Drive Assy Market Outlook:

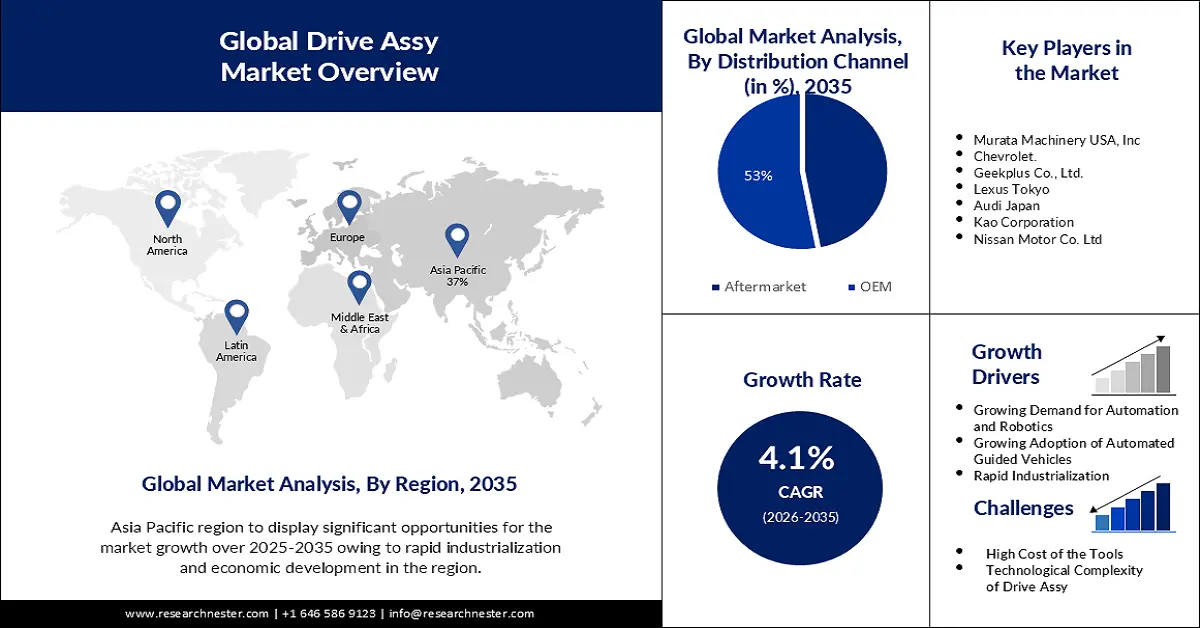

Drive Assy Market size was valued at USD 1.08 billion in 2025 and is expected to reach USD 1.61 billion by 2035, expanding at around 4.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of drive assy is assessed at USD 1.12 billion.

Electric car drive assemblies are made to optimize performance, power, and economy while reducing emissions.

It's a major factor in the growing acceptance of EVs as a greener mode of transportation. Hence, owing to the increasing concern for vehicular pollution the shift in preference towards electric vehicles is rapidly growing worldwide It's predicted that EV sales will increase significantly through 2023. In the first quarter of this year, sales of electric automobiles exceeded 2.3 million, a 25% increase over the same period the previous year.

Furthermore, government rules and incentives are also a major factor in the drive assy market's expansion. For instance, a firm commitment by the government to transition to 100% zero-emission cars in public procurement was made in 2022 with the launch of the Zero Emission Government Fleet Declaration under the EVI.

Also, numerous nations offer grants, tax credits, and other financial aid to encourage the use of electric vehicles. Therefore, the demand for drive assemblies is rising as a result of producers being encouraged to create more electric vehicles (EVs) in response to stricter emission laws.

Key Drive Assy Market Insights Summary:

Regional Insights:

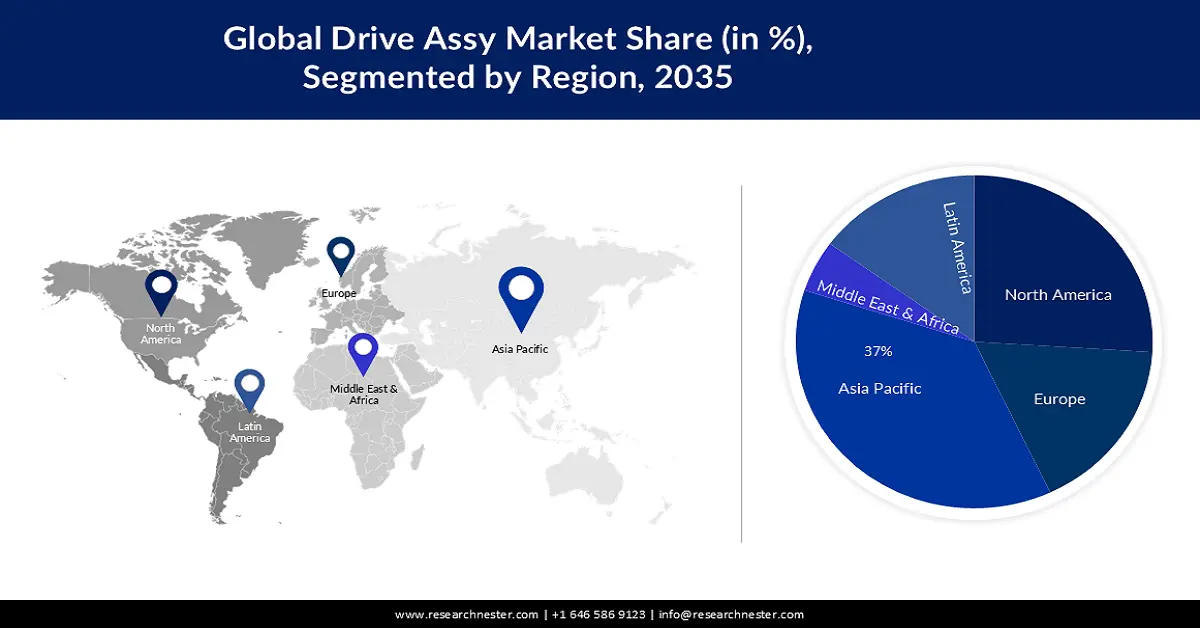

- Asia Pacific is expected to hold the largest revenue share of 37% by 2035, impelled by rapid urbanization and economic development in key countries.

- North America is anticipated to capture over 26% revenue share by 2035, driven by rising disposable income and widespread adoption of electric vehicles in the region.

Segment Insights:

- OEM segment in the Drive Assy Market is poised to dominate with around 53% share by 2035, propelled by ensuring quality control and adherence to industry standards.

- Gear & Pinion segment is estimated to account for more than 34% revenue share by 2035, owing to delivering precise timing, reduced noise, and high-velocity ratio efficiency.

Key Growth Trends:

- Growing demand for automated guided vehicles

- Growing demand for automation and robotics

Major Challenges:

- High cost of the tools to restrain the growth of the market

- Technological complexity of drive assy.

Key Players: Jungheinrich AG, Great Wall Motor Co., Ltd., Curtiss-Wright Corporation, Murata Machinery USA, Inc, Chevrolet, Geekplus Co., Ltd, Lexus Tokyo, Audi Japan, Kao Corporation, Nissan Motor Co. Lt.

Global Drive Assy Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.08 billion

- 2026 Market Size: USD 1.12 billion

- Projected Market Size: USD 1.61 billion by 2035

- Growth Forecasts: 4.1%

Key Regional Dynamics:

- Largest Region: Asia Pacific (37% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: China, USA, Japan, Germany, India

- Emerging Countries: India, Brazil, Mexico, South Korea, Indonesia

Last updated on : 19 November, 2025

Drive Assy Market - Growth Drivers and Challenges

Growth Drivers

-

Growing demand for automated guided vehicles - The demand for drive assy is growing among manufacturers of automated guided vehicles (AGVs) due to the growing demand for AGVs worldwide. By 2025, it is foreseen that the number of automated guided vehicles (AGVs) on the global drive assy market will exceed 272,700 units.

Automated guided vehicles are extensively deployed in the warehouse and logistics industry owing to their ability to enhance efficiency, limit labor costs, and improve safety. These vehicles are designed to transport goods and materials within a facility without the need for human intervention. To enable smooth and precise movement of AGVs, high-quality drive assemblies are required. These drive assemblies provide the necessary power transmission, control, and maneuverability for AGVs to navigate through complex environments, follow designated paths, and avoid obstacles. - Growing demand for automation and robotics - Automation and robotics are becoming increasingly prevalent in industries such as manufacturing, logistics, and healthcare. Drive assemblies play a crucial role in powering and controlling the movement of automated systems, thus driving the demand for drive assemblies.

Furthermore, advancements in drive assembly technology, such as the development of compact and efficient designs, allow for seamless integration into automated systems. These innovations further enhance the performance and capabilities of automation and robotics, driving the need for more advanced drive assemblies.

- A surge in industrialization - As industrialization continues to expand globally, there is an increasing need for machinery and equipment that require drive assemblies. Industries such as mining, construction, and energy rely on drive assemblies for the efficient operation of heavy machinery and equipment.

