Drilling Rig Market Outlook:

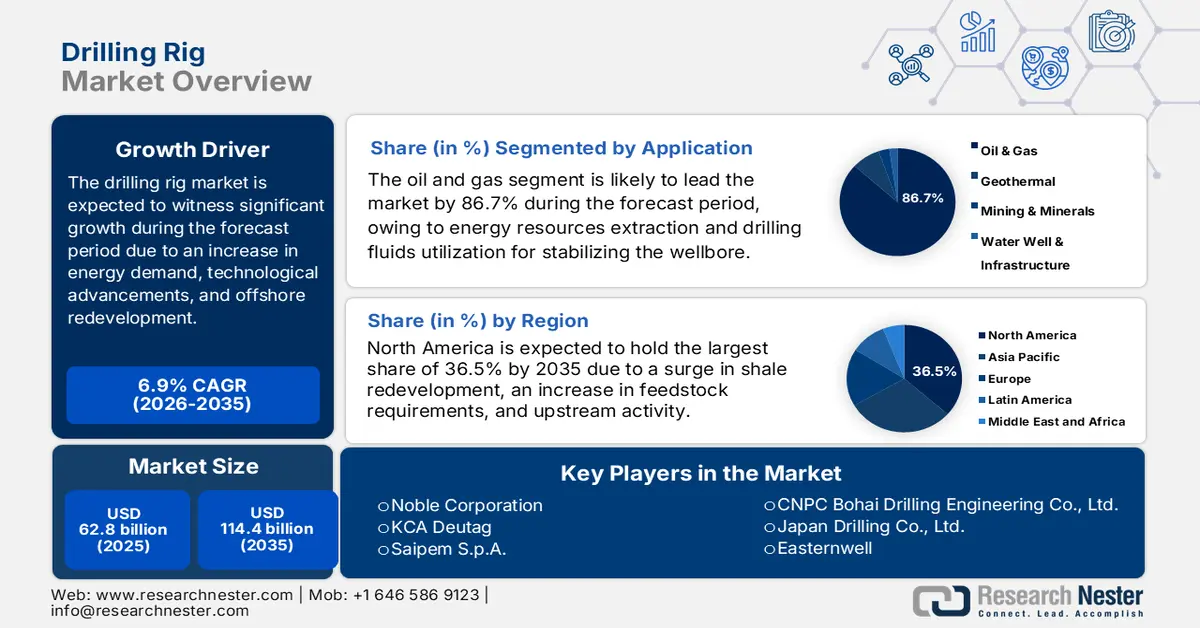

Drilling Rig Market size was over USD 62.8 billion in 2025 and is estimated to reach USD 114.4 billion by the end of 2035, expanding at a CAGR of 6.9% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of drilling rig is estimated at USD 67.1 billion.

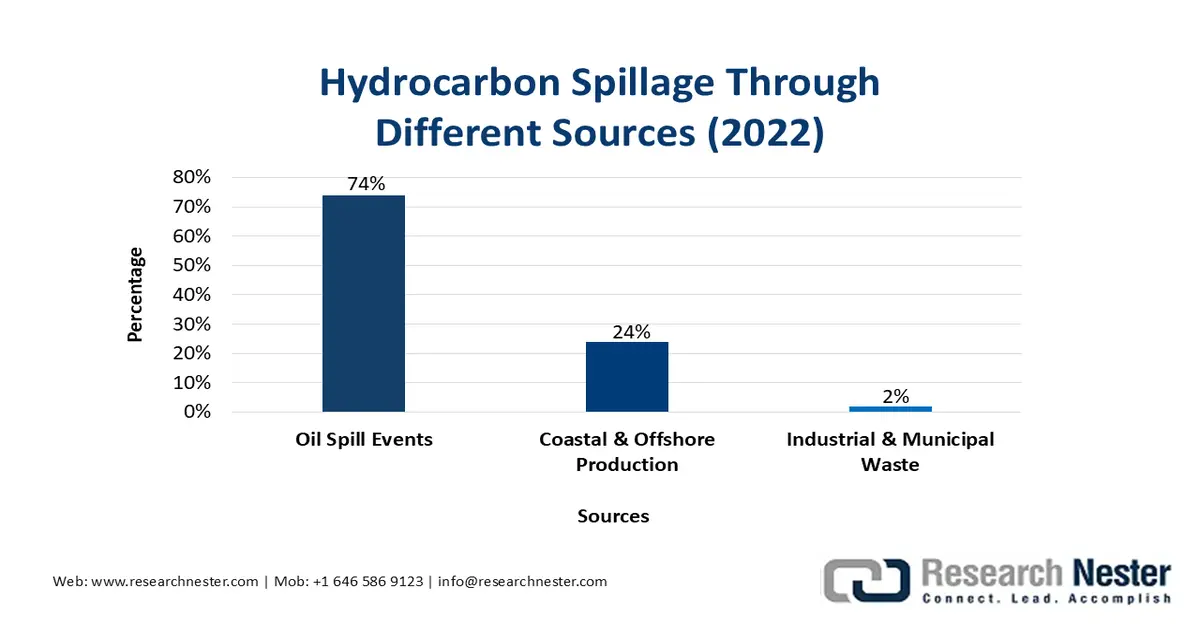

The international drilling rig market is being readily fueled by a rise in energy demand, technological advancement, and offshore redevelopment. The overall industry is witnessing a massive transformation toward digitalization, sustainability, and automation, with an increase in the demand for hydrocarbons across emerging economies. Besides, according to an article published by NLM in May 2022, oil spills tend to affect household food security by 60% and effectively lower the ascorbic acid content in vegetables and cassava crude protein content by 36% and 40%. Moreover, approximately 2.37 × 106 tonnes of petroleum effectively enter the environment every year, either through natural activities or anthropogenic activities. A significant 65.2% portion of this originates from industrial and municipal wastes, and the remaining 26.2% from oil spill incidents, thereby driving the market’s demand globally.

Source: NLM

Furthermore, digitalized and automation rigs, offshore redevelopment, ESG alignment and sustainability, along with regional transformations, and fleet high-grading are other factors responsible for bolstering the market’s growth internationally. As per an article published by the U.S. Department of Energy in 2025, the Ultra-Deepwater and Unconventional Natural Gas and Other Petroleum Resources Research Program, unveiled by the Energy Policy Act of (EPAct), is considered a public and private partnership, which is valued at USD 400 million for more than 8 years. It has been significantly designed to provide suitability to consumers by creating technologies to enhance America’s regional oil and gas production and diminish the region’s reliance on worldwide imports. Moreover, the continuous liquefied natural gas and crude petroleum supply chain is denoting a positive outlook for the overall market globally.

2023 Liquefied Natural Gas and Crude Petroleum Export and Import

|

|

Liquefied Natural Gas |

Crude Petroleum |

|

|

|

Countries/Components |

Export (USD) |

Import (USD) |

Export (USD) |

Import (USD) |

|

Australia |

46.2 billion |

- |

- |

- |

|

U.S. |

39.6 billion |

- |

124 billion |

168 billion |

|

Qatar |

37.3 billion |

- |

- |

- |

|

Japan |

- |

45.1 billion |

- |

- |

|

China |

- |

43.7 billion |

- |

312 billion |

|

France |

- |

13.8 billion |

- |

- |

|

Saudi Arabia |

- |

- |

181 billion |

- |

|

Russia |

- |

- |

122 billion |

- |

|

India |

- |

- |

- |

140 billion |

Source: OEC