Dropshipping Market Outlook:

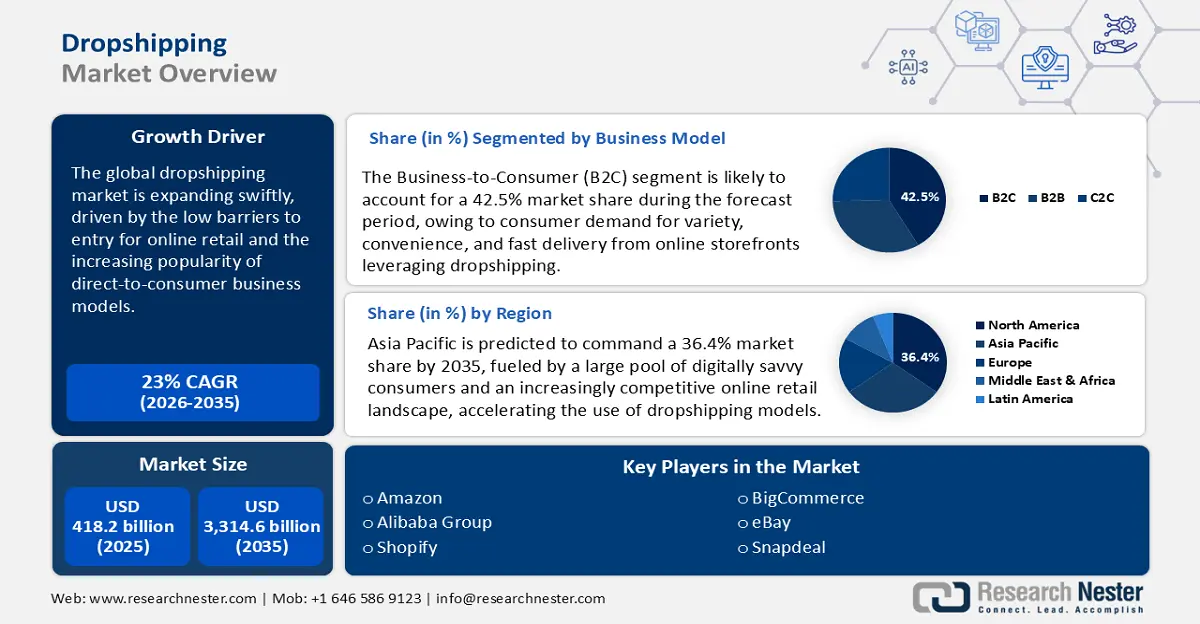

Dropshipping Market size is valued at USD 418.2 billion in 2025 and is projected to reach a valuation of USD 3,314.6 billion by the end of 2035, rising at a CAGR of 23% during the forecast period, i.e., 2026-2035. In 2026, the industry size of dropshipping is anticipated to reach USD 514.3 billion.

The dropshipping market continues to exhibit robust growth as the e-commerce market matures, with key players increasingly adopting this model for minimizing the overhead of inventory and expanding broader product ranges. The appeal of dropshipping is the minimal capital required, thus making it most desirable to entrepreneurs aiming at establishing faster access to the market. The market is anticipated to rise, driven by demand from consumers for tailored products and greater technology integration in supply chain management. For example, in January 2025, Amazon announced a new fee plan for its U.S. marketplace, a move that would simplify operations for sellers and reward growth, demonstrating the way platforms are changing to support this business model.

The rising importance of integrated platforms offering end-to-end solutions has transformed the dropshipping ecosystem. Providers are focusing on enhancing automation capabilities, fraud prevention, and multi-channel marketing tools. This allows new entrants to leverage platforms that facilitate comprehensive management of sourcing, marketing, and sales processes. A prime example of this is the strategic partnership announced in August 2024 between the dropshipping automation platform Dsers and several major e-commerce channels, including TikTok Shop, Shopify, and WooCommerce. This collaboration enabled new one-click bundle automation and advanced analytics for apparel and electronics dropshippers, streamlining operations and providing sellers with powerful tools to grow their businesses across multiple platforms.

Key Dropshipping Market Insights Summary:

Regional Highlights:

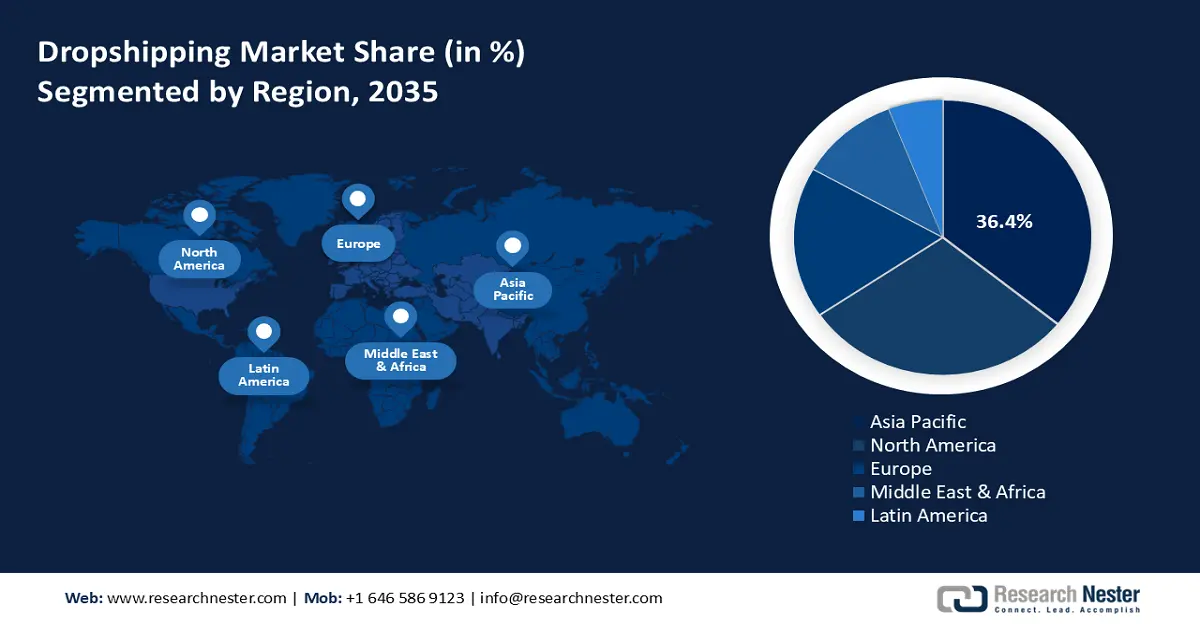

- By 2035, Asia Pacific in the Dropshipping Market is expected to capture a 36.4% share, supported by the growing number of internet users, higher disposable incomes, and the runaway expansion of e-commerce.

- Throughout 2026–2035, North America is projected to post a 15% CAGR, spurred by the well-developed e-commerce infrastructure, high consumer spending power, and an entrepreneurial environment that favors new business models.

Segment Insights:

- By 2035, the Business-to-Consumer (B2C) segment in the Dropshipping Market is set to account for a 42.5% share, bolstered by the vast and growing base of individual online buyers.

- The apparel and fashion industry is anticipated to retain a 38.5% share through 2035, sustained by robust customer demand for stylish, varied, and personalized apparel and accessories.

Key Growth Trends:

- Automation and anti-fraud improvements

- Platform innovations driving b2b and b2c integration

Major Challenges:

- Sophisticated cross-jurisdictional regulatory compliance

- Ensuring product quality and authenticity

Key Players: Shopify Inc., AliExpress (Alibaba Group), SaleHoo Group Limited, Spocket, Printful Inc., Zendrop, DSers, Syncee, Inventory Source, CJDropshipping, Dropshipzone, Qikink, Rakuten Group, Inc., NETSEA (BEENOS Inc.), TopSeller.jp.

Global Dropshipping Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 418.2 billion

- 2026 Market Size: USD 514.3 billion

- Projected Market Size: USD 3,314.6 billion by 2035

- Growth Forecasts: 23% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (36.4% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, United Kingdom, Germany, Canada

- Emerging Countries: India, South Korea, Brazil, Australia, Mexico

Last updated on : 3 October, 2025

Dropshipping Market - Growth Drivers and Challenges

Growth Drivers

- Automation and anti-fraud improvements: The adoption of AI-facilitated automation solutions is proving to be a key enabler of operational efficiency and building confidence within the dropshipping universe. Platforms are also incorporating more AI-driven product recommendations and anti-fraud tools to enable sellers to maximize product offerings and limit financial risks. For instance, automated dropshipping platform AutoDS rolled out a list of new features in July 2025, including smart recommendations and anti-fraud, to enhance merchants' capabilities and deliver a safer, more personalized experience to customers.

