Drug Screening Market Outlook:

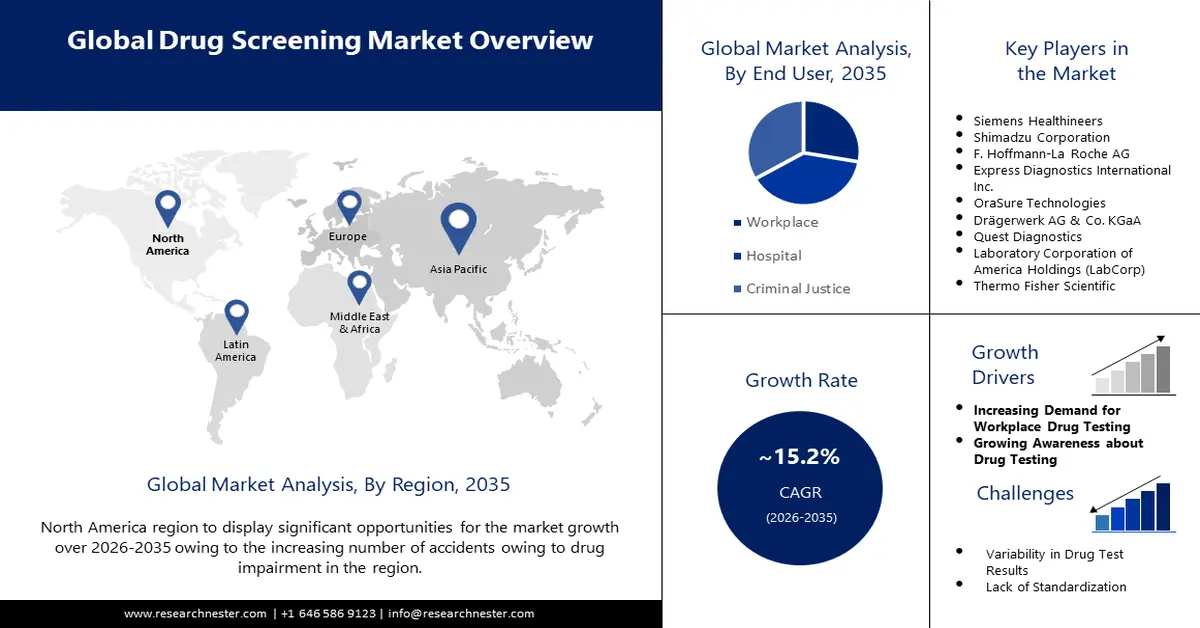

Drug Screening Market size was valued at USD 9.76 billion in 2025 and is likely to cross USD 40.18 billion by 2035, expanding at more than 15.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of drug screening is assessed at USD 11.1 billion.

The growth of the market is propelled by the increasing prevalence of drug abuse and growing demand for non-invasive testing. According to the 2023 World Drug Report, over 39.5 million people around the world were suffering from drug use disorders (DUD) in 2021. Another 2024 NLM report calculated the worldwide DUD deaths to be 25.9 per 1,000,000 in 2021, which is further expected to reach 38.4 and 42.4 per 1,000,000 by 2030 and 2040, respectively. This signifies the increasing seriousness of this medical condition, pushing authorities to take proper action against the widespread. Testing equipment and services available in this sector are designed as per the regulatory guidance and public safety criteria, making them a preferred option to serve the purpose.

Moreover, the use of opioids, including heroin and prescription opioids, and cannabis continues to be a major concern across the globe. Also, the non-medical use of prescription stimulants such as amphetamines is on the rise. Thus, the surge for widely available and applicable test commodities at an affordable payers’ pricing has become a major R&D driving factor for the market. On this note, a study on the drug testing practices for private payors in the U.S. was published by ScienceDirect in April 2024. It revealed that the cost-variables, including deductible, co-insurance, out-of-pocket, and copay, accounted for USD 18.5, USD 10.3, USD 29.3, and USD 0.4, respectively, for individual substance use disorder candidates.

Key Drug Screening Market Insights Summary:

Regional Highlights:

