Global Windows and Doors Market

- Introduction

- Market Definition and Segmentation

- Study Assumptions and Abbreviations

- Research Methodology & Approach

- Primary Research

- Secondary Research

- SPSS Methodology

- Data Triangulation

- Executive Summary

- Global Industry Overview

- Regional Synopsis

- Industry Supply Chain Analysis

- DROT Analysis

- Drivers

- Restraints

- Opportunities

- Trends

- Government Regulation

- Competitive Landscape

- ATRIUM WINDOWS & DOORS

- JELD-WEN, Inc.

- Kolbe

- LIXIL Corporation

- MILGARD Manufacturing, LLC

- Nationwide Windows

- Oppein Home Group Inc.

- Pella Corporation

- SGM Window Manufacturing Limited

- YKK AP America Inc.

- Ongoing Technological Advancements

- Product Analysis for Windows and Doors

- Patent Analysis

- SWOT Analysis

- Porter Fiver Forces Analysis

- Analysis of Strategic Initiatives Adopted by Key Players

- Merger and Acquisition Analysis

- Recent Development Analysis

- Industry Risk Assessment

- Growth Outlook

- Global Outlook and Projections

- Global Overview

- Market Value (USD Million), Volume (Thousand Units) Current and Future Projections, 2024-2037

- Increment $ Opportunity Assessment, 2024-2037

- Global Segmentation (USD Million), 2024-2037, By

- Product, Value (USD Million)

- Doors

- Windows

- Material, Value (USD Million)

- Wood

- Metal

- Steel

- Aluminium

- Others

- UPVC

- Others

- Mechanism, Value (USD Million)

- Swinging

- Sliding

- Folding

- Revolving

- Others

- End user, Value (USD Million)

- Residential

- Non-Residential

- Regional Synopsis, Value (USD Million), 2024-2037

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

- Product, Value (USD Million)

- Cross Analysis of mechanism w.r.t end user, 2024-2037 (USD Million)

- Global Overview

- North America Market

- Overview

- Market Value (USD Million), Volume (Thousand Units) Current and Future Projections, 2024-2037

- Increment $ Opportunity Assessment, 2024-2037

- Segmentation (USD Million), 2019-2037, By

- Product, Value (USD Million)

- Doors

- Windows

- Material, Value (USD Million)

- Wood

- Metal

- Steel

- Aluminium

- Others

- UPVC

- Others

- Mechanism, Value (USD Million)

- Swinging

- Sliding

- Folding

- Revolving

- Others

- End user, Value (USD Million)

- Residential

- Non-Residential

- Country Level Analysis, Value (USD Million)

- U.S.

- Canada

- Product, Value (USD Million)

- Cross Analysis of mechanism w.r.t end user, 2024-2037 (USD Million)

- Overview

- Europe Market

- Overview

- Market Value (USD Million), Volume (Thousand Units) Current and Future Projections, 2024-2037

- Increment $ Opportunity Assessment, 2024-2037

- Segmentation (USD Million), 2019-2037, By

- Product, Value (USD Million)

- Doors

- Windows

- Material, Value (USD Million)

- Wood

- Metal

- Steel

- Aluminium

- Others

- UPVC

- Others

- Mechanism, Value (USD Million)

- Swinging

- Sliding

- Folding

- Revolving

- Others

- End user, Value (USD Million)

- Residential

- Non-Residential

- Country Level Analysis, Value (USD Million)

- UK

- Germany

- France

- Italy

- Spain

- Netherlands

- Russia

- Switzerland

- Poland

- Belgium

- Rest of Europe

- Product, Value (USD Million)

- Cross Analysis of mechanism w.r.t end user, 2024-2037 (USD Million)

- Overview

- Asia Pacific Market

- Overview

- Market Value (USD Million), Volume (Thousand Units) Current and Future Projections, 2024-2037

- Increment $ Opportunity Assessment, 2024-2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2019-2037, By

- Product, Value (USD Million)

- Doors

- Windows

- Material, Value (USD Million)

- Wood

- Metal

- Steel

- Aluminium

- Others

- UPVC

- Others

- Mechanism, Value (USD Million)

- Swinging

- Sliding

- Folding

- Revolving

- Others

- End user, Value (USD Million)

- Residential

- Non-Residential

- Country Level Analysis, Value (USD Million)

- UK

- Germany

- France

- Italy

- Spain

- Netherlands

- Russia

- Switzerland

- Poland

- Belgium

- Rest of Europe

- Product, Value (USD Million)

- Cross Analysis of mechanism w.r.t end user, 2024-2037 (USD Million)

- Overview

- Latin America Market

- Overview

- Market Value (USD Million), Volume (Thousand Units) Current and Future Projections, 2024-2037

- Increment $ Opportunity Assessment, 2024-2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2019-2037, By

- Product, Value (USD Million)

- Doors

- Windows

- Material, Value (USD Million)

- Wood

- Metal

- Steel

- Aluminium

- Others

- UPVC

- Others

- Mechanism, Value (USD Million)

- Swinging

- Sliding

- Folding

- Revolving

- Others

- End user, Value (USD Million)

- Residential

- Non-Residential

- Country Level Analysis, Value (USD Million)

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Product, Value (USD Million)

- Cross Analysis of mechanism w.r.t end user, 2024-2037 (USD Million)

- Overview

- Middle East & Africa Market

- Overview

- Market Value (USD Million), Volume (Thousand Units) Current and Future Projections, 2024-2037

- Increment $ Opportunity Assessment, 2024-2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2019-2037, By

- Product, Value (USD Million)

- Doors

- Windows

- Material, Value (USD Million)

- Wood

- Metal

- Steel

- Aluminium

- Others

- UPVC

- Others

- Mechanism, Value (USD Million)

- Swinging

- Sliding

- Folding

- Revolving

- Others

- End user, Value (USD Million)

- Residential

- Non-Residential

- Country Level Analysis, Value (USD Million)

- Saudi Arabia

- UAE

- Israel

- Qatar

- Kuwait

- Oman

- South Africa

- Rest of Middle East & Africa

- Product, Value (USD Million)

- Cross Analysis of mechanism w.r.t end user, 2024-2037 (USD Million)

- Overview

- About Research Nester

- Our Global Clientele

- We Serve Clients Across World

Windows and Doors Market Outlook:

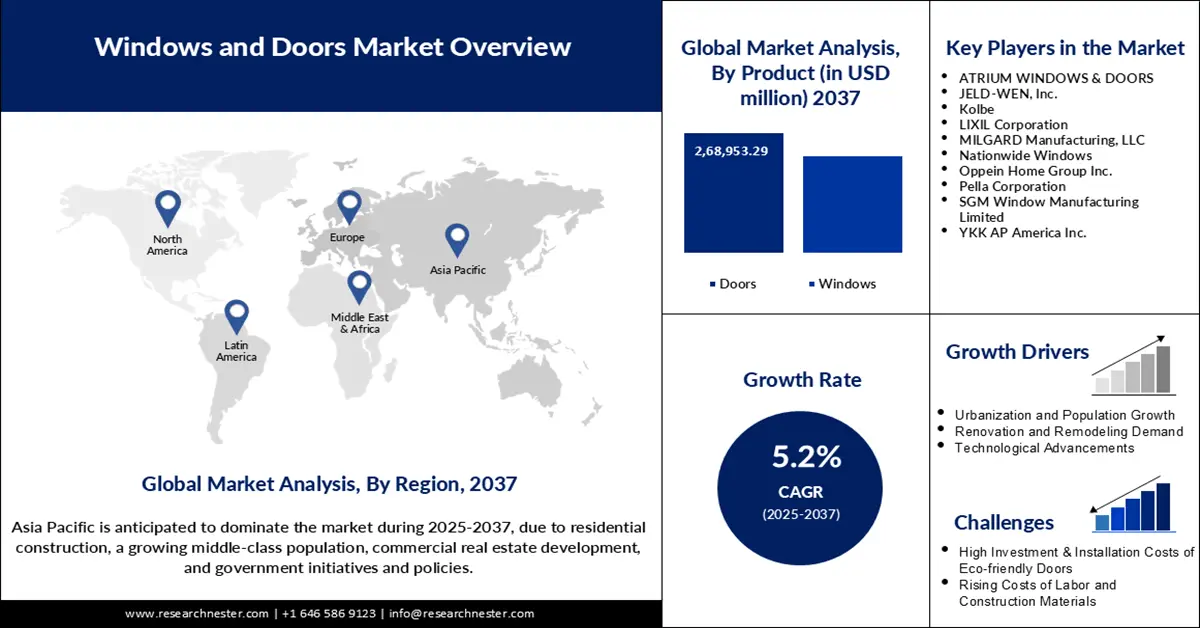

Windows and Doors Market size was valued at USD 254.1 billion in 2024 and is projected to reach a valuation of USD 487.2 billion by the end of 2037, rising at a CAGR of 5.2% during the forecast period, i.e., 2025-2037. In 2025, the industry size of windows and doors is estimated at USD 265.2 billion.

The global windows and doors market is expected to experience remarkable growth due to increased construction activities, changing customer preferences for energy-efficient products, and the integration of windows and doors with home automation systems. In January 2024, MITER Brands completed the USD 3.1 billion acquisition of PGT Innovations, which formed one of the biggest residential window and door companies in the U.S. The change enhances product development and market segmentation in line with changing design trends and environmental concerns. As more capital is channeled towards renovation and urban development, the market is poised for stable advancements in the types of materials and performance characteristics.

Sustainability and customization are two ongoing trends affecting product development, especially in the aspiring regions such as Asia and Europe. This corresponds to the EU climate legislation and the increasing use of low-emission solutions in building construction. New policies, such as the U.S. Inflation Reduction Act and India’s Smart City Mission, are driving product development and market expansion in both the residential and commercial sectors. Manufacturers are also focusing on making new products recyclable and adopting modular formats that make recycling easier. Customers are also focusing on low-profile, visually appealing designs that reflect regional climate conditions and architectural designs. This alignment of policy and preference is driving next-generation product development pipelines faster.

Key Windows and Doors Market Insights Summary:

Regional Insights:

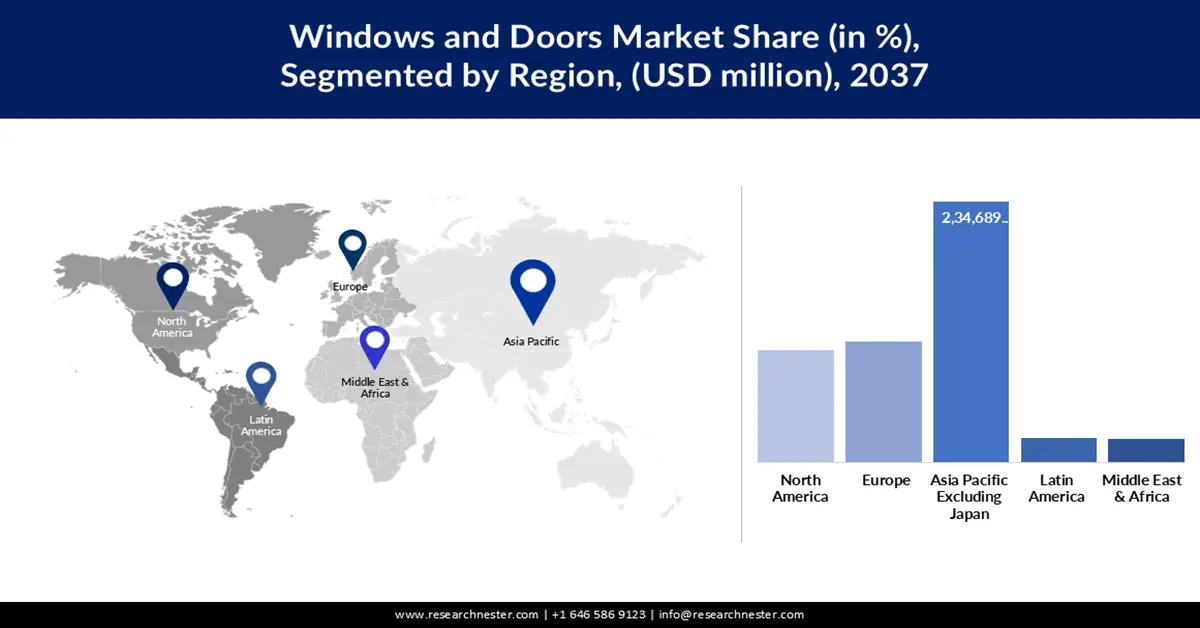

- The Asia Pacific region is anticipated to lead the Windows and Doors Market with a 48.1% share by 2037, owing to expanding housing developments, rapid urbanization, and large-scale infrastructure growth.

- North America is forecast to record a CAGR of 5.2% through 2037, sustained by remodeling activities, energy-efficient building initiatives, and evolving architectural preferences.

Segment Insights:

- The Doors segment is anticipated to hold a 59.0% share by 2035 in the Windows and Doors Market, supported by expanding residential applications, smart security systems, and innovations in touchless and climate-resilient designs.

- The UPVC segment is projected to account for a 47.1% share by 2037, propelled by its cost efficiency, recyclability, and superior thermal insulation characteristics.

Key Growth Trends:

- Urbanization and housing initiatives in developing economies

- Energy-efficiency regulations and green building certifications

Major Challenges:

- Shortage of labor and skilled installation issues

- Supply chain disruptions and material availability

Key Players: ATRIUM WINDOWS & DOORS ,JELD-WEN, Inc. ,Kolbe,LIXIL Corporation ,MILGARD Manufacturing, LLC ,Nationwide Windows ,Oppein Home Group Inc. ,Pella Corporation ,SGM Window Manufacturing Limited ,YKK AP America Inc.

Global Windows and Doors Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2024 Market Size: USD 254.1 billion

- 2025 Market Size: USD 265.2 billion

- Projected Market Size: USD 487.2 billion by 2037

- Growth Forecasts: 5.2% CAGR (2025-2037)

Key Regional Dynamics:

- Largest Region: Asia Pacific (48.1% Share by 2037)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Japan, Germany, India

- Emerging Countries: Indonesia, Vietnam, Brazil, Mexico, South Korea

Last updated on : 9 September, 2025

Windows and Doors Market - Growth Drivers and Challenges

Growth Drivers

- Urbanization and housing initiatives in developing economies: Population expansion and the movement to urban areas are placing pressure on the need for affordable housing and urban development. India’s Prime Minister’s affordable housing scheme called Pradhan Mantri Awas Yojana has aimed to deliver 11.8 million homes to the economically disadvantaged. This rapid increase in the construction of houses considerably increases the demand for modern doors and windows. Vietnam, Indonesia, and portions of Africa are experiencing a similar level of activity under government-led urban renewal initiatives. When developers are seeking to bring in more projects in less time, there is a trend toward prefabricated and UPVC window systems. These trends make emerging markets some of the most promising areas of growth in the next decade.

- Energy-efficiency regulations and green building certifications: Concerns regarding the effects of climate change and the steady rise in the cost of electricity have boosted demand for energy-efficient fenestration products. The U.S Department of Energy revealed that buildings are responsible for 40% of the total energy used across the U.S. In October 2024, Western Window Systems introduced its Series 8000 Vantage Line that meets Energy Star 7 and California Title 24 requirements. These innovations assist in improving comfort and ensure that builders and homeowners meet the required energy standards set by the government. LEED and BREEAM certifications for green buildings are further leading to the specification of better building products. Product lines are being redesigned based on thermal performance, solar control, and airtightness.

- Smart home integration and consumer personalization: With the increasing adoption of smart homes, consumers expect an interconnected and automated system in every aspect of their homes, including doors and windows. In February 2024, Marvin launched Marvin Connected Home, a smart window and door automation system that works with Alexa and Control. These control systems are for lighting, air flow, and shading and can be operated by voice or through a schedule and are in line with wellness design and occupant-responsive architecture. Personalization is becoming one of the key areas of focus in the digital business, and smart technologies are at the core of it. Leading brands are also incorporating sensors for predictive maintenance and security purposes. Incorporation with smart HVAC and lighting systems is now an essential standard.

Challenges

- Shortage of labor and skilled installation issues: One of the major challenges the industry has been grappling with is the scarcity of skilled installers and labor force. As per the National Association of Home Builders (2023), 77% of construction firms in the U.S. are struggling to find skilled workers. This hampers project schedules and increases installation costs, which is a blow to window and door makers who depend on the timely execution of their projects. Manufacturers are retaliating with more accessible modular systems and upskilling programs, but the gaps persist. This labor issue is most apparent in the retrofit and custom-installation categories. However, workforce stabilization is crucial for scaling up premium solutions.

- Supply chain disruptions and material availability: Material acquisition difficulties persist due to the complexity of the materials required, such as the low-emissivity glass, reinforced frames, and sustainable polymers. The pandemic disrupted international sourcing, and its impact is still evident in the delays in delivery. Manufacturers are experiencing increasing prices and longer delivery times for essential materials used in the production process, such as aluminum, coatings, and adhesives. Some suppliers are returning to their home country to reduce the impact of fluctuations or opening a regional warehouse. However, constrained supply and supply volatility continue to exert pressure on inventory balances. Long-term success depends on having a diversified approach to sourcing and the ability to manage inventory effectively.

Windows and Doors Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Period |

2025-2037 |

|

CAGR |

5.2% |

|

Base Year Market Size (2024) |

USD 254.1 billion |

|

Forecast Year Market Size (2037) |

USD 487.2 billion |

|

Regional Scope |

|

Windows and Doors Market Segmentation:

Product Segment Analysis

The doors segment is anticipated to dominate the market with a share of 59.0% during the forecast period, owing to the growing need for residential doors and commercial security systems. It comes in functional diversity, such as sliding and folding, smart, and fire-rated doors. In May 2024, Andersen Corporation released a new type of retractable screen system specifically for patio doors that combines the look of a screen door with the functionality of a regular door while also providing adequate ventilation and keeping off insects. The innovation is aligned with consumers’ desire for continuity between interiors and exteriors and enables ongoing product expansion across segments. With climate zones established, doors are being built to address both insulation and structural standards, particularly in areas prone to hurricanes and earthquakes. Further advancements in lightweight materials and touchless access solutions will further strengthen their position in new construction and renovations.

Material Segment Analysis

UPVC is expected to dominate with a share of 47.1% in the global door and window market by 2037 due to factors such as low cost, thermal efficiency, and recyclability. It is immune to drastic changes in weather conditions and is not easily affected by rust or fading of colors. In December 2023, Aparna Enterprises introduced its UPVC brand, Okotech, in the Southeast Asian market owing to the increasing demand for high-quality, long-lasting window products around the world. Thus, UPVC is used in both luxury and affordable housing segments due to its performance, regardless of the price range. As the regulatory authorities keep raising the bar in terms of energy efficiency, UPVC proves to be a solution for achieving low U-value and thermal transmittance values. These characteristics make the material suitable for use in double or triple glazing, acoustic insulation, and low-E coatings. In terms of foiling, coloring, and structure reinforcement, UPVC is gradually improving on the high-end aesthetics without the high costs or maintenance issues.

Our in-depth analysis of the windows and doors market includes the following segments:

|

Segment |

Subsegments |

|

Product |

|

|

Material |

|

|

Mechanism |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Windows and Doors Market - Regional Analysis

Asia Pacific Market Insights

Asia Pacific is anticipated to dominate the global windows and doors market with a share of 48.1% through 2037 attributed to population growth, housing projects, and infrastructure expansion. The market is also diverse in terms of climatic zones, which require new solutions for airflow control, impact, and energy. This opens the door for corporations to offer solutions that are specially tailored for the climates in various regions of the world.

China is the largest regional demand driver owing to large-scale urban renewal, green city programs, and the growing middle class. In July 2024, NorDan and Saint-Gobain promoted sustainable glazing in the region by combining low-emitting materials with enduring frames. Due to the increased use of prefabricated construction techniques, modular window and door systems are also gaining popularity in both commercial and multi-story residential buildings. Energy labeling and building code reforms support this positive trend.

India has a high growth potential for the windows and doors market due to housing initiatives such as the Pradhan Mantri Awas Yojana and real estate growth. With the population projected to hit 1.5 billion in 2030 and more fluctuating climate, UPVC and aluminum systems are becoming popular due to their thermal regulation and longevity. Smart city and net-zero initiatives from the government remain key to opening up market opportunities. Another trend that is also affecting the nature of buildings in urban areas is the increased consumer demand for low energy consumption, easy to maintain structures. However, the domestic incentives under the Make in India are enhancing the scale and competitiveness of the local suppliers.

North America Market Insights

North America is a saturated market that is projected to exhibit a CAGR of 5.2% through 2037 attributed to new construction, remodeling, and changing design preferences. Government support for energy upgrades and other renovations for commercial and residential buildings increases the demand for products and services in the market. Also, with increased concerns about climate change and its impact on buildings, there is a trend toward the use of efficient insulation and impact-resistant products. This is also evident in the strategic partnerships between suppliers, builders, and smart tech firms contributing to product differentiation and lifecycle value.

The U.S. continues to lead in growth in North America, having spent over USD 1.8 trillion on construction in 2022, as noted by the National Association of Surety Bond Producers (NASBP). This momentum has the potential to drive the growth of both high-rise buildings in urban areas as well as suburban housing. American consumers value form, energy compliance, and integration as essential factors that continue to shape the market. Increased adoption of hurricane-impact windows in coastal states and triple-glazed windows in colder climates is driving innovation in material and functionality. At the same time, tax credits and green building codes at the state level remain influential in purchasing trends and product innovations.

Canada is showing a constant and gradual growth due to densification of cities, upgrades, and the growing popularity of green construction. In October 2024, Panda Windows & Doors introduced the Elegant Steel Collection in Canadian metropolitan areas owing to the increasing requirement for architectural-grade finishes in the premium segment of housing. Due to severe winters and a growing focus on Net-Zero Ready buildings in the country by 2030, there is a rising need for highly efficient, thermal, and low-maintenance systems. As the world becomes more environmentally conscious, local building codes are still being developed in accordance with energy standards.

Key Windows and Doors Market Players:

- ATRIUM WINDOWS & DOORS

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- JELD-WEN, Inc.

- Kolbe

- LIXIL Corporation

- MILGARD Manufacturing, LLC

- Nationwide Windows

- Oppein Home Group Inc.

- Pella Corporation

- SGM Window Manufacturing Limited

- YKK AP America Inc.

The global windows and doors market is highly competitive, and players are constantly involved in innovation, acquisitions, and product diversification. Some of the prominent players in the market are ATRIUM WINDOWS & DOORS, JELD-WEN, Inc., Kolbe, LIXIL Corporation, MILGARD Manufacturing, LLC, Nationwide Windows, Oppein Home Group Inc., Pella Corporation, SGM Window Manufacturing Limited, and YKK AP America Inc. These firms are continuing to invest in automation, energy performance, and customized solutions to stay competitive in a rapidly evolving market.

Among the notable events in the sector, Western Window Systems introduced the Series 8000 Vantage Line in November 2024, a new window series that combines strength and sleek design. Using the latest Euro Groove technology and a high-density polyurethane thermal barrier, the line is Energy Star 7 and California Title 24 compliant. With the increasing stringency of building codes and the changing trend towards smart living and green buildings, the key to market competitiveness is product innovation, geographical diversification, and digitalization.

Here are some leading companies in the windows and doors market:

Recent Developments

- In January 2025, JELD-WEN completed the divestiture of its Towanda, Pennsylvania facility to Woodgrain Inc. for USD 115 million. The move followed a court-ordered resolution related to antitrust litigation and is part of JELD-WEN’s strategic restructuring. The divestiture allows the company to streamline operations while Woodgrain gains additional manufacturing capacity. Both companies are expected to benefit operationally from the transition.

- In January 2025, Lixil launched the AX450 aluminum moving glass wall, designed for modern homes requiring wide, thermally efficient openings. The product features a warm-edge spacer system for insulation and is certified to meet AAMA and NFRC standards. It offers a streamlined look with performance built in. The launch supports Lixil’s growing focus on premium, energy-conscious design solutions.

- In December 2024, Partners Group finalized its acquisition of Empira Group, a real estate investment firm with a USD 15.18 billion portfolio across Europe and the United States. This acquisition highlights growing investor interest in energy-efficient residential properties. It signals a push toward modern building solutions that align with ESG targets. The transaction offers new opportunities for fenestration suppliers in high-value real estate developments.

- Report ID: 4351

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Windows and Doors Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.