Docking Station Market Outlook:

Docking Station Market size was valued at USD 2.1 billion in 2025 and is projected to reach USD 3.6 billion by the end of 2035, rising at a CAGR of 6.4% during the forecast period, i.e., 2026-2035. In 2026, the industry size of docking station is estimated at USD 2.2 billion.

The rise of remote and hybrid work environments, the emergence of portable devices, and the necessity for simplified setups are the key factors behind the robust growth of the worldwide docking station market. The article published by the World Economic Forum in January 2024 stated that the number of digital jobs across all nations that can be done remotely is anticipated to grow by around 25% surpassing more than 90 million roles by the end of 2030. The article also stated that this rise is effectively fueled by technological advancements and higher-wage positions such as software development and financial risk management, thereby enabling workers to operate from anywhere without any geographic constraints. Therefore, this trend underscores a shift in work dynamics, whereas the widespread adoption of remote work will efficiently boost demand for docking stations, as employees will necessitate reliable multi-device connectivity as well as desktop-like functionality.

Furthermore, the article published by the International Council on Clean Transportation in October 2024 disclosed that as of June 2024, India had a total of 23,731 wired public charging stations that were operational across the nation. Simultaneously, the state of Karnataka led the country with 5,705 stations, which accounted for 24% of the national total, followed by Maharashtra with 3,615 stations (15%). In addition, the report also mentioned that there was only one public charging station for every 191 electric vehicles, which reflects the urgent need for infrastructure expansion to support the growing EV fleet. Therefore, this rise in public EV charging infrastructure highlights the increasing demand in the docking station market that enables both efficient device connectivity and power management.

Key Docking Station Market Insights Summary:

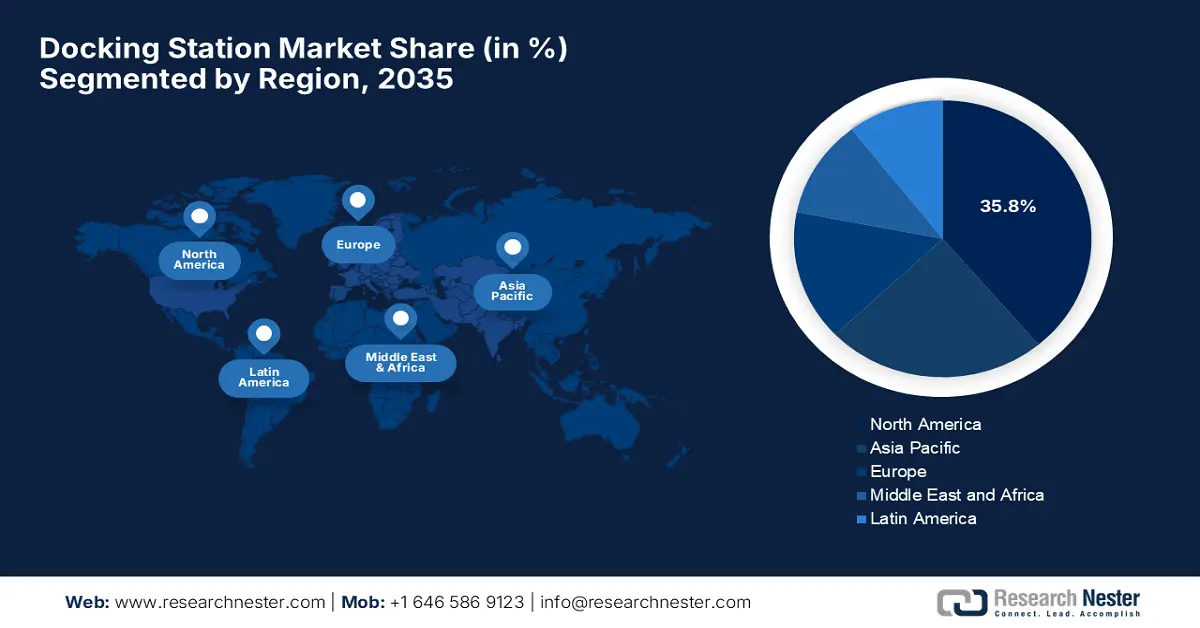

Regional Insights:

- North America is projected to command a 35.8% share by 2035 in the docking station market owing to the widespread hybrid work adoption.