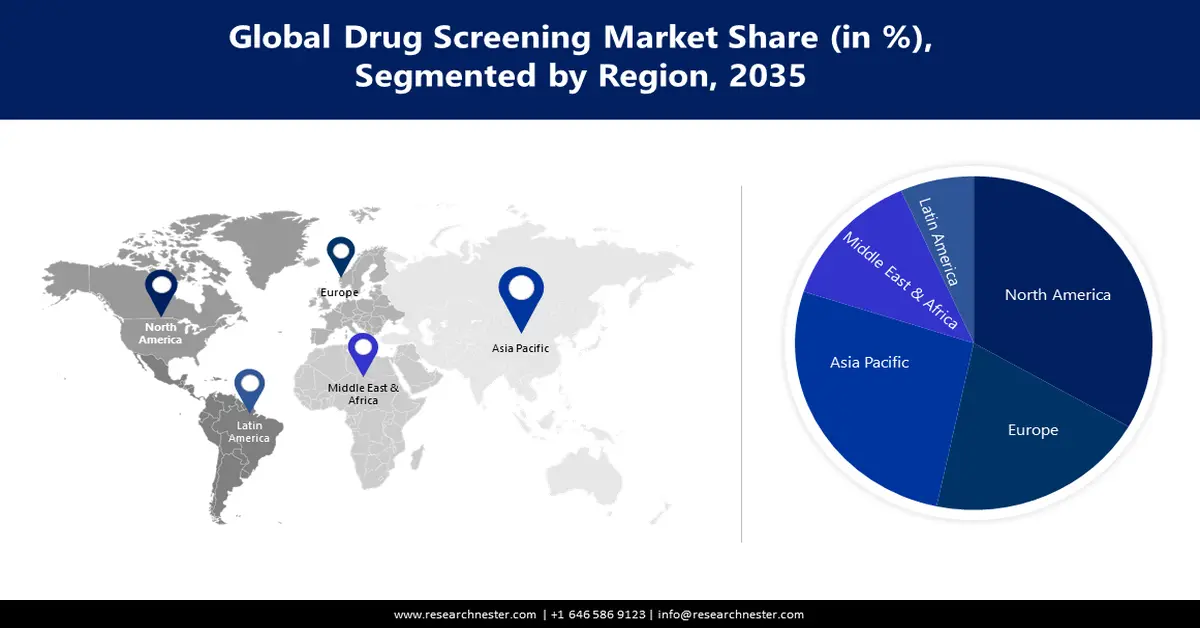

- The North America drug screening market is projected to capture a 35% share by 2035, driven by the increasing number of SUD-related accidents and government funding in the region.

- The Asia Pacific market is expected to secure a 24% share by 2035, attributed to rising awareness, government initiatives, and increasing demand for drug screening services.

Segment Insights:

- The hospital segment in the drug screening market is expected to secure a 35% share by 2035, driven by the growing number of patients and availability of specialized healthcare professionals.

- The rapid testing devices segment in the drug screening market is forecasted to capture a 30% share by 2035, influenced by the increasing demand for onsite testing across healthcare, sports, and government agencies.

Key Growth Trends:

- Extended utility in various disciplines

- Tech-based innovations in commodities

Major Challenges:

- V ariability and ethical issues in product launch

Key Players: Quest Diagnostics, Laboratory Corporation of America Holdings (LabCorp), Thermo Fisher Scientific, Alere Inc., Siemens Healthineers, Shimadzu Corporation, F. Hoffmann-La Roche AG, Express Diagnostics International Inc., OraSure Technologies, Drägerwerk AG & Co. KGaA.

Global Drug Screening Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 9.76 billion

- 2026 Market Size: USD 11.1 billion

- Projected Market Size: USD 40.18 billion by 2035

- Growth Forecasts: 15.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 11 September, 2025

Drug Screening Market Growth Drivers and Challenges:

Growth Drivers

-

Extended utility in various disciplines: As the awareness about the impact of substance abuse on health and productivity in both work and public places grow, investment in the drug screening market rises. Particularly, safety-sensitive industries, such as transportation and medical, are increasingly adopting these solutions to prevent accidents and financial losses. For instance, in 2024, Loop received Home Office licenses for onsite drug testing in festivals and venues in the UK. This allowance helped the organization enable HO licensed mobile laboratories in every event for fast and accurate substance detection. Furthermore, the stringent regulatory frameworks for clinical trials are also fueling demand in this sector.

-

Tech-based innovations in commodities: The contribution of AI and machine learning to enhance the quality and reach of medical services has created a prominent business flow in the market. The integration of these advanced features is now also being accepted by several public safety authorities, such as FDA, based on their ability to streamline data-driven analysis and reporting. This is inspiring other MedTech pioneers to engage their resources in this field. In this regard, in March 2025, Intelligent Bio Solutions shared positive results from the FDA evaluation on its Intelligent Fingerprint Drug Screening System. The company aimed at full-fledged commercialization of this AI-based tool in the U.S. pharmacokinetic study industry.

Challenges

-

Variability and ethical issues in product launch: The market raises a range of legal and ethical concerns, including questions about privacy, discrimination, and false indications. The additive needs of organizations for navigating these issues carefully to avoid legal liability and maintain the trust of employees and other stakeholders may increase the overall budget. This, coupled with the lack in standardization, may discourage them from investing in this sector. However, regulatory frameworks are now cultivating new pathways for accurate detection and seamless workflow.

Drug Screening Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

15.2% |

|

Base Year Market Size (2025) |

USD 9.76 billion |

|

Forecast Year Market Size (2035) |

USD 40.18 billion |

|

Regional Scope |

|

Drug Screening Market Segmentation:

Product Type Segment Analysis

The rapid testing devices segment is projected to account for 30% share of the drug screening market by 2035. The segment's rise is attributable to the increasing demand for onsite testing across various industries, including healthcare, sports, and government agencies. Rapid testing devices provide a quick and easy way to screen individuals for drugs, making them an attractive option for these industries. In addition, these devices are undergoing significant technological advancements, resulting in improved convenience and sensitivity. On this note, in May 2024, eMed launched a fully remote proctored drug screening solution, eMed Screen, to provide instant results for employers. These factors are conjugately making these devices a more reliable and effective option for customers, rising adoption in this segment.

End user Segment Analysis

The hospital segment is predicted to hold approximately 35% share of the drug screening market over the assessed timeline. The presence of a high number of patients in these organizations, which is rapidly expanding, is fueling the segment's expansion. The availability of a wide range of healthcare professionals, such as physicians and doctors, who are specialized in internal medicine, pediatrics, or general practice is also a major driver in this segment’s growth. In addition, the sufficient supply of required resources to solve unique problems is magnifying the priority of hospitals as a first point-of-care for patients. Moreover, the increased public expenditure on these service providers for SUD treatment is contributing to this segment’s leadership.

Our in-depth analysis of the global drug screening market includes the following segments:

|

|

|

|

Product Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Drug Screening Market Regional Analysis:

North American Market Insights

The drug screening market in North America is poised to capture the largest market share of 35% throughout the analysed timeframe. The increasing number of SUD-related accidents, owing to drug impairment or overdose, in the region is presenting a large consumer base for this sector. According to CDC reports, the rate of deaths due to cocaine and psychostimulants increased by 4.9% and 1.9%, respectively, in the U.S. in 2023 from 2022. In the same year, nationwide 105,007 people lost their lives due to drug overdose. Furthermore, increasing government funding, technological advancements, and pharmaceutical R&D in the region are fuelling this landscape.

The U.S. is augmenting the market with a stringent regulatory framework and increasing investments from employers. In this regard, Quest Diagnostics released a Drug Testing Index Analysis in 2024, revealing a 633.0% increment in substituted urine specimens collected from over 5.5 million general employees of this country in 2023. Additionally, among 9.8 million samples from the U.S. workforce, the marijuana positivity increased by 4.7% in the same year from 2022. Thus, to prevent accidental events, federal organizations such as the Department of Transportation, the Nuclear Regulatory Commission and the Department of Defense have mandated daily basis drug testing for their safety-sensitive workers.

APAC Market Insights

The drug screening market in Asia Pacific is predicted to register the 2nd largest share of close to 24% and a significant CAGR by the end of 2035. The region’s growth is impelled by the rising awareness and government initiatives. This is further leading to an increase in demand and discoveries for associated services and testing devices. For instance, in October 2023, the Kerala Police Department commenced the real-time trial on a hand-held drug screening device, SoToxa Mobile Test System, in Thiruvananthapuram. Considering the 5 minutes response time and accuracy of this tool, the government estimated a state-wide expansion of this product. Such efforts from these authorities are inspiring both local and foreign pioneers to participate in this merchandise.

China is propagating the market with its ambitious goal of achieving the top position in pharmaceutical development and production. The country is rigorously conducting R&D to secure the global leadership in clinical trials for various life science products. This can be testified by the report from WHO, where it highlighted China to be the country with highest registries for clinical trials in the world between 2023 and 2024, accounting for 23,768. Further, with the supportive government subsidies in pharmaceutical research and manufacturing is creating new business opportunities and attracting global leaders in this sector. For instance, in SPT Labtech collaborated with ICE Bioscience to enable intelligent drug screening and life sciences automation for researchers in China.

Drug Screening Market Players:

- Quest Diagnostics

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Laboratory Corporation of America Holdings (LabCorp)

- Thermo Fisher Scientific

- Alere Inc.

- Siemens Healthineers

- Shimadzu Corporation

- F. Hoffmann-La Roche AG

- Express Diagnostics International Inc.

- OraSure Technologies

- Drägerwerk AG & Co. KGaA

- Sterling Check Corp.

The market is enhancing its offerings with the integration of advanced technologies and R&D participation of key players. They are continuously improving their portfolio to outperform competitors, showcasing a healthy business flow and innovation cohort in this field. For instance, in February 2025, Profacgen introduced its new ion channel testing services, including high-throughput detection and automated electrophysiology, to streamline drug development. This pipeline is crafted to assist pharma developers mitigate challenges in the research and formulation by providing accurate detection for high-expression cell lines and neurons. Such key players are:

Recent Developments

- In April 2024, Labcorp attained approval from the FDA to market its nAbCyte Anti-AAVRh74var HB-FE Assay as a companion diagnostic to BEQVEZ. This nAbCyte cell-based neutralizing antibody screening component is useful for determining patient's eligibility for hemophilia B treatment with fidanacogene elaparvovec-dzkt.

- In January 2024, Sterling acquired Vault Workforce Screening to solidify its clinical background screening portfolio in the U.S. market. This acquisition added a wide network of 17,000 clinics and a flexible service model to its existing pipeline of drug and health services for employers in healthcare, transportation, and other regulated industries.

- Report ID: 4891

- Published Date: Sep 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Drug Screening Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.