Dropshipping Market - Growth Drivers and Challenges

Growth Drivers

- Automation and anti-fraud improvements: The adoption of AI-facilitated automation solutions is proving to be a key enabler of operational efficiency and building confidence within the dropshipping universe. Platforms are also incorporating more AI-driven product recommendations and anti-fraud tools to enable sellers to maximize product offerings and limit financial risks. For instance, automated dropshipping platform AutoDS rolled out a list of new features in July 2025, including smart recommendations and anti-fraud, to enhance merchants' capabilities and deliver a safer, more personalized experience to customers.

- Platform innovations driving b2b and b2c integration: Platform innovations are providing very substantial market access by enabling merchants to serve both B2C and B2B buyers from a single, shared backend. The adoption is driven by the requirement for integrated solutions that can facilitate complex wholesale operations without demanding a separate, stand-alone storefront. For example, Alibaba expanded its Global 5-Day Delivery service in September 2023 to more than 14 countries. This service utilizes express couriers like UPS and FedEx to offer significantly faster shipping options, addressing a major challenge for many dropshippers.

- Expanding logistics partnerships, enhancing cross-border trade: Smooth and efficient shipping is crucial to the success of the dropshipping operation, and greater collaboration in the shipping industry has helped toward improved shipping times and tracking functionalities. In a move characteristic of this trend, the e-commerce platform Qoo10 acquired the Wish marketplace for $173 million in February 2024. This strategic acquisition is expected to create a more powerful global cross-border e-commerce platform by integrating Wish's technology and data science capabilities with Qoo10's operational expertise and logistics network. This emphasis on logistical proficiency directly supports the scalability of international traders and significantly improves overall customer satisfaction.

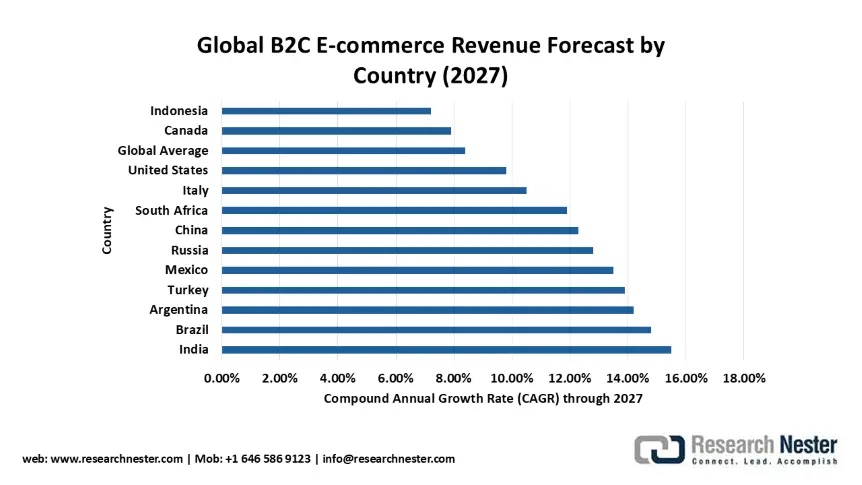

Global B2C E-commerce Revenue Forecast by Country (2027)

This growth hierarchy underscores the varying stages of digital adoption and e-commerce penetration worldwide. The positioning of countries along the growth spectrum highlights strategic opportunities for market entry and investment prioritization. Understanding these differential growth patterns is essential for developing targeted international expansion strategies in the B2C e-commerce sector.

Source: ITA

U.S. E-Commerce Retail Performance (Q2 2025) - Dropshipping Market Implications

|

Metric |

Q2 2025 Performance |

Impact on Market |

|

E-Commerce Sales (Adjusted) |

$304.2 billion |

Massive market size creates abundant opportunities for dropshipping businesses to capture market share |

|

Quarterly E-Commerce Growth |

+1.4% from Q1 2025 |

Consistent growth indicates stable, expanding market conditions for dropshipping operations |

|

Annual E-Commerce Growth |

+5.3% from Q2 2024 |

Strong year-over-year growth outperforms total retail, highlighting e-commerce's increasing dominance |

|

E-Commerce Share of Retail |

16.3% of total sales |

Significant penetration shows consumer preference for online shopping, driving dropshipping demand |

|

Unadjusted E-Commerce Sales |

$292.9 billion (+6.2% quarterly) |

Raw growth figures indicate robust underlying demand for online retail services |

Source: U.S. Census Bureau

Challenges

- Sophisticated cross-jurisdictional regulatory compliance: Dropshipping operations tend to be challenged by piercing through the varied legal and tax regimes governing cross-border trade. Increased regulations are enforcing stricter requirements for documentation, declaration of taxes, and supplier transparency, which can complicate operations. For example, in March 2025, India's Ministry of Commerce released revised e-commerce and dropshipping regulations requiring GST and customs compliance on cross-border sellers and enforcing rigorous record-keeping. Such cumbersome regulations can prove to be significant entry barriers into the market and increase compliance costs for dropshippers.

- Ensuring product quality and authenticity: Maintaining the quality of goods is probably the toughest challenge for dropship sellers since they employ third-party suppliers who have varying levels of manufacturing quality and quality control. Consumer trust is lost in an instant if fake or inferior goods enter the market, injuring brand reputations and putting businesses at risk of prosecution. Regulators and platforms are increasing enforcement efforts as a consequence. Dropshipping businesses must therefore prioritize rigorous supplier vetting and implement robust quality assurance protocols to mitigate these risks.

Dropshipping Market: Key Insights

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

23% |

|

Base Year Market Size (2025) |

USD 340 billion |

|

Forecast Year Market Size (2035) |

USD 3,314.6 billion |

|

Regional Scope |

|