Drone Surveillance Market Outlook:

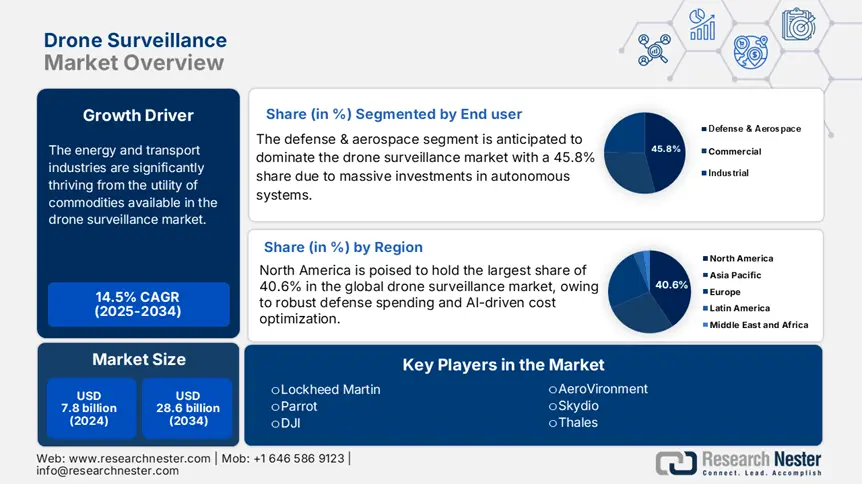

Drone Surveillance Market size was over USD 7.8 billion in 2024 and is estimated to reach USD 28.6 billion by the end of 2034, expanding at a CAGR of 14.5% during the forecast timeline, i.e., 2025-2034. In 2025, the industry size of drone surveillance is assessed at USD 9.2 billion.

The market is heavily influenced by the increasing demand for high-end commercial and military drones. According to the Observatory of Economic Complexity (OEC) reports, in 2023 alone, the U.S. exported $2.5 billion worth of unmanned aerial vehicles (UAVs), specifically to allied nations, while importing $480 million of mostly commercial-grade drones from China. Besides, the 15.4% tariff was implemented by European authorities on Chinese drone imports to protect domestic manufacturers, creating new opportunities for local production houses. These trade dynamics are shaping accessibility and competency, favoring specialized large-scale exports from Western nations while commercial segments remain dominated by cost-effective manufacturers.

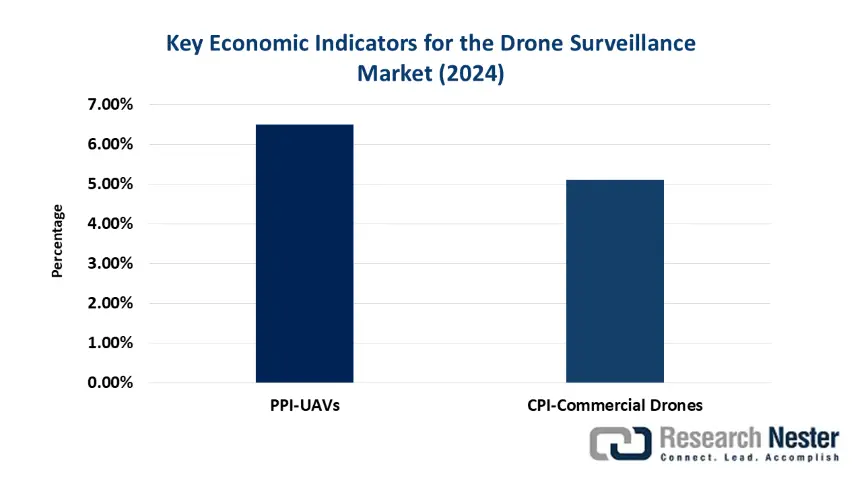

Despite the enlarging consumer base around the globe, the pricing pressures on the market remain persistent. This can be testified by the 6.5% year-over-year (YoY) rise in the producer price index (PPI) for UAVs in 2024 due to military demand and semiconductor shortages, as reported by the Bureau of Labor Statistics (BLS). Subsequently, the consumer price index (CPI) for commercial drones increased by 5.1% on account of heightened R&D and compliance costs. Thus, to address supply chain vulnerabilities, manufacturers are shifting production to alternative hubs, such as Vietnam and India. The U.S. is further reducing foreign dependence through the Creating Helpful Incentives to Produce Semiconductors for America (CHIPS) Act, which earmarked $2.8 billion for domestic drone component manufacturing.

Drone Surveillance Market - Growth Drivers and Challenges

Growth Drivers

- Rising adoption for infrastructural monitoring: The energy and transport industries are significantly benefiting from the utility of commodities available in the drone surveillance market. This can be evidenced by a 50.3% reduction in manual labor expenses due to adopting UAVs for infrastructure monitoring. Thus, associated private and public organizations are increasingly investing in this sector. For instance, Duke Energy purchased autonomous drones from Percepto for its power plants, which slashed inspection times by 70.4%. Similarly, Petrobras in Brazil started utilizing drones for offshore rig inspections, reflecting its impact in the energy industry of Latin America.

- Regulatory relaxation for BVLOS operations: The relaxation of Beyond Visual Line of Sight (BVLOS) from regulatory frameworks, such as the FAA and EASA, is unlocking the potential to generate $12.4 billion in commercial revenue by 2030. This is serving as a major driver for the drone surveillance market. Exemplification of this approach includes the utilization of medical delivery drones from Zipline in Rwanda, which eliminated delivery delays by 90.4%. This underscored the necessary efficiency gain possible under BVLOS frameworks, particularly in drone logistics. Currently, companies are prioritizing detect-and-avoid (DAA) sensor technology to comply with evolving safety standards.

- Increasing disaster response applications: Efforts to prevent and precisely monitor the damages from natural disasters are underscoring the importance of drone surveillance, with validation of being vital for wildfire tracking and flood mapping. For instance, the United Nations estimated a 20.4% increase in drone-aided disaster response by 2030 while highlighting the critical role of drones in emergency management. This can also be evidenced by the outcomes from using Draganfly's drones, making the identification of Hurricane Ian's damage 5x faster than manual surveys, demonstrating the technology's life-saving efficiency.

Challenges

- Cross-border transfer restrictions: Data privacy regulations, such as the GDPR and the Digital Personal Data Protection Act in India, present a significant hurdle for the drone surveillance market. The World Trade Organization revealed that the compliance costs increased by 15.4-25.3% in 2024 due to strict data storage and transfer criteria. This forces manufacturers to implement expensive localization measures, causing a budget overflow. For instance, in 2023, DJI was pushed to install domestic servers to achieve 30.4% faster commercial access in Europe, as per the European Union Agency for Cybersecurity (ENISA).

- High cybersecurity implementation costs: Financial exhaustion from stringent cybersecurity requirements also discourages companies from investing in the market. Testifying to the same, in 2024, the process of acquiring compliance with the National Institute of Standards and Technology (NIST) criteria was costing SMEs across the U.S. $50.4-$100.7 thousand for each drone fleet. However, Parrot addressed this problem by integrating end-to-end encryption in its pipelines, which reduced security breaches by 60.4% in defense applications, as reported by the French Ministry of Defense.

Drone Surveillance Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2034 |

|

CAGR |

14.5% |

|

Base Year Market Size (2024) |

USD 7.8 billion |

|

Forecast Year Market Size (2034) |

USD 28.6 billion |

|

Regional Scope |

|

Drone Surveillance Market Segmentation:

End user Segment Analysis

The defense & aerospace segment is anticipated to dominate the drone surveillance market with a 45.8% share during the assessed period, due to massive investments in autonomous systems. For instance, Edge Group from the UAE invested $1.6 billion in a border patrol fleet. Following the same pathway, Lockheed Martin secured $800.4 million from defense contracts for its Indago 4 drone in 2023, as unveiled by the Department of Defense (DoD). This augmentation also thrives on evolving battlefield requirements, demanding customizable solutions with modular drone designs. Thus, to maintain their competency in this high-value industry, leading pioneers are engaging more resources to develop upgradeable platforms with swappable payloads.

Payload Segment Analysis

The electro-optical/infrared (EO/IR) cameras segment is predicted to show dominance over the drone surveillance market by securing a 41.6% share by the end of the stipulated timeline. Having a critical role in modern surveillance operations, this subtype is gaining traction in the majority of fields of application. These advanced sensor systems rapidly became the most suitable option for 24/7 monitoring capabilities with a combination of high-resolution and thermal detection. The segment's leadership also stems from EO/IR's versatility across military, border security, and critical infrastructure protection applications, where real-time visual intelligence is paramount.

Technology Segment Analysis

The AI-powered autonomous drones segment is expected to garner the highest share of 28.4% in the drone surveillance market during the analyzed tenure. Increased compliance and rapid AI integration are primarily solidifying the proprietorship. For instance, in 2024, the Federal Aviation Administration (FAA) initiated BVLOS waivers, while the NIST enhanced AI security standards, which enabled a 25.3% decrease in operational expenses. The segment also gained validation for its cutting-edge performance and increased accuracy, which influences consumers to invest more. As evidence, Nova 2 from Shield AI established a strong military value by delivering 60.6% faster threat response in trials under the Defense Advanced Research Projects Agency (DARPA).

Our in-depth analysis of the market includes the following segments:

|

Segments |

Subsegments |

|

Type |

|

|

Application |

|

|

Technology |

|

|

End user |

|

|

Payload |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Drone Surveillance Market - Regional Analysis

North America Market Insights

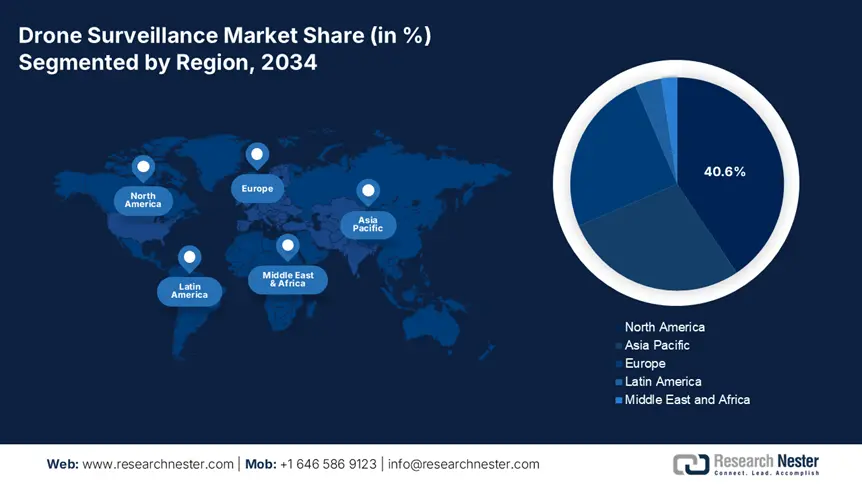

North America is poised to hold the largest share of 40.6% in the global drone surveillance market throughout the analyzed timeframe. Robust defense spending and AI-driven cost optimization in homeland security applications are the two major growth factors in this landscape. The region is primarily controlled by the U.S., which excels in operational deployments, with the U.S. Forest Service utilizing drones for real-time wildfire analytics. Besides, the Customs and Border Protection agencies are also deploying drones for border patrol and counter-terrorism operations. Furthermore, the region's technological edge in AI-powered surveillance solutions and significant investments in counter-illegal activity monitoring systems reinforce its market leadership.

The U.S. dominates the North America market with $4.2 billion in DoD spending in 2024 alone. In addition, the NTIA released $1.8 billion 5G fund, which accelerated real-time surveillance capabilities of this sector by enhancing the range of drone connectivity. Besides, AI adoption across the country boosted CBP border security efficiency by 30.4% and cut Duke Energy's infrastructure inspection costs by 50.3%, reflecting viability in various industries. These factors are expected to continue to boost market growth in the coming years.

The drone surveillance market in Canada is growing remarkably with substantial government allocations and local advancements. The Innovation, Science and Economic Development (ISED), for example, invested $360.5 million in discoveries related to AI-driven drones. Additionally, the Canadian Radio-television and Telecommunications Commission (CRTC) mandated drone-assisted tower inspections that reduce costs by 25.4%, drawing attention to widespread utilization. Furthermore, the country's contribution to the regional progress is displayed through a 40.4% revenue surge for Drone Delivery Canada in 2023.

APAC Market Insights

Asia Pacific is expected to become the fastest-growing region in the global drone surveillance market throughout the assessed timeframe. The ongoing regulatory advancements, increased defense allocations, and robust 5G adoption are contributing to the region's accelerated progress in this field. For instance, in 2024, the governing body in Australia reformed the Civil Aviation Safety Authority (CASA), enabling long-range deployments. The extended utilization of drones for typhoon monitoring in the Philippines under the guidelines from the National Disaster Risk Reduction and Management Council (NDRRMC) is also reflecting the continuous enlargement of the consumer base. Furthermore, intense border security investments from China and India are creating demand for advanced multi-sensor payloads.

China leads the drone surveillance market in Asia Pacific and is poised to capture 45.4% of regional revenue by 2034. The $2.6 billion subsidy program from the Ministry of Industry and Information Technology (MIIT) is providing financial backing to the country's augmentation in this sector. On the other hand, rapid advanced 5G-drone integration is also fueling its APAC dominance. Additionally, demand for military-grade drones in China accounts for 60.5% of sales in this sector, displaying the nation's leadership in defense adoption. Alongside, purchases for commercial use also grow at a 35.4% annual rate.

India is establishing itself as an epicenter of both a large consumer base and localized production for the drone surveillance market. The country is propagating with a 15.4% regional share gained through government initiatives and public spending. For instance, the Ministry of Electronics and Information Technology (MeitY) enacted the Production Linked Incentive (PLI) scheme, which procured $800.4 million investment in this sector. The 2023 National Cybersecurity Policy is also propelling demand for secure border surveillance drones, while domestic pioneers are expanding their territory towards Southeast Asia.

Government Investments & Policies (2024-2025)

|

Country |

Policy/Initiative |

Budget/Funding (Million) |

Key Impact |

|

Australia |

Advanced Air Mobility (AAM) Roadmap |

$75.6 |

Focus on AI-driven surveillance drones for defense and maritime patrol. |

|

South Korea |

Drone Logistics Expansion Policy |

$60.3 |

Deployed drones for port/cargo surveillance. |

|

Malaysia |

Cyberjaya Smart City Drone Network |

$30 |

Piloting autonomous drones for 24/7 urban security surveillance. |

Source: Department of Infrastructure, MSIT, MDEC

Europe Market Insights

Europe is poised to show consistent growth in the global drone surveillance market between 2025 and 2034. During the timeline from 2022 to 2024, the landscape witnessed a 10.4% price decline due to cloud computing efficiencies in data processing, which enhanced accessibility, as per the ENISA. Besides, the 2024 infrastructure audit mandates by ENISA and the AI Act started favoring ethical AI integration in various industries, which deepened the sector's penetration in Europe. The region also has a strong adoption rate in critical infrastructure protection, with the Digital Innovation Hubs projecting the same to garner a €2.4 billion value by 2030, which is largely fueled by logistics automation.

Germany is anticipated to gain control over 28.4% of the Europe drone surveillance market revenue by 2034. The financial backing from government investments and technological leadership is consolidating a prosperous future for this landscape. For instance, in 2024, the Federal Ministry for Digital and Transport (BMDV) allocated €1.5 billion in funding to autonomous drones. In addition, industrial applications dominate the country's demand base with a 40.4% share, where Siemens is leveraging its portfolio of AI drones for factory inspections.

The UK is predicted to capture 25.4% of revenue generation from the drone surveillance market in Europe by 2034. The country's regional contribution is highly attributable to the £500.4 million drone strategy of the Department for Science, Innovation and Technology (DSIT). Strong defense sector adoption is also consolidating the nation's position in this field. Besides, government spending in this category reached £600.5 million in 2024 alone, marking a 15.3% YoY increase and reflecting the country's commitment to expanding its capabilities in this sector.

Country-wise Government Provinces (2024-2025)

|

Country |

Policy/Initiative |

Budget/Funding (Million) |

Key Focus |

|

Spain |

AI-Driven Border Surveillance Program |

~$43.3 |

Gibraltar border & maritime patrol |

|

Italy |

5G-Enabled Drone Corridors (MISE) |

~$65.7 |

Logistics & critical infrastructure |

|

Russia |

AI Swarm Drone Development (Rostec) |

~$94.5 |

Defense & counter-drone systems |

Source: Spanish Ministry of Interior, Italian Ministry of Economic Development

Key Drone Surveillance Market Players:

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

The drone surveillance market is intensified with a competitive culture among regional leaders who employ distinct strategies to maintain their leadership. For instance, DJI attained dominance over the sector with its portfolio of cost-effective solutions, while U.S. firms are more focused on the commercialization of defense-grade AI integration. This scenario can further be exemplified by Skydio's excellence in autonomous drones and Lockheed's large-scale procurement from military contracts. On the other hand, key players in Europe tend to capitalize on cybersecurity and 5G-enabled real-time surveillance. Moreover, this merchandise reflects a balanced landscape combining commercial scalability and tech-based discoveries.

Here is a list of key players operating in the global market:

|

Company |

Country |

Market Share (2024) |

|

DJI |

China |

35.5% |

|

Lockheed Martin |

U.S. |

18.4% |

|

Parrot |

France |

8.5% |

|

Skydio |

U.S. |

7.3% |

|

AeroVironment |

U.S. |

6.4% |

|

Thales |

France |

xx% |

|

Northrop Grumman |

U.S. |

xx% |

|

Autel Robotics |

China |

xx% |

|

Wingcopter |

Germany |

xx% |

|

Astra Robotics |

India |

xx% |

|

Innovaero |

Australia |

xx% |

|

Korea Aerospace Industries (KAI) |

South Korea |

xx% |

|

Meraque |

Malaysia |

xx% |

|

Elbit Systems |

Israel |

xx% |

Below are the areas covered for each company in the drone surveillance market:

Recent Developments

- In March 2024, Skydio marked a significant advancement in defense surveillance capabilities with the launch of the X10D enterprise drone, featuring AI-powered obstacle avoidance and NIST-compliant encryption. The drone secured $48.5 million in Q1 2024 defense contracts, representing a 35.4% quarter-over-quarter growth.

- In February 2024, DJI introduced Dock 2, revolutionizing telecom infrastructure maintenance by enabling fully autonomous drone operations for tower inspections. AT&T's deployment of more than 204 units demonstrated significant efficiency gains, reducing inspection costs by 30.3%.

- Report ID: 7975

- Published Date: Jul 31, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Drone Surveillance Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert