity Assessment, 2023 to 2036

- By Product

- Continuous Rate Elastomeric Pump, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Variable Rate Elastomeric Infusion Pump , Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Global Elastomeric Infusion Pumps Market Outlook & Projection, Opportunity Assessment, 2023 to 2036

- By Treatment

- Pain Management, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Chemotherapy, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Chelation Therapy, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Infection Management, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Antibiotic/Antiviral, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Others, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Global Elastomeric Infusion Pumps Market Outlook & Projection, Opportunity Assessment, 2023 to 2036

- By Route of Administration

- Intravenous, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Intra-arterial, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Subcutaneous, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Epidural, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Intramuscular, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Global Elastomeric Infusion Pumps Market Outlook & Projection, Opportunity Assessment, 2023 to 2036

- By End User

- Hospitals, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Ambulatory Surgical Centers, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Home Care, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Others, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Global Elastomeric Infusion Pumps Market Outlook & Projection, Opportunity Assessment, 2023 to 2036

- By Geography

- North America, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Europe, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Asia Pacific, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Latin America, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Middle East & Africa, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

Cross Analysis of Product w.r.t Treatment (USD Million), 2023-2036

Part 23

- North America Elastomeric Infusion Pumps Market Outlook & Projection, Opportunity Assessment, 2023 to 2036

- Market Overview

- Market Revenue by Value (USD Million), Compound Annual Growth Rate (CAGR)

- Year-on-Year (Y-o-Y) Growth Trend Analysis

- North America Elastomeric Infusion Pumps Market Outlook & Projection, Opportunity Assessment, 2023 to 2036

- By Product

- Continuous Rate Elastomeric Pump, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Variable Rate Elastomeric Infusion Pump , Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- North America Elastomeric Infusion Pumps Market Outlook & Projection, Opportunity Assessment, 2023 to 2036

- By Treatment

- Pain Management, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Chemotherapy, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Chelation Therapy, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Infection Management, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Antibiotic/Antiviral, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Others, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- North America Elastomeric Infusion Pumps Market Outlook & Projection, Opportunity Assessment, 2023 to 2036

- By Route of Administration

- Intravenous, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Intra-arterial, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Subcutaneous, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Epidural, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Intramuscular, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- North America Elastomeric Infusion Pumps Market Outlook & Projection, Opportunity Assessment, 2023 to 2036

- By End User

- Hospitals, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Ambulatory Surgical Centers, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Home Care, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Others, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- North America Elastomeric Infusion Pumps Market Outlook & Projection, Opportunity Assessment, 2023 to 2036

- By Country

- US, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Canada, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

Cross Analysis of Product w.r.t Treatment (USD Million), 2023-2036

Part 24

- Europe Elastomeric Infusion Pumps Market Outlook & Projection, Opportunity Assessment, 2023 to 2036

- Market Overview

- Market Revenue by Value (USD Million), Compound Annual Growth Rate (CAGR)

- Year-on-Year (Y-o-Y) Growth Trend Analysis

- Europe Elastomeric Infusion Pumps Market Outlook & Projection, Opportunity Assessment, 2023 to 2036

- By Product

- Continuous Rate Elastomeric Pump, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Variable Rate Elastomeric Infusion Pump , Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Europe Elastomeric Infusion Pumps Market Outlook & Projection, Opportunity Assessment, 2023 to 2036

- By Treatment

- Pain Management, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Chemotherapy, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Chelation Therapy, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Infection Management, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Antibiotic/Antiviral, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Others, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Europe Elastomeric Infusion Pumps Market Outlook & Projection, Opportunity Assessment, 2023 to 2036

- By Route of Administration

- Intravenous, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Intra-arterial, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Subcutaneous, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Epidural, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Intramuscular, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Europe Elastomeric Infusion Pumps Market Outlook & Projection, Opportunity Assessment, 2023 to 2036

- By End User

- Hospitals, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Ambulatory Surgical Centers, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Home Care, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Others, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Europe Elastomeric Infusion Pumps Market Outlook & Projection, Opportunity Assessment, 2023 to 2036

- By Country

- UK, Market 2023-2036F Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Germany, Market 2023-2036F Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- France, Market 2023-2036F Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Italy, Market 2023-2036F Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Spain, Market 2023-2036F Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Russia, Market 2023-2036F Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- NORDIC, Market 2023-2036F Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Rest of Europe, Market 2023-2036F Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Cross Analysis of Product w.r.t Treatment (USD Million), 2023-2036

Part 25

- Asia Pacific Elastomeric Infusion Pumps Market Outlook & Projection, Opportunity Assessment, 2023 to 2036

- Market Overview

- Market Revenue by Value (USD Million), Compound Annual Growth Rate (CAGR)

- Year-on-Year (Y-o-Y) Growth Trend Analysis

- Asia Pacific Elastomeric Infusion Pumps Market Outlook & Projection, Opportunity Assessment, 2023 to 2036

- By Product

- Continuous Rate Elastomeric Pump, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Variable Rate Elastomeric Infusion Pump , Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Asia Pacific Elastomeric Infusion Pumps Market Outlook & Projection, Opportunity Assessment, 2023 to 2036

- By Treatment

- Pain Management, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Chemotherapy, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Chelation Therapy, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Infection Management, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Antibiotic/Antiviral, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Others, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Asia Pacific Elastomeric Infusion Pumps Market Outlook & Projection, Opportunity Assessment, 2023 to 2036

- By Route of Administration

- Intravenous, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Intra-arterial, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Subcutaneous, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Epidural, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Intramuscular, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Asia Pacific Elastomeric Infusion Pumps Market Outlook & Projection, Opportunity Assessment, 2023 to 2036

- By End User

- Hospitals, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Ambulatory Surgical Centers, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Home Care, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Others, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Asia Pacific Elastomeric Infusion Pumps Market Outlook & Projection, Opportunity Assessment, 2023 to 2036

- By Country

- China, Market 2023-2036F Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- India, Market 2023-2036F Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Japan, Market 2023-2036F Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Indonesia, Market 2023-2036F Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Malaysia, Market 2023-2036F Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Australia, Market 2023-2036F Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Thailand, Market 2023-2036F Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Vietnam, Market 2023-2036F Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- South Korea, Market 2023-2036F Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Cross Analysis of Product w.r.t Treatment (USD Million), 2023-2036

Part 26

- Latin America Elastomeric Infusion Pumps Market Outlook & Projection, Opportunity Assessment, 2023 to 2036

- Market Overview

- Market Revenue by Value (USD Million), Compound Annual Growth Rate (CAGR)

- Year-on-Year (Y-o-Y) Growth Trend Analysis

- Latin America Elastomeric Infusion Pumps Market Outlook & Projection, Opportunity Assessment, 2023 to 2036

- By Product

- Continuous Rate Elastomeric Pump, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Variable Rate Elastomeric Infusion Pump , Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Latin America Elastomeric Infusion Pumps Market Outlook & Projection, Opportunity Assessment, 2023 to 2036

- By Treatment

- Pain Management, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Chemotherapy, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Chelation Therapy, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Infection Management, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Antibiotic/Antiviral, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Others, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Latin America Elastomeric Infusion Pumps Market Outlook & Projection, Opportunity Assessment, 2023 to 2036

- By Route of Administration

- Intravenous, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Intra-arterial, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Subcutaneous, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Epidural, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Intramuscular, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Latin America Elastomeric Infusion Pumps Market Outlook & Projection, Opportunity Assessment, 2023 to 2036

- By End User

- Hospitals, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Ambulatory Surgical Centers, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Home Care, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Others, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Latin America Elastomeric Infusion Pumps Market Outlook & Projection, Opportunity Assessment, 2023 to 2036

- By Country

- Brazil, Market 2023-2036F Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Argentina, Market 2023-2036F Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Mexico, Market 2023-2036F Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Rest of Latin America, Market 2023-2036F Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

Cross Analysis of Product w.r.t Treatment (USD Million), 2023-2036

Part 27

- Middle East & Africa Elastomeric Infusion Pumps Market Outlook & Projection, Opportunity Assessment, 2023 to 2036

- Market Overview

- Market Revenue by Value (USD Million), Compound Annual Growth Rate (CAGR)

- Year-on-Year (Y-o-Y) Growth Trend Analysis

- Middle East & Africa Elastomeric Infusion Pumps Market Outlook & Projection, Opportunity Assessment, 2023 to 2036

- By Product

- Continuous Rate Elastomeric Pump, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Variable Rate Elastomeric Infusion Pump , Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Middle East & Africa Elastomeric Infusion Pumps Market Outlook & Projection, Opportunity Assessment, 2023 to 2036

- By Treatment

- Pain Management, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Chemotherapy, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Chelation Therapy, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Infection Management, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Antibiotic/Antiviral, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Others, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Middle East & Africa Elastomeric Infusion Pumps Market Outlook & Projection, Opportunity Assessment, 2023 to 2036

- By Route of Administration

- Intravenous, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Intra-arterial, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Subcutaneous, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Epidural, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Intramuscular, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Middle East & Africa Elastomeric Infusion Pumps Market Outlook & Projection, Opportunity Assessment, 2023 to 2036

- By End User

- Hospitals, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Ambulatory Surgical Centers, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Home Care, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Others, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Middle East & Africa Elastomeric Infusion Pumps Market Outlook & Projection, Opportunity Assessment, 2023 to 2036

- By Country

- GCC, Market 2023-2036F Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Israel, Market 2023-2036F Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- South Africa, Market 2023-2036F Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Rest of Middle East & Africa, Market 2023-2036F Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Cross Analysis of Product w.r.t Treatment (USD Million), 2023-2036

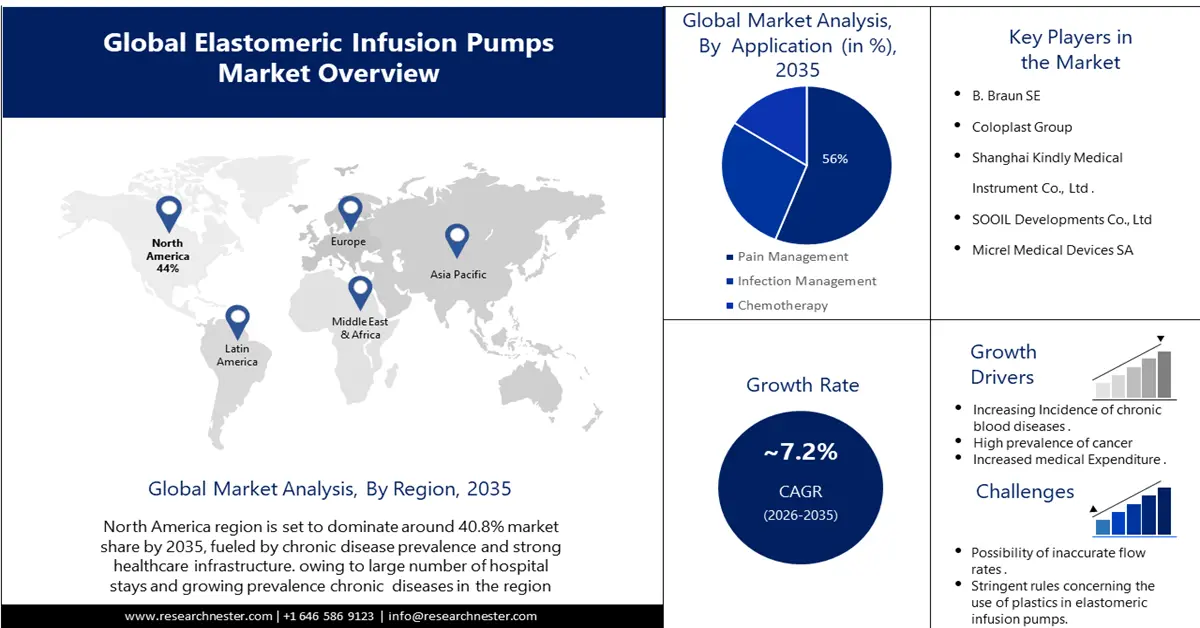

Elastomeric Infusion Pumps Market Outlook:

Elastomeric Infusion Pumps Market size was over USD 973.73 million in 2025 and is poised to exceed USD 1.95 billion by 2035, witnessing over 7.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of elastomeric infusion pumps is evaluated at USD 1.04 billion.

The increasing global prevalence of chronic illnesses is driving the market's expansion. The World Health Organization (WHO) issued numbers in September 2023 showing that non-communicable illnesses account for 74% of all deaths globally, killing 41 million people year. Non-communicable diseases claim the lives of 17 million people year before they turn 70, with low- and middle-income nations accounting for 86% of these early fatalities.

Worldwide demand for elastomeric infusion pumps is growing as a result of their affordability, versatility, and convenience of use when it comes to long-term medicine administration. Important developments include their use in home healthcare environments, increased acceptance of pain management, and the administration of chemotherapy and antibiotics outside of conventional hospital settings.

Moreover, advancements in elastomeric pump technology like enhanced accuracy and adjustable dosage contribute to their growing appeal on a worldwide scale.

Key Elastomeric Infusion Pumps Market Insights Summary:

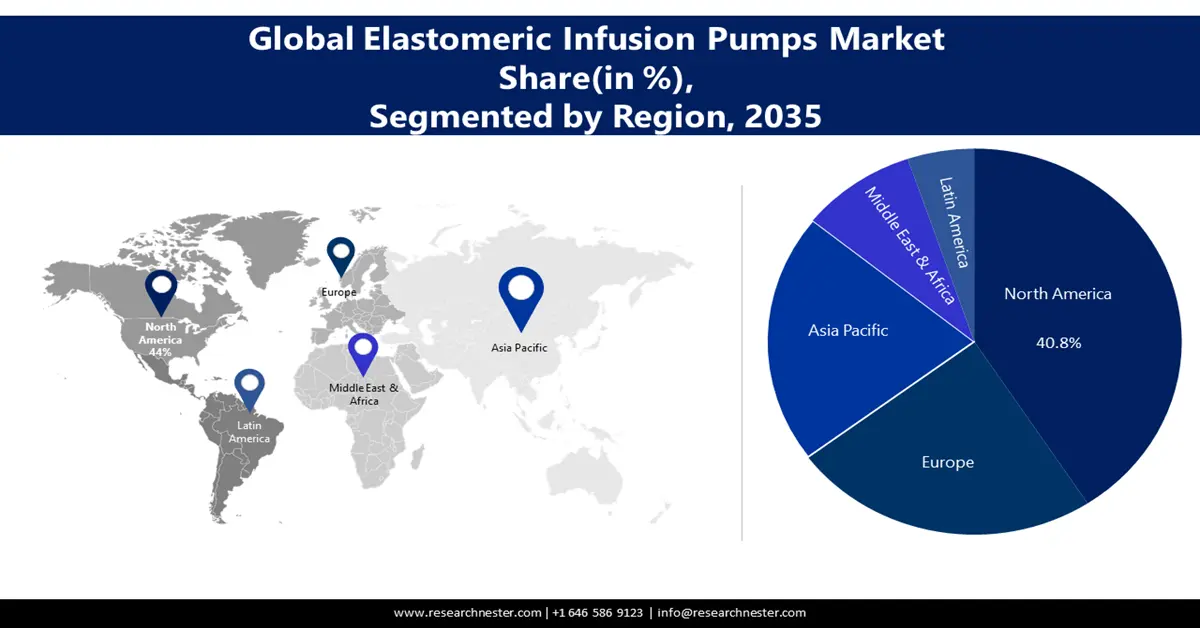

Regional Highlights:

- North America elastomeric infusion pumps market is poised to capture 40.8% share by 2035, driven by chronic disease prevalence and strong healthcare infrastructure.

- Europe market will secure significant revenue share by 2035, driven by the high burden of chronic diseases and adoption of patient-centric healthcare.

Segment Insights:

- The hospital segment in the elastomeric infusion pumps market is poised for substantial share by 2035, influenced by the aging population and need for consistent medication delivery post-surgery.

- The pain management segment in the elastomeric infusion pumps market is anticipated to capture a remarkable share by 2035, driven by the ability to provide continuous pain relief safely and easily.

Key Growth Trends:

- Demand for chronic disease management

- Growing product development and innovation

Major Challenges:

- Limited drug compatibility

- The high cost of the elastomeric infusion pumps market is predicted to hinder growth in the upcoming period.

Key Players: Ace-Medical, Avanos Medical, Inc., VYGON UK Ltd., Woo Young Medical Co., PROMECON GmbH, Baxter International Inc..

Global Elastomeric Infusion Pumps Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 973.73 million

- 2026 Market Size: USD 1.04 billion

- Projected Market Size: USD 1.95 billion by 2035

- Growth Forecasts: 7.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, United Kingdom

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 8 September, 2025

Elastomeric Infusion Pumps Market Growth Drivers and Challenges:

Growth Drivers

- Demand for chronic disease management - The growth in chronic illnesses highlights the need for simple and efficient treatment options, which elastomeric infusion pumps might assist address. The need for long-term medication delivery solutions is growing as chronic diseases become more prevalent. Elastomeric pumps provide the efficient and comfortable administration of continuous medication delivery, enhancing patient adherence and quality of life.

They provide a useful alternative to traditional delivery methods, such as regular injections or oral medications, particularly for patients with conditions requiring ongoing treatment monitoring. Businesses are using cutting-edge technology to manage diseases. The FDA has approved Baxter International Inc.'s Novum IQ syringe infusion pump with Dose IQ Safety Software in the United States, according to the top inventor in medication delivery technology.

- Growing product development and innovation - Increasing product development and innovation within the market's key players, as well as an increasing number of elastomer infusion pumps in use, are contributing to this expansion. B. Braun, on the other hand, has developed a Space Pump+ Pro Infusion System that includes integrated intelligent features like automatic medication verification and monitoring over the Internet.

Challenges

- Limited drug compatibility - In the elastomeric infusion pumps business, limited compatibility with medicinal products presents a challenge, which could affect adoption and use rates. The restrictions to the supply of pharmaceuticals via elastomer pumps limit the potential market for these devices. This is because if healthcare professionals are unable to deliver the necessary medicines effectively, they may be reluctant to use these devices.

- The high cost of the elastomeric infusion pumps market is predicted to hinder growth in the upcoming period.

- Strict regulations associated with use are another notable factor hindering the market expansion in the future.

Elastomeric Infusion Pumps Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.2% |

|

Base Year Market Size (2025) |

USD 973.73 million |

|

Forecast Year Market Size (2035) |

USD 1.95 billion |

|

Regional Scope |

|

Elastomeric Infusion Pumps Market Segmentation:

Treatment Segment Analysis

By the end of 2035, ABC segment is expected to capture remarkable

By the end of 2035, pain managementsegment segment is expected to capture remarkable elastomeric infusion pumps market share. It is easy and safe to administer medicines continuously with a single-use elastomeric infusion pumps. They help maintain the stability of medication plasma levels and analgesia, which is a useful alternative to painkillers when it comes to controlling acute pain.

Elastomeric pumps provide an uninterrupted and constant flow of medication over a fixed period, which results in more uniform pain relief compared with conventional methods such as pills or injections that dispense the medicine by bursts.

End User Segment Analysis

By the end of 2035, hospital segment is poised to hold substantial elastomeric infusion pumps market share. Due to their portability, ease of use, and ability to provide accurate dosage over a long period of time, elastomeric pumps are suitable for the delivery of medicinal products following surgical procedures. As the world's population ages, the number of chronic diseases that require continuous medication delivery increases.

Compared to the past, population aging is proceeding much more rapidly. The proportion of the world's population aged 60 years or more will nearly double from 12% to 22% between 2015 and 2050. To manage these conditions, hospitals play an essential role and the use of elastomer pumps is a valuable instrument for monitoring and maintaining consistency in drug administration.

Our in-depth analysis of the global elastomeric infusion pumps market includes the following segments:

|

Product |

|

|

Treatment |

|

|

Route of Administration |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Elastomeric Infusion Pumps Market Regional Analysis:

North American Market Insights

North America region is set to dominate around 40.8% market share by 2035. As reported by Centers for Disease Control and Prevention (CDC), America’s chronic diseases account for USD 4.1 Trillion in healthcare spending annually. Nearly six in every ten Americans (6 out of every 10 people) have at least one of the chronic diseases listed in the CDC’s list of chronic diseases.

Heart disease, stroke, colorectal cancer, and diabetes are among the most common chronic diseases in the United States. These chronic diseases are the leading cause of death and disability, and they are also the leading cause of healthcare spending through the use of basic healthcare tools, such as elastomer infusion pumps, across North America.

The US has a well-developed healthcare system, with a large number of specialized care facilities, which puts elastomeric pumps in high demand for pain management and chemotherapy, as well as other applications.

The increasing geriatric population, which is more susceptible to chronic diseases and other related disorders, is increasing the need for hospitalization and intravenous medication for home care, which is also expected to drive elastomeric infusion pumps market growth in Canada. For example, in Canada, a large proportion of the population is between 15 and 64 years old according to statistics published by the United Nations Population Fund for 2022 which represents 65 % of the total population.

European Market Insights

By 2035, European region is estimated to account for significant elastomeric infusion pumps market share. Like other regions in the world, Europe has a high burden of chronic diseases such as cancer, diabetes, and cardiovascular diseases. For example, noncommunicable diseases (NCDs) such as cardiovascular disease (CVD), diabetes (CVD), chronic respiratory disease (CRD), mental disorders (MDS), neurological disorders (NMD), and cancer (CJD) represent 80% of disease burden in the EU countries and account for the majority of preventable early deaths. The human and economic costs of NCDs are considerable and are expected to increase as the EU population ages.

The increasing adoption of home healthcare solutions and the demand for patient-centric medical equipment, as well as an increase in healthcare services such as ambulatory surgery and postoperative care in the United Kingdom, are contributing to this growth.

The adoption of elastomer infusion pumps across the continent has been reinforced by a Germany focus on healthcare effectiveness, patients' safety, and sustainable health care practices which have marked them as a significant elastomeric infusion pumps market for these indispensable tools.

The strong presence of the main players, availability of advanced healthcare infrastructure, and technical innovation which has an impact on market development in France.

Elastomeric Infusion Pumps Market Players:

- NIPRO Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Daiken Medical Co., Ltd

- Leventon, S.A.U.

- B. Braun Medical Inc.

- Ace-medical

- Avanos Medical, Inc.

- VYGON UK Ltd.

- Woo Young Medical Co.

- PROMECON GmbH

- Baxter International Inc.

Recent Developments

- Baxter launched a new generation of elastomer infusion pumps in January 2024 with enhanced durability and user-friendly interfaces, further strengthening its position as the leading supplier of infusion therapy solutions.

- B. Braun Melsungen AG, with its innovative pumps, has established significant market penetration in March 2023 and is gaining acceptance from healthcare providers throughout the world.

- Report ID: 2031

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Elastomeric Infusion Pumps Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.