With industrialization comes the demand for efficient power transmission and control systems, which is where drive assemblies play a vital role. Drive assys including gears and pinions help transmit power and torque, enabling the smooth operation of machinery and equipment

Challenges

-

High cost of the tools to restrain the growth of the market - The drive assembly drive assy market faces cost pressures due to the need for continuous innovation and advancements in technology. Manufacturers need to invest in research and development to stay competitive, which can increase production costs. Hence, the end product price also increases which further hinders the adoption of drive assy.

-

Technological complexity of drive assy.

- Surging cyber threat - With the deployment of advanced technology such as AI and IoT the prevalence of cyber attacks also increases. This refrains end users from opting for this product. As a result, owing to this factor the drive assy market might face restrain in its growth.

Drive Assy Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

4.1% |

|

Base Year Market Size (2025) |

USD 1.08 billion |

|

Forecast Year Market Size (2035) |

USD 1.61 billion |

|

Regional Scope |

|

Drive Assy Market Segmentation:

Distribution Channel Segment Analysis

In drive assy market, OEM segment is poised to dominate around 53% share by the end of 2035. OEMs play a vital role in ensuring quality control and adhering to industry standards. They are responsible for maintaining consistent production standards and delivering reliable drive assemblies to their customers.

Also, OEMs work closely with vehicle manufacturers to design and develop drive assemblies that meet specific requirements, such as performance, durability, and cost-effectiveness. Furthermore, the expansion of the automotive industry, and the growing demand for technological innovation are escalating the growth of the segment. OEMs strive to provide innovative drive assembly solutions that meet the changing needs of vehicle manufacturers.

Component Segment Analysis

In drive assy market, gear & pinion segment is estimated to account for more than 34% revenue share by the end of 2035. Gear and pinion drives offer a wide range of speed and torque for the same input power, with more precise timing than a chain system, less noise & friction loss, and other advantages over other parts. Since the gear provides positive drive, a high-velocity ratio can be achieved in the least amount of area.

Also, there is a growing demand for fuel-efficient vehicles and the need for noise reduction. For instance, the 2022 new model vehicle’s fuel efficiency is estimated to be over 25 mpg. Whereas, the 2002 model vehicles’ fuel efficiency was approximately 18 mpg – indicating an improvement of about 34%. Moreover, manufacturers in this segment constantly innovate to develop gears and pinions with improved efficiency, reduced weight, and enhanced performance.

Our in-depth analysis of the global drive assy market includes the following segments:

|

Component |

|

|

Distribution Channel |

|

|

End-User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Drive Assy Market - Regional Analysis

APAC Market Insights

Asia Pacific industry is expected to hold largest revenue share of 37% by 2035. One of the major elements is the rapid urbanization and economic development in countries including China, India, and Japan. These countries have seen a rise in manufacturing activities leading to a boost in demand for drive assemblies in sectors such as automotive, machinery, and construction.

Also, the region’s growing population has fuelled the demand for automobiles. For instance, about 4.3 billion people are residing in the Asia Pacific region, which is over 60% of the global population. Additionally, as more people in this region can afford vehicles, the automotive industry has seen substantial growth, driving the need for drive assays.

North American Market Insights

By 2035, North America region in assy market is anticipated to capture over 26% revenue share. This is primarily caused by the fact that this is one of the most developed regions and the disposable income of the people is also growing. Furthermore, there is a high level of sales and widespread usage of electric vehicles in this region. As a consequence, the drive assy market in this region is growing.

Drive Assy Market Players:

- Jungheinrich AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Great Wall Motor Co., Ltd.

- Curtiss-Wright Corporation

- Murata Machinery USA, Inc

- Chevrolet

- BMW Group

- Daimler Truck AG

- Toyota Motor

- Volkswagen Group

- SAIC Motor Corporation Limited

Recent Developments

- Great Wall Motor's wholly-owned subsidiary, Dedicated Hybrid Transmission (DHT) technology producer HYCET has benefited from Comau's design and implementation of a high-volume, automated manufacturing line. A next-generation transmission system called the L.E.M.O.N. hybrid DHT makes it possible to operate electric motors and gasoline engines simultaneously, facilitating effective power sharing between them. Comau's end-to-end solution uses a total of 12 robots spread over 6 lines to achieve an annual production capacity of 150,000 pieces per line with a cycle time of less than 2 minutes, meeting the customer's large-scale manufacturing requirements.

- The Naval Air Systems Command (NAVAIR) has awarded the Curtiss-Wright Corporation (NYSE: CW) a 5-year firm-fixed-price indefinite delivery, indefinite quantity (IDIQ) contract. Curtiss-Wright will supply E-28 Retrieve Drive Assemblies, including spare parts, to assist in the replacement of the legacy sub-systems throughout U.S. Navy and Marine Corps sites as part of a multi-year initiative with a maximum potential value of about $28 million.

- Report ID: 3497

- Published Date: Nov 19, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Drive Assy Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.