Drug Screening Market Outlook:

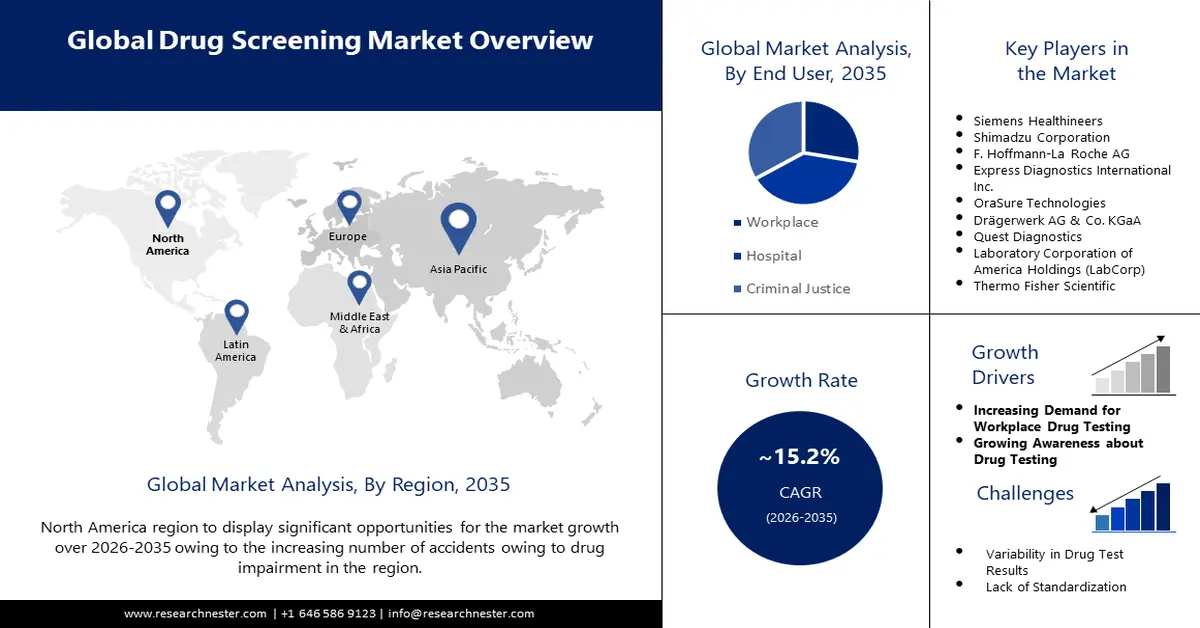

Drug Screening Market size was valued at USD 9.76 billion in 2025 and is likely to cross USD 40.18 billion by 2035, expanding at more than 15.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of drug screening is assessed at USD 11.1 billion.

The growth of the market is propelled by the increasing prevalence of drug abuse and growing demand for non-invasive testing. According to the 2023 World Drug Report, over 39.5 million people around the world were suffering from drug use disorders (DUD) in 2021. Another 2024 NLM report calculated the worldwide DUD deaths to be 25.9 per 1,000,000 in 2021, which is further expected to reach 38.4 and 42.4 per 1,000,000 by 2030 and 2040, respectively. This signifies the increasing seriousness of this medical condition, pushing authorities to take proper action against the widespread. Testing equipment and services available in this sector are designed as per the regulatory guidance and public safety criteria, making them a preferred option to serve the purpose.

Moreover, the use of opioids, including heroin and prescription opioids, and cannabis continues to be a major concern across the globe. Also, the non-medical use of prescription stimulants such as amphetamines is on the rise. Thus, the surge for widely available and applicable test commodities at an affordable payers’ pricing has become a major R&D driving factor for the market. On this note, a study on the drug testing practices for private payors in the U.S. was published by ScienceDirect in April 2024. It revealed that the cost-variables, including deductible, co-insurance, out-of-pocket, and copay, accounted for USD 18.5, USD 10.3, USD 29.3, and USD 0.4, respectively, for individual substance use disorder candidates.