- Platform innovations driving b2b and b2c integration: Platform innovations are providing very substantial market access by enabling merchants to serve both B2C and B2B buyers from a single, shared backend. The adoption is driven by the requirement for integrated solutions that can facilitate complex wholesale operations without demanding a separate, stand-alone storefront. For example, Alibaba expanded its Global 5-Day Delivery service in September 2023 to more than 14 countries. This service utilizes express couriers like UPS and FedEx to offer significantly faster shipping options, addressing a major challenge for many dropshippers.

- Expanding logistics partnerships, enhancing cross-border trade: Smooth and efficient shipping is crucial to the success of the dropshipping operation, and greater collaboration in the shipping industry has helped toward improved shipping times and tracking functionalities. In a move characteristic of this trend, the e-commerce platform Qoo10 acquired the Wish marketplace for $173 million in February 2024. This strategic acquisition is expected to create a more powerful global cross-border e-commerce platform by integrating Wish's technology and data science capabilities with Qoo10's operational expertise and logistics network. This emphasis on logistical proficiency directly supports the scalability of international traders and significantly improves overall customer satisfaction.

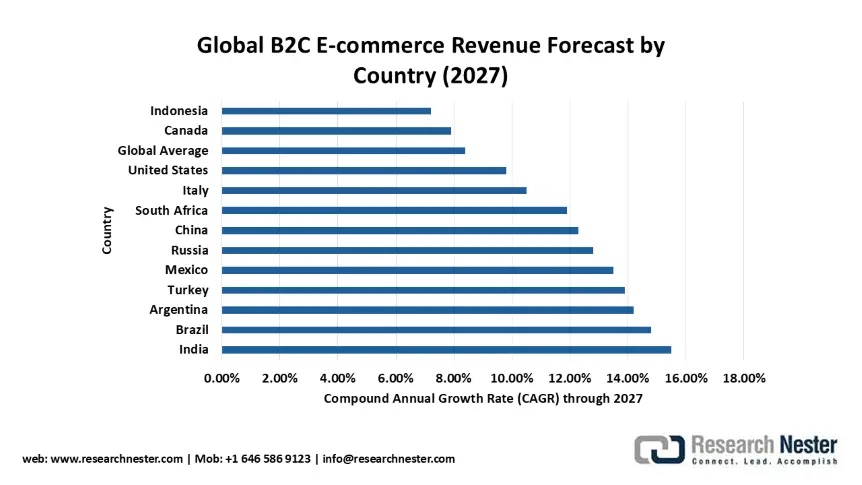

Global B2C E-commerce Revenue Forecast by Country (2027)

This growth hierarchy underscores the varying stages of digital adoption and e-commerce penetration worldwide. The positioning of countries along the growth spectrum highlights strategic opportunities for market entry and investment prioritization. Understanding these differential growth patterns is essential for developing targeted international expansion strategies in the B2C e-commerce sector.

Source: ITA

U.S. E-Commerce Retail Performance (Q2 2025) - Dropshipping Market Implications

|

Metric |

Q2 2025 Performance |

Impact on Market |

|

E-Commerce Sales (Adjusted) |

$304.2 billion |

Massive market size creates abundant opportunities for dropshipping businesses to capture market share |

|

Quarterly E-Commerce Growth |

+1.4% from Q1 2025 |

Consistent growth indicates stable, expanding market conditions for dropshipping operations |

|

Annual E-Commerce Growth |

+5.3% from Q2 2024 |

Strong year-over-year growth outperforms total retail, highlighting e-commerce's increasing dominance |

|

E-Commerce Share of Retail |

16.3% of total sales |

Significant penetration shows consumer preference for online shopping, driving dropshipping demand |

|

Unadjusted E-Commerce Sales |

$292.9 billion (+6.2% quarterly) |

Raw growth figures indicate robust underlying demand for online retail services |

Source: U.S. Census Bureau

Challenges

- Sophisticated cross-jurisdictional regulatory compliance: Dropshipping operations tend to be challenged by piercing through the varied legal and tax regimes governing cross-border trade. Increased regulations are enforcing stricter requirements for documentation, declaration of taxes, and supplier transparency, which can complicate operations. For example, in March 2025, India's Ministry of Commerce released revised e-commerce and dropshipping regulations requiring GST and customs compliance on cross-border sellers and enforcing rigorous record-keeping. Such cumbersome regulations can prove to be significant entry barriers into the market and increase compliance costs for dropshippers.

- Ensuring product quality and authenticity: Maintaining the quality of goods is probably the toughest challenge for dropship sellers since they employ third-party suppliers who have varying levels of manufacturing quality and quality control. Consumer trust is lost in an instant if fake or inferior goods enter the market, injuring brand reputations and putting businesses at risk of prosecution. Regulators and platforms are increasing enforcement efforts as a consequence. Dropshipping businesses must therefore prioritize rigorous supplier vetting and implement robust quality assurance protocols to mitigate these risks.

Dropshipping Market: Key Insights

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

23% |

|

Base Year Market Size (2025) |

USD 340 billion |

|

Forecast Year Market Size (2035) |

USD 3,314.6 billion |

|

Regional Scope |

|

Dropshipping Market Segmentation:

Business Model Segment Analysis

The Business-to-Consumer (B2C) segment is likely to account for a significant 42.5% market share during the forecast period, driven by the vast and growing base of individual online buyers who constitute the key customers for most dropshipping firms. The segment is supported by continual innovation in user experience, seamless integration with social commerce channels, and mobile-enabled solutions. Innovations from companies like Printify, which introduced new features for its Pop-Up Store feature in July 2025, including more customization tools, are a perfect representation of the ongoing push to enhance the B2C consumer retail buying experience. The development of more engaging and customizable storefronts is key to grabbing the notice of online consumers.

Product Type Segment Analysis

The apparel and fashion industry is forecast to retain a 38.5% market share through 2035, fueled by robust customer demand for stylish, varied, and personalized apparel and accessories. This segment's growth is supported by robust supply chains and scalable dropshipping platforms that are modified to fit the dynamic nature of fashion retailing and its flexible inventory management needs. The application of advanced automation software is one of the key reasons why this segment is growing. For instance, in March 2025, the dropshipping solution DSers partnered with Magento to streamline operations for merchants by integrating their tools, making it easier to manage stores and fulfill orders from within the Magento platform. This collaboration focuses on simplifying product management, inventory, and order processing, allowing dropshippers to efficiently manage their e-commerce businesses.

Platform Type Segment Analysis

The consumer segment must continue to dominate 70% of the market share in 2035, with individual entrepreneurs and small businesses remaining the primary users of dropshipping platforms. The simplicity with which one can enter the business and the convenience of the dropshipping model guarantee that it will be a popular option among those interested in establishing an online business. The growth in this segment is driven by the creation of easy-to-use platforms offering end-to-end solutions, ranging from store setup to the sourcing of products and order fulfillment. The fashion industry is increasingly prioritizing comprehensive and accessible resources for entrepreneurs.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Business Model |

|

|

Product Type |

|

|

Platform Type |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Dropshipping Market - Regional Analysis

APAC Market Insights

Asia Pacific dropshipping market is expected to capture a 36.4% market share during the forecast period, due to a growing number of internet users, higher disposable incomes, and the runaway expansion of e-commerce. The diversified markets of the region offer huge opportunities for dropshipping firms that are able to react to the local tastes and preferences. To take advantage of this, dropshippers would be likely to invest in accessing some market nuances and applying localised marketing strategies. This would allow them to take greater advantage of the huge potential for e-commerce within the region.

China is a significant leader in the global dropshipping sector, serving as a primary international supplier of products for dropshippers while simultaneously representing a massive and expanding consumer market. The country's developed e-commerce platform, spearheaded by names like Alibaba and JD.com, is a favorable ecosystem for dropshipping. The government of China has also ensured that the e-commerce system is secure. In March 2025, the General Administration of Customs of China began piloting "Real Name E-Commerce Merchant Verification" on all cross-border domestic dropshipping sellers, subjecting them to traceable identity, invoice, and tax declaration. This step is anticipated to boost transparency and accountability in the market.

India's dropshipping economy is set to expand, with a thriving digital economy, a youth and aspirational population, and growing internet penetration. The government's Digital India mission and open e-commerce networks are establishing a good ecosystem for online retail. The key development is the government-backed Open Network for Digital Commerce (ONDC), launched in January 2025. It supports SME sellers in adopting dropshipping firms on an open selling network and includes compliance software for import/export to democratize e-commerce and make small businesses possible.

North America Market Insights

North America is predicted to record a CAGR of 15% from 2026 to 2035, attributed to a well-developed e-commerce infrastructure, high consumer spending power, and an entrepreneurial environment that favors new business models. Availability of big e-commerce platforms and a robust network of suppliers as well as logistics players, further strengthens the region's dominance.

The U.S. is a lucrative market with competitive and innovative dropshipping, characterized by high product niching, influencer marketing, and sophisticated automation tools applied to maximize operations. The U.S. government has also stepped in to cater to small e-commerce businesses. In September 2024, the U.S. Small Business Administration (SBA) rolled out dropshipping-focused updates to its eCommerce Exporting program, expanding marketplace seller grant eligibility for shipping exports via US-based B2B or B2C dropship logistics. The program encourages the expansion of the dropshipping business through monetary support and resources for small businesses.

Canada dropshipping sector is expanding, supported by a technology-savvy population and a growing base of online entrepreneurs. The market is prone to trends in the U.S., but also possesses inherent attributes, with a strong focus on cross-border trade and good regulation. The government of Canada has acted to ensure transparent and equitable practices in the digital market. Canada's Competition Bureau released new guidelines in June 2025 for social and mobile commerce, and dropshippers must comply with truth-in-advertising principles and offer clear return policies. This helps to protect consumers as well as build credibility in the dropshipping model.

Europe Market Insights

Europe dropshipping market is anticipated to witness constant growth through 2035, led by a developed consumer market, extensive use of the internet, and a complex regulatory framework. Compliance with several consumer protection, data privacy, and taxation regulations is also an important driver of the market's transformation. These factors will fuel innovation and competition within the European market. Businesses must adapt to changing market conditions and regulations to succeed.

Germany has a well-developed and large online marketplace with a particular emphasis on consumer protection, quality products, and data protection. Germany government has implemented strict laws to foster a secure and honest online business environment. The German Federal Network Agency (Bundesnetzagentur) made online business websites mandatory to have verified supplier registration and product safety standards for all consumer goods, including dropshipped imports, in May 2024. This law helps to protect consumers and ensure fair competition, and it requires dropshippers to use caution in the choice of suppliers and compliance practices.

The UK is among the considerable dropshipping markets in Europe, with a developed e-commerce sector and strong digital buying culture. The marketplace mirrors influences from all over the world, but also its own regulatory framework that shapes the industry. The UK government has attempted to achieve fairness and transparency in the online market. In January 2024, the UK Competition and Markets Authority (CMA) reformed its rules on transparency on digital platforms with a requirement for online platforms to make merchant and product origin explicitly visible. This is meant to help consumers make more informed purchasing choices and make sellers more accountable.

Key Dropshipping Market Players:

- Shopify Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- AliExpress (Alibaba Group)

- SaleHoo Group Limited

- Spocket

- Printful Inc.

- Zendrop

- DSers

- Syncee

- Inventory Source

- CJDropshipping

- Dropshipzone

- Qikink

- Rakuten Group, Inc.

- NETSEA (BEENOS Inc.)

- TopSeller.jp

The dropshipping market is characterized by intense competition among a high number of varied actors like large online stores, specialty dropshipping apps, and broad networks of dropshippers and logistics firms. Key players in the market include Shopify Inc., AliExpress (Alibaba Group), SaleHoo Group Limited, Spocket, Printful Inc., Zendrop, DSers, and CJDropshipping. These companies do not stop innovating to provide longer and more affordable solutions for dropshippers, with automation, product finding, and integration across multiple sales channels in mind.

The competitive landscape of the dropshipping sector is also affected by strategic decisions of e-commerce platforms to own their partner ecosystems and monetization models. This includes changes in developer programs that can influence the price and availability of third-party tools. A significant event was Shopify's June 2024 announcement of major Partner Program changes, including the gradual elimination of the 0% revenue share incentive for the first USD 1 million of income for theme developers, to be implemented from January 1, 2025. While aimed at improving theme discovery and quality, this transition also alters the monetary incentives for developers, which may have downstream effects on the toolset ecosystem used by dropshippers.

Here are some leading companies in the dropshipping market:

Recent Developments

- In September 2025, Syncee released several AI-powered features for its dropshipping and wholesale marketplace, including AI product suggestions, AI image search, and new filtering options to help merchants find products faster. These innovations aimed to streamline the product discovery process for e-commerce businesses.

- In September 2025, Printify announced Amplified 2025, an initiative to empower entrepreneurs to launch and grow online stores, which follows Printify's continued expansion of its global print provider network throughout 2025. This initiative aims to further support the success of e-commerce businesses.

- In March 2024, Alibaba announced a partnership with the United States Postal Service (USPS) to offer new shipping and logistics solutions for US-based customers, including faster and more reliable delivery options. This collaboration aims to enhance e-commerce capabilities and streamline international shipping for businesses utilizing Alibaba's platform.

- Report ID: 3705

- Published Date: Oct 03, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Dropshipping Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.