- Asia Pacific is anticipated to witness robust expansion by 2035 because of rapid enterprise modernization.

Segment Insights:

- The commercial application segment is expected to hold a 70.8% share by 2035 in the docking station market supported by the sustained transition toward hybrid work models.

- The USB-C/Thunderbolt segment is set to grow considerably by 2035 as a result of its universal role in simplifying data, video, and power connectivity.

Key Growth Trends:

- Adoption of high-performance laptops and ultrabooks

- BYOD policies

Major Challenges:

- Compatibility and standardization concerns

- Supply chain and component dependency

Key Players: HP Inc. (U.S.), Lenovo Group Ltd. (China), Targus Corporation (U.S.), Kensington Computer Products Group (U.S.), Plugable Technologies (U.S.), StarTech.com Ltd. (Canada), Toshiba Corporation (Japan), Belkin International (U.S.), Anker Innovations Co. Ltd. (China), CalDigit, Inc. (U.S.), ASUSTeK Computer Inc. (Taiwan), Acer Inc. (Taiwan), Razer Inc. (Singapore / U.S.), SIIG, Inc. (U.S.).

Global Docking Station Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.1 billion

- 2026 Market Size: USD 2.2 billion

- Projected Market Size: USD 3.6 billion by 2035

- Growth Forecasts: 6.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: India, Vietnam, Indonesia, Brazil, Mexico

Last updated on : 26 November, 2025

Docking Station Market - Growth Drivers and Challenges

Growth Drivers

- Adoption of high-performance laptops and ultrabooks: This is one of the most important growth drivers for the docking station market since modern laptops with limited ports require docking stations for expanded connectivity, supporting multiple monitors, and external storage. As per an article published by OPM in December 2023, the 2022 status of Telework in the Federal Government report, the adoption of tele and remote work has created an ongoing need for supporting equipment, which implies a strong demand for docking stations. The report also notes that a key strategy for agencies was improving information technology, such as laptops, VPN, and ensuring employees have the tools they need to telework, which are highly essential for a functional remote setup. Furthermore, it mentioned that with 46% of the federal workforce teleworking and a substantial portion doing so frequently, i.e., 56% teleworked 3+ days per pay period, the demand for reliable home office hardware rises.

- BYOD policies: There has been a growing implementation of the Bring Your Own Device Policy (BYOD) in most corporations, which consistently drives business in the docking station market since it ensures both compatibility and productivity. In this regard, Microsoft in January 2025 reported that its Teams’ BYOD rooms allow organizations to enable meeting spaces without dedicated Teams Rooms hardware. Also, through the pro management portal, admins can view and manage peripheral inventories, associate devices to specific rooms, and enable automatic end-user experiences when employees connect their own laptops or devices. Furthermore, the platform supports usage reporting, auto-association of peripherals, and policy configurations to optimize device management and ensure integration in hybrid work environments.

- Increased utilization of portable devices: This is also extremely beneficial for the docking station market since the proliferation of portable devices, such as laptops, tablets, and smartphones, heightens the demand for docking stations. In March 2022, the U.S. General Services Administration stated that its directive OAS 9900.1A allows remote and telework employees to be issued government-furnished IT equipment, which includes laptops, monitors, keyboards, docking stations, and supporting cables, to perform official duties outside agency worksites. Therefore, this policy reflects the federal government’s response to the growing number of remote workers, ensuring that they have the necessary tools for productivity. Furthermore, docking stations are explicitly included as essential for enabling multi-device connectivity and efficient workspace setups for teleworking employees, hence denoting a positive market outlook.

Key Docking Station Launches and Market Opportunities

|

Company |

Event |

Year |

Market Opportunity |

|

Digitus (Assmann Group) |

Launch of USB-C 8K 12 Port Docking Station (DA-70919) |

2025 |

Enhances hybrid workplace productivity with multi-monitor support, high-resolution display, and broad device connectivity. |

|

Apricorn |

Launch of Aegis Thunderbolt 4 Docking Station |

2025 |

Supports hybrid workforce with seamless device integration, multi-monitor setups, fast data transfer, and secure remote/office use. |

|

Kensington |

Launch of SD5000T5 EQ Thunderbolt 5 Triple 4K Docking Station |

2024 |

Unlocks the full potential of Thunderbolt 5 laptops with multi-monitor support, ultra-fast data transfer, and high-power delivery for professionals and creators. |

Source: Company Official Press Releases

Challenges

- Compatibility and standardization concerns: This is considered to be one of the pressing challenges in the docking station market. Since it operates with multiple operating systems, laptop architectures, and peripheral standards, manufacturers need to ensure their docks function consistently across diverse devices. In this context, any sort of inconsistencies associated with USB-C or Thunderbolt implementations, driver issues, and firmware variations can cause variations in performance, creating obstacles for enterprise adoption. Standardization efforts are ongoing, wherein the rapid evolution of laptops, tablets, and hybrid devices can often outpace the uniform industry guidelines. Furthermore, the integrations can increase support costs, compelling vendors to invest heavily in testing and cross-platform support solutions.

- Supply chain and component dependency: Manufacturers involved in the docking station market are heavily reliant on supply chains for key components, which include semiconductors, connectors, PCBs, and enclosures. On the other hand, geopolitical tensions, raw material shortages, as well as logistics disruptions can delay production or increase costs, adding to burgeoning expenses for small and medium-scale manufacturers. In this context, the complexity of sourcing high-quality components from multiple regions adds further risks, particularly when assembly occurs in different countries. Furthermore, in terms of enterprises and vendors, these dependencies affect the inventory management, procurement planning, causing a major obstacle to market expansion.

Docking Station Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.4% |

|

Base Year Market Size (2025) |

USD 2.1 billion |

|

Forecast Year Market Size (2035) |

USD 3.6 billion |

|

Regional Scope |

|

Docking Station Market Segmentation:

Application Segment Analysis

The commercial application segment in the docking station market is expected to attain the largest stake of 70.8% over the forecasted years. The permanent shift to hybrid work models is the primary driving factor for this leadership. Organizations are standardizing docking stations to create extremely seamless, uniform workspaces for employees both in-office and remotely. This is also supported by investments in IT infrastructure, thereby supporting productivity. In March 2022, Dell Technologies announced that it had launched intelligent PCs, accessories, and ecosystem solutions that are designed to support employees across multiple locations. Central to this initiative is the Dell dual charge dock, which marks the world’s first laptop docking station with a wireless charging stand for Qi-enabled smartphones and earbuds, capable of supporting dual 4K monitors, ideal for home offices.

Connectivity Segment Analysis

By the end of 2035, USB-C/Thunderbolt segment is expected to grow at a considerable rate in the docking station market. The subtype’s growth is effectively fueled by its critical role as a universal standard for data, video, and power delivery. Therefore, this consolidation simplifies connectivity for a multi-device workforce. In December 2024, the European Commission announced that it had implemented the EU common charger directive, which mandates that all new mobile phones and portable electronic devices sold in the EU support USB-C charging. Also, this regulation aims to increase consumer convenience by reducing electronic waste by approximately 11,000 tonnes on a yearly basis, and harmonize fast-charging technology across brands. It also stated that the rule will extend to laptops, promoting a standardized and environmentally friendly approach to device charging, hence making this a global standard.

Product Type Segment Analysis

In terms of product type, the universal docking stations segment is expected to lead with a considerable share in the docking station market over the discussed timeframe. The sub-segment leads since it directly addresses the connectivity needs of a diverse agnostic workforce. Also, these docks offer compatibility across most of the laptop brands and operating systems by providing flexibility for businesses. This aligns well with the IT procurement principle of interoperability, which is considered to be a key consideration for technology buyers who are looking to maximize the lifespan of their hardware investments. In addition, universal docks reduce vendor lock-in, enabling organizations to streamline device management across mixed hardware. Furthermore, their scalability and ease of deployment also support growing hybrid work, wherein multi-device accessibility is highly essential.

Our in-depth analysis of the docking station market includes the following segments:

|

Segment |

Subsegments |

|

Application |

|

|

Connectivity |

|

|

Product Type |

|

|

Distribution Channel |

|

|

Technology |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Docking Station Market - Regional Analysis

North America Market Insights

North America is predicted to lead with the highest share of 35.8% in the global docking station market throughout the discussed tenure. The leadership of the region in this sector is highly attributable to the widespread hybrid work adoption, a well-established enterprise IT ecosystem, and rapid integration of multi-device digital workflows. In January 2025, ASUS announced that the master thunderbolt 5 Dock DC510 is showcasing the rising shift toward ultra-high-performance docking solutions, which are suitable both for creators and power users. It has triple Thunderbolt 5 ports, which support the dual 8K or triple 4K displays, 80 Gbps data transfers, and 140-watt passthrough charging, representing how next-generation connectivity is reshaping advanced workstation setups. Furthermore, its toolless PCIe 4.0 SSD expansion, I/O, and modern design highlight the industry’s movement toward multifunctional, high-bandwidth docks.

The strong corporate technology investments, accelerated digital transformation, and the rise in employee-centric work environments are readily driving business in the U.S. docking station market. Enterprises in the country are deploying advanced docking solutions to enhance productivity and reduce complexities associated with IT across workplaces and shared office spaces. In January 2022, Synaptics introduced the Gemini reference design, which marks a major milestone in wireless connectivity, delivering the world’s first-ever true Wi-Fi 6/6E wireless docking experience with secure connect-on-approach and dual-4K display support. With an integration of tightly coupled hardware and software that range from MA-USB virtualization to adaptive display link compression, wherein the solution enables ultra-low-latency, cable-free docking that mirrors wired performance.

The docking station market in Canada is efficiently supported by its expanding remote-friendly workforce, as well as the government's strong emphasis on digital infrastructure modernization. Also, the adoption of modern laptop fleets across both public and private sectors has increased the need for reliable docking systems. In August 2025, StarTech.com introduced its driverless USB4 triple 4K60 dock, which is engineered for high-performance IT environments and has 10Gbps USB connectivity and 2.5GbE networking. The company also mentioned that the dock supports triple 4K displays through the laptop’s native GPU, enabling deployment without drivers across Windows and ChromeOS for scalable hybrid work setups. Furthermore, with enhanced peripheral flexibility, mounting options, and the firm’s connectivity tools suite, the solution is designed to streamline enterprise rollouts, thereby maximizing productivity in modern workspaces.

APAC Market Insights

Asia Pacific is expected to register lucrative growth in the regional docking station market, facilitated by rapid enterprise modernization, booming laptop penetration, and adoption of mobile-first work cultures. Besides, small and large businesses in the region are heavily investing in docking solutions with a collective goal of improving workspace flexibility, whereas the technological upgrades in major economies are elevating the demand for multi-port connectivity devices. In addition, the expansion of hybrid work policies across countries such as India, China, and India is accelerating the adoption of advanced docking ecosystems, prompting a favorable business environment in this region. Growing IT infrastructure spending and widespread digital transformation initiatives are further supporting sustained demand for high-performance connectivity accessories. Furthermore, the rising presence of docking station vendors and increased localization of manufacturing also help in sustaining the region’s long-term market growth.

China holds a most prominent position in the regional docking station market due to its strong capability in electronic manufacturing, increasing utilization of computing across technology, finance, and creative industries. The country’s market also benefits from growing demand for multi-monitor productivity setups, which is fueling the adoption of docking technologies. In September 2021, Good Way Technology announced the mass production of two Google-certified WWCB docking stations by expanding its portfolio to support Chrome OS laptops with compatibility across Windows, Mac, USB-C, USB4, and Thunderbolt systems. Besides, the lineup also includes a 14-port enterprise-grade dock supporting triple displays and a compact travel-friendly model, which is designed for portability and essential connectivity. Hence, the company aims to boost productivity across enterprise, education, as well as home-office environments by enhancing clean, efficient workspaces.

India is the frontrunner in the regional docking station market, backed by the IT hardware deployments, large-scale workforce expansion in tech, and ever-increasing adoption of BYOD, along with hybrid work policies. For instance, in November 2025, StarTech.com announced that it had officially launched in India by bringing its 40-year legacy of IT connectivity solutions to support the country’s growing tech infrastructure. The company offers a wide portfolio of products that includes multi-port adapters, USB and Thunderbolt hubs, and AV solutions, which are rigorously tested for compatibility and reliability to simplify IT deployments and reduce downtime. Furthermore, the rapid procurement capabilities of manufacturers, worldwide distribution networks, and a focus on sustainability help the country gain an increased consumer base.

Europe Market Insights

Europe is predicted to grow notably in the global docking station market, primarily shaped by strong regulatory support for technology standardization, fast adoption of USB-C ecosystems, and a sustained shift towards flexible work models. In September 2025, Other World Computing announced the launch of Thunderbolt 5 dual 10gbe network dock, which is a high-performance docking solution designed for creative and IT professionals. The company also underscored that the dock offers dual 10GbE ports, a 2.5GbE port, three Thunderbolt 5 ports, and four USB ports, enabling multi-network connectivity, ultra-fast NAS access, and expansion of multiple devices through a single cable. Furthermore, the dock is aimed at simplifying complex workflows while maintaining desktop-class speed and flexibility, hence making it suitable for overall market growth.

Germany has grabbed the dominating position in the regional docking station market, positively impacted by its advanced industrial landscape, emphasis on high-efficiency office infrastructure, and strong preference for standardized IT hardware. Engineering, manufacturing, and corporate service sectors in the country are relying on robust docking solutions to support precision workflows. For instance, in October 2025, Daimler Buses announced that it is expanding public charging infrastructure for electric buses and coaches across the region, starting with a pilot project in Cologne, which has four 400 kW fast-charging stations for intercity and tourist routes. It covers planning, construction, operation, and maintenance, offering a turnkey solution accessible 24/7 for operators of any brand. Hence, this initiative will boost the market by increasing demand for fast-charging infrastructure for electric buses in the region.

The U.K. in the docking station market is supported by its highly digital service economy, strong adoption of cloud-driven workflows, and widespread hybrid workforce models. Simultaneously, businesses in the country prioritize docking solutions that enable agile office reconfiguration, consistent user experience across devices, and attract more players to make investments in this field. In October 2025, the ROC + DOCK project, developed by HydroSurv in collaboration with South Devon College and BMT, showcased a completely integrated system for automating the deployment, recovery, recharging, and retasking of zero-emission uncrewed surface vessels in ports and coastal sites. The company stated that central to the project are a solar-powered docking station, a remote operations centre with BMT’s REMBRANDT simulator, and upgraded training vessels, enabling safe simulator-based training and hands-off USV operations, hence making it suitable for overall market growth.

Key Docking Station Market Players:

- Dell Technologies (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- HP Inc. (U.S.)

- Lenovo Group Ltd. (China)

- Targus Corporation (U.S.)

- Kensington Computer Products Group (U.S.)

- Plugable Technologies (U.S.)

- StarTech.com Ltd. (Canada)

- Toshiba Corporation (Japan)

- Belkin International (U.S.)

- Anker Innovations Co. Ltd. (China)

- CalDigit, Inc. (U.S.)

- ASUSTeK Computer Inc. (Taiwan)

- Acer Inc. (Taiwan)

- Razer Inc. (Singapore / U.S.)

- SIIG, Inc. (U.S.)

- Dell Technologies is recognized as one of the major infrastructure providers in this field. The company leverages its enterprise relationships to fuel the demand for high-performance docking stations, especially for its business clients. Dell has strong R&D investment and a broad patent portfolio, aligning well with its docking products with its broader strategy of integrated workspace solutions, which includes multi-display setups, high-wattage charging, and seamless device management.

- HP Inc.’s docking station business complements its primary PC and printing offerings, enabling it to address both enterprise and consumer segments. The company has sustainability as a key part of its strategy, and it pursues circular design and uses recycled materials, making it interesting for environmentally conscious IT consumers. Its docking solutions are tightly integrated with HP laptops as well as enterprise workflows, helping drive bundled sales.

- Lenovo Group is one of the central players that leverages its leadership in laptops, along with enterprise computing, to push docking solutions that are highly compatible and optimized for its ThinkPad and ThinkBook lines. The company’s key pillar of strength lies in its synergy, in which docking stations are part of an ecosystem that includes PCs, services, and peripherals. Furthermore, its worldwide distribution network and design expertise allow it to serve both enterprise and SMB markets effectively.

- Targus Corporation, a specialist in mobile‑accessory spaces that emphasizes universal docking with broad device support. Its account management teams support Fortune-level companies that are deploying docking stations at scale. The company continually makes investments in patented docking designs, such as quad‑monitor docks, as well as eco-friendly materials to strengthen its appeal to enterprise customers who are looking for sustainable, reliable peripherals.

- Kensington Computer Products Group, a division of ACCO Brands, is well known for peripheral quality and reliability. The company’s target group of audience is professionals and commercial customers, by offering enterprise-grade docks with security features and broad compatibility. The company’s strategic strength lies in pairing its docking stations with its larger portfolio of peripherals, such as locks, keyboards, and other IT accessories, enabling cross-selling and bundling opportunities within corporate procurement.

Below is the list of some prominent players operating in the global market:

The international docking station market is extremely competitive, which has both OEM laptop makers, such as Dell, HP, Lenovo, and Toshiba, and specialty peripheral companies, such as Targus, Plugable, and CalDigit. The key players are differentiating by offering enterprise-grade docks with high power delivery, multi-display support, whereas the consumer-focused brands emphasize sustainability. In November 2025, Leviton announced that it had acquired International Dock Products, thereby enhancing its marine portfolio with premium dockside power and accessory solutions, which include power pedestals, ladders, and piling caps. Besides, this acquisition strengthens the company’s ability to provide a suite of marine-grade, watertight, and corrosion-resistant products for marinas, yacht clubs, and professional dock builders. Furthermore, the company aims to deliver expanded value and innovative dockside infrastructure solutions across the marine industry.

Corporate Landscape of the Docking Station Market:

Recent Developments

- In May 2025, Spectralink announced a new HDMI docking station for its Versity 97 healthcare smartphone, making the device a full desktop experience with multitasking, window resizing, and session continuity. It enables clinicians to chart faster, view clinical data on larger screens.

- In January 2025, Targus introduced its DOCK230 Thunderbolt 5 triple video 8K ecosmart docking station, which features 140W EPR power delivery, triple-8K display support, and up to 120 Gbps Thunderbolt bandwidth. The dock is one of the first to integrate Intel Thunderbolt Share, allowing two Thunderbolt PCs to share a single monitor.

- Report ID: 291

- Published Date: Nov 26, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Docking Station